The popularity of investing in industrial buildings is due to several factors. It provides both steady income and high returns through redevelopment. Market fundamentals are supportive with a lack of space and rising rents. Industrial has a lower cost of operating than office and multi-family, a stable investment duration, provides diversification, and is supported by corporate credits. Industrial is the primary beneficiary as retailers shift attention to ecommerce and away from stores. Redeveloping older industrial stock, moving capital to where it’s needed, and better information will open a vast opportunity of great industrial investments.

In industrial markets, Groupthink is misallocating capital. Institutional investors favor big box distribution, new construction, and large scale investments. For almost all other types of industrial real estate, financing is constrained. Industry focus is exclusively on supply chain and logistics, but technology and new production will provide increased opportunities to buy, renovate, and profit.

Adding Value – Buying and Renovating

Our nation’s stock of industrial buildings, just like infrastructure, is in a poor state of repair and both need substantial investment. Buying and renovating is an excellent way to boost returns. Lack of space, the need for modern improvements, and outstanding locations, provide many ways to add value.

The evolving economy is influencing location dynamics. Being close to population densities, a talented workforce and public transportation is now essential for many industrial users. Buildings need new systems, appearance and functionality. Low rent uses of garment manufacturing and storage are making way for creation, new production, and ecommerce. Buildings are being adapted for higher uses.

Look for old, dysfunctional buildings with poor loading and low ceilings. They often have extensive code violations, poor life safety, non-functioning fire sprinkler, dilapidated bathrooms, and improvised break rooms. Even though these buildings are unpainted, unpaved and uncared, all are great, contrarian investments. Many new companies in the field of robotic production, custom manufacturing, food preparation, ecommerce and other creative uses fit seamlessly in old, repurposed industrial. Oakland, South Bronx, Central Los Angeles, Newark, and West Dallas are a few examples but every city has industrial in need of extensive redevelopment.

While local conditions dictate specific renovations, these buildings have similar minimum requirements. Basic refurbishment will include HVAC, plumbing, paint, ADA, bathrooms, fire sprinkler, earthquake, cleaning, and finishing. Additional value comes from adding building intelligence. Fiber optic cabling, new power grids, communal patio areas, natural light and air flow are part of a revitalized plan. Neighborhood amenities are always welcome. In general, a simple investment platform of buying, refurbishing, and increasing rents is well overdue after decades of neglect.

Capital Divergence

While finance is plentiful on the Institutional side, borrowing is difficult for Non-Institutional. Funds, Endowments, Insurance Companies, REITs, and Sovereigns are piling into distribution buildings and large land developments. Although spreads are favorable, it is an intensely over sold environment where buyers are competing for limited opportunities.

Conversely, non-institutional grade properties, which is majority of industrial buildings, are crippled by a lack of reasonably priced financing and availability. Even “A” locations may not meet lender requirements because of tenant quality, building age, size, condition or some other criteria that prevents the lender from either selling or retaining the loan. Reserve requirements dictate as much as 50% cash down payments especially after accounting for improvement costs. Rates vary greatly. Global institutions can access funds internationally for less than 1%. Most borrowers rely on conventional loans, in the area of 4.5%, but this offers minimal leverage over cap rates. When it’s difficult to borrow, a more common vehicle is the Hard Money loan starting at 9%. This divergence between institutional and non-institutional demonstrates the potential of capital availability.

Divergence in capital and returns is widely understood by investors. On occasion, institutions will drop their standards below 50,000 square feet to get more yield, but generally, larger deals are required to be efficient with large capital amounts. Meanwhile, smaller developers, comprised of wealthy friends and family, lack scalability and are geographically bound. The big rivals in the non-institutional space are owner/users but only in cases when properties are on-market and buildings are in relatively move-in condition.

Poor Market Information

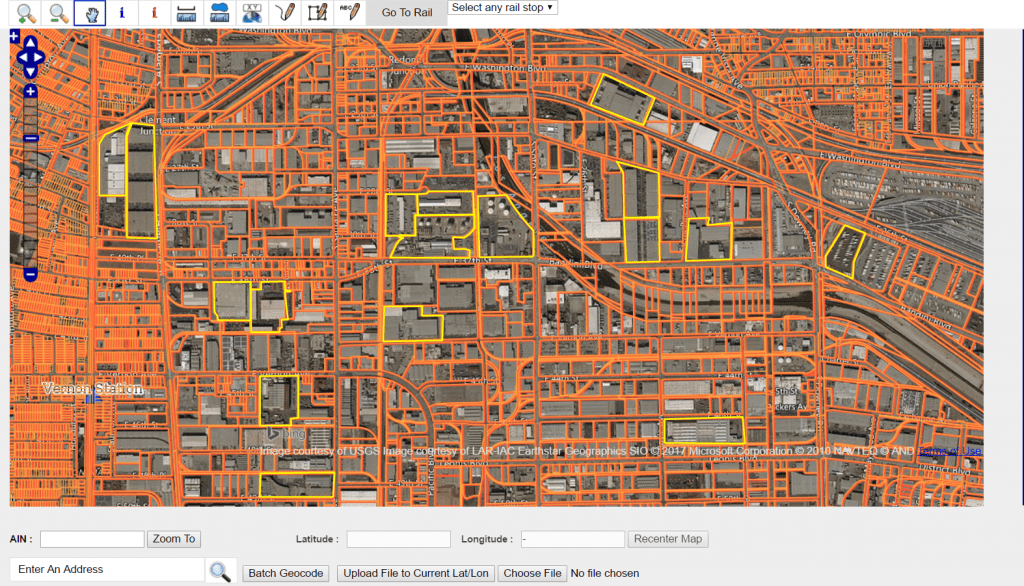

One thing that would help capital is a better source of market information. There is no universal place to trade real estate like there is for stocks or commodities. Real estate information is imperfect because it is composed of micro-markets normally geographical, and filtered by product type, size, or profile. The on-market is limited to an infinitesimally small part of the property universe at any one time. Experienced buyers trade on the “off-market” through relationships, contacts, brokers, and their own personal efforts. The most common way to search the “off-market” is by being a distinct part of the community. Establishing your reputation is still very common, with brokers, at industry events, or getting the word out directly. As an aside, local SIOR meetings can have twice as many investor/developers than brokers which is a completely new occurrence.

To combat information scarcity, large organizations have developed their own electronic tools using big data sets composed of all the properties they would like to own. Data tools are a clear strategic advantage when filtering through tens of thousands of buildings. Modest investments in search techniques using data science provides proprietary information unavailable to the general market. In addition to being a part of the on-market, it’s possible to create your own “off-market” network. For example, by focusing on industrial buildings, redevelopments, and development land, direct search techniques create opportunities that are otherwise elusive. As the “on-market” becomes overly crowded and inventory, scarce, in-house search teams are using custom computer programs as a new way to overcome the disequilibrium of market information.

In summary, lack of available property is causing many large buyers to look where they never have before. The large amount of money flowing to industrial will also reduce the inventory for Occupiers to purchase their own facilities. The move to the “off-market” provides incentives for new techniques to locate property. As institutions dominate the Big Industrial market, it is very likely they will do the same in lower tiers. In the interim this opens a ‘buy and renovate” program for smaller developers and capital providers to find good investments and to feed larger institutional owners.