Why a Strategic Approach to Real Estate?

Real estate is a significant cost to business; It is also fairly permanent and visible. For a large part of the real estate public, the emphasis is on the “deal,” not how real estate will improve the business. For this reason, a strategic approach will give the real estate user new tools to improve its use of property.

Here are a few goals in the strategic use of property:

- Real estate has the potential to be a competitive advantage if the opportunities and business are thoughtfully considered. Strategize to make real estate improve the business.

- As a counter to the deal-driven real estate market, a strategic approach analyzes what is best for the business, not what is best for the developer.

- Real estate is the fount of identity for customers and employees. It is the place of production, creation, and administration.

- Business changes and companies require ever more complex analyses. But real estate tends to be more stable and visible.

- Functionally, properties can be acquired or modified to improve business processes.

- Operationally, real estate is a key component in communication and networking with customers and business allies.

- Develop a strategic mindset throughout the organization

I learned much of this material from Dr. Martha O’Mara, Ph.D in her book and seminar entitled Strategy and Place: Managing Corporate Real Estate and Facilities for Competitive Advantage. The original work from 1999 can still be found on Amazon.

3 Types of Real Estate Decisions

Companies face three major types of decisions when planning their real estate future.

The three basic categories are:

- Incrementalism

- Standardization

- Value-based

A closer look these strategies will put your decisions in a clearer perspective and allow for a fuller understanding of your needs.

Diagnostic for Strategic Analysis

To enable real estate to work strategically, companies should think of the business strategically. Many companies have full time staffs to examine these issues daily. Much has been written about competitive strategy, most notably, in the works of Michael E. Porter. In this exercise we want to identify “key” strategies that companies wish to follow. We then look at property-specific features to see what will propel the business strategy.

The type of thinking that this framework will encourage should resemble the following:

- Customers:

- Who are they? Do we need to move closer? More central? Is it easy to make pick-ups? Deliveries?

- How is access?

- On the property?

- To the property?

- Do we need visibility?

- What kind of image do we want to project?

- Suppliers:

- Are we close enough to suppliers?

- Do we handle materials efficiently?

- Can we obtain lower prices with another location?

- Are there other suppliers?

- Rivalry:

- Who are our competitors? What do they do better?

- Can real estate make us more competitive?

- Are rival buildings more efficient?

- Do our customers offer employees a better workplace?

- Can real estate improve our position over rivals?

- By productivity?

- Improving workplace?

- Improving image?

- Work Force:

- Can we offer employees a better atmosphere?

- A more productive environment?

- Can we move to be closer to our employees?

- To better employees?

- Can we offer employees a better atmosphere?

You can perform this diagnosis for yourself using the following two pages:

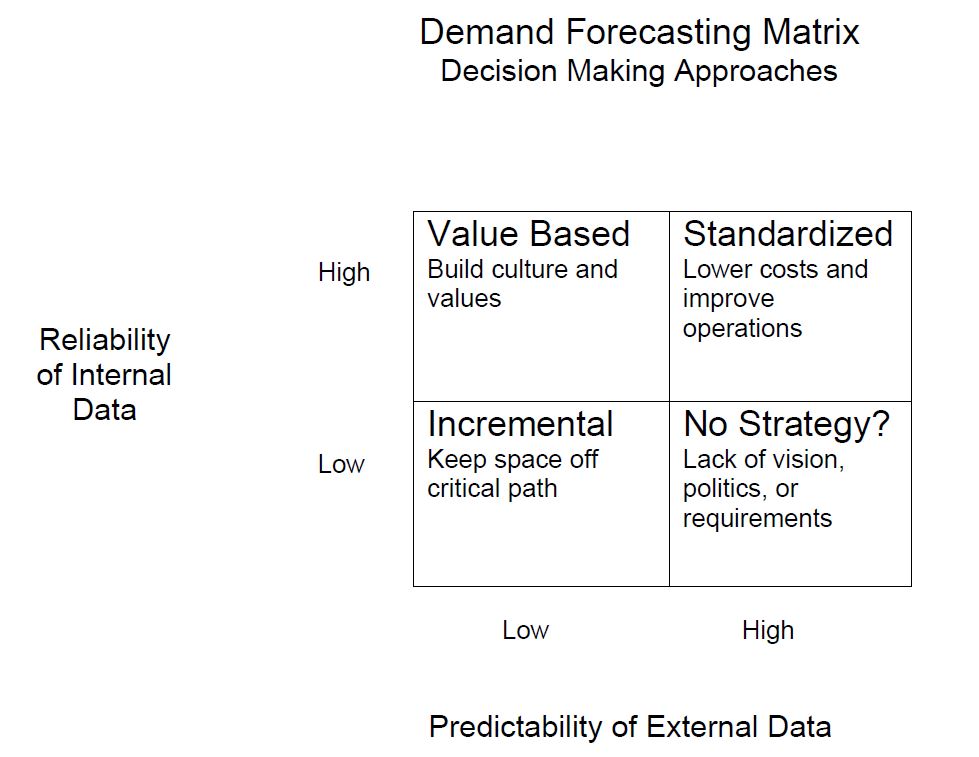

Forecasting for Demand, Growth, or Consolidation

Demand forecasting is one of the trickier analyses because growth is usually not straight-line but occurs dynamically because of a new product or process. Normally, one tries to model future demand by making “best case” estimates.

