More Uncertainty in a Soft Market

More Uncertainty in a Soft Market

As an industrial real estate broker in Los Angeles, we make a living by hustle and personal relationships. Despite our effort, when you step back to analyze, it is the macro influences that are the determinant factors. The Great Financial Crisis drove down interest rates and brought in a wave of institutional investors that purchased almost every available property. These property owners received an additional boost during the Covid period that created a surge of imports and warehouse shortages that increased rents. The economic result was inflation and to combat higher prices, the Fed increased interest rates. This action resulted in reduced investor activity because deals no longer made sense. Now we are facing a Tariff Tantrum that is freezing tenant demand. A few months’ pause in activity wouldn’t be bad except many owners are leveraged and need to service their debt. Each macro event has an unintended consequence on pricing and vacancy.

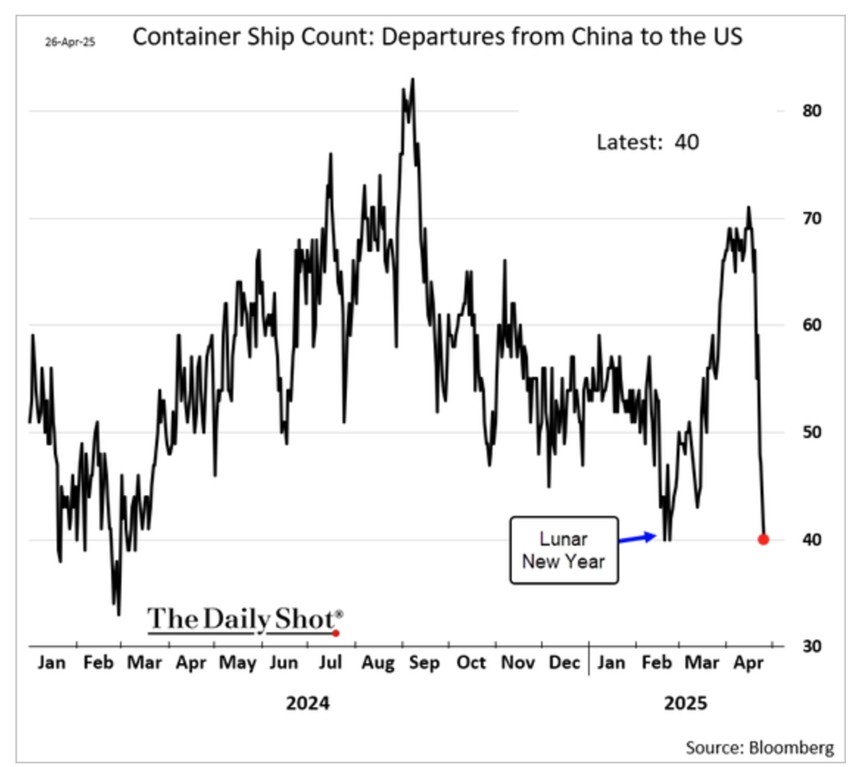

Los Angeles industrial is particularly dependent on goods coming through San Pedro Bay. During Covid, when there were 100 ships waiting to be unloaded, it created a beneficial rent surge for property owners. Today, with a 70% decrease in port traffic, rents are declining. While obvious in buildings, the clearest example is Industrial Outside Storage (IOS), basically truck yards, which has seen a drop of more than 50%. IOS was the darling of large investors and served as a new property class. However, many of those truck yards remain vacant and were underwritten at much higher rents.

Another source of demand, particularly here in the South Bay, comes from aircraft and defense companies. Its origin in WWII has ebbed and flowed between war and peace. I had one client who made aircraft fasteners and during times of peace, they would store their machinery and lease out the buildings. But during the Korean, Vietnam, and Cold War periods, they would bring out that same machinery and start manufacturing. We are at another similar period with a different breed of defense companies financed by venture capital and not by prime contractors. It’s a growing industry but also hampered by not getting the parts they need from foreign countries. We are also seeing Chinese companies exploring the creation of a manufacturing base in the U.S. with their advanced manufacturing equipment.

You could say it’s the revenge of the private property owner. During the boom period of low interest rates, competition prevented private owners from affordably purchasing property except through investment vehicles with larger funds. Today, private and long-time owners with a low basis can cut their rents and because of Proposition 13, also have low property taxes. For private owners, they merely need to cover their lifestyle while they wait for better times. Large, newly created funds are faced with valuation cuts that can put them out of business. It’s an unpleasant decision to make, but cutting rents is the way to lease buildings until conditions improve. There are simply too many buildings for lease. Long-time property owners have a clear advantage in today’s market until market conditions change. After all, it’s a cycle.

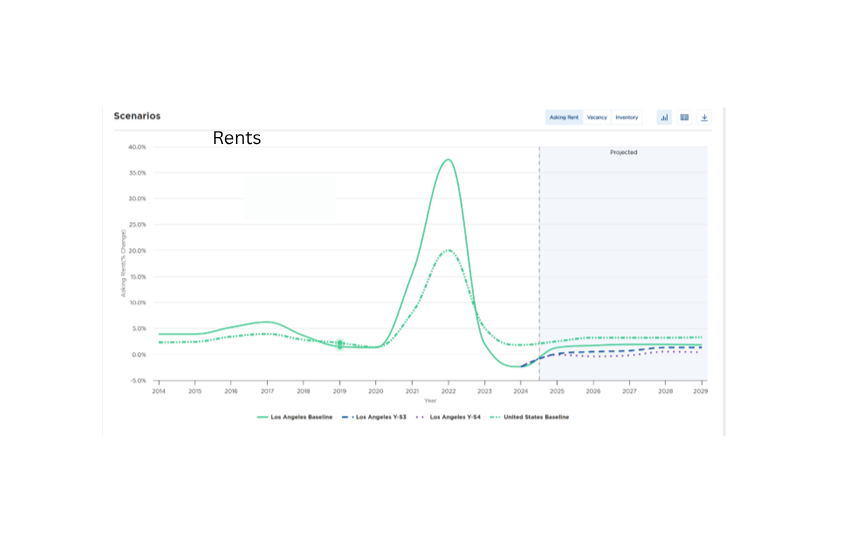

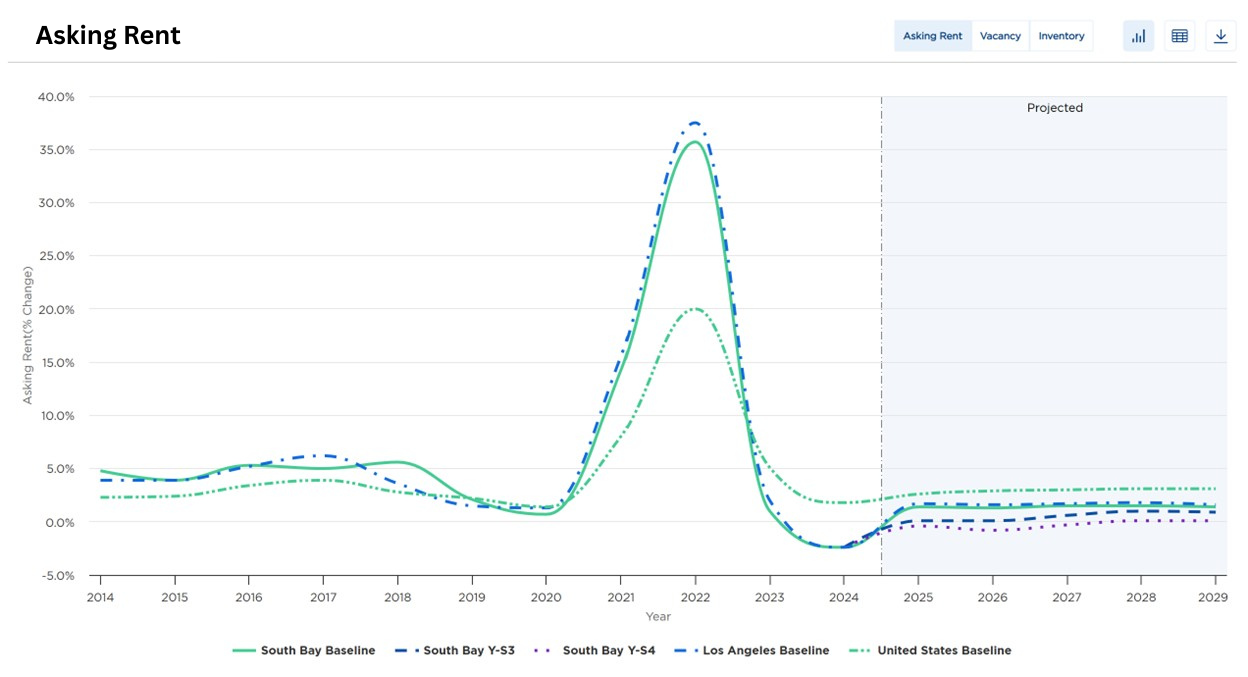

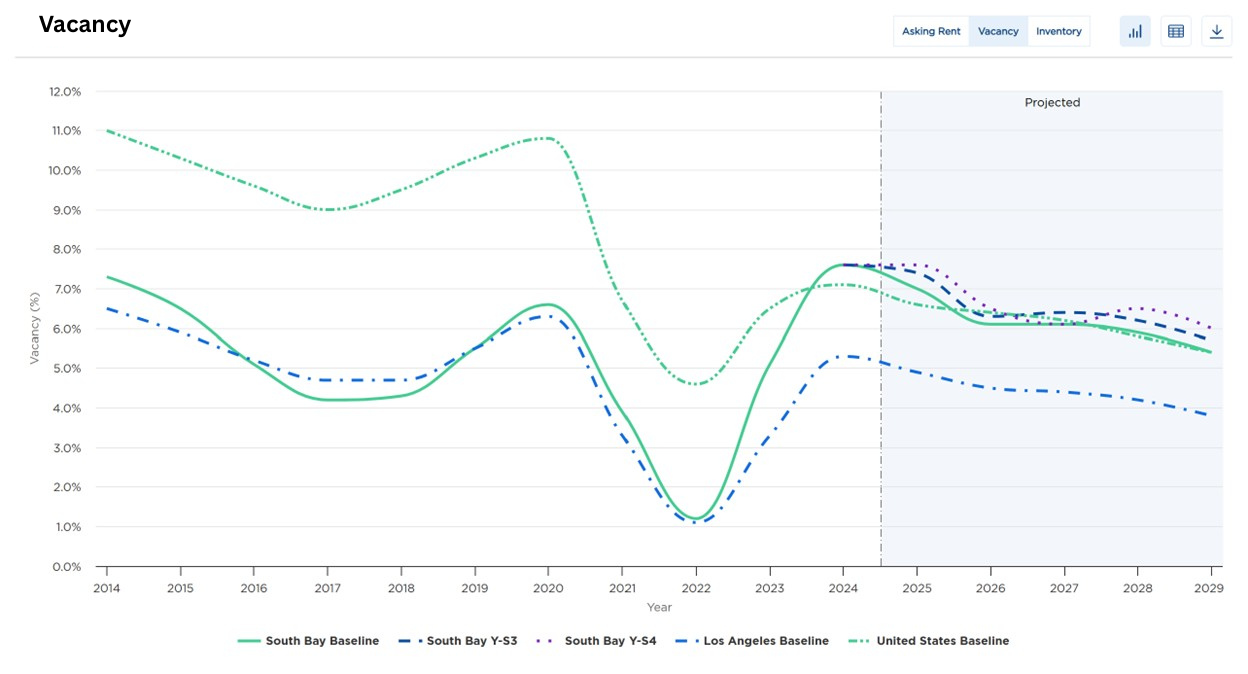

(The Rent and Vacancy charts are supplied by Moody’s Analytics and are based on their data research and forecast methods. However, they do not account for market sentiment based on current tariff conditions and potential of negotiations. Until trade dynamics become more certain, the current sentiment is unfavorable especially for property owners and tenant’s dependent on import and export activity)

Los Angeles Industrial Real Estate: Opportunities in the New Tariff Era

Los Angeles Industrial Real Estate: Opportunities in the New Tariff Era

Introduction

The industrial real estate landscape in Los Angeles stands at a critical inflection point following the implementation of significant tariffs by the Trump administration in early 2025. With Chinese goods now effectively subject to tariffs exceeding 54% and China’s reciprocal 34% tariffs on US imports, the traditional trade flows that have long defined the Los Angeles industrial market are undergoing substantial transformation.

