Summer 2023- New Industrial Building Analytics

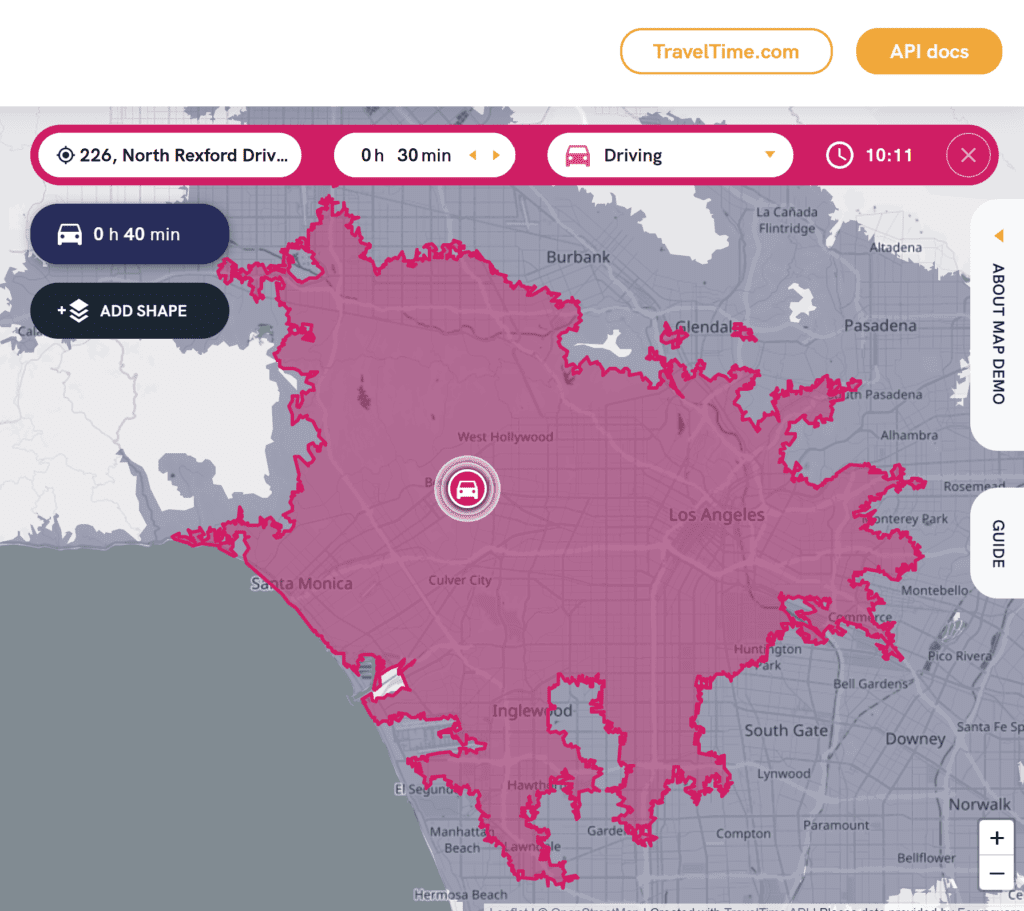

This summer we are expanding our research and analytics to help you find the right deal. In Los Angeles or anywhere else in North America. We are growing by hiring two new salespeople, an IT manager, and a data scientist. Please contact us for a consultation about your next industrial real estate deal.

———–

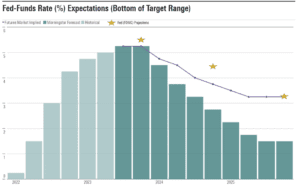

Higher interest rates created a lull in the market but with forecasts showing interest rate declines starting in 2024, investors are looking for opportunities. There’s plenty of liquidity at the right price. Owners and tenants alike are vulnerable to current higher interest rates if they need to finance. This has caused some property owners to look at their real estate to raise cash. It’s a favorable time to sell if there is income in place through a sale leaseback or other long term leases.

