Data Analytics and Industrial Real Estate

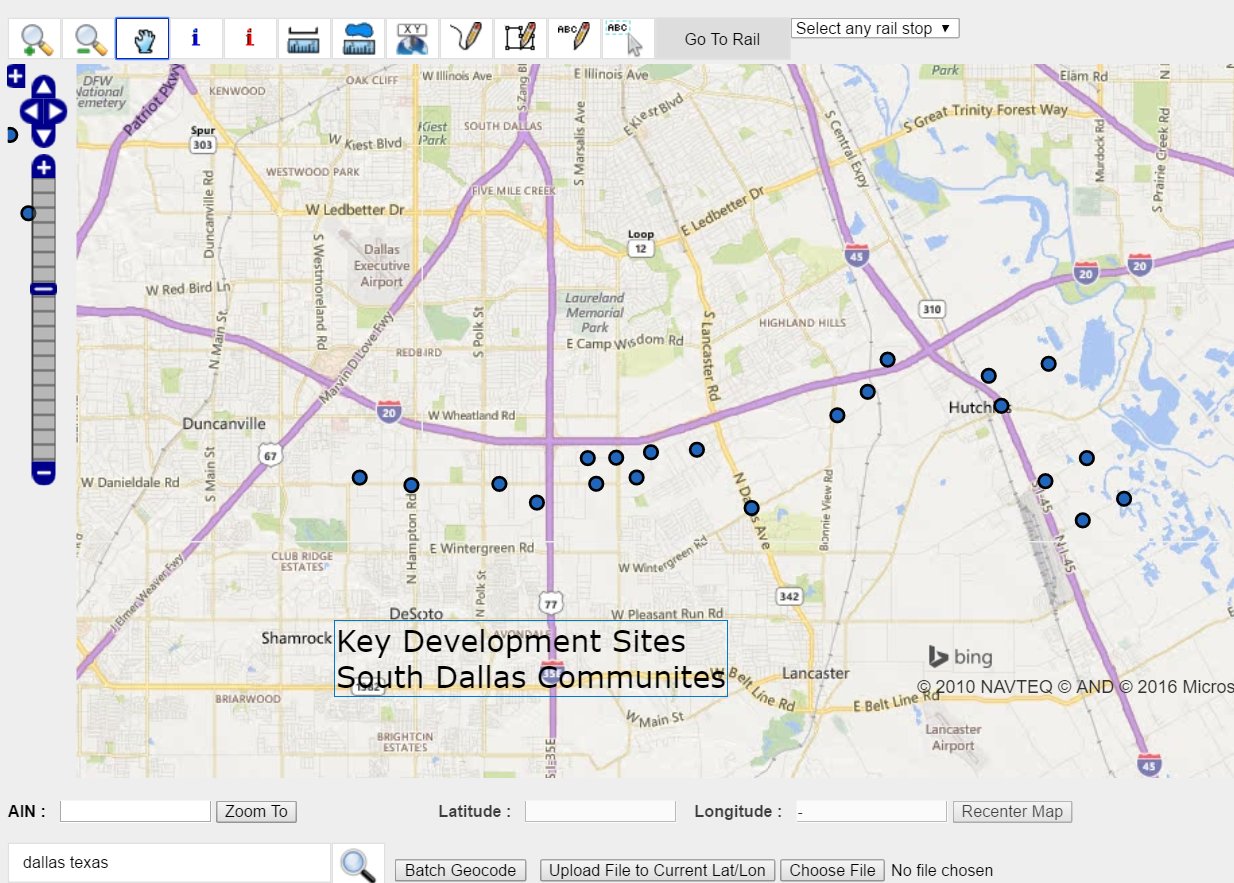

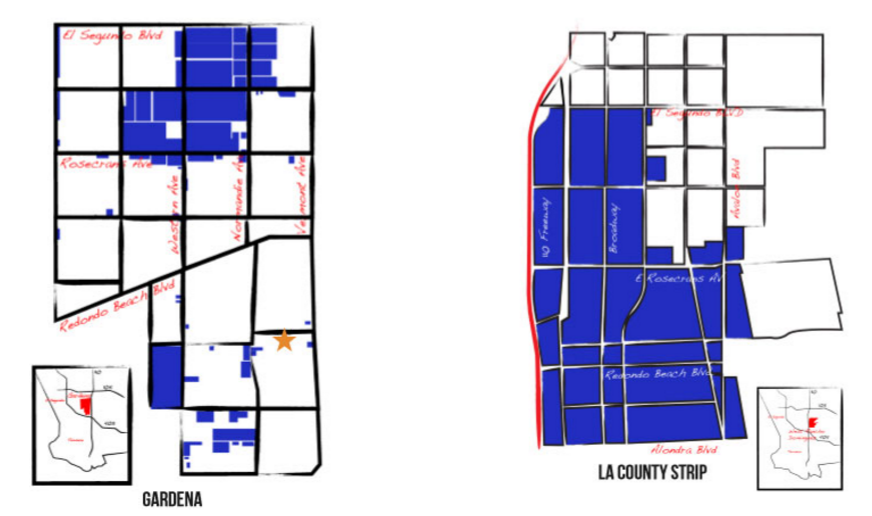

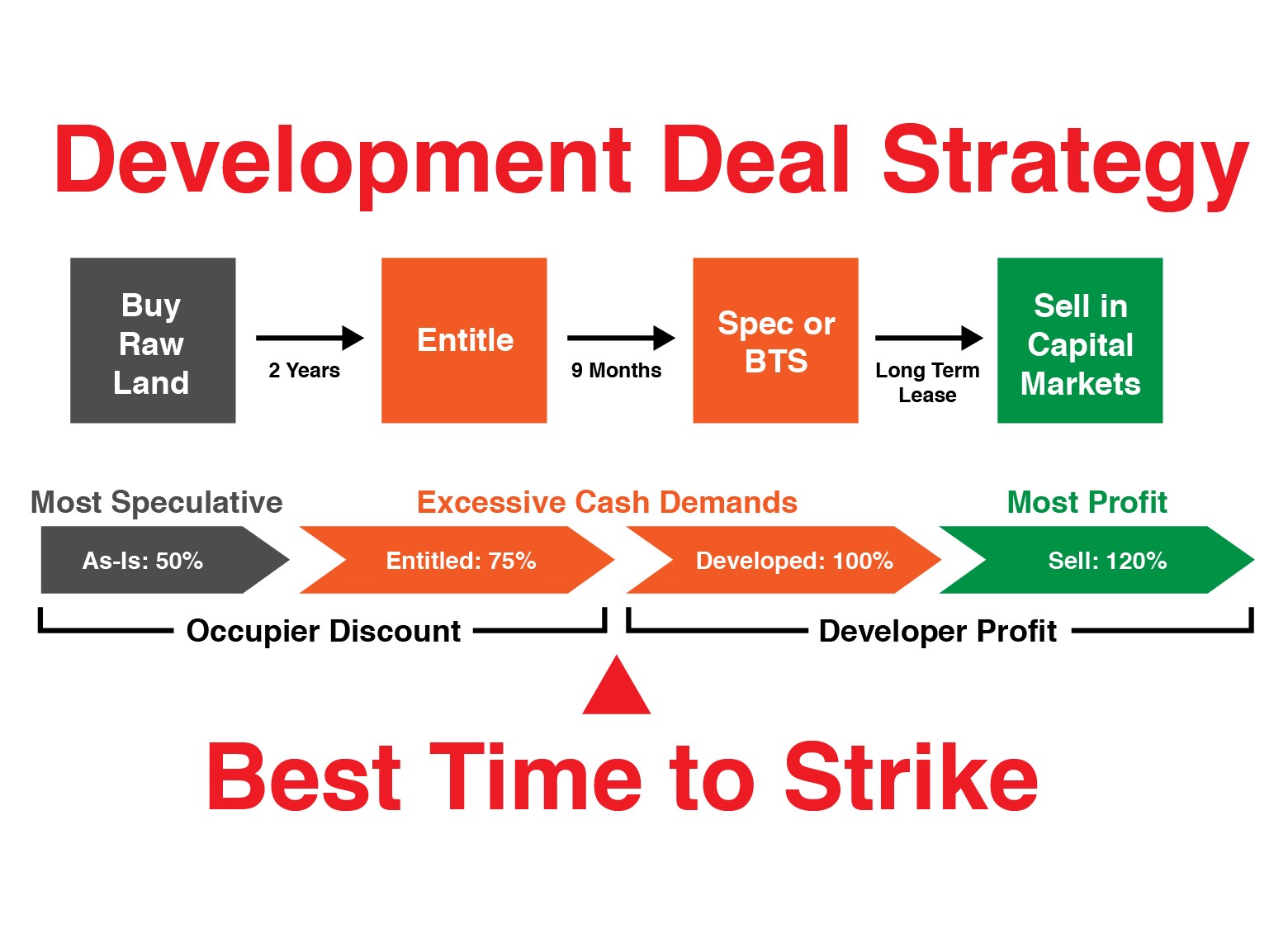

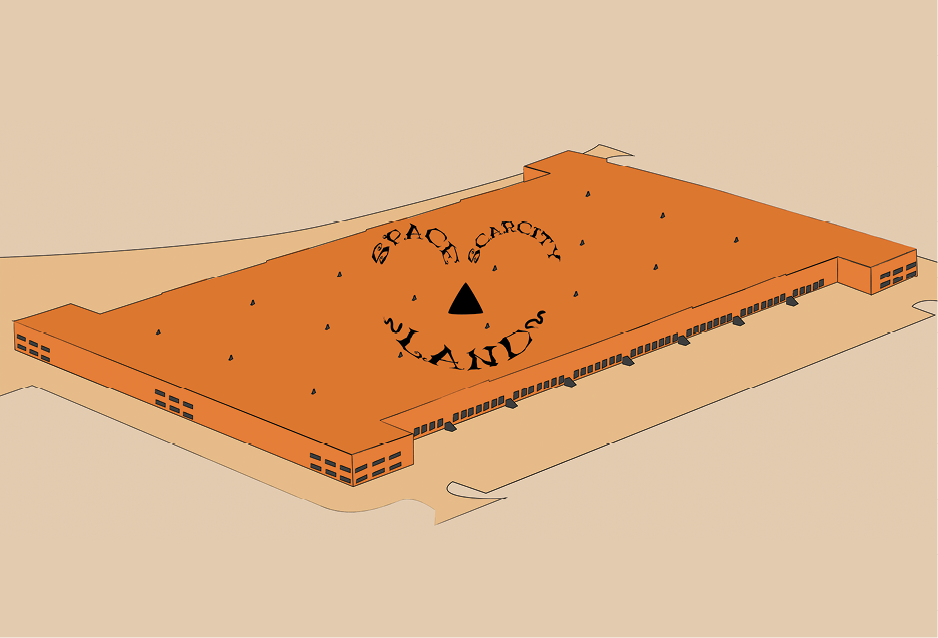

Analytic tools are essential ways to address space shortages for Occupiers or Investors. The reasons are complicated but the traditional market no longer supplies enough quality space. Online listing services do not yield satisfying choices. More aggressive tools, that emulates your precise business strategy or market expertise are needed to find deals in the era of Space Scarcity. The surest way to make deals is to create them and data is an integral part. Understanding the market comes first before developing the tools to exploit it. For instance, this is the case that better data will help you purchase Big Industrial deals…

Continue reading “Data Analytics and Industrial Real Estate”