This report examines the emerging opportunities in Los Angeles industrial real estate created by this new tariff environment. While short-term disruptions are inevitable, the combination of reshoring initiatives, supply chain restructuring, and development constraints creates a potentially favorable environment for strategic industrial assets in the region.

Current Market Metrics

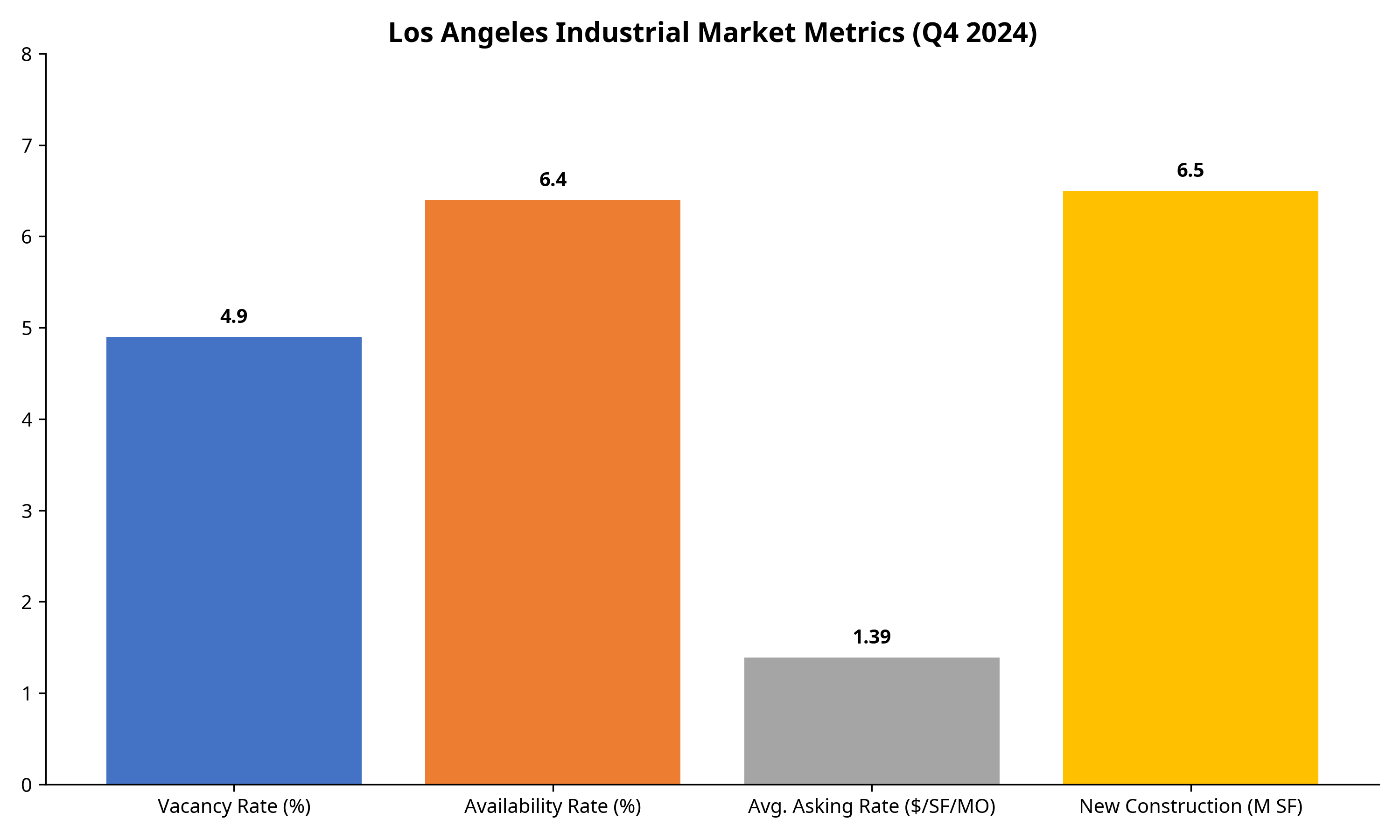

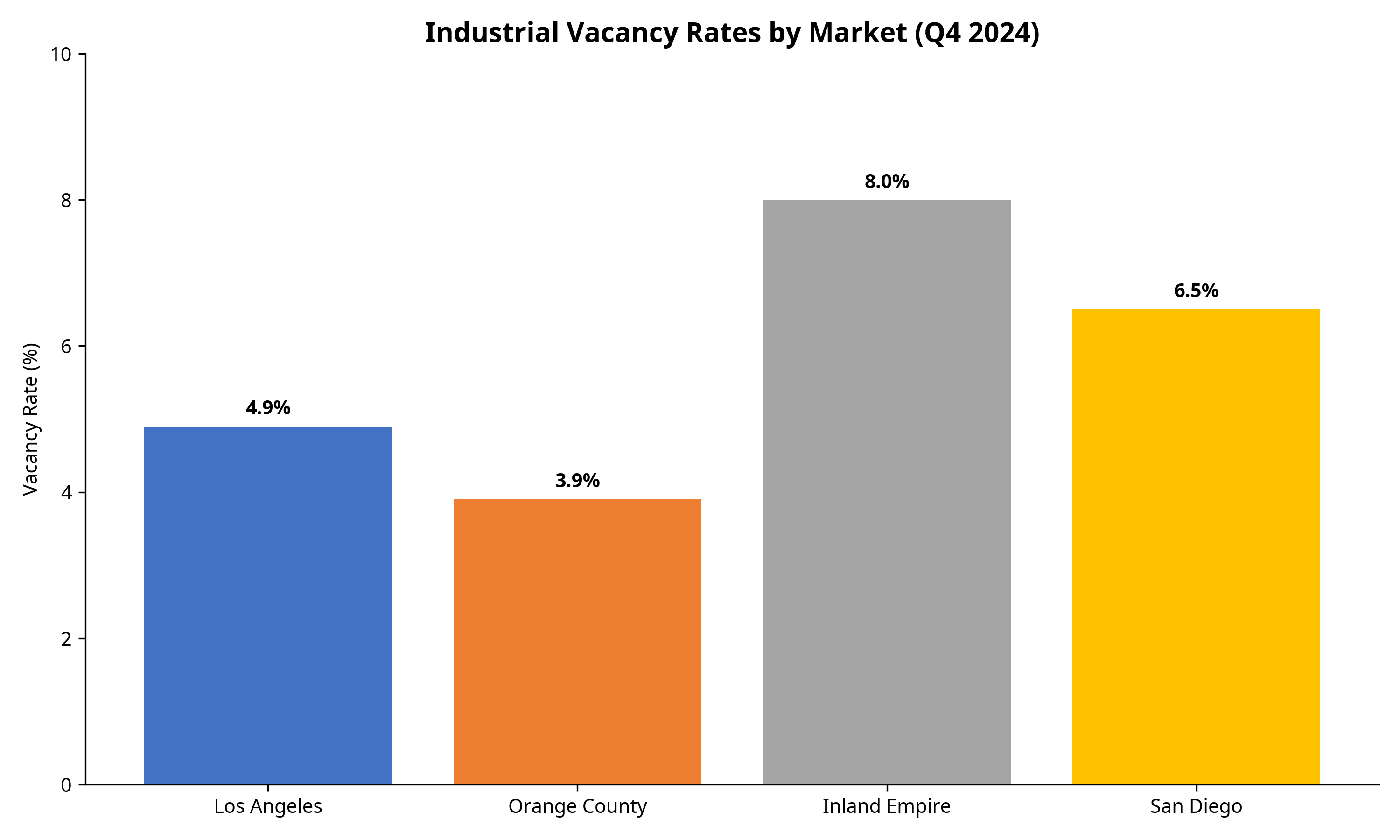

The Los Angeles industrial real estate market entered this period of tariff-induced change with the following key metrics:

Los Angeles Industrial Market Metrics (Q4 2024)

Source: Cushman & Wakefield Los Angeles Industrial Market Report, Q4 2024

Vacancy & Availability

- Vacancy Rate: 4.9% in Los Angeles County (year-end 2024)

- Availability Rate: 6.4% (up from 4.8% one year earlier)

- Total Direct Available Space: 42.1 million SF

- Total Sublease Available Space: 9.2 million SF

Rental Rates & Construction

- Average Asking Rate: $1.39 NNN/PSF/MO

- Rental Trends: Rates have fallen for five straight quarters but remain 54% higher than pre-pandemic levels

- New Construction: 6.5 million square feet added in Los Angeles County in 2024

- Construction Pipeline: Slowing dramatically, with “limited new options in 18-24 months”

