General Sentiment

To judge the health of the industrial market, I rely on activity reports from fellow brokers. Across the board, its been obviously weak. Most of my peers are squeaking out a living from short term leases and renewals. Sales and investments are moribund. There’s a bit of government support and stimulus work for those in the pipeline, but not enough to have a broad impact. Many agents have left the business. Most of my broker friends anticipate the same for 2010. We may be nearing the bottom of the cycle, but most sellers and banks are not willing to accept the greatly reduced prices.

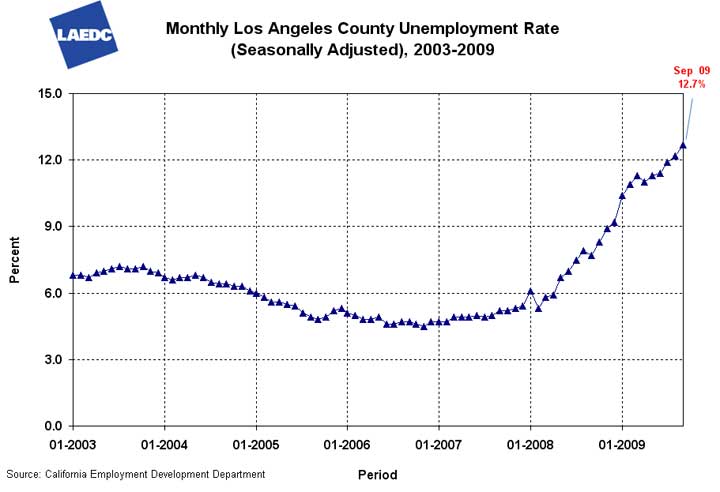

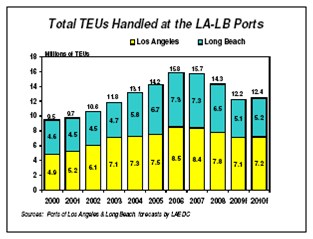

Statistically, keep your eyes on container imports, unemployment numbers, and lending reports. Improvements in these categories should translate directly to greater Los Angeles industrial. Those investors who bet heavily on a “port strategy” have seen the value of their investments erode. Logistics was, and still is, the primary factor for industrial real estate investing. The same failures apply to many owner users who financed purchases with the China Trade in mind. They have received a double whammy with falling building prices and lower trade income. While expectations are weak, survivors are changing the way transactions occur. Tenants are taking an incremental approach in making decisions until they get a better picture of the future. Once business conditions shift to more certainty, companies will focus on permanent and sustainable decisions.

Incrementalism

| Characterization | Advantages | Disadvantages |

| Take space when needed; piecemeal | Short forecasting horizon | Hodgepodge of facilities; lacks overall plane |

| Short term decision making | No need for long term decisions | Conflicting and confusing |

| Functional space, no amenities | Opportunistic in real estate market | No consistent image |

| Uncertain or fast changing business conditions | Short and relatively riskfree commitments | No macro saving or operational effectiveness |

Standardization

| Characterization | Advantages | Disadvantages |

| Standard policy and specs | Reinforces identity and stability | Difficult to modify when needed |

| Measured and efficient | More economy to scale | Reinforces existing structures |

| Certainty in business | Reduced confusion | Stifles creativity and change |

One industry fallacy is the marketing ploy of offering short term teaser rates. As these discounts are often negotiated, rents increase on an arbitrary date which the tenant may or may not be able to afford. Sometimes landlords are forced to extend the low rate or lose the tenant all together. Plus reasonably intelligent tenants will calculate the inducement in a present value calculation and not fall subject to an unaffordable rent increase. To truly be effective, these “discounted” rents should mirror the tenant’s operations with metrics based on gross sales, employment, or pallet positions. Maybe a return to percentage rent is warranted in certain circumstances. If the loan can be serviced under this variation, fixing the rent to the tenant’s business would lease buildings faster than having a teaser promotion.

Short Term Leasing Triage

As owners find current rents or their business model will no longer support their mortgage, they begin to seek unusual solutions. I’ve seen import companies use their existing operational infrastructure to branch into public warehousing. Others will simply offer warehouse space and offices with no more security than a handshake. Video cameras and security guards offer enough protection that an expensive demising wall is foregone. Some businesses who are familiar with Container Freight Stations find this a normal solution. Meanwhile many tenants are adaptable. Communication and data is portable and goods can be transferred easily. Some of these operations have learned from military logisticians who supply goods on the fly. Portability can be a competitive advantage because legacy competitors are often stuck with costly capital investments in real estate, employee costs and infrastructure.

