Back to Local Markets

WHERE THE ACTION IS

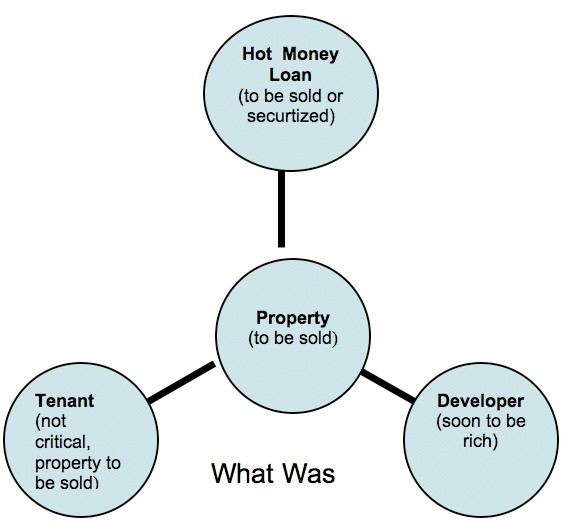

Perhaps I should qualify. Where there is action, it’s on the local level. Now that plentiful financing has been squeezed from the market, there is no more room for mega projects, program development, or new concepts. It’s back to basics and that means individual businesses and landlords dealing with their own unique decisions. Loans are available through SBA programs but limited to business expansions. Local banks that were not burned by sub-prime also have resources for conservative lending. The land side is virtually dead for development except under the most risk averse situations. There is however considerable activity in securing tenants for build-to-suit, but locating sites is still a challenge.