Vacancy Rates Comparison

Source: JLL Industrial Market Outlook, Q1 2025

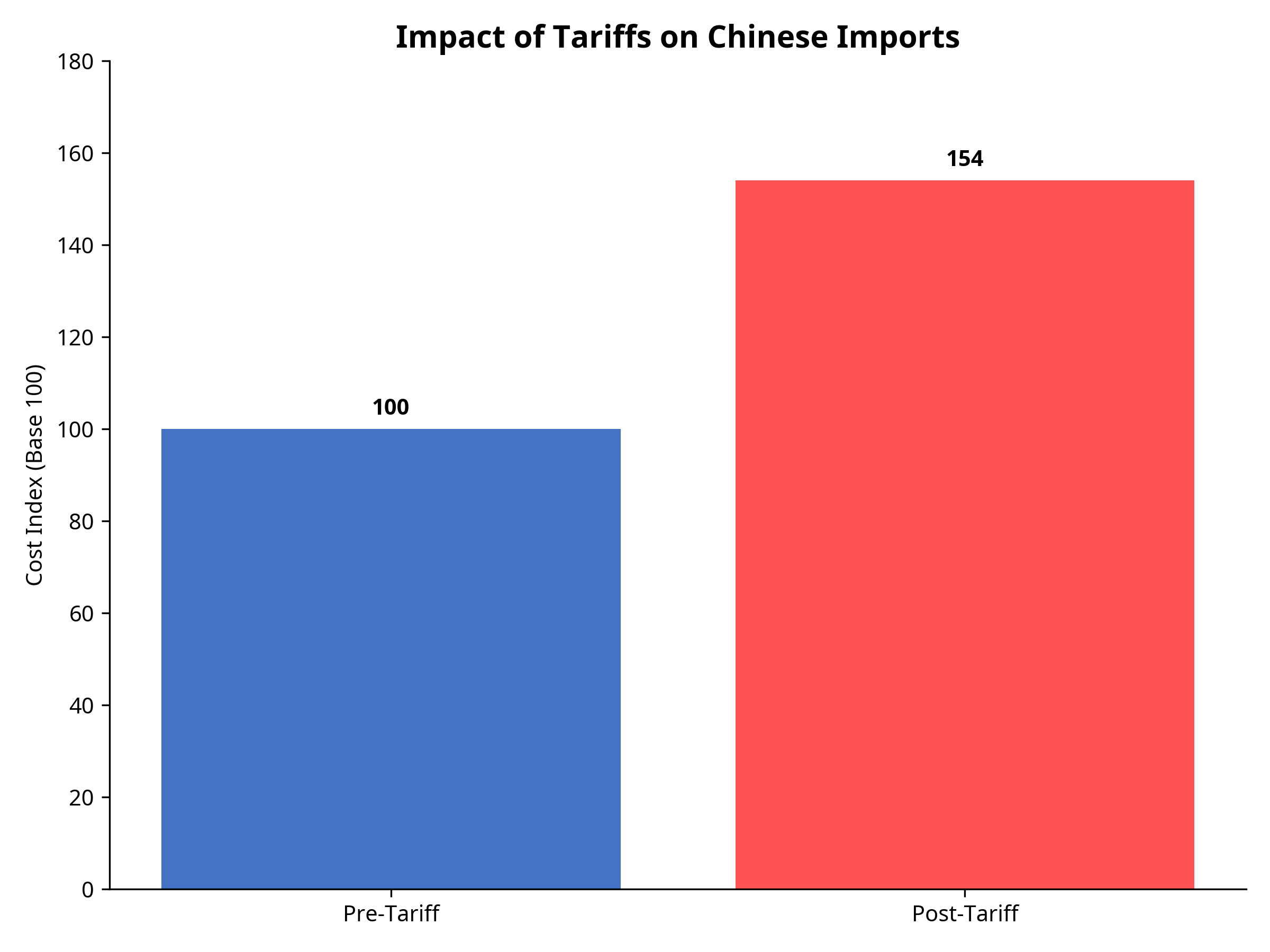

Tariff Impact Analysis

Impact of Tariffs on Chinese Imports

Chart shows the effective cost increase of Chinese imports after tariffs (base 100 = pre-tariff cost)

Recent Tariff Implementations

- An additional 34% tariff on all Chinese goods imported into the US (March 2025)

- Two previous 10% tariff tranches imposed since January 2025

- Combined with pre-existing tariffs, Chinese goods are now effectively subject to tariffs exceeding 54%

- China has responded with reciprocal 34% tariffs on all US imports, effective April 10, 2025

Port of Los Angeles Impact

- Port of Los Angeles Executive Director Gene Seroka predicts a 10% drop in cargo volume in the second half of 2025

- Every four containers moved through the Port of LA creates one job; a 10% reduction in cargo could impact employment across the supply chain

- Higher import volume at local ports in early 2025 suggests companies front-loaded imports ahead of tariff implementation

- Companies are actively reconsidering sourcing strategies, with potential shifts away from China to countries like Vietnam, Indonesia, and Malaysia

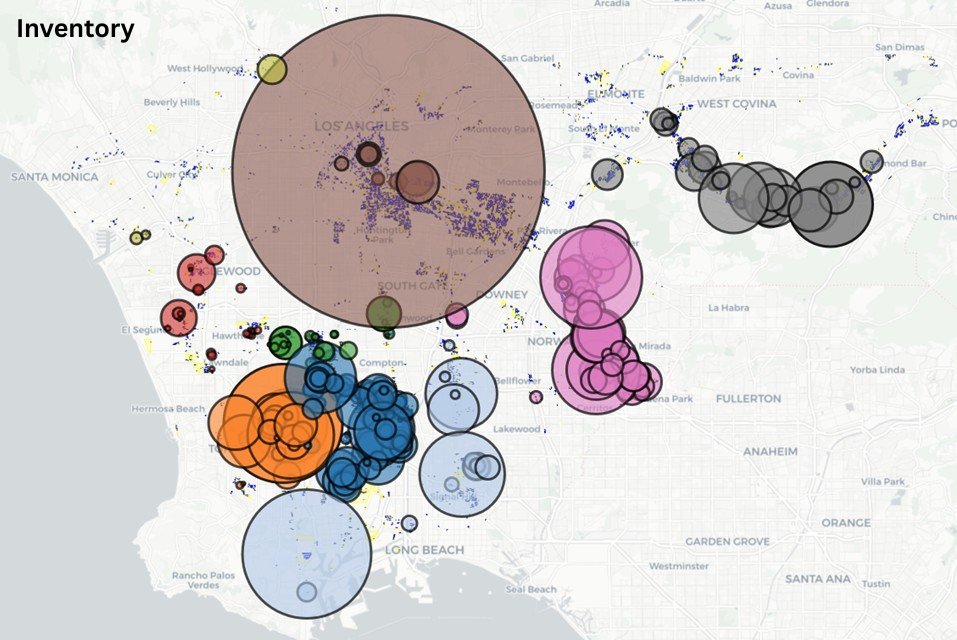

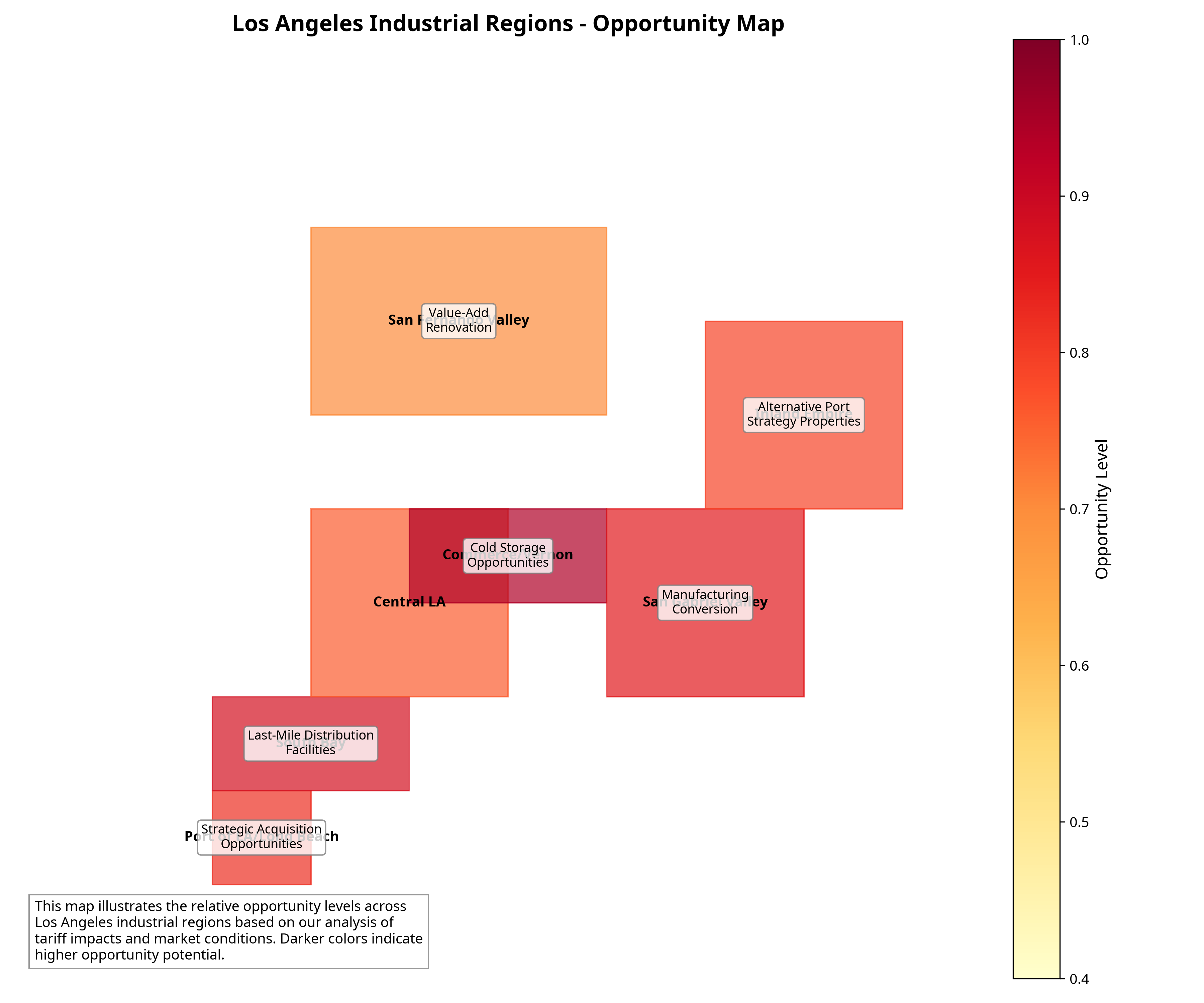

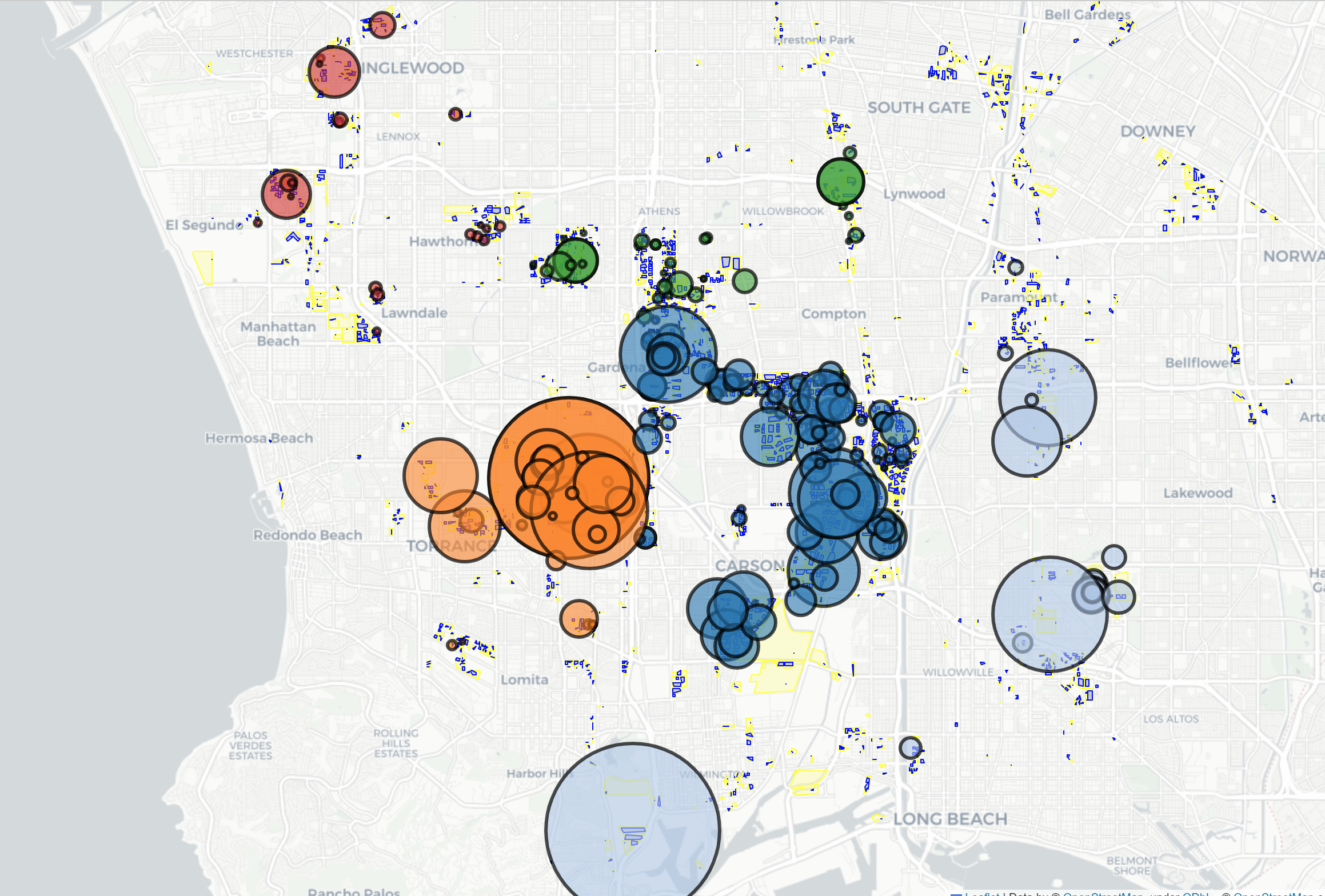

Los Angeles Industrial Regions Map

Industrial Regions Opportunity Map

Map shows relative opportunity levels across Los Angeles industrial regions based on tariff impacts and market conditions

The map above illustrates the key industrial regions of Los Angeles County and adjacent areas, highlighting the relative opportunity levels based on our analysis of tariff impacts and market conditions. Regions like Commerce/Vernon show particularly high opportunity potential for cold storage facilities, while the South Bay area presents strong opportunities for last-mile distribution facilities.

