More real estate opportunities are popping up on decentralized platforms than ever before. Take for instance Los Angeles. There are more industrial buildings sold “off-market” than on. Industrial real estate has always had a decentralized component. Brokers find a good lead. They shop it first to their best clients off-market, decentralized. And if unsuccessful, put it on the market, on a central, MLS-type server for all to search and see. The difference today is that blockchain and cryptography is an electronic evolution that will give customers new ways to profit from their real estate.

Blockchain has these advantages 1) Keeps high dollar transactions confidential while obtaining price discovery. 2) Increases Net Operating Income by monetizing smaller units. 3) Simplifies and provides exacting real estate data through trusted peers in most major industrial markets. 4) Creates rules for dealing in a decentralized market. Customers include corporates, investors, developers, and particularly industrial building and landowners.

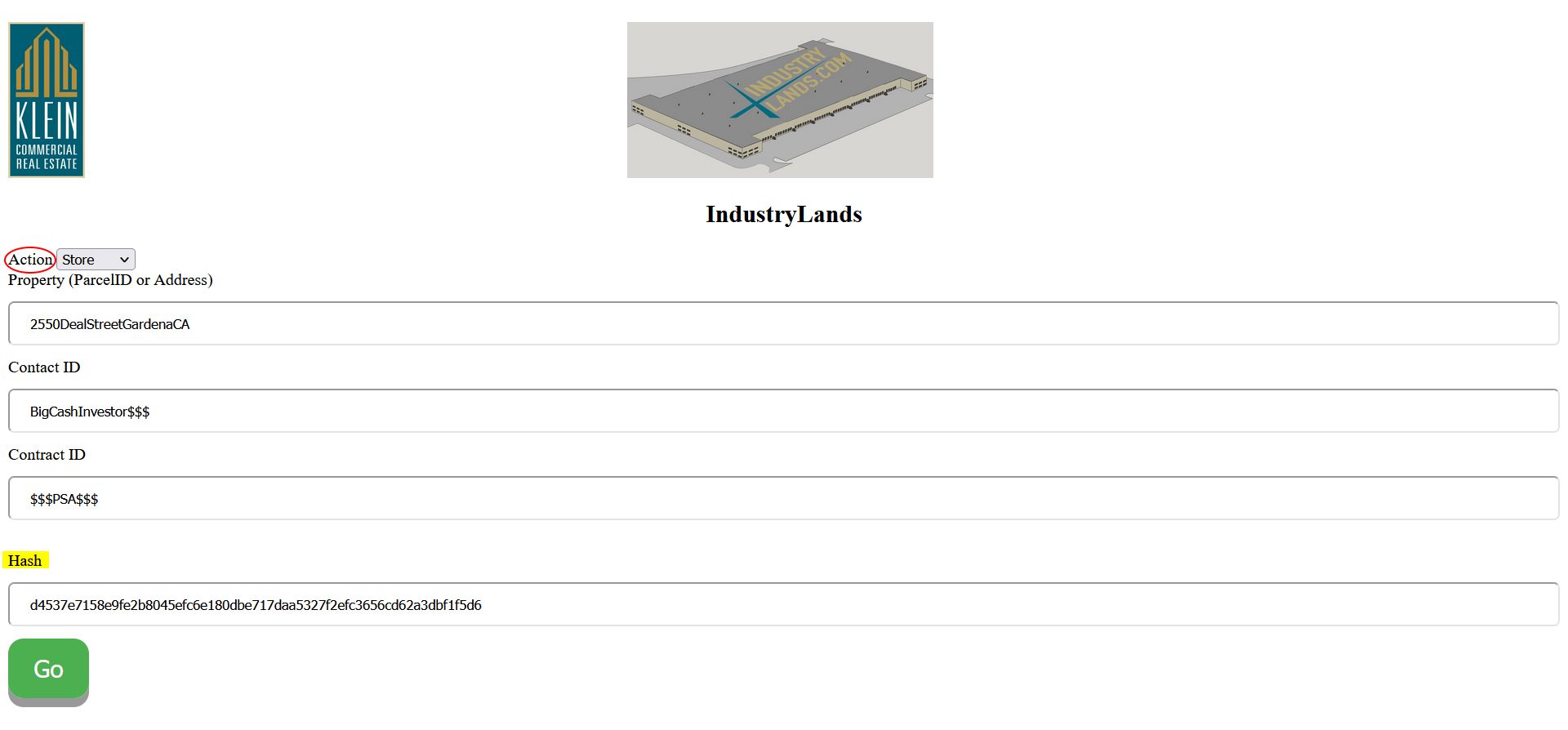

Blockchain is a decentralized platform to control data transactions by sharing a cryptographic key only with Trusted Parties. Users can share information and transact secretly by creating a hash using the SHA 256 function. The hash is a long string of digits that are almost impossible to crack. Possessors of the hash have authenticated identities and rights associated with that key. There are three ways we can create and share the key. A Web Application, by API, and a crypto wallet. So far, the wallet is a step advanced for most clients, but it is preferred by the most active users. Here is a screen shot of the Web App.

We create a hash by mashing up Property ID, Customer ID, and Document ID. We give this secured hash to customers, and they can access the files either through the web application, by clicking a link, or through a crypto wallet. It creates the long hash highlighted above and the cryptographic key you can use on the public blockchain. The WebApp also has functions to store and read on the blockchain. It retrieves data (or documents) stored on the blockchain using a Private Data Collection or IPFS.

We can send customers a link through the API that also stores and reads so customers don’t need to logon to the WebApp. All they need to do is click on the link and it retrieves the data and provides proof that I am the Procuring Clause, here is an example:

