Whether you make one deal in a lifetime or several a year, Occupiers look at the Space Markets one dimensionally, fixed-in time, because they need to have doors open ASAP. Only available space will do. Most times, Occupiers do not have the luxury to leverage their space commitment on the investment side. A select few, mostly those who own their own business, use space commitments as an opportunity to increase personal net worth by turning rent expense into profit.

In the one-dimensional world, the entire market is represented by listings. And if you need to open immediately, that’s the only market that counts. Conversely, for the dealmakers, taking new space is an opportunity to earn income. You join the developer, land owner, and capital in a profit-making, multi-dimensional enterprise as we describe in our pictorial. Generally, you work off-market to leverage your Occupancy into profits.

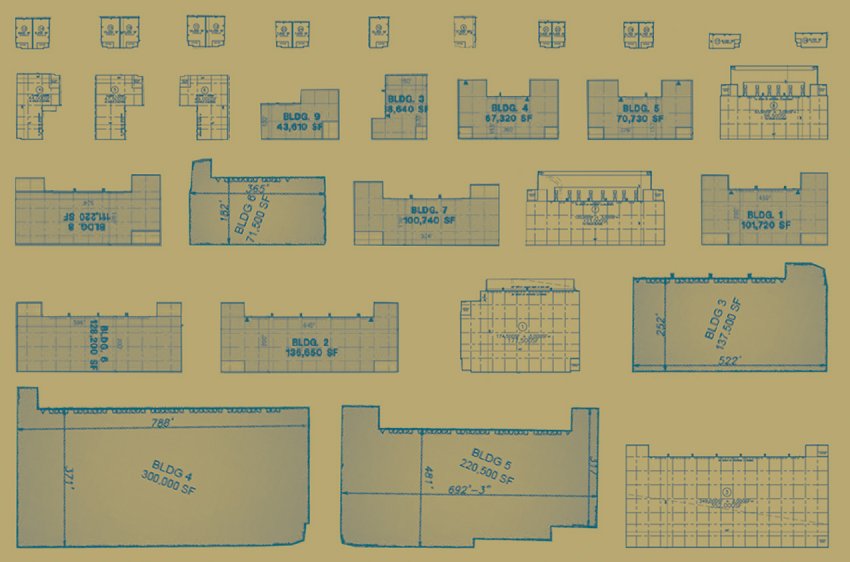

Many companies who warehouse and distribute are moving to the Inland Empire. You get 50% more space for the same money and the extra ceiling height is free. There will be a new wave of construction of all sizes. The best deals are presales in the early development phase. Remember to leverage your occupancy.The Move to Inland Empire

Warehouse and building sharing can reduce costs and maintain flexibility. Sharing has gained popularity in the tech/startup world and is now entering the mainstream. One impetus to sharing is to capture scale advantage because big buildings are much cheaper to build than smaller ones. Production industries will also share resources as a way to reduce capital investment. What Exactly is Space Sharing?