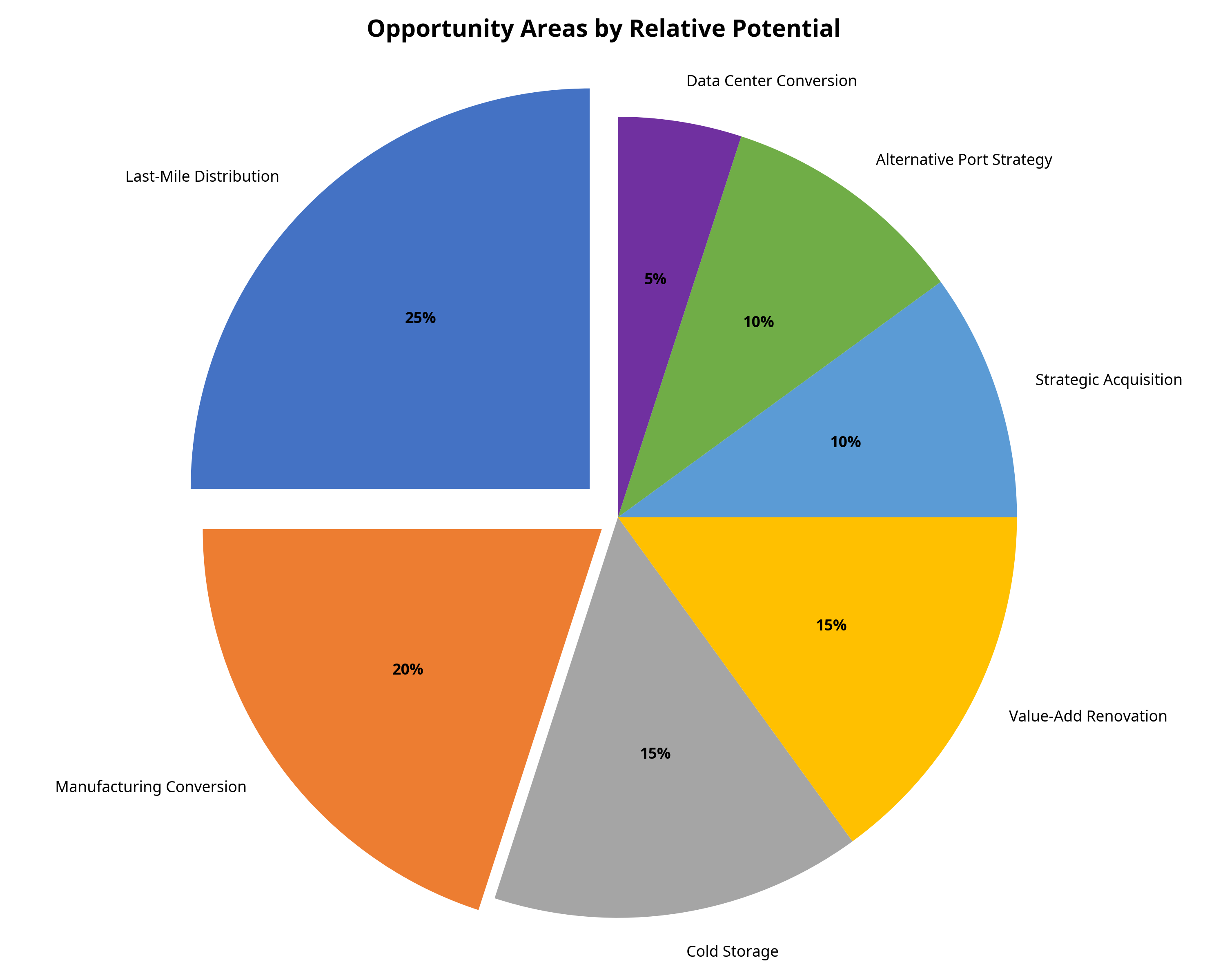

Seven Key Opportunity Areas

Opportunity Areas by Relative Potential

Relative opportunity potential based on market analysis

Opportunity Areas Overview

The intersection of tariff impacts and market conditions creates several distinct opportunity areas in the Los Angeles industrial real estate market:

- Last-Mile Distribution Facilities: Smaller, strategically located facilities that reduce delivery times and transportation costs

- Manufacturing Conversion Opportunities: Properties suitable for light manufacturing, especially high-tech manufacturing

- Cold Storage and Specialized Facilities: Temperature-controlled warehouses for food and pharmaceuticals

- Value-Add Renovation Opportunities: Older industrial properties that can be upgraded to meet modern logistics requirements

- Strategic Acquisition of Undervalued Assets: Properties near port facilities that may temporarily decrease in value

- Alternative Port Strategy Properties: Facilities positioned to benefit from cargo shifting to alternative ports

- Data Center Conversion: Industrial properties with robust power infrastructure for AI and cloud computing

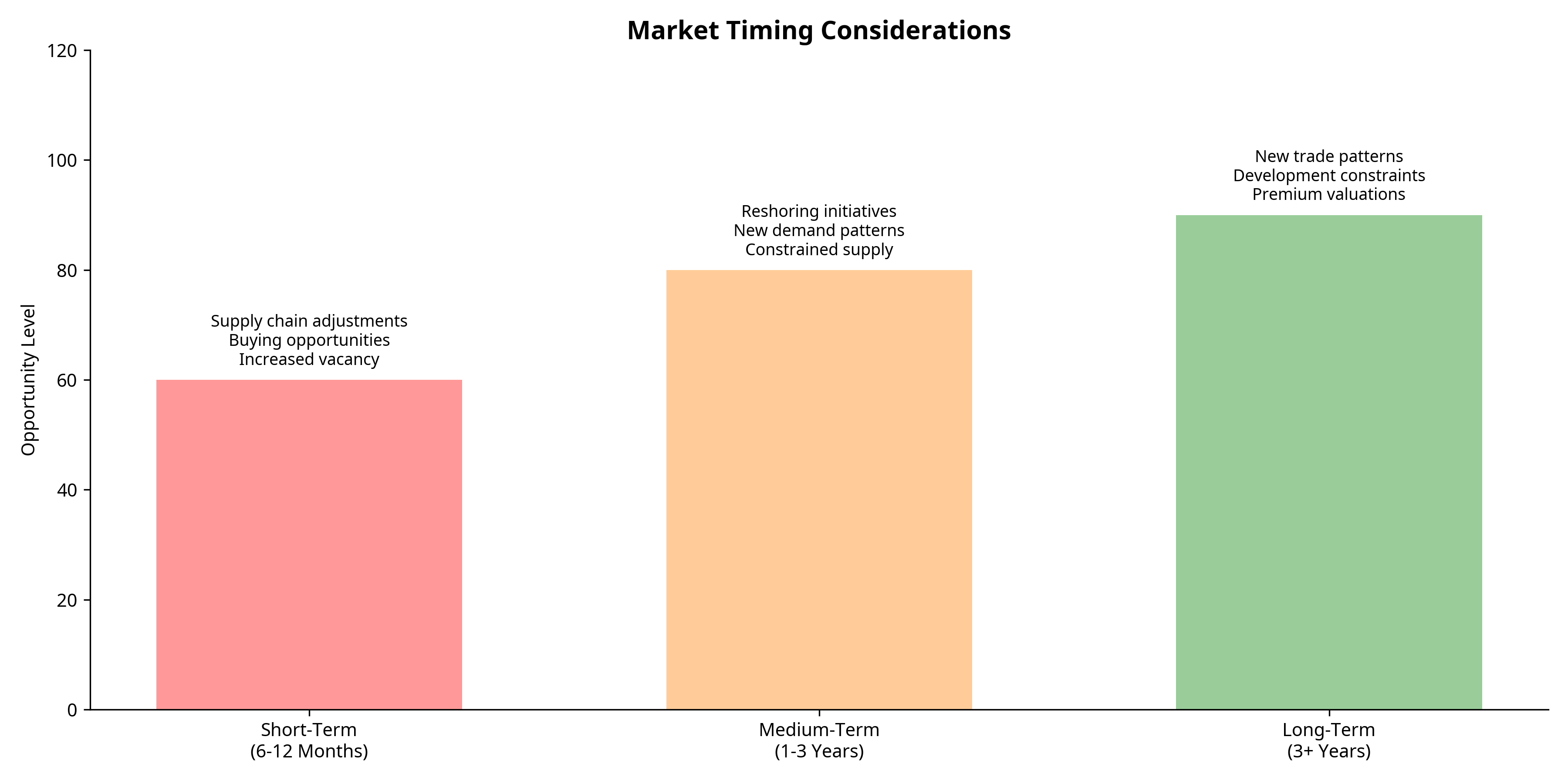

Market Timing Considerations

Timeline of Opportunity

Timeline showing opportunity levels and key factors across different time horizons

Short-Term (6-12 Months)

- Supply chains will adjust to tariffs, potentially creating buying opportunities

- Expect increased vacancy in properties heavily dependent on Chinese imports

- Potential for price adjustments in certain submarkets most exposed to trade disruption

Medium-Term (1-3 Years)

- Reshoring initiatives will take hold, driving demand for manufacturing facilities

- Supply chain reconfiguration will create new demand patterns

- Limited new development will begin to constrain supply, potentially driving rent growth

Long-Term (3+ Years)

- New trade patterns will solidify, with Los Angeles maintaining its strategic importance

- Development constraints from AB 98 will further limit new supply

- Properties that successfully adapt to new market realities will achieve premium valuations

Strategic Investment Recommendations

1. Focus on Location Quality

Properties with superior access to transportation networks, population centers, and skilled labor will outperform regardless of short-term market fluctuations.

2. Target Flexible Building Designs

Industrial properties that can accommodate multiple use cases will maintain value through market transitions.

3. Monitor Reshoring Announcements

Track major companies announcing US manufacturing investments to identify potential tenant demand patterns.

4. Consider Counter-Cyclical Acquisitions

The temporary disruption in port volumes may create buying opportunities for well-located assets at attractive valuations.

Conclusion

The recent tariff implementations have created a complex but potentially opportunistic environment for Los Angeles industrial real estate. While short-term disruptions are inevitable, the combination of reshoring initiatives, supply chain restructuring, and development constraints creates a potentially favorable environment for strategic industrial assets.

The Los Angeles industrial market’s fundamental strengths—its strategic location, robust transportation infrastructure, and access to one of the largest consumer markets in the country—will continue to support its long-term viability despite the current trade policy shifts.

