For the past several years, and particularly during the COVID-19 Period, conventional underwriting took a back seat to momentum. No one’s pro-forma predicted the incredible rent growth over this period. Low interest rates and shortage of product drove prices higher. Industrial rents doubled in two years. Underwriting was limited to the simple and liberal measurement of Net Rent/Purchase Price = Rate of Return. Any return higher than treasury rates signaled a buy. It was the period of “Search for Yield”.

Things are changing and not for the worse. The market is stepping back from overheating. Conventional underwriting has returned and it includes line items for vacancy, lease-up time, rehab costs, commission and higher cap rates. The spread between A and B/C has widened. Most institutions are shying away from older buildings. Local buyers with strong market presence will find deals. Tenant activity is strong and rents are climbing.

Occupiers are still facing difficult decisions; they will have to go longer distances, accept less desirable conditions, or pay up above asking. Landlords are selecting the best capitalized tenants because their occupancy increases property value. It is no longer a “hyper-landlord market” however, it remains a very strong landlord’s market. The unusual and extraordinary urgency is moderating though. Tenants have slightly more choices but available inventory is very limited. Overall, start looking early and prepare for high rents.

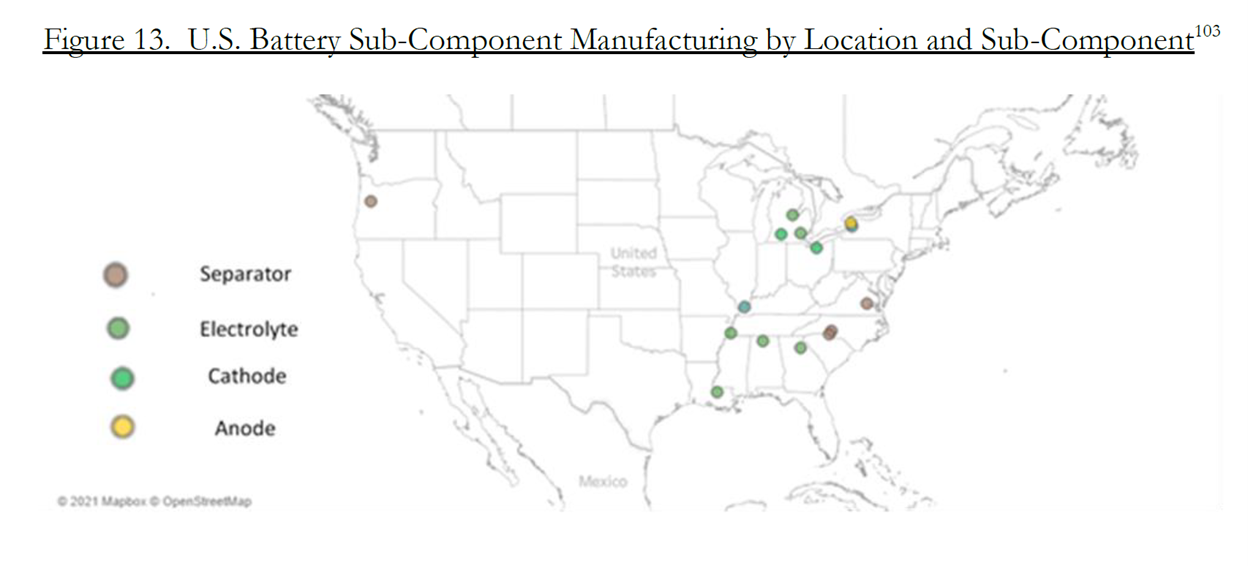

A new major stimulus is on its way for industrial property. Two pieces of federal legislation, The CHIPS and Science Act of 2022 and The Inflation Reduction Act of 2022, are supercharged industrial policy bills directed at improving the nation’s tech and clean energy industrial infrastructure. Almost $800 billion of grants, subsidies, loans, and direct investment will go to industrial uses. This investment is intended to create and improve the supply chains for electric vehicles, batteries, minerals, wind and solar. Semiconductor investment will make computer chips more readily available for new applications and products. As the U.S. builds up its capacity for self-reliance, other supply chains for food, basic and critical materials, oil and gas, and electrical grid will be improved. Supply chains will link international allies through “friend-shoring” policies.

A new major stimulus is on its way for industrial property. Two pieces of federal legislation, The CHIPS and Science Act of 2022 and The Inflation Reduction Act of 2022, are supercharged industrial policy bills directed at improving the nation’s tech and clean energy industrial infrastructure. Almost $800 billion of grants, subsidies, loans, and direct investment will go to industrial uses. This investment is intended to create and improve the supply chains for electric vehicles, batteries, minerals, wind and solar. Semiconductor investment will make computer chips more readily available for new applications and products. As the U.S. builds up its capacity for self-reliance, other supply chains for food, basic and critical materials, oil and gas, and electrical grid will be improved. Supply chains will link international allies through “friend-shoring” policies.