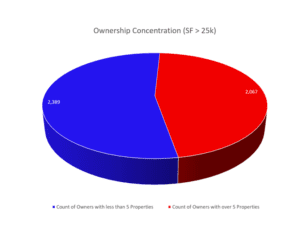

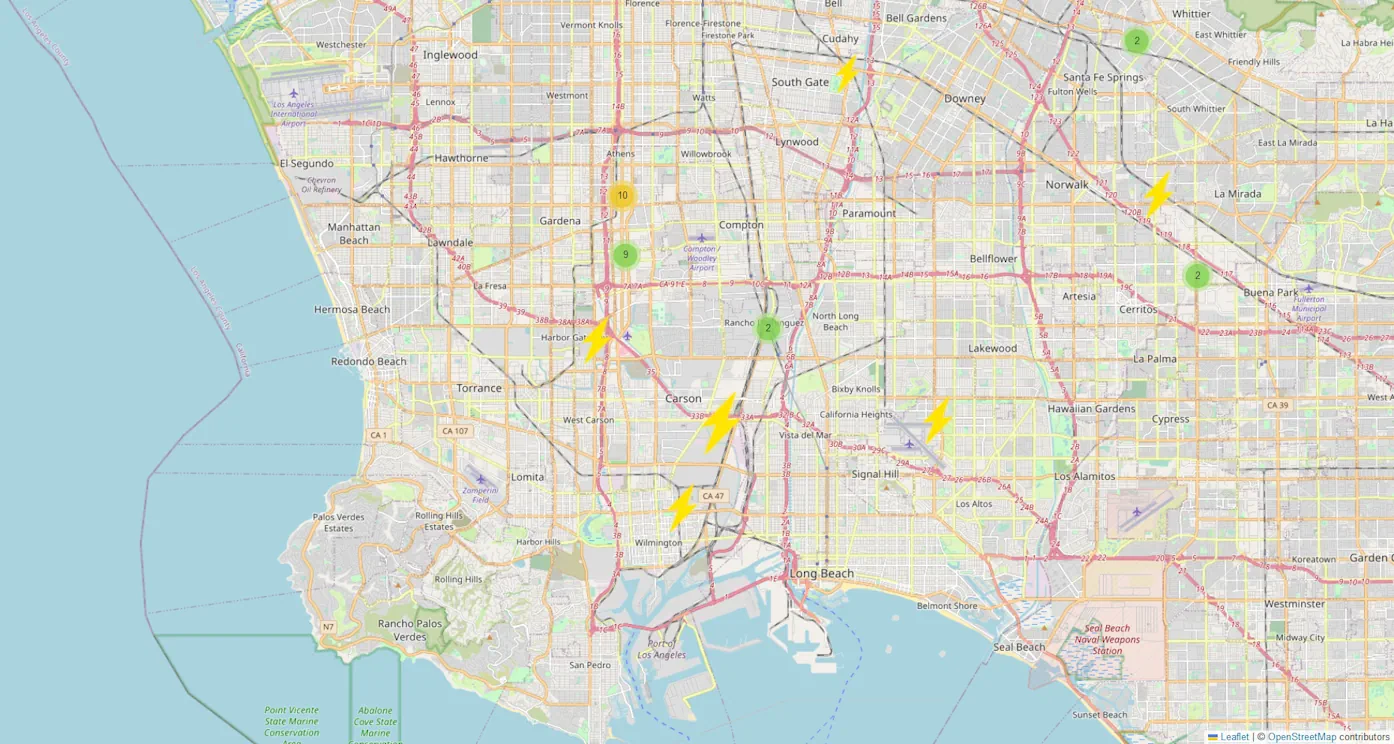

Sophisticated industrial building investors own almost half the buildings in Los Angeles County greater than 25,000 square feet and they are continuing to buy more at today’s adjusted pricing.