Hard Tech Manufacturing Demand in South Bay Los Angeles

Where to Find Hard Tech Buildings in Los Angeles

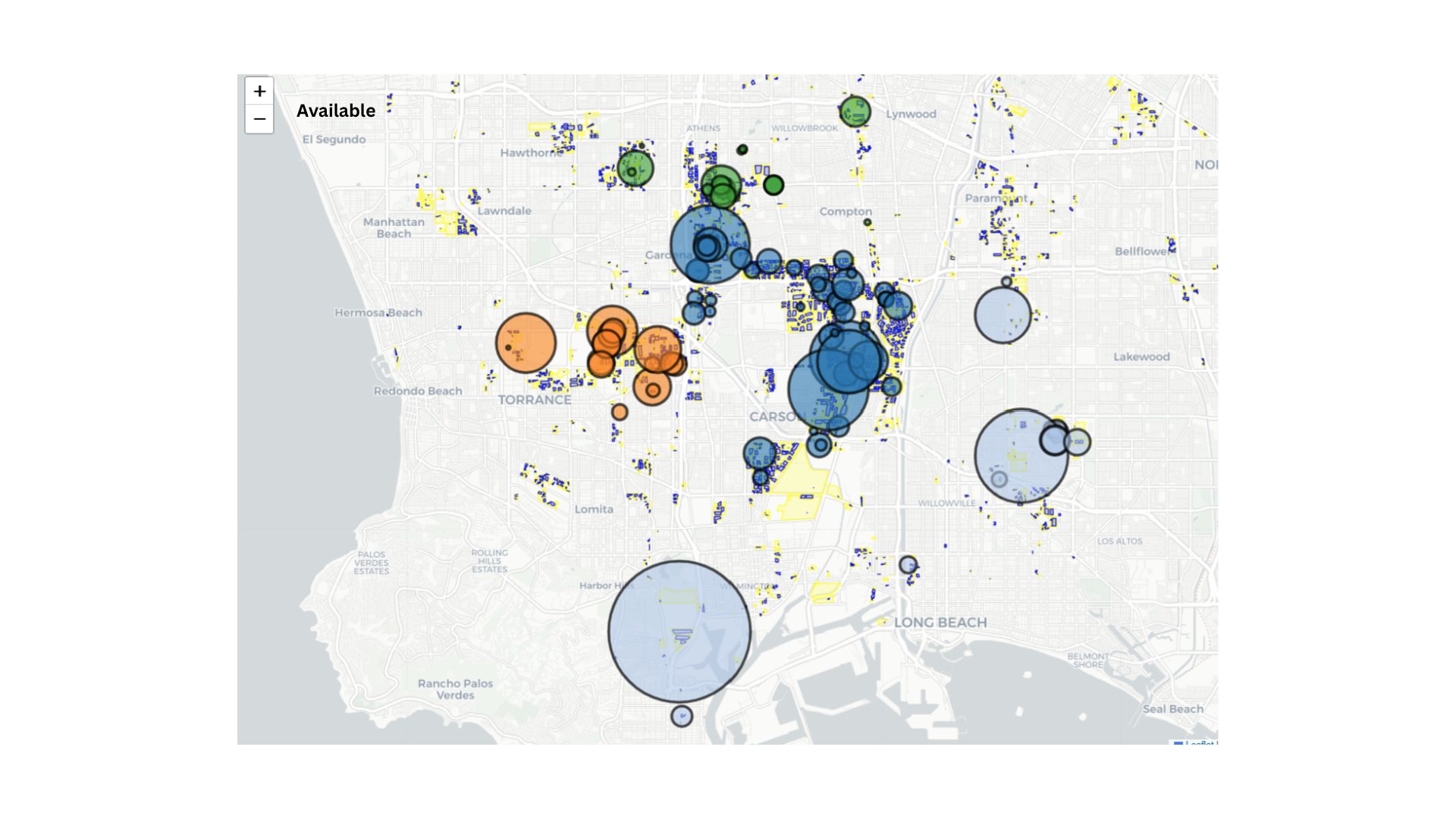

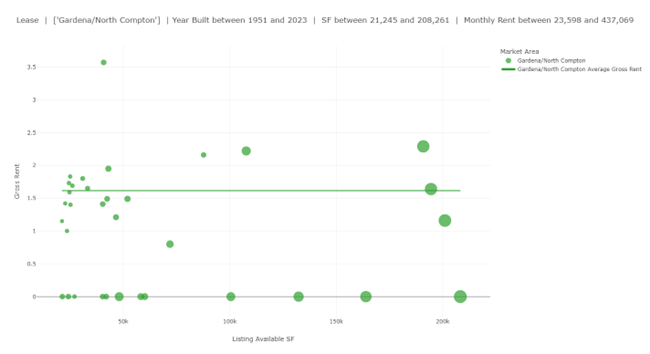

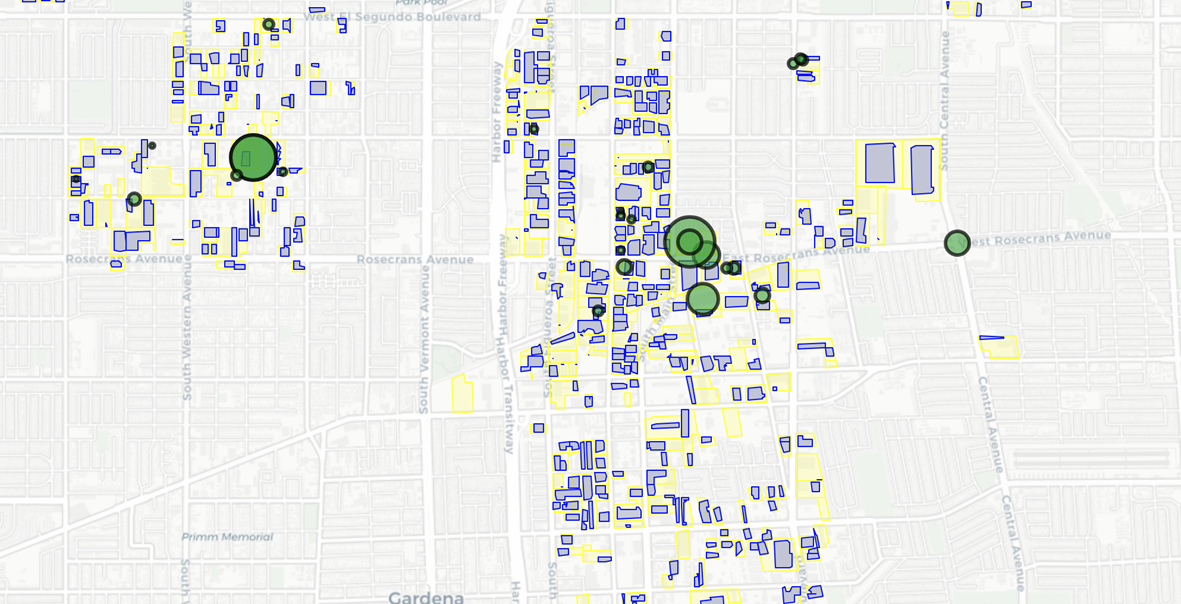

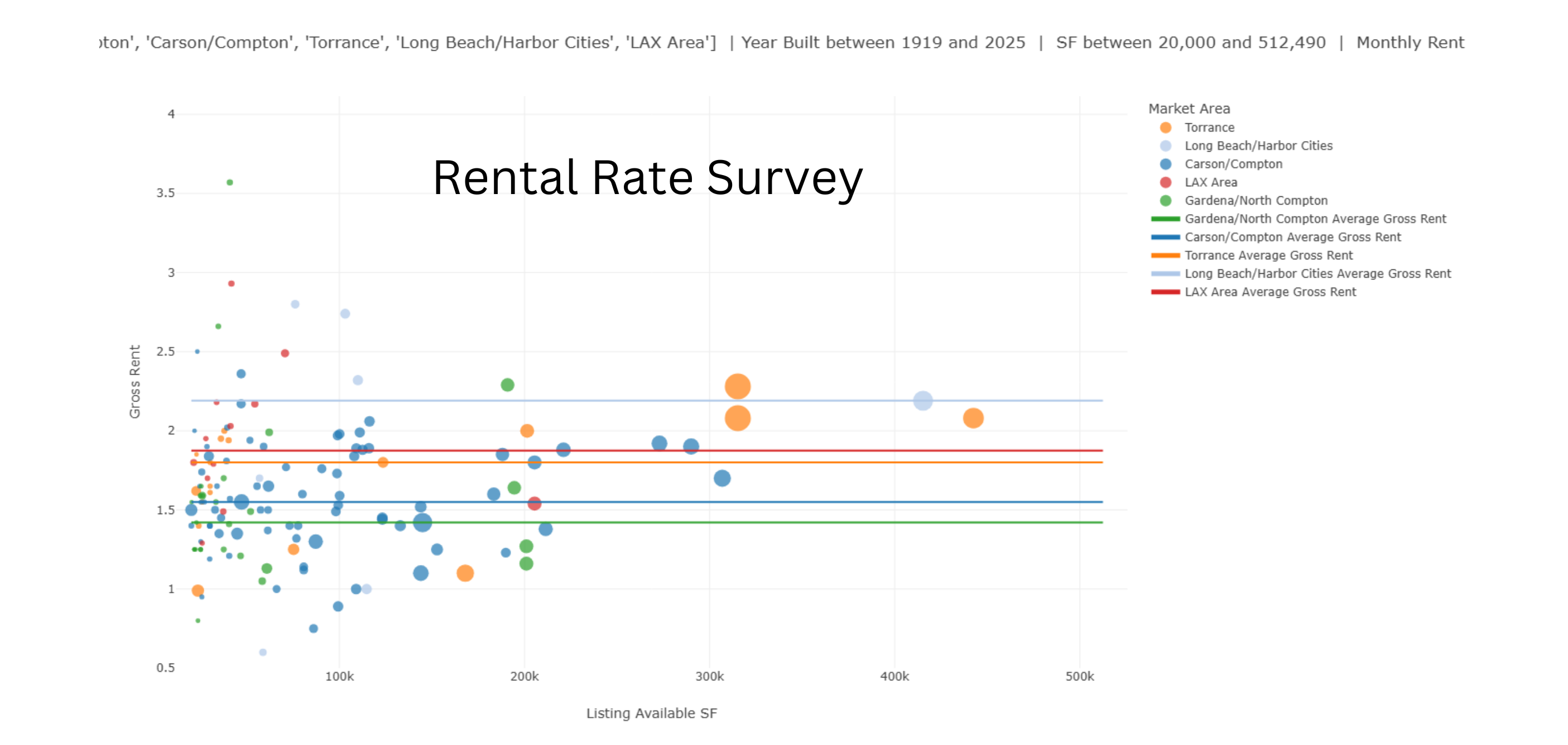

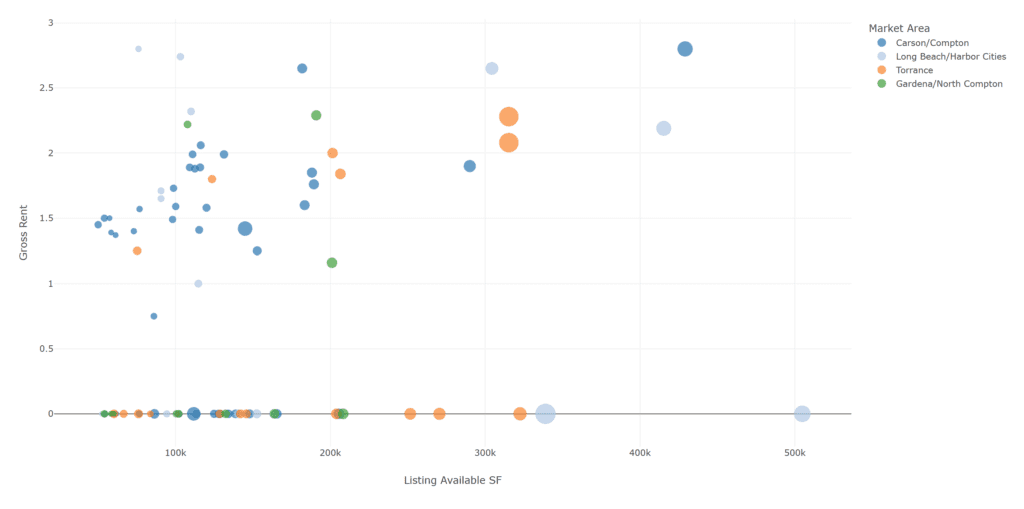

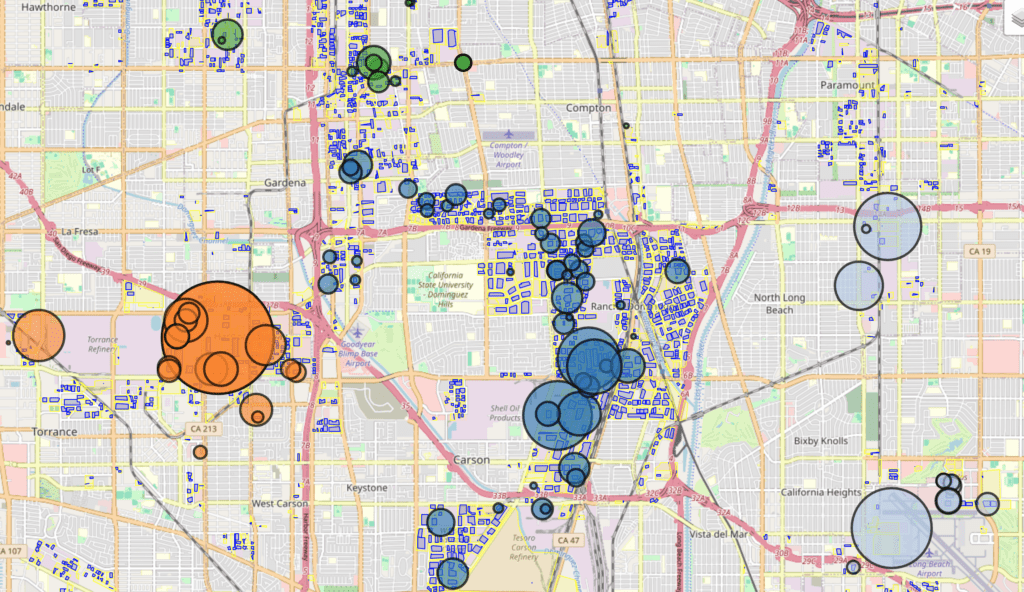

Despite higher than normal industrial vacancies, Hard Tech companies are finding it difficult to locate adequate industrial space. Many Hard Tech companies require substantial electical power. They want a free-standing building for U.S. Government clearance, more office space than is typical, a large parking area, and a location to attract engineers. Many Hard Tech companies prefer El Segundo and neighboring beach communities because of its history of aerospace and defense manufacturing. But they will consider other locatons along the 405 corridor from LAX to Irvine, including Torrance, Long Beach and other locations in Orange County. Some