If in doubt it normally pays to take more space than needed because a space shortage can crimp production and the additional marginal costs is small compared to a loss of sales. Additionally, if done right, the extra space can be subleased until needed.

Overall Strategic Context – What direction is the company heading?

- Growth Management

- Under control with incremental growth

- Out of control growth without strategy

- Consolidation and Disposition

- Migration to lower cost position

- Repositioning

Types of Forecasting Stages:

1. Direct Translation

- Headcount to square feet

- Widgets and product to square feet

- Historical growth and metrics needed

- Straight line charting

2. Extrapolation from Business Indicators

- Non-linear relationships

- Partially subjective

- Sudden growth through new product or invention

- Metrics

3. Bull and Bear Scenarios

- Risks of multiple outcomes

- Modeling and wave analysis

- Minimum and maximum analysis

4. Build in Flexibility

- Land banking, optioning, space banking

- Note space under the curves

Real Estate Metrics

Demand Forecasting and Financial Measurement

- Metrics are an important means to diagnose current and future real estate issues.

- Metrics are used for the following purposes:

- Economy Measures: These ratios measure the relation of real estate’s contribution to the economy of the business. Such measurements as real estate to sales, profit, or overhead show the overall costs of the real estate strategy.

- Efficiency Measures: Efficiency measurements show if the company is making the best use of its resources. These ratios show efficient use of capital, the use of the property, and how effective the building is to its productive mission.

- Effectiveness Measures: This measurement shows how productive real estate is to the company’s production goals. The reliability, suitability and functionality of the property can be judged with these ratios.

- Efficacy Measures: Efficacy measures if the company is receiving desired results from its property. It measures how relevant property is to the company mission by examining real estate returns, profitability, and satisfaction.

- These measurements are also frequently used for forecasting and gauging the use of property.

- Companies can judge company performance by examining these ratios or other ratios that may be more pertinent to the enterprise.

Financial Management and Negotiation of Real Estate

Lease Analysis

- Generally, the analysis of leases is fairly straightforward using a net present value analysis; this will compare several alternatives with different cash flows.

- The highest and lowest price alternatives can be easily judged.

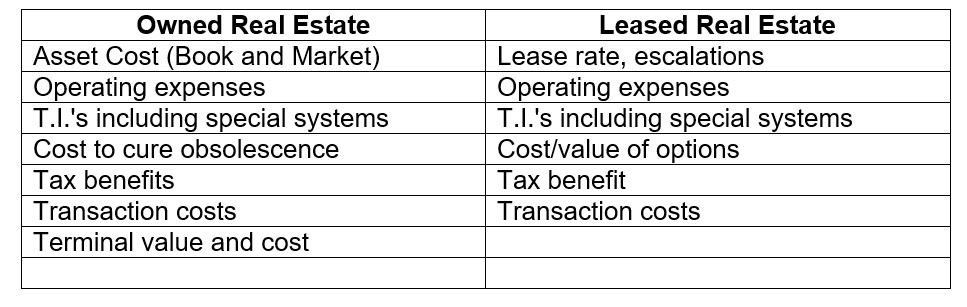

Sale vs. Lease Analysis

- This analysis also uses net present value analysis to compare cash flows between buying and leasing.

- Predicting the future value of the real estate asset is a wild card so it is best done under a best and worst case scenario.

- Generally, if there is a high degree uncertainty in the business, leasing is preferred because this will reduce exposure to a real estate “bet.” Long term certainty in the business reduces the “bet” because of the buildings continual use and amortization.

Cost of Capital

- The cost of capital is intrinsic to the Net Present Value Analysis. Companies will differ in their view of the cost of capital. Different scenarios tend to moderate the uncertainty. What is your cost of capital for real estate projects?

- Corporate borrowing rate – 3.5%

- Mortgage rate – 5.5%

- Rate for new product investment – 20%

- Blended rate?

- One answer is to compare the cost of the real estate to other properties on the market.

- Secondly, does the property provide more utility than others on the market do?

Asset Level Analysis: Basic Portfolio and New Property

Location Decisions

- Major Facility Decisions:

- Additional Building Nearby

- Retain workforce and location preference

- High fixed costs that can’t be shifted

- Lack of other alternatives

- More expensive to manage

- Merge multiple facilities in one nearby

- Retain workforce and location preference

- Cost savings by consolidation, scale economics

- Upgrade operation, equipment and facility

- Recommitment to area

- Relocate entire operation to new area

- Business restructuring or repositioning

- Achieve lower costs

- Control surroundings (green acres)

- Clusters

- Go where the competition is

- Logical for similar companies to make similar location decisions

- Lower transaction costs

- Greater mass leads to lower cost of inputs and ideas

- Why Companies Move

- Growth

- Schools

- Cost of Housing

- Workforce

- Strategic Location

- Lower Prices

- Additional Building Nearby

Relationship Management and Interpersonal Skills

- Any implementation requires personal and management skills to affect policies; when moving the company, one can expect challenges.

- These are just a few issues to expect:

- Tensions are created with new moves

- Differing management and organizational objectives

- What’s best for the business

- Often takes time

- Build information database, think objectively

- Outsourcing requires more control and good relationships