Industrial Building Sales

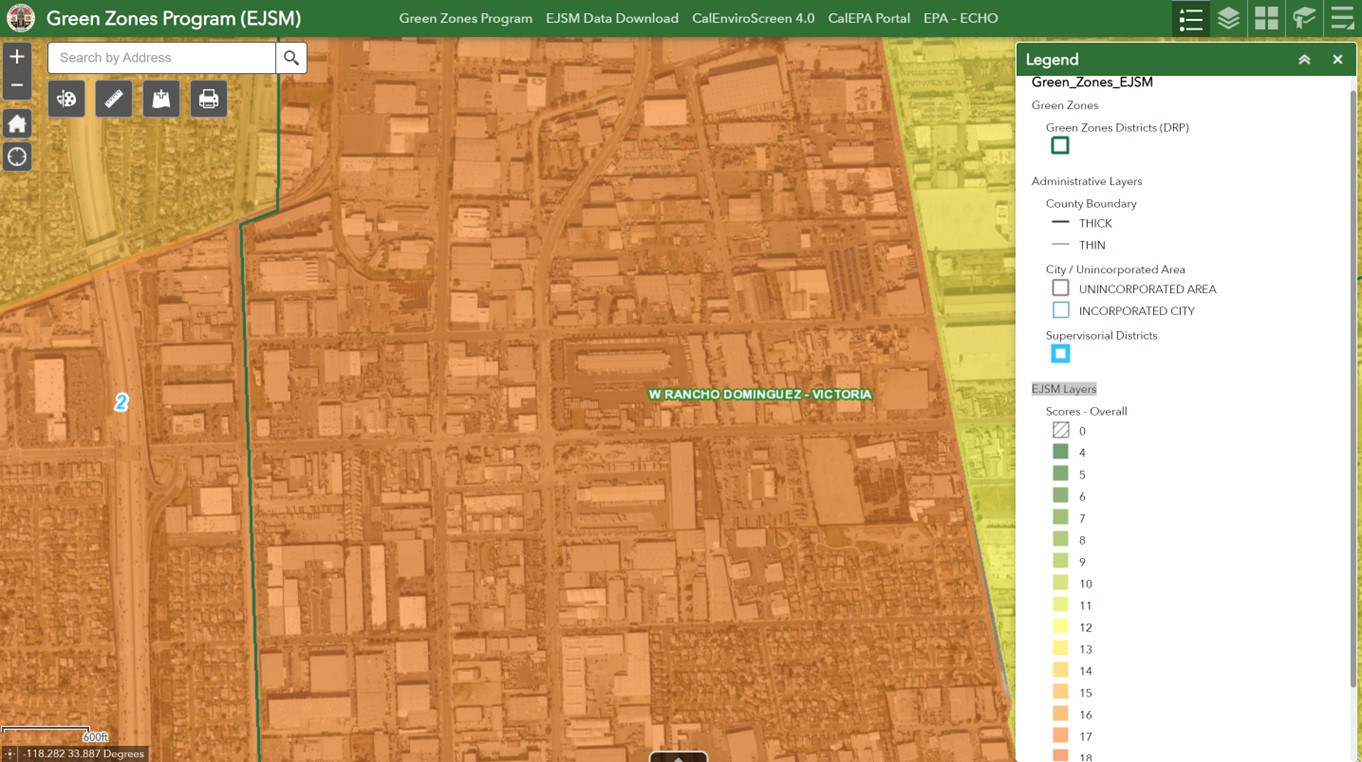

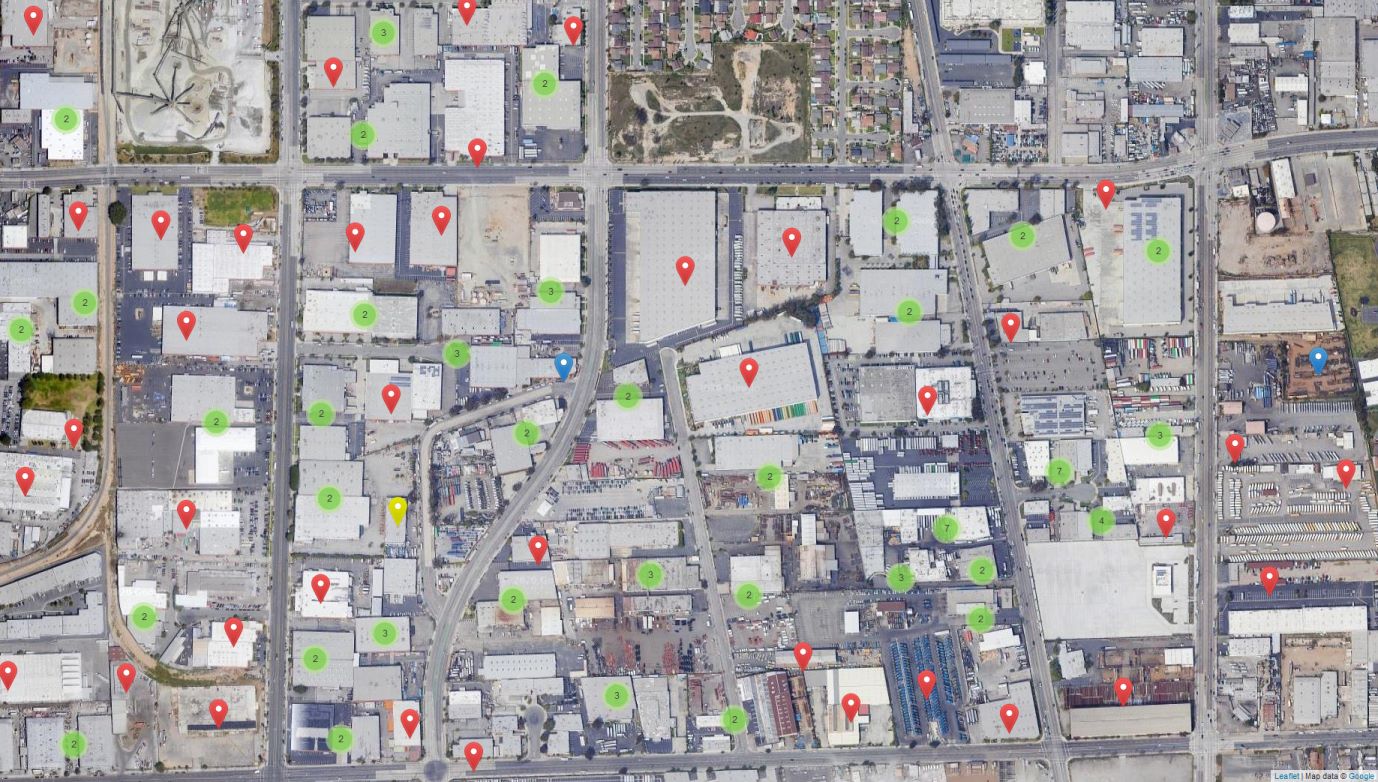

The Los Angeles industrial real estate market is financialized. That means pricing reflects accepted investment principles. Investment buyers, flush with private capital, are searching for smaller and older buildings than what you would normally expect from fund level buyers. Assets owned by individuals, corporations, families, and partnerships are being sold to large investment groups, funds, and REITS. It started with “Class A” buildings but escalated for almost all industrial buildings with low interest rates after the Great Financial Crisis. Activity surged during Covid, levelled off during the recent period of higher interest rates, and is regaining strength with more capital allocations hitting almost all industrial properties that generate long-lasting income.

In our experience, some building owners prefer comprehensive marketing and others want discretion. We developed our resources to do both:

| Conventional Listing | Private Listing |

|---|---|

| Exclusive | Non-Exclusive |

| Market Rate Broker Fee | Lower Broker Fee |

| Generally, No Dual Agency | Dual-Agency |

| Common with Owner/Users | Common with Investor/Developer Sales |

| No Immediate Hurry | Deadline |

| Public – Wider Distribution | Confidential and Discrete |

| Dedicated effort and resources | Flexibility – Can sell yourself |

| Posted online and through Industrial Multiple | Distributed to professional buyers |