Hard Tech Companies will make the difficult decision to split their manufacturing from engineering to find the right facility in the location they want. Other parts of Los Angeles that served as machining centers in the past are located in Gardena/Carson, Commerce/Vernon and parts of the San Fernando Valley. Following are a couple of graphs describing market conditions:

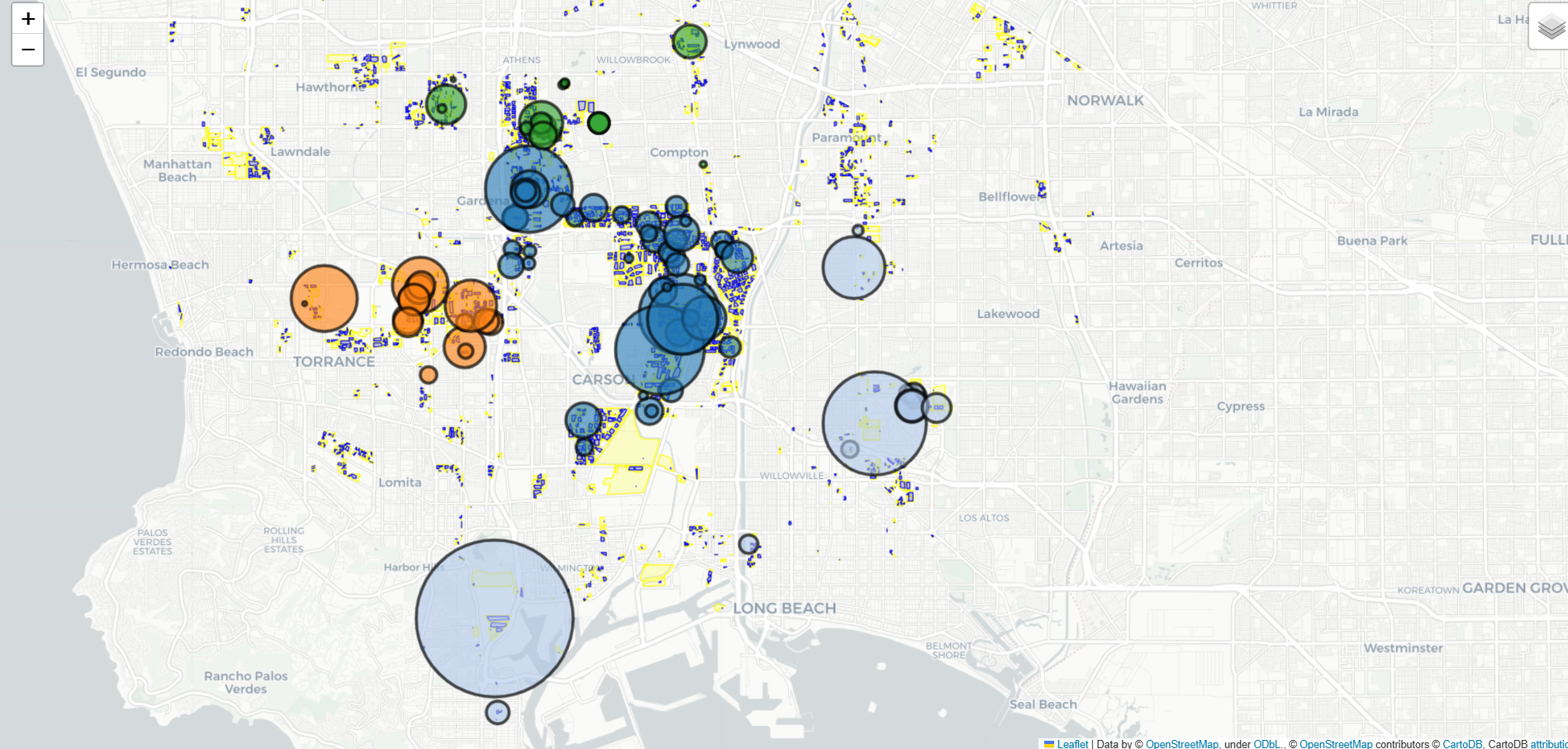

Offerings are scarce in the El Segundo/Beach Cities area. When Hard Tech companies grow, they often look to Torrance, Hawthorne, Gardena, Carson or Long Beach. These cities are close to experienced engineers and they house good production facilities.

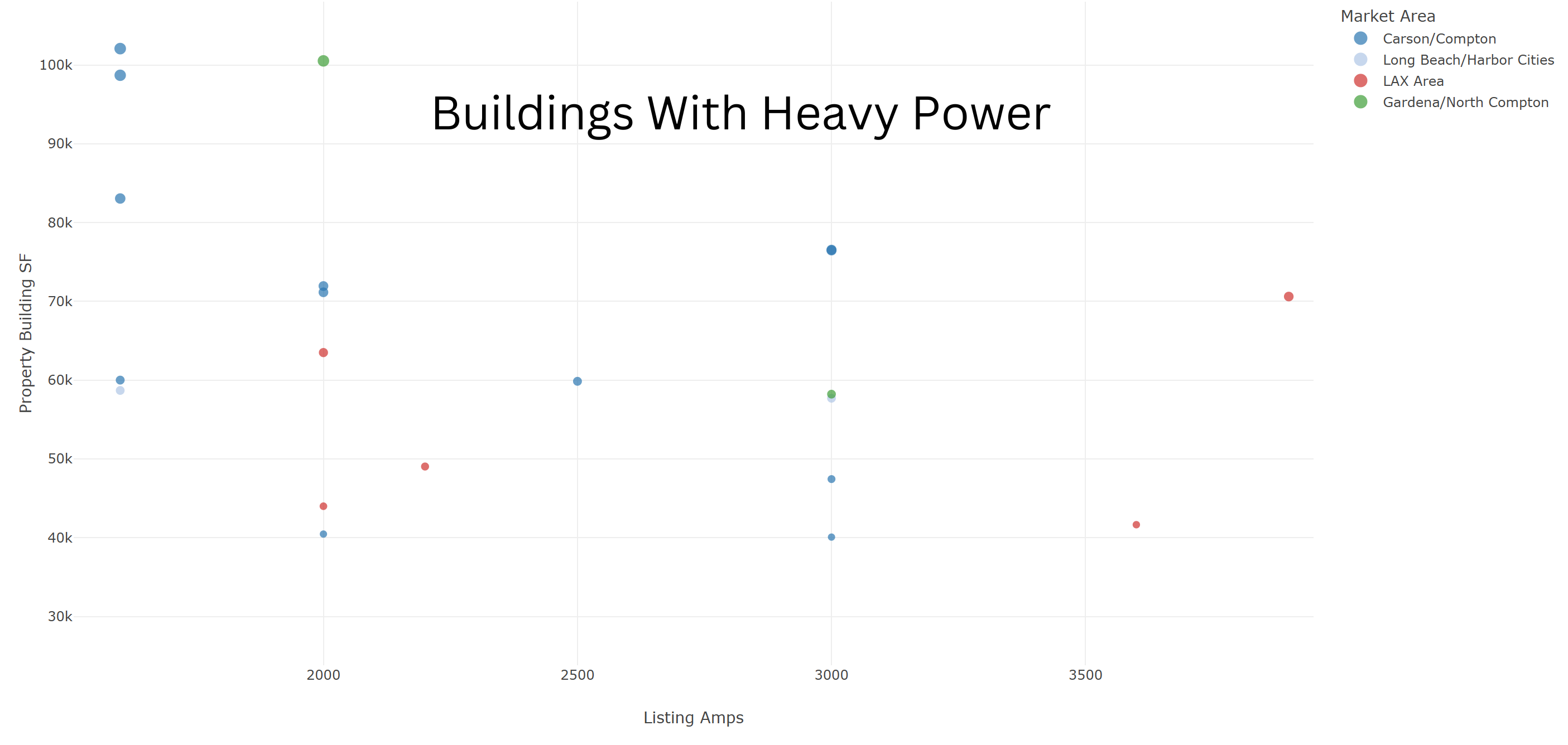

Power is a main criteria for many Hard Tech Companies. If you need heavy power, 2000 AMPs or greater, there are only a few buildings with the necessary capacity in each square foot range.

Rents hover between $1.50 to $2.25 Gross per square foot per month depending on location and amenities.

