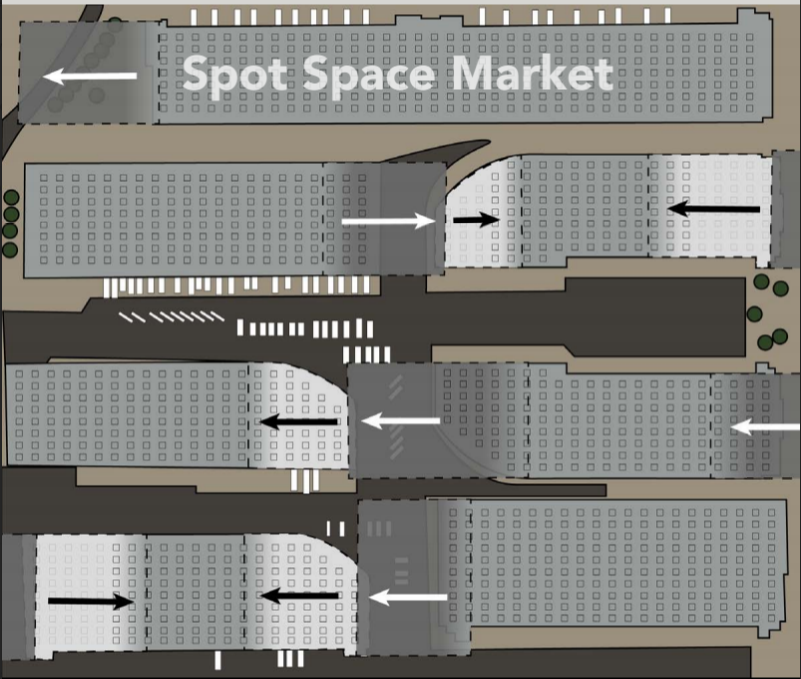

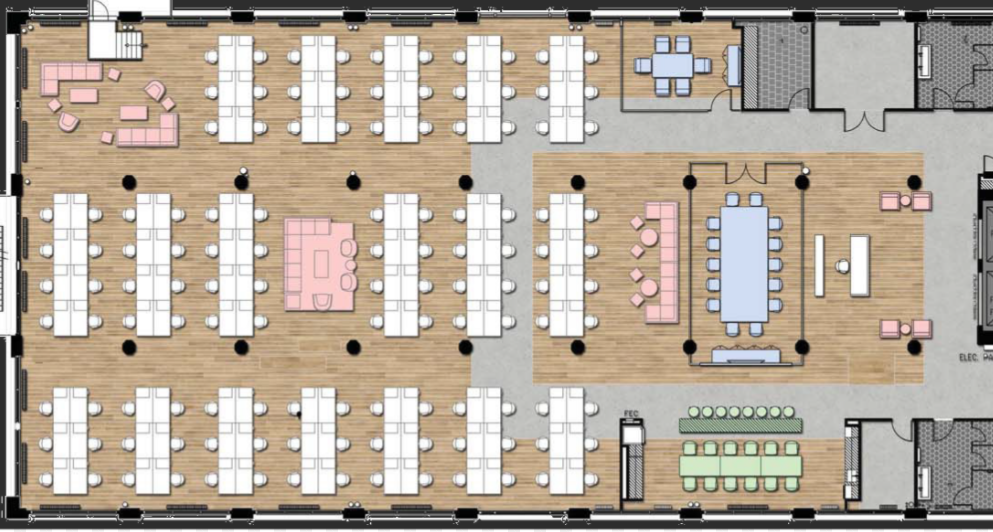

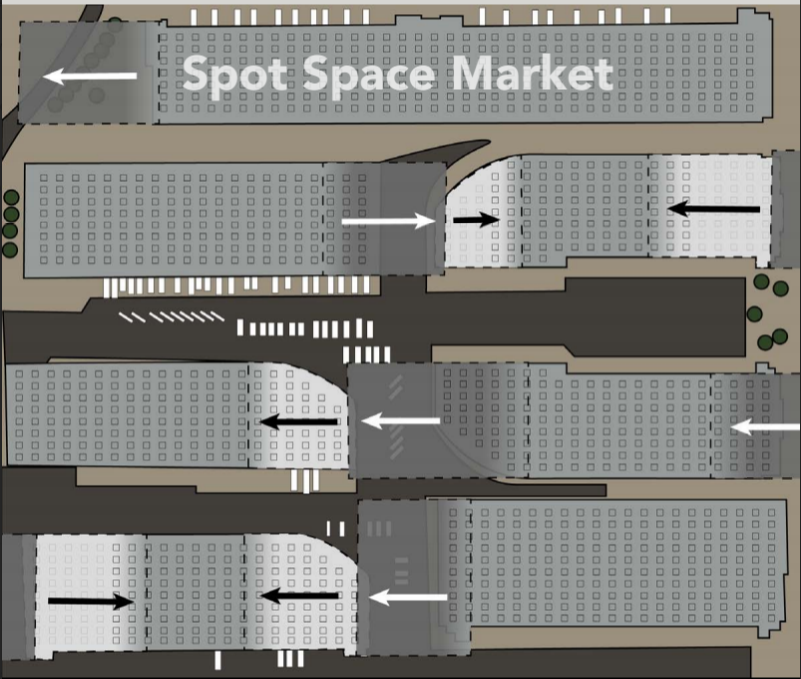

Dynamic pricing is becoming a greater influence on space leasing and building sales. By dynamism, I mean fluctuating rents separate from conventional underwriting. A “spot market” is emerging to satisfy demand for smaller, flexible, and elastic spaces. Many examples include Truck Yards, Warehouse Sharing, Creative, Cannabis, and other categories of sub-space where “street rents” are disconnected from contract rents. WeWork and Amazon are two primary examples that contract with the Landlord at one rent, and lease out space bits at higher rents. Public Warehouses, Self-Storage, Swap Meets, Studios and Truck Yards operate along the same model by collecting additional rent by offering “alternative occupancies” with varying degrees of added services. The revolution is any building can be pieced out especially with easily acquired technology that can create “smart” buildings for automation, surveillance, and access.

Continue reading “Race for Space – The New Dynamism”