Industrial Building Portfolios, $50MM and greater, are where the action is today. Institutional investors need scale and the only place to find it, as far as industrial, is in the portfolios of National Operating Companies and Private Partnerships. Institutional Investors stand between the real estate and fixed obligations to satisfy pension, insurance, and retirement plans. It’s major financial plumbing and as the obligations grow so does the need for product. Roll ups, a familiar consolidation vehicle in corporate America, is now the preferred way for large real estate investors to buy. Unknown to many, national industrial building ownership is consolidating and almost all local developers/investors sell into these relatively few pools as a final exit.

In order to obtain more income, institutional investors have different strategies. Purchasing brand new developments is a popular way to buy yield. New to the field, are sub-institutional quality buildings, also called “B” and “C”. On its own, a single “B” or “C” asset, may not garner much institutional interest, but as part of a larger portfolio, the property trades at a very low margin. There is strong financial support for proven cash flow in infill markets, even if the buildings are older. Average vacancies across portfolios and the cost to operate these buildings are low.

In Los Angeles, and a few other markets around the U.S., small investment partnerships and family owned businesses have seen the value of their real estate explode. The portfolio effect is one reason, but the real estate itself, often located in rough industrial, is the beneficiary of urban economics and distribution networks. Formerly junky industrial buildings are fetching institutional quality prices.

Outside of major markets, the logic is much the same although prices tend to be a lot lower. Infill industrial, freight hubs and key logistic locations are the valuable pieces that make up a larger portfolio. Many private operators have spent a generation or two expanding these building networks to where the whole is worth more than the pieces. No matter how the investment partnerships and operating companies were formed, the buildings are analyzed for their cash flow potential.

Why now? Not only do portfolio values increase through aggregation, but there are also positive pricing effects due to consolidation. Portfolio theory demonstrates that there are rewards with larger scale. Lower costs of administration and management benefit beneficiaries directly. Scale, across a broad set of assets, reduces cost and expenses.

Big Data, particularly national parcel data, has an important effect on Portfolio Management. Big Data and Analytics increase the ability to seek, analyze, and close on big industrial building holdings in very short time frames. This creates a layer of liquidity that is new for industrial building assets of this type. Because of Big Data sets and large values, the game has taken on new dynamics. For one thing, Occupiers have unprecedented advantage to leverage occupancy with ownership that yields tangible benefits. For portfolio owners, it’s the speed to monetize large asset pools that is a significant new innovation.

On the Buyer side, the top tier of industrial buyers is limited to a small handful of REITs, Insurance Companies, and Private Funds who can write a check for $50MM or greater. Below the top tier, there is a spectrum made up of different buyers and deals. Opportunistic, credit lease, multi-tenant, or tenant-occupied each have applications to larger pools and it is often the developer’s place to help the investment fit. In capable hands, a rough-hewed older industrial building can be turned into a well performing part of an institutional portfolio as long as it is bought correctly on the Spectrum.

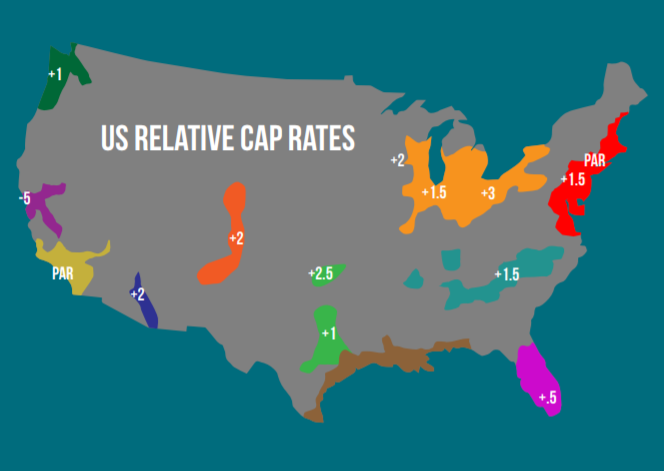

Geography is another way large investors make price adjustments on the fly. Certain major markets establish an index based on market size. Los Angeles, New York and Dallas are primary benchmarks. Other markets are adjusted accordingly into a national matrix. While these indexes are based on real numbers, thin trading in smaller markets leads to mispricing. As data improves and more experienced local analysis makes its way to decision makers, the business of large portfolios is more transparent. Knowledge of U.S. markets, access to product and personal relationships with leading investors make large industrial assets more liquid and valuable than ever before.

We advise, we sell, or we bring in our own deal. Please let us know if we can help with your Industrial Building Portfolio.

Thanks for Subscribing,

Jim Klein, SIOR

310-451-8121

jimklein@kleincom.com

PS: Participation Available in Industrial Syndication – Infill Los Angeles

(If you want to be removed from this mailing, please respond and we will immediately delete you from our database)