If you are seeking a new building or have questions about Los Angeles industrial real estate, please contact us today.

Thank you,

Jim Klein, SIOR – Jimklein@kleincom.com

Quan Wu – Quan@kleincom.com

It’s 2025 and It Will Never Be The Same

In North Santa Monica, where I reside, we are the lucky ones. Destruction from the fires is just over the ridge. We can walk down the staircase on Adelaide, pass Canyon Elementary, climb back up Rustic Canyon, and be in the center of the burn area in a 15-minute hike. It’s smoky, many residents have left the streets to quiet. Face masks are common and the color of the sky is a tinge of orange. Threats of more wind are in the offing. Today, large convoys of police cars and fire trucks, 15 or 20 in a group, are traveling up the 405 with flashing lights to pre-position.

When we evacuated on the first night, we came to the New Gardena Hotel. It’s Japanese-owned and managed with high standards and a good breakfast. It’s in the center of the Gardena restaurant row with noodles, seafood, Japanese, Korean, and Vietnamese delicacies across the street at Pacific Square and Tozai Plaza. I saw a customer at the hotel who did the same as us, to be near his business. His house was destroyed.

Today is President’s Trump inauguration day in Washington D.C. It will bring a new era of governing. The administrative state will be top of the agenda. If you’ve dealt with local planning agencies and the mounds of restrictions from Green Zone Ordinances, buffer zones, AB 98, Environmental Justice, and other anti-industrial building measures, you can see how far astray local leaders have gone by neglecting basic municipal services. The other initiatives I’ll be watching will be AI, Crypto, and Super Intelligence. These are new agencies headed by talented and experienced executives with histories of founding tech companies. And limited Regulation!

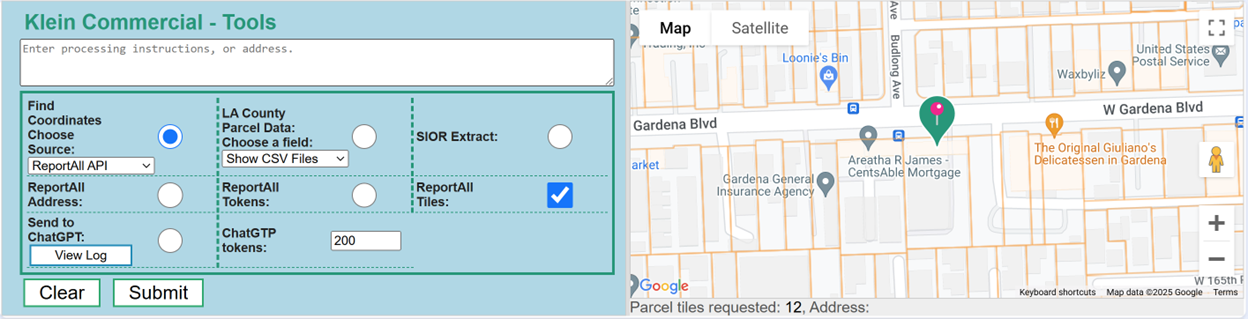

AI is the transforming technology of a generation. Already, AI chat applications provide learning, automation, and useful outputs that merit continual dialog with your AI pal. At our office, we are preparing for the AI future by cleaning our data (parcel records, salesforce, available, and specialty niches) so it can be read by machines. We geolocate each property and create a unique link to build and show relationships. We focus on local properties, especially those that are potential transactions. We follow certain industries and share techniques with colleagues in different markets.

Crypto is a step to the future. An increase in the value of coins and an embrace of crypto by key finance legislators will bring wider acceptance and knowledge. We experimented by building a blockchain on Hyperledger, but we didn’t have enough transactions to justify the instance cost. Now, we are using IPFS, a public decentralized blockchain where cost is low. In Los Angeles, because many properties trade off-market, in quiet transactions, or under new Buyer regulations, there is a blockchain use case to order and provide certainty. Blockchain is helpful when Sellers want to be discrete. You need not trade crypto coins or speculate to use blockchains. Please look for further explanation of how we use IPFS with customary brokerage procedures

In Los Angeles, industrial real estate has gone from frothy to flat. Rents are in decline, sale prices are down, and to the consternation of many sellers, investors have a “large margin of safety” when they make an offer. There is a wide variety of buildings available, especially for warehouse and distribution. One segment of shortage is modern, free-standing, and secure industrial buildings that can meet government clearance. Power and parking are needed for tech-industrial. Multi-tenant units, too, are in short supply.

We create analytics and compare buildings based on attributes and location. Clients can understand the real estate markets by scrolling over and seeing the metadata for each property. We create graphs for tenants, owners, and investors. Originally coded for Streamlit, we migrated to a SQL database and then to Postgres so we could capture location data. We’ll be able to solve some nagging problems with this next revision. Organizing market data in this, or other ways, is a necessary step for adopting new standards.

Our staff has grown to eight people split between sales and administration. We have a 45-year history in South Bay industrial real estate and an office in Gardena for most of that time. We live on deals. Please contact us if we can help with your next industrial deal. In Los Angeles, or anywhere in the U.S.

Buyer-Broker Agreements Are Now A California Mandate – 2025

Buyer-Broker Agreements Are Now A California Mandate – 2025

As of the start of 2025, all buyers being represented by a broker will need to agree in writing regarding their business and transactional relationship. In many cases, the broker’s compensation is now being shifted to the buyer. There will be a lot of explaining to do if a buyer wants experienced representation. California Civil Code §1670.50, effective January 1, 2025, mandates that real estate agents representing buyers enter into a written “buyer-broker representation agreement” with their clients. This agreement must be executed as soon as practicable, but no later than when the buyer submits an offer to purchase real property.

Key Provisions in a Buyer-Broker Agreement Include:

- Broker’s Compensation

- Clearly state how the broker will be compensated for their services.

- Include the amount or method of calculation (e.g., a fixed fee, percentage of the purchase price, or other arrangements).

- Specify whether the compensation is contingent on the completion of a transaction or is payable under other conditions.

- Services to Be Provided

- Detail the specific services the broker agrees to provide to the buyer, such as property searches, negotiations, or assistance with purchase contracts.

- Payment Conditions

- Clarify the conditions under which compensation becomes payable, including:

- Whether payment depends on the successful closing of a transaction.

- Responsibility for compensation if the seller offers to pay part or all of the buyer’s broker’s fees.

- Clarify the conditions under which compensation becomes payable, including:

- Contract Duration

- For agreements with individual buyers, limit the duration of the agreement to no more than three months.

- Prohibit automatic renewals of the agreement.

- State that any extensions must be in writing and signed by all parties.

- Termination Clause

- Include conditions under which either party may terminate the agreement.

- Address the buyer’s obligations regarding compensation if the agreement is terminated before a transaction is completed.

- Legal Disclosure Requirement

- Attach or reference the required buyer representation disclosure form as specified in Section 2079.14. This ensures the buyer understands their rights and obligations.

- Signatures

- Include the signatures of all parties (buyer and broker) to validate the agreement.

- Governing Law and Dispute Resolution

- Optionally include provisions regarding governing law (California law) and how disputes will be resolved (e.g., mediation, arbitration, or litigation).

Additional Notes on Compensation

- The agreement should address how compensation will be handled if the buyer purchases a property without the broker’s involvement.

- If a seller or another broker offers compensation, the agreement should clarify whether this reduces the buyer’s obligation to compensate their broker.

AIRCRE has developed two forms for both exclusive and non-exclusive agreements. Both are detailed and protect the broker. I will be curious to see how fund-level investors treat this mandate. First Tuesday has also developed a similar form that is simpler to use. I’m debating which of the two versions is more practical. In either case, we’ve been instructed by our legal counsel to prepare an addendum for every property that is submitted. California has added a layer of complexity to every deal. There is an opportunity in this legislation to modernize our brokerage process, but more about that another time.