In a soft and agile market, flexibility is particularly advantageous with product launches and uncertain sales forecasting. The corollary in the retail world are pop up shops that feature a designer branded product for a few months and then moves to a new location with another product. The new fad of Twitter food trucks that navigate the city and message their fans are another example of a flexible business model. Needless to say restaurants with fixed overhead costs are not as enamoured with this new dining experience. As economic challenges bring fresh ideas, expect to see more short term occupancies supported by new technology.

Pension Plans

Pension funds are major investors in the real estate world. Because of their size, pension funds can dominate a market. Along with REITS, their influence is felt throughout Los Angeles industrial and commercial property. Unfortunately, group-think has caused a collective failure with overpriced property and non-performing land. For Pension Advisors and their related investment vehicles, it is not enough of an excuse that they made the same mistakes as everyone else. The advisors are well rewarded to avoid such bad decisions. The largest pension fund of all has fallen the hardest and many signs are pointing to incompetence, poor ethics, and corruption. The result of poor pension investing is destabilizing municipal finance. Government services will be cut to pay for faltering pension obligations. Of course, a large part of the blame goes to the pension industry itself. There are too many financial obligations negotiated through labor agreements that will not be satisfied by either prudent or risky investing. Some cities will need to go bankrupt to shed their costly pension plans. The next wave of investing is just starting as funds look to purchase distressed assets. The expectation is large returns over a short holding period. Hopefully, pensions will also look long-term at some of the individual problem assets in the market. A turn around strategy with a longer holding period will reduce volatility and maintain steady gains in excess of actuarial payouts.

The other irony in the pension mess is that many pension funds are considering the finance of municipal infrastructure. In exchange for a toll or bankable cash stream, the investor will finance the capital improvement like a bridge, road, port, or water system. In the past, municipalities would be able to finance this improvement through a bond issue or other financing vehicle. But partly because of high pension obligations, governments can no longer afford to finance important municipal improvements and are turning to funds supported by pension monies. Not only will municipalities need to increase contributions, but they will also be paying fees to these same pension companies. More importantly, California needs vital improvements to attract new business whether it’s publicaly or privately financed.

Lenders

Banks have moved to center stage in many negotiations. Properties being sold today are often underwater. Personal guarantees, blanket encumbrances, and cross-collateralization are complicating closings. Before a Buyer gets too far into a deal they need to look at the indebtedness before spending a lot of time on other issues. In one deal, the seller agreed to bring additional funds to close the sale. In another, the deficiency was shifted on to other properties, including the Seller’s home. Luckily, those were the easy solutions. The painful and common situations, like bankruptcies and foreclosures, are not as easily solved.

The other interesting part of the financial crisis is each bank will solve things differently. Some won’t cooperate at all because of their own individual problems. Others will discount the note, but will not accept a cram-down. Some banks will temporarily reduce mortgage payments as long as their interest is covered. Many banks favor big borrowers over Mom and Pops. SBA borrowers are in the most difficult circumstances because many have pledged their homes and have mortgage leverage that vastly exceeds market rents.

Over all, industrial foreclosures have been limited in comparison to multi and single family residential But year end defaults of industrial have increased. There should be enough problem industrial next year that the buyers will examine workouts instead of shopping traditional brokerage offerings. When interest rates increase, some of the favorable short term loans that have been extended to landlords should also increase defaults. If you are looking for industrial and not scouring for defaults, you will be missing some of the best opportunities.

Regulation

Companies are awaiting new legislation that affect their business. Health Care reform for small business will affect most of my clients and may damper rehiring. New banking rules that set increased capital requirements will translate directly to real estate investing. Finally the California Air Resources Board will soon establish rules to reduce greenhouse gasses. With a cap and trade mechanism forecast it will create winners and losers among industrial companies and dramatically change the value of some industrial properties.

Conclusion

Fundamentally, the brokerage business remains the same. It’s about representation, finding deals, and negotiating. Companies will look for lower real estate costs and better locations. But 2010 will also be influenced by many new factors and alert participants will find some real gems because of the market disintermediation. More importantly, as we climb out of recession there will be many new and different rules to conduct business.