Industrial Real Estate – Year End 2023

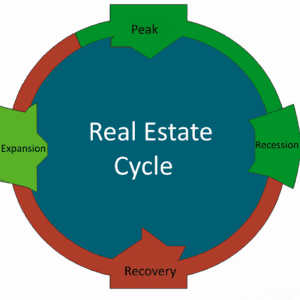

The industrial real estate cycle is pointing at Recession. It should not be a surprise because it was brought intentionally by higher interest rates in an effort to combat inflation. Based on my market experience, it’s a mild recession. Tenant activity is adequate, not robust. Rents are down after surging during the Supply Chain Chaos, but they are still above pre-covid levels. Sale prices are also down because higher interest rates require a price adjustment.

When rents are falling, landlords need to close those deals immediately. If they stall and get lost in the back-and-forth, that tenant will skip to a cheaper building.

There are overleveraged buyers who purchased at the peak when rents were their highest. The best example are outside storage yards. But almost any building that was purchased with short term or adjustable-rate finance will have to digest higher rates with some needing to add cash. Businesses, too, are facing higher interest rates. Private credit facilities have entered the void left open by the banks. These companies, who own their real estate, are motivated to sell and leaseback.

The current financial environment makes Sale Leasebacks advantageous for both buyers and sellers. In periods when it’s difficult to obtain financing, lenders will be more generous with a 10 year (or longer) lease in place. Corporate sellers and owner-occupiers, facing higher interest rates, can look to their owned real estate to raise lower cost financing in a Sale leaseback transaction.

There are generally three different types of sale leasebacks:

The first is an Absolute NNN lease with no landlord responsibility including casualty and condemnation. The tenant keeps paying rent no matter what. It has elements of a corporate bond in its reliance on the tenant’s credit. A Credit Tenant Lease is for critical manufacturing, distribution, or infrastructure for a long term lease with a rated tenant.

The second form of Sale Leaseback is used to raise cash for lower rate financing or for other financial engineering reasons. Owner users and corporates can unlock years of “unrealized” equity. There are often balance sheet advantages. Sale Leasebacks are routine with private-equity owned businesses. Pricing is closely related to the tenant’s credit rating.

The third type of Sale-Leaseback is in name only. Because either the lease term is short, or tenant credit is weak. These deals are more fully underwritten on the real estate. Tenant term and credit is less a factor than building quality and market acceptance. Buildings in major metros that are easy to backfill are good candidates.

A good use of the sale leaseback is with growing companies. Retailers are a common example. In the manufacturing realm many companies benefiting from the Inflation Reduction and CHIP Acts are using Sale-Leaseback’s to finance their new factory building and acquisitions.

Sale leasebacks are a common tool in the CEO playbook. Located in Los Angeles, we ally with local SIOR independent, market experts from across North America and Europe to support our activities. We will respond rapidly to industrial building opportunities you may have in Los Angeles and elsewhere in the United States.

Thank you.