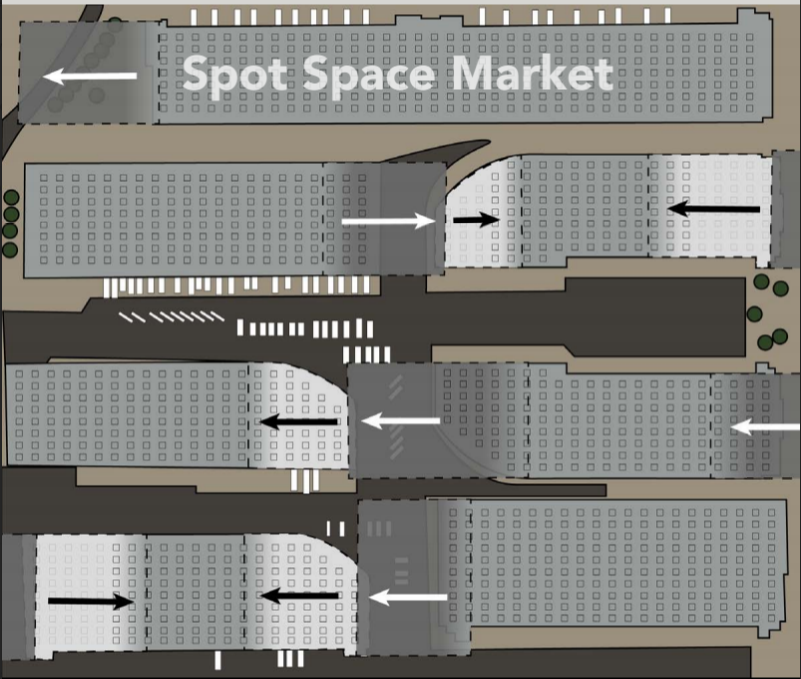

Dynamic pricing is becoming a greater influence on space leasing and building sales. By dynamism, I mean fluctuating rents separate from conventional underwriting. A “spot market” is emerging to satisfy demand for smaller, flexible, and elastic spaces. Many examples include Truck Yards, Warehouse Sharing, Creative, Cannabis, and other categories of sub-space where “street rents” are disconnected from contract rents. WeWork and Amazon are two primary examples that contract with the Landlord at one rent, and lease out space bits at higher rents. Public Warehouses, Self-Storage, Swap Meets, Studios and Truck Yards operate along the same model by collecting additional rent by offering “alternative occupancies” with varying degrees of added services. The revolution is any building can be pieced out especially with easily acquired technology that can create “smart” buildings for automation, surveillance, and access.

Dynamic pricing is buttressed by space scarcities and rent surges. The L.A. Harbor is a perfect case where proximity, drayage costs, and labor unrest, results in dynamic fluctuations partially geared to seasonality but more to sheer demand. Unused yard areas that can be repurposed for truck parking are going for $.35 per foot and warehouse sections are approaching $1.00. Long standing tenants and family owners are the primary beneficiaries by subbing out their unneeded space.

We sold this 25,000 square foot building two years ago to a Chinese investor and he created the closest example I have seen locally to a “smart” building. In order to sustain autonomous production, he installed 100% IP surveillance cameras, automatic doors and levelers, new power, fire sprinkler and Wi-Fi throughout. Because it is a 24-hour operation with robots, the owner built a small apartment upstairs so the entire operation can be centrally monitored and controlled around the clock. The building itself becomes a major input to the production process. In addition, once the electronic infrastructure is in place, sharing is simple.

Runaway Pricing:

Dynamism is just as clear in the scramble for investable assets. Many small partnerships or family businesses find themselves sitting on incredible wealth from secondary industrial properties they have acquired through a long, productive business career. Particularly in Southern California, the combination of high rents, low cap rates, upside potential, and high dollar values have attracted the largest investment funds to the region. Not because these are terrific buildings, but “B” and “C” buildings generate strong cash flows, in great markets, and can sustain reliable income. Investors receive a slight premium with steady performance and dynamic increases with hands on operations.

One opportunity for Owner/Users is the high price of Los Angeles real estate, soon approaching $200 per foot. It enables them move to Inland Empire, Las Vegas, or Phoenix, all quickly becoming a part of Greater Southern California. Many local companies can improve their operation at greater savings and still have a hefty profit left over. While I hate to see business decamp from Los Angeles, no one has a better national network of experience to accomplish a seamless, “pick up and move” strategy than I do.

Dynamic Trading Network

As speed ramps up, it will be important to have the platform keep up with dynamic space trading. More and more it will be discrete electronic networks that will replace word-of-mouth and informal communication. Public Listing Services will always have a place, but the “electronic whisper network” is a practical solution to transact deals rapidly and still keep offerings confidential when necessary. Torrent networks, Slack, and RocketChat are a few of communication tools we are exploring. In addition, we want to replace the lumbering process of “papering” a deal by using faster agreements. For now, AIRCRE forms combined with a paralegal service based in India is allowing us more time for deals but is not the ultimate solution

Building a strong Digital Operation is the only way to maintain parity with dynamism. In our work stations, we combine field video, parcel information, and Salesforce leads to search for space deals that would otherwise not be “on the market”. In essence, we are creating space through Search and Spot Pricing. Because of the velocity, we can often deal the space faster than listing it. While still crude on our end, Digital Operations is a remarkable return on investment. For the first time, customers are investing alongside of us to create richer communication and data platform to see those deals.

Please let us know what we can do to help.

Jim Klein, SIOR

310-451-8121

jimklein@kleincom.com