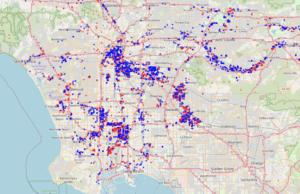

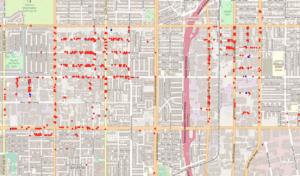

Through research, we can identify those properties that are held by sophisticated investors compared to property owners that have less experience. Once mapped, we can precisely see where investors prefer to be located and which buildings they would like to purchase.

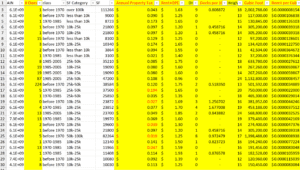

For tenants in the market, we use similar data to help you find the best buildings. We focus on total occupancy cost and building utility. Warehouse economics includes measurement of total cost per square foot (including property taxes), docks per 10,000 SF, and cost per cubic foot. By comparing cost and utility, we can often identify the “best deal”. We also use subjective measurements that include landlord sophistication and property basis. Variables are shown on the report below we recently did for a Gardena tenant. We will be depicting the results on a scatterplot for easier reference.

Incidentally, this map shows how few buildings (over 10,000 SF) are available for lease in Gardena. It’s a tight market with few vacancies (shown in blue).

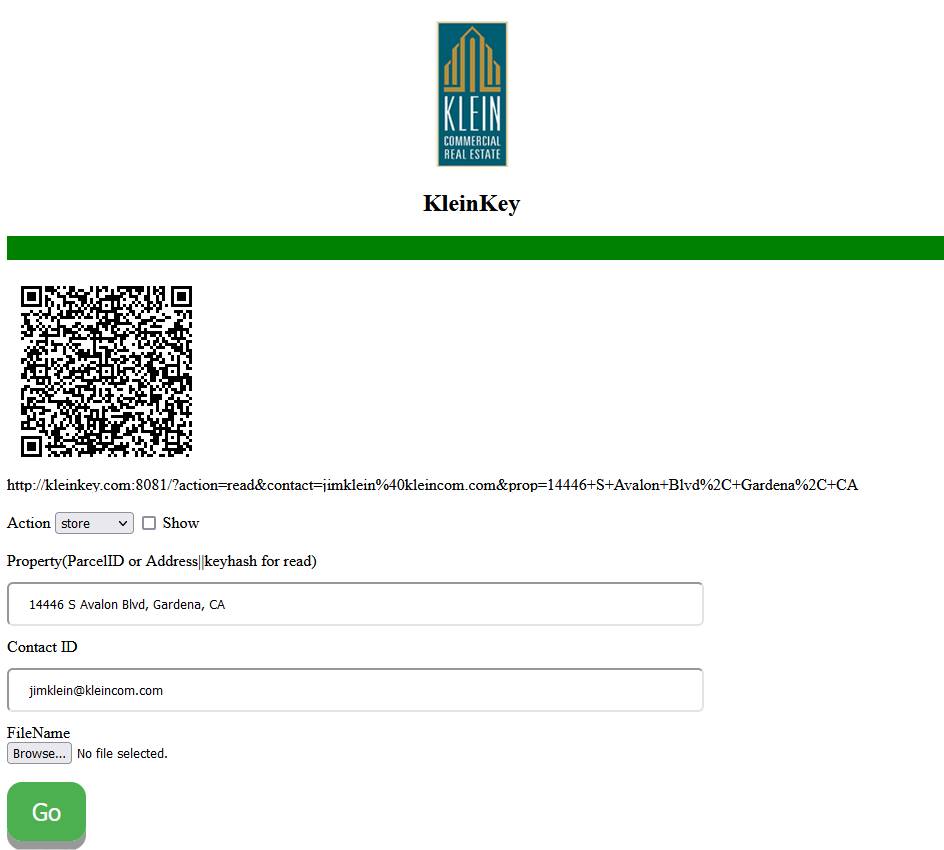

Thank you for subscribing and please contact us with any of your industrial building inquiries. You can use the QR code below to redeem for superior industrial real estate knowledge and service.

Thank you,

Jim Klein, SIOR

310-451-8121

jimklein@kleincom.com