KLEIN NEWS FALL 2010

.jpg)

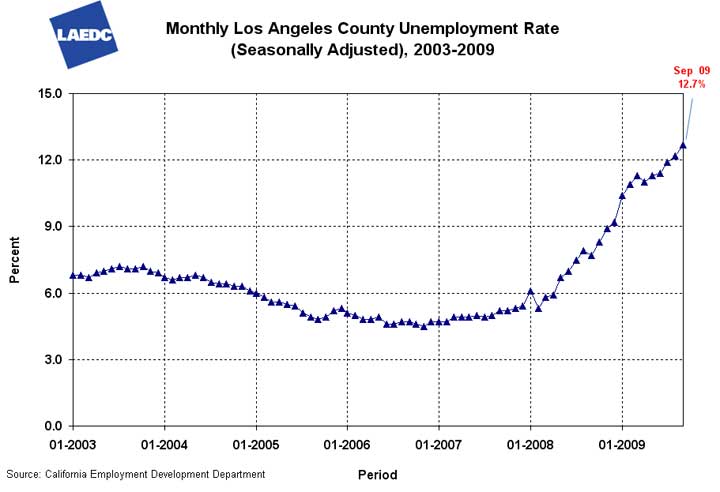

Activity Is Up, But Far From Celebratory

With the year of fear behind us and summer doldrums over, should we expect an increase of activity? Compared to the past two years of bad news, yes, activity is up. Many businesses that were paralyzed with fear are now investigating opportunities in the property market. Private companies are looking for space just in time to replace the waning influence of government stimulus. For instance, businesses that can access low interest rates are in a particularly enviable position. The evidence is demonstrated by a few stellar deals that were purchased by a few brave souls who struck when no one else could. Now that the great fear has receded, we are left with a bad market instead of a catastrophic one. Buyers and Tenants are coming out of their shell to see if they can find bargains and re-launch business plans.

Continue reading “KLEIN NEWS FALL 2010”

.jpg)

.jpg)

.jpg)