The major theme in this stage of the cycle is space shortage. There are very few available buildings to lease or purchase. This has caused strong rent growth throughout the region. This is a national condition and all major industrial markets are suffering from a shortage of vacant buildings.

One other factor is that spreads are at historic highs. Even though cap rates are low, interest rates are even lower and the difference is being captured by astute developer/investors. This can also be seen by comparing replacement cost to purchase prices of leased buildings. The value of having a tenant place with a 10-year lease greatly exceeds the cost of land, construction and development fees. This “delta” is also known as the risk premium.

Tenants are able to take advantage of these two conditions by recognizing the value they bring to a development project. The earlier the commitment, the more value the tenant will create for themselves. I’ve been spending a lot of time this year showing tenants how they can overcome the space shortage problem by anchoring new development. It’s explained in detail here.

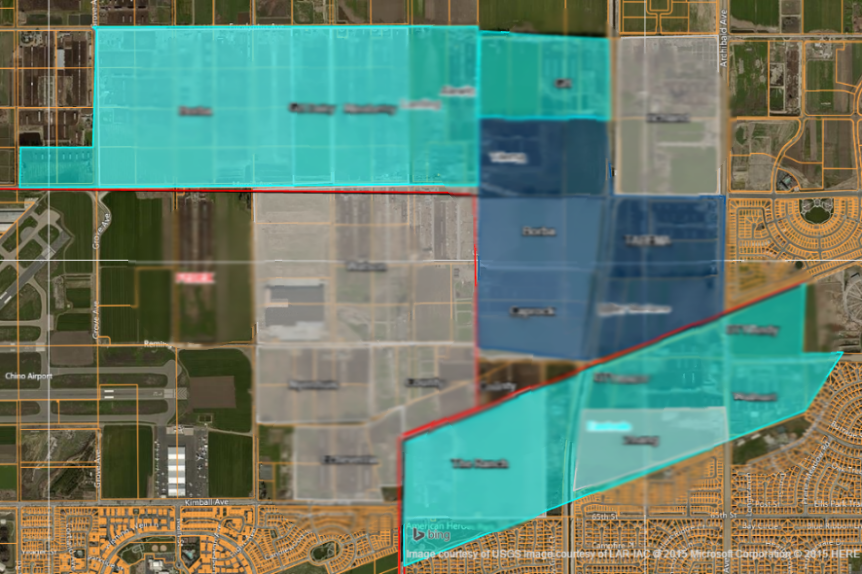

Also this year, we sold a 9-acre parcel in Compton, California; leased 175,000 square feet of buildings, and led several industrial real estate panels at major industry events. On the technology side, we continue to develop our MAPP program that integrates industrial land, tenants, and developers into one central and very visual software program. We’ve recently added annotation tools and the ability to batch process locations. MAPP shows the full panoply of Big Industrial, Land and Buildings, Nationwide.

I’m always available to discuss industrial real estate.