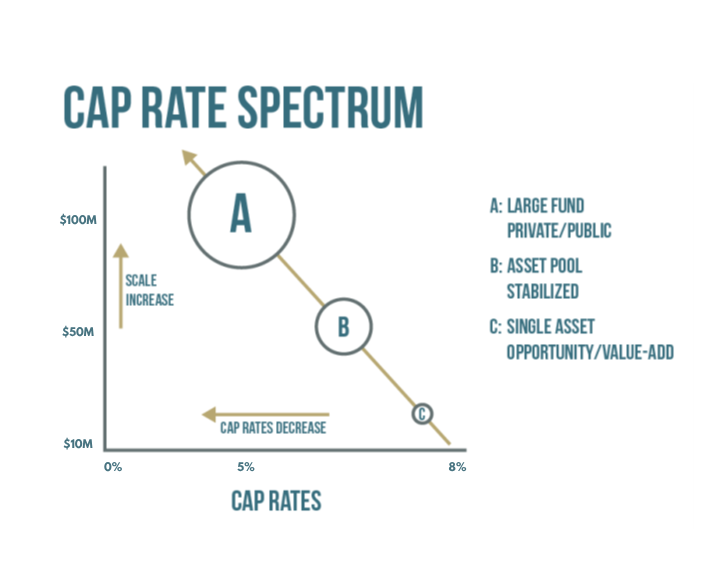

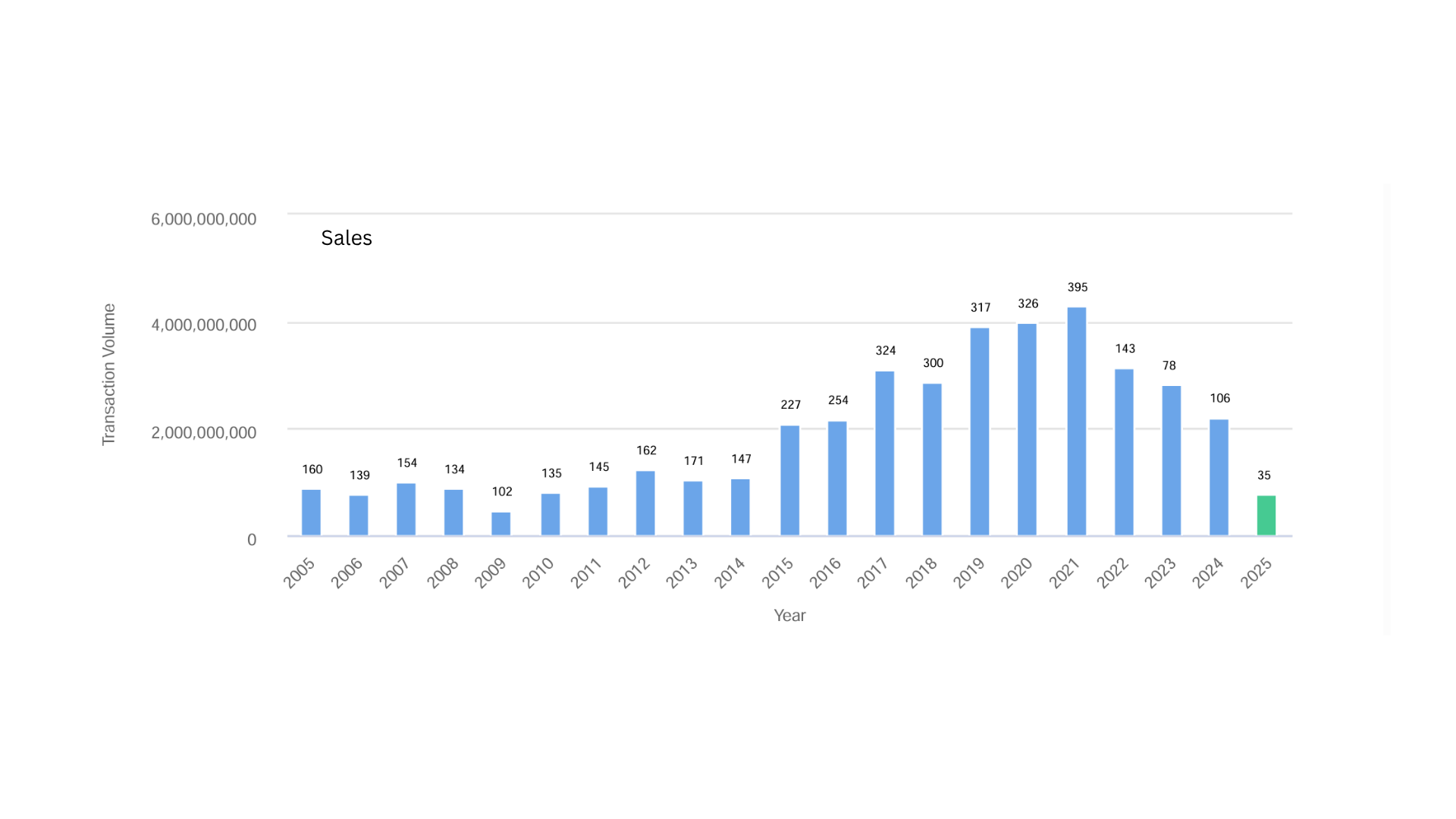

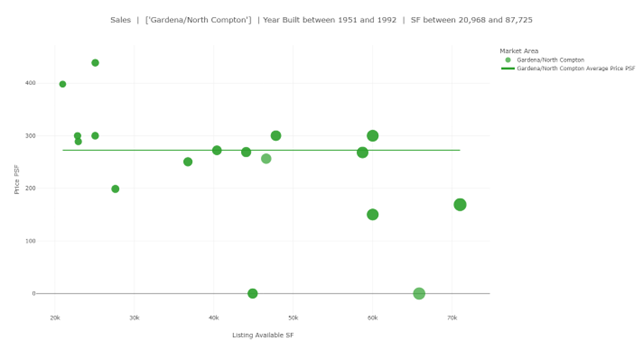

Industrial Building Sales

The Los Angeles industrial real estate market is financialized. That means pricing reflects accepted investment principles. Investment buyers, flush with private capital, are searching for smaller and older buildings than what you would normally expect from fund level buyers. Assets owned by individuals, corporations, families, and partnerships are being sold to large investment groups, funds, and REITS. It started with “Class A” buildings but escalated for almost all industrial buildings with low interest rates after the Great Financial Crisis. Activity surged during Covid, levelled off during the recent period of higher interest rates, and is regaining strength with more capital allocations hitting almost all industrial properties that generate long-lasting income.

In our experience, some building owners prefer comprehensive marketing and others want discretion. We developed our resources to do both:

| Conventional Listing | Private Listing |

|---|---|

| Exclusive | Non-Exclusive |

| Market Rate Broker Fee | Lower Broker Fee |

| Generally, No Dual Agency | Dual-Agency |

| Common with Owner/Users | Common with Investor/Developer Sales |

| No Immediate Hurry | Deadline |

| Public – Wider Distribution | Confidential and Discrete |

| Dedicated effort and resources | Flexibility – Can sell yourself |

| Posted online and through Industrial Multiple | Distributed to professional buyers |

The Sweet Spot in Industrial Buildings

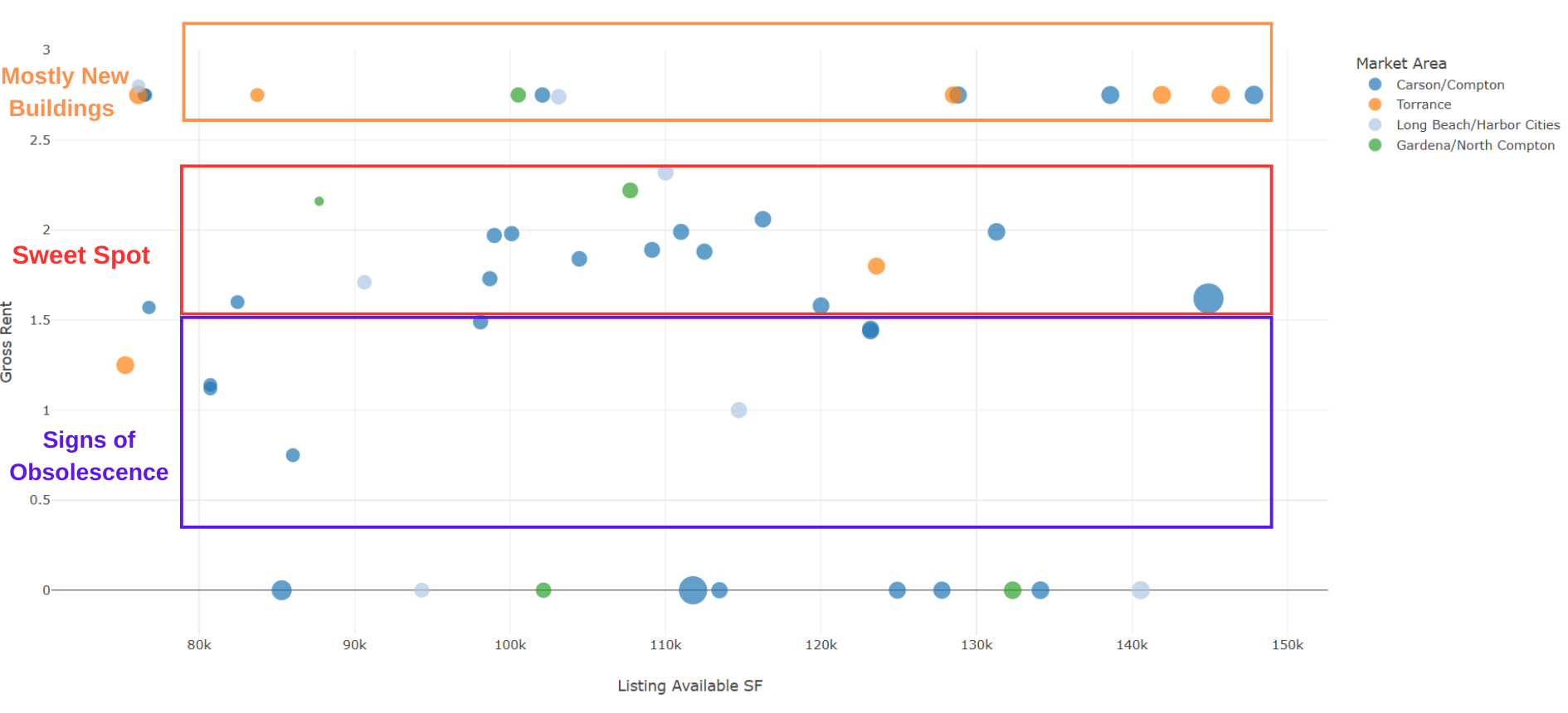

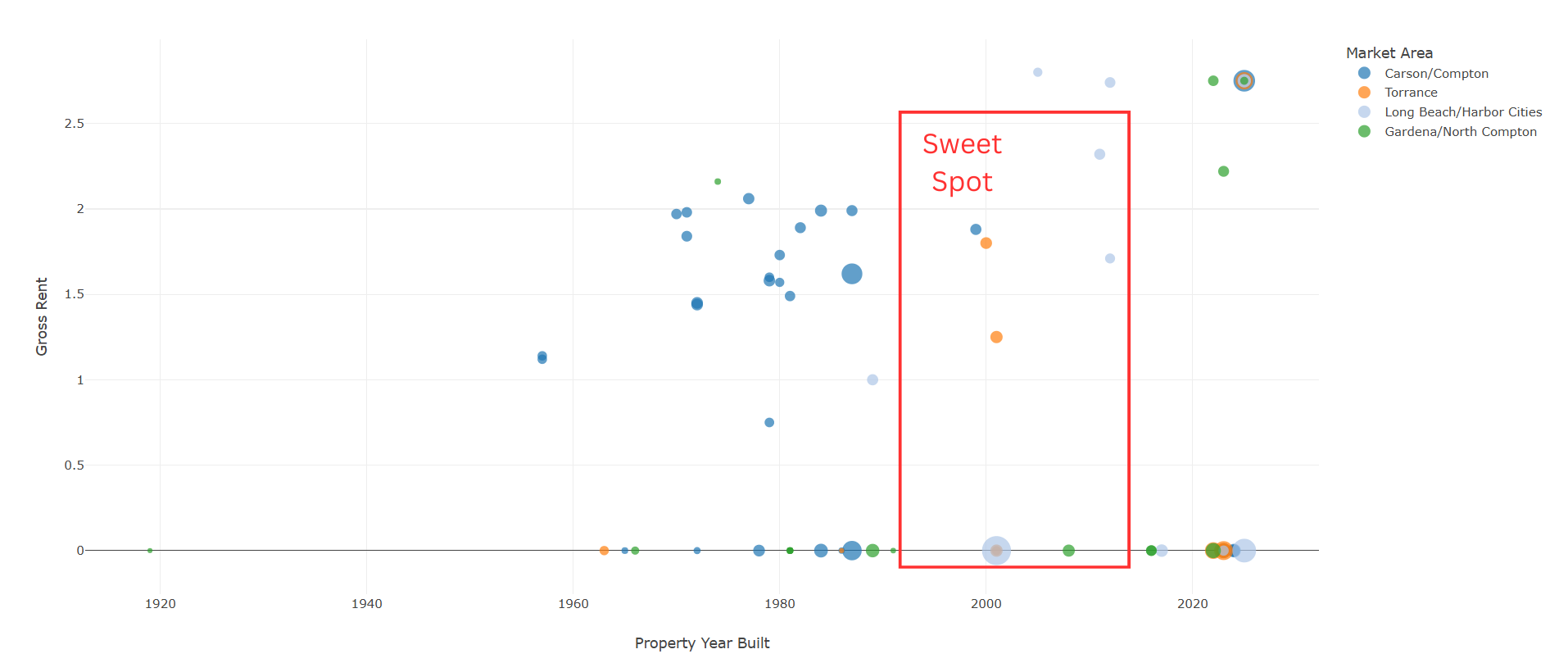

For most tenants, better values are found in second or third generation buildings. This means buildings that are roughly 15 to 20 years old having already been occupied by previous tenants. They are still modern warehouses with good ceiling heights (24’-30’), loading, power, and efficient layouts. Most of these second generation buildings are well away from residential areas which have become a greater concern for industrial users. Many are LEED certified.

Newer buildings are even more functional because of higher ceilings (32’-40’) and better design. They are more costly because of higher land prices, construction costs, and property taxes. Most are unpriced and appear on the bottom of the graph. In reality, they should be on the top scale because they are the most expensive. Older buildings (pre-2000) can require upgrades to overhead sprinklers, seismic, offices, and have design flaws that can inhibit efficient operations.

The number of offerings in the current cycle will give you a wide selection of choices in almost all Southern California markets.

Current Rent-(Gross)

75,000 SF – 150,000 SF

All South Bay

By Year Built

Location Map

Please Contact: Jim Klein, SIOR – 310-451-8121 – jimklein@kleincom.com

1204 W. Gardena Blvd, #A, Gardena, CA 90248

WE SELL INDUSTRIAL BUILDINGS

Current Rent-(Include Property Taxes and Insurance)

Current Sale Prices

Location Map

Please Contact: Jim Klein, SIOR-310-451-8121-jimklein@kleincom.com

1204 W. Gardena Blvd, #A, Gardena, CA 90248