Everyone has an opinion about where we are in the real estate cycle. Home builders and residential lenders see this as a crisis. Commercial brokers nationwide talk about a slow down. Just this month I have seen a lender take over negotiations in a land sale, a substantial money default on a development deal, and a newer investor unable to replace his interest only loan. We are also receiving calls from sellers who passed on our “low” offers earlier in the year and a few landlords are complaining about tenants getting behind in their rent. So far, most of the problems are related to financing and over-optimistic projections. Still, this a lot of personal incidents in a short period.

The Los Angeles industrial market is holding, but volume is down.Sale prices are reasonably stable and gross rents have been increasing. Vacancies are low. At this stage, many are distinguishing between financing and general commercial real estate markets. For those who rely on significant borrowed money, they feel the crunch. Owners with only a modicum of debt are in an enviable position. A robust user market in Los Angeles provides a comfortable cushion for most owners. Partly, we are seeing a financing transition with the levered structured loans being replaced by foreign investors, better operators, and old time conservative investors. It will be rocky until valuations get to more traditional underwriting standards. Too many deals were underwritten on lofty sales projections and prices will be marked down using current rental values as the benchmark. Differences between Institutional and non-institutional grade will become more pronounced as top tier capital flows to Grade A properties and there is a free-for-all for everything else.

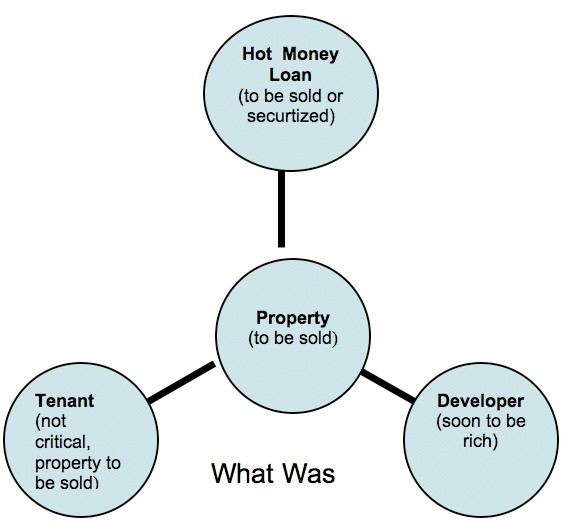

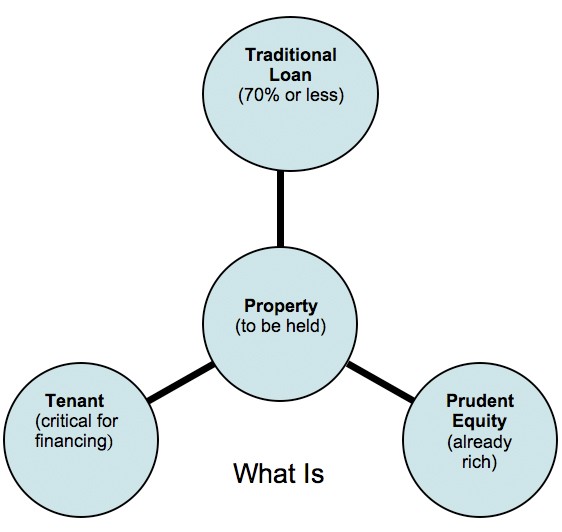

Until recently, lenders were forking over 95% loans for development deals. And while hurdle rates were based on rapid sales velocity, these developments were successful because of so much liquidity. It was never a question of money, but of finding the deal. Now we are entering a new regimen that will emphasize prudent investing. Other highlights will be more emphasis on tenant strength and more equity as a requirement to receive favorable loan terms. Cash investors will find long sought after yield. Build-to-suit deals will return. Brokers will become more valuable because of their marketing skills, tenant relationships, and deal-making ability.

The Importance of Brokerage

It’s no longer an opportunity-finding business. Brokers will need to be more active among lenders, buyers and tenants. Making the deal will be a necessary service. Proforma skills will return, especially in the areas of contributed cash and partner returns. Lenders will want more proof that the deal works. Build-to-suits will replace spec construction. Brokers will need to pay more attention to design, construction and financing. Regional knowledge will become more of a factor because tenants and buyers will consider a much greater geographic area to find bargains. The broker’s personal network will become wider. Leasing and sales will require more effort. Broker’s who can direct traffic among tenants, financing, and property will continue to be successful. Forthcoming conditions will weed out many brokers who only provide a property list.