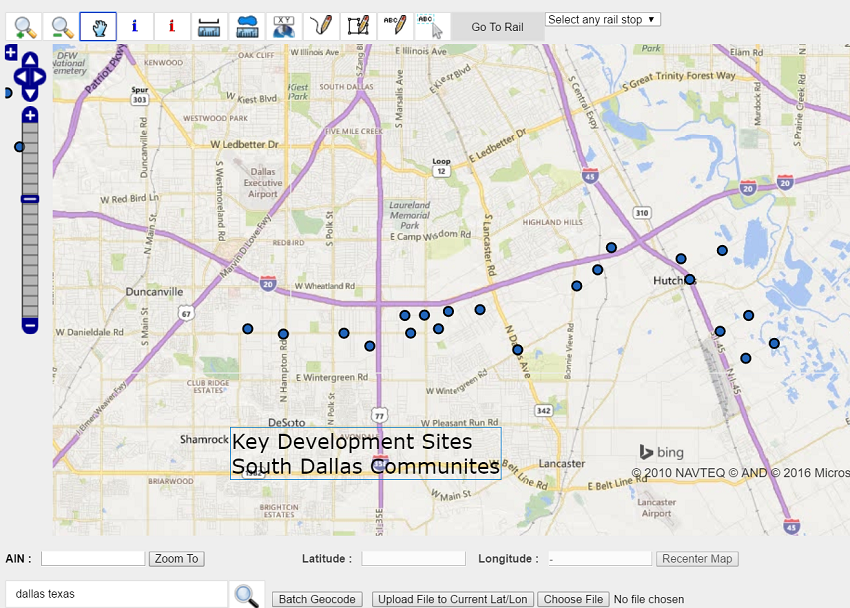

Data creates better deals. While a lot of our business is good relationships and experience, databases are essential to know the entire scope of business. We collect parcel and occupier data nationally so we can make better deals. One thing to look for is our MAPP Applicationwhere we merge the virtual and non-virtual into a deal making platform for Big Industrial. We’ll send you our log-in information by year end. Data Analytics and Industrial Real Estate

Thanks for subscribing.

Regards,

Jim Klein, SIOR

310-493-0053

jimklein@kleincom.com

(If you want to be removed from this list, please respond accordingly and we will remove you from the database)

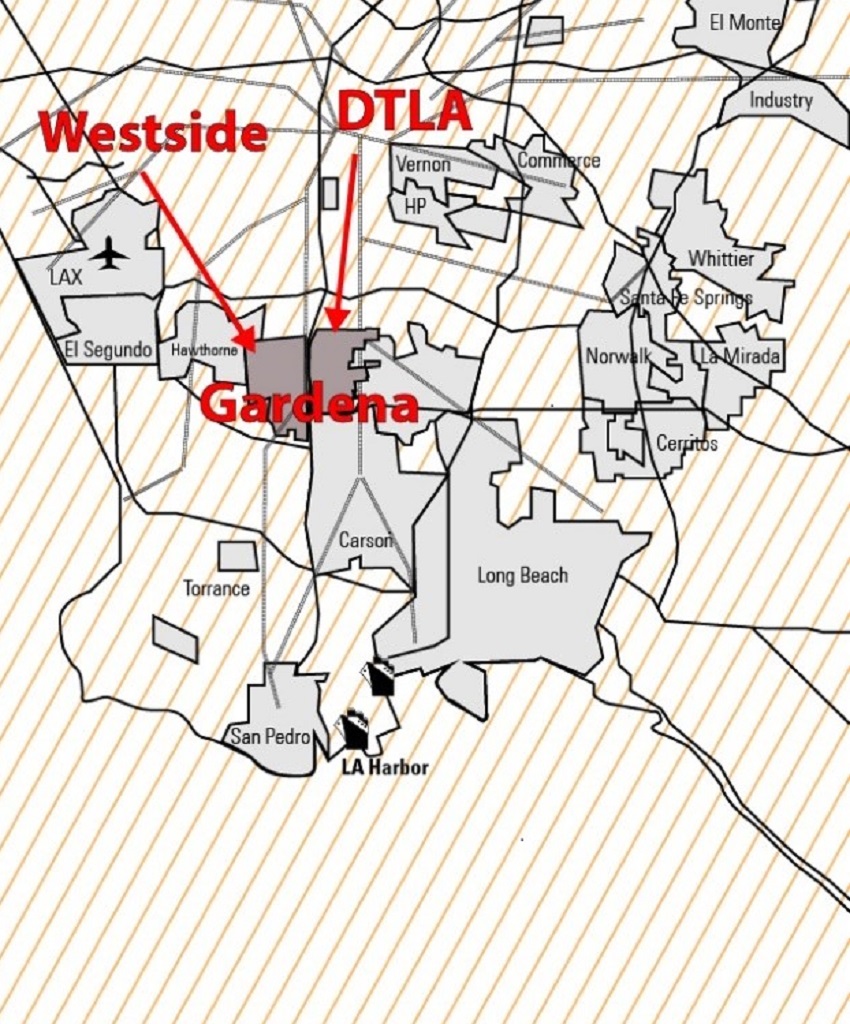

PS: Don’t forget Gardena, California. Best place to invest in the entire U.S. for industrial infill. Ideal for ecommerce and close-in production. Sweet spot is $500,000 to $5,000,000.