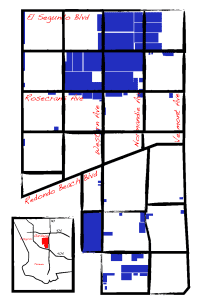

2014 ended on a strong note at year end. All my listings are either leased or sold and it confirms the space shortage that is looming throughout Los Angeles. Tenants should be looking six months prior to lease expiration and be prepared to pay double rent as soon as they find a space they like. Not only has there been very limited new construction over the past several years, but high sale prices have taken a lot of buildings off the lease market. This has put upward pressure on lease rates for functional distribution type warehouses. Most new developments are exceeding their proformas with deals being struck during construction, especially on the sale side. The predominance of cash buyers, both from foreign investors and funds is dramatic even as the march of higher prices and lower yields continue.

Continue reading “Strong Demand But Not Much Product”