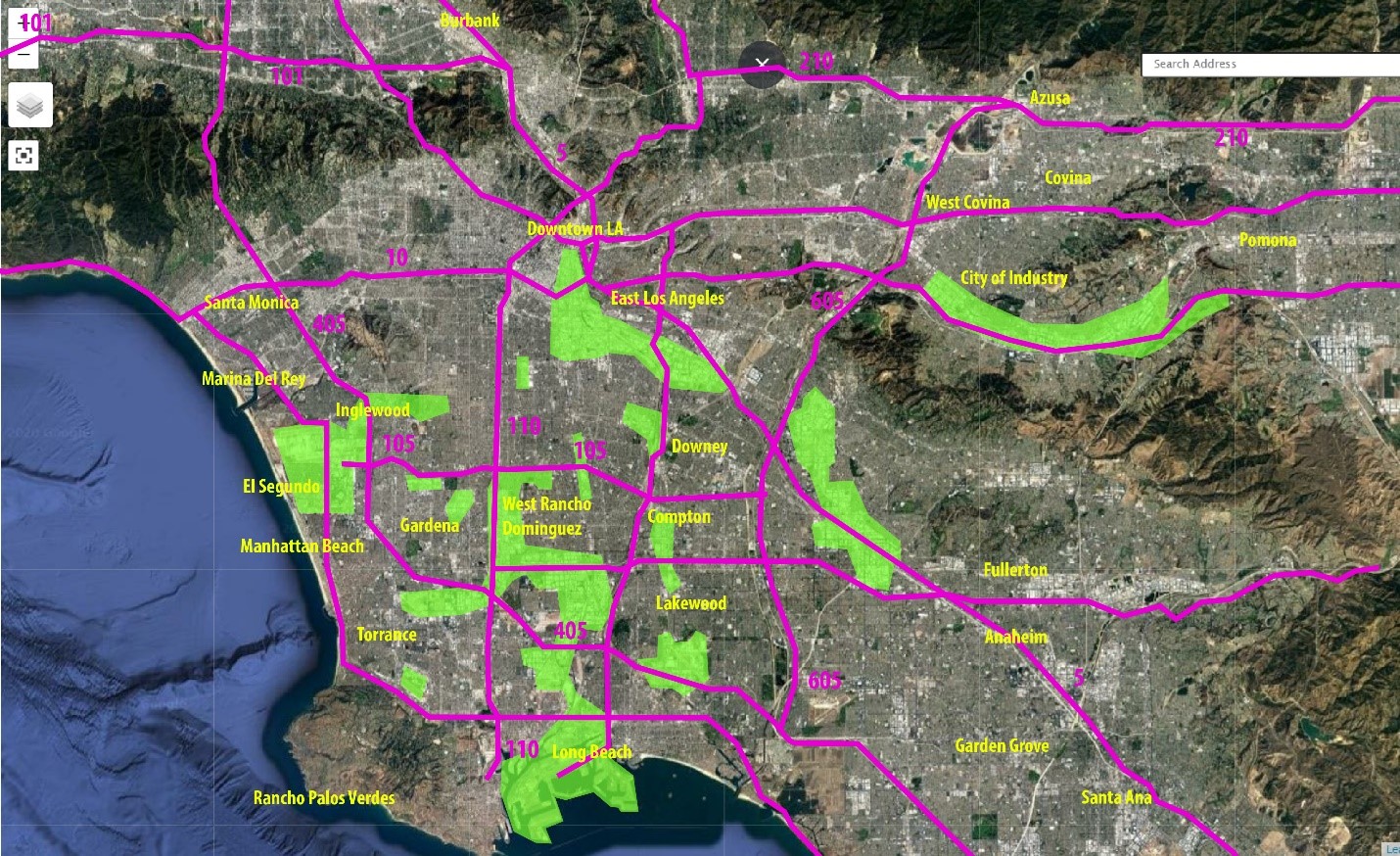

The demand for industrial buildings will stay strong because of new industries. The recent history of the industrial market is driven by distribution; goods coming in from China and other Asian countries are shipped through the Los Angeles/Long Beach ports to distribution hubs around the U.S. and on to the consumer. This trade pattern, or similar variations, is what drives the big box warehouse business. If the Chips and Inflation Reduction legislation become law, there will be a second driving force for industrial real estate.

The type of buildings new industries will occupy are not big distribution buildings in their entirety or divided. Factory sizes are smaller, 50,000 SF to 200,000 SF and not 500,000 SF to 1,000,000+ SF. Tenants will seek free-standing buildings for security and identity. Ideal location for new industrial and distribution are different. New industries will be closer to people, education, amenities, and clusters. Developers will see requirements for new construction and redevelopment. Very high ceilings are not generally required, and many older buildings will be revitalized. These are ideal market conditions with solid companies looking for space and higher rents to offset inflation.

More tenants use critical thinking when they take space. Space is the means to improve production and launch innovation. In contrast, location decisions for distribution companies are different. Warehouse space is commodified, and location metrics are driven by time to market, number of loading doors, ceiling height, and container parking. New industries use an entirely different formula. Real estate adds value to the Company’s mission. A new production building is measured by its contribution to sales, orders, satisfaction, technical rigor and other business strategies. Our work history in the area of corporate real estate strategy and transaction experience is natively adaptable to new industries seeking space in Los Angeles and other major U.S. cities.