http://industrylands.com:8081/api/pcproof/store/2550DealStreetGardenaCA/BigCashInvestor$/$PSA$/

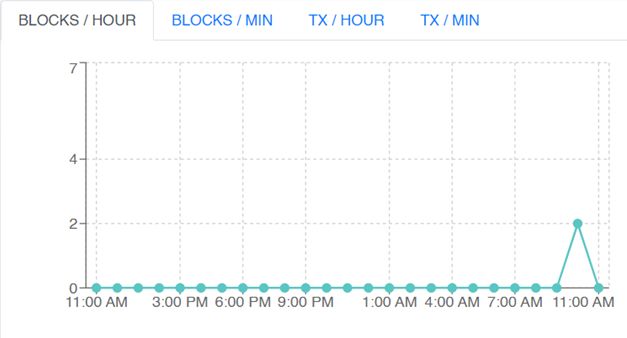

By drilling down into Hyperledger Explorer you can find the same hash on the blockchain that was created by the web app. You can see when the transaction was committed on the blockchain. I clicked on the link while I was writing the article. The key is central to operating a decentralized marketplace.

This blockchain has elementary smart contracts, rudimentary document storage, and standard ways to share a key. It’s built with Hyperledger Fabric, an open-source platform that is easy to share.

Take for example, Midwest industrial markets now beckoning out-of-town money. A Midwest broker who has a good property for a West Coast Investor can give me a key that unlocks all the documentation and fee agreements at once. When I give either seller or buyer a key, it contains proof of where the data originated and contains any contractual obligations. The same thing applies to California Occupiers looking to leave the state. I obtain information from my SIOR colleagues anywhere in the U.S. by possessing the key that contains confidential information which I securely share with my clients. Provenance, ownership, fractions, and financial transactions all likely next steps virtual and non-virtual worlds.

Blockchain works in local markets too. Clearly, in off-market deals. It’s also ideal for dealing in sub-units of bigger spaces where you can time price surges and lulls more precisely. For instance, where rents have been increasing by 10% per annum, many landlords want to keep leases shorter and obtain the increases. My favorite current case are customers who realize there’s a profit in subleasing space as rents that have jumped to $1.50 per foot per month. Blockchain is perfect to manage more frequent, short-term commitments.

Imagine the value of a peer network that is mining industrial space in major European, Chinese, American, and Middle Eastern markets. Or offering U.S. development and investment sites for the nation’s industrial renaissance. With our 40-years of industrial real estate experience, blockchain is an improvement to source properties and increase income for property owners.