As it has been, many buyers crave off-market deals because the multiples and auctions priced property too competitively. In continuing fashion, many lenders will want to sell as quickly as possible to avoid write offs. If conditions become reminiscent of the early 90’s, sellers will take any reasonable price for a quick close. In addition, on the market properties may also be fruitful as they have not been recently. Some sellers will want to use all avenues, but it will become a Buyer’s market because of cash shortfalls. Strategy will also play a role. First mover advantage will no longer be important as many buyers will wait for a perceived bottom. Character will also matter as many unscrupulous buyers begin to surface in uncertain times.

A Tenant Revival

Although vacancies are still low, financing will require good tenant leases. Appreciation will no longer be a replacement for poor leasing. Still tenants will need to recognize we are in a bifurcated market. In class A industrial buildings, tenants will have limited alternatives and they are being required to pay “all-time” high operating expenses. The lower grade buildings will be opportunities because this is where the credit crunch is more harshly felt. These are well located and functional buildings but are older, have lower clearances, and fewer loading docks. As U.S. exports increase, these non-institutional grade properties will become value plays. Land will also be fruitful because leases will drive new developments in greenfield and the occasional infill piece that surfaces.

Some tenants may also be able to buy an ownership interest. Many developers will gladly have tenants as partners if it results in a deal. Typically, the owner takes all the risk and the tenant has maximum flexibility subject to lease terms. In this scenario the tenant pays the entire cost of ownership while they are occupying the building plus a return to the owner. When the lease term is over, the owner hopefully receives the building back at an appreciated rate as a reward for taking the real estate risk. As financing becomes harder to obtain, some investors may seek tenant partners will share the rewards of ownership. This mutually beneficial arrangement will help a tenant gain an ownership interest and allow the investor the means to purchase a property.

As the market becomes more jittery, tenants will want to pay closer attention to lease terms and documents that pertain to the Subordination, Non-Disturbance and Attornment Agreement (SNDA). While the standard lease provides adequate protection, many tenants do not obtain the important Non Disturbance Agreement from the Lender. Generally, the tenant agrees to subordinate their lease to the lender. In exchange, as long as the tenant fulfills their obligations, they won’t be evicted in case of foreclosure. In normal times, most lenders want the tenants to remain, but in uncertain times as is now is occurring on the residential side, many of customary procedures will no longer apply.

Group Investing Returns

Many of the wealthier property owners have sat out the past several years. Cash had no value and returns were unfavorable. Now that easy financing is gone, many of the cash investors will return once prices reach a level they consider acceptable. Some of investments will take the form of a group investment where partnerships are formed to raise capital. These syndications especially allied with a tenant will prove a promising area as loans become more restrictive. Forming a group will be one way to contribute the additional equity that will be required. Group investing will be a return to the past and should give developers more control than the investment bank partners they may have recently had.

INDUSTRIAL TENANTS

August 20th, 2007

Many owners wonder about the stability of their tenants. Of course, everyone wants excellent credit or a strong personal guarantee to secure the lease. However, stronger credit tenants will gravitate to newer and better located properties, while leaving a vast pool of older buildings in less desirable areas to sort out the lesser credits. This is not necessarily a new situation, but because today’s tenants may have different racial profiles, come from a foreign country, use English as a second language, and have new business models, this makes underwriting a new tenant more complicated and risky. Additional security deposit, guarantees from other associated operations, or personal background checks may help. However, owners are more likely to find there is simply not a lot of cash or personal net worth. Many will be good paying tenants but they either come from fairly humble backgrounds or are putting all their resources back into the business. This condition mirrors the world economy with the rise of many powerhouse companies from India, China, Mexico, and Russia.

Here’s an example of a typical tenant today. It starts out with a driver and a couple of trucks. If they get lucky they find an account or two who will pay for some warehouse space. When the company moves into a new building, they hire labor by word-of-mouth or from a street corner. New drivers are independents with their own trucks or are novice drivers from the same hometown. By sheer guile and margin shaving, the company begins to undercut the national truckers. The new customers don’t ask a lot of questions and are unaware that the considerable savings come from older, smog-creating trucks, labor practices that may not fully meet state and federal requirements, and a warehouse that is in violation of several fire department and building codes. Nevertheless, the trucking company moves into a new 100,000 square foot warehouse owned by a major landlord and they continue to expand with several more major accounts. This is an example of the American Dream that repeats itself in the garment, metals, and construction industries. Unfortunately, companies like these, and there are many of them, do not meet the test of careful financial review.

Landlords will judge from the pool of tenants that are in the market at the time their building is vacant. Without sterling credentials, landlords may need to decide on factors that can’t be substantiated on paper. Personal impressions, business plans, appropriateness of the use, and other subjective factors can be helpful when documentation and monetary resources are lacking. Every building owner wants credit, but businesses that evolve from the core of the metropolitan area or from places around the world will need to be examined with different standards that reflect outsourcing, sub-contracting, and diverse business models.