Single Building Occupiers generally have less sophistication than companies who take a lot of real estate. They take a market approach and rely heavily on market sale and lease prices.

After a few deals, Multi- building occupiers begin to understand development and occupancy dynamics through the lens of capital deployments, global occupancy, and cost/profit controls. They see the entire process from land acquisition, through development and ending in capital markets. Along the way, there are profits to earnduring the entire process.

For example, by simply moving the commitment forward to the Land Entitlement Stage, Occupiers can obtain large discounts in contrast to purchasing a completed building. Likewise, buying a building with a capital partner will yield lower rents and favorable terms.

By leveraging your tenancy, Occupiers will receive financial rewards.

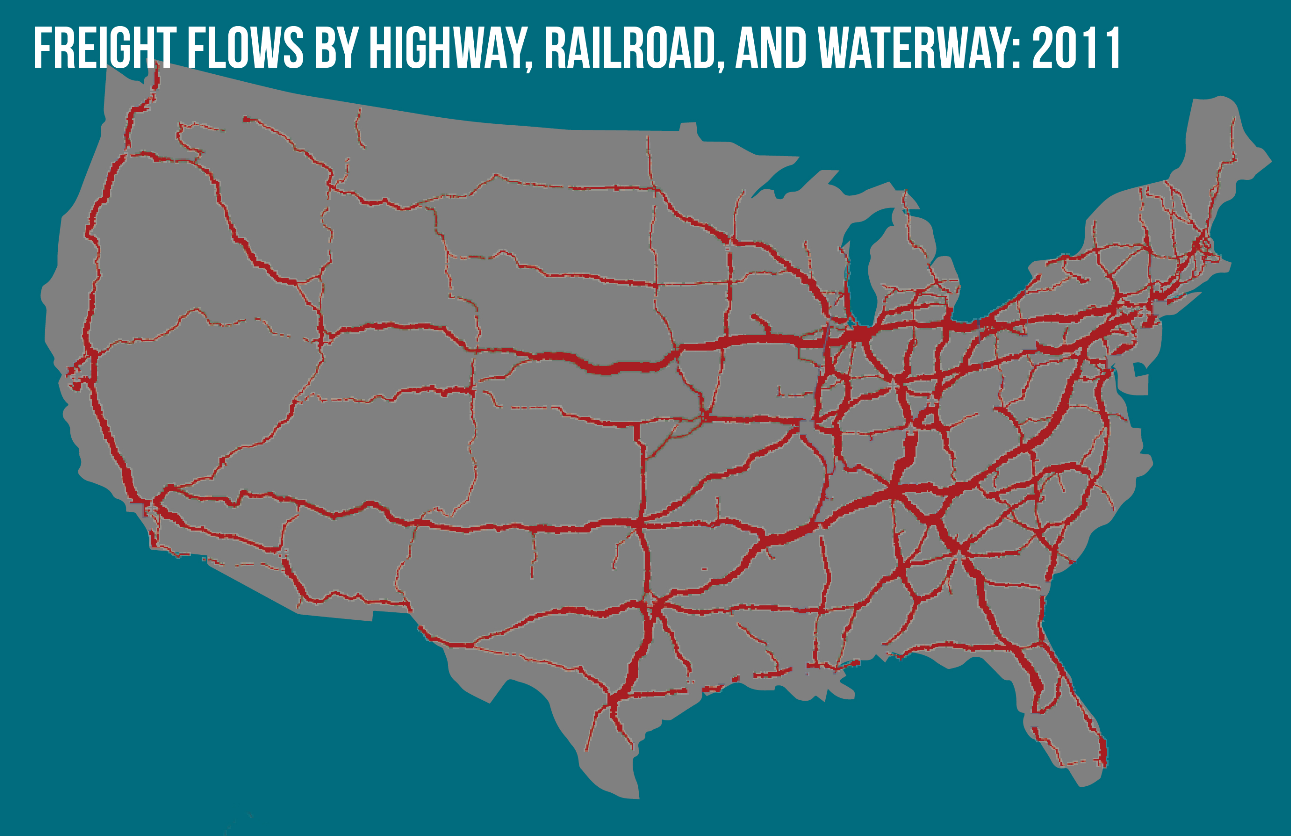

Using Freight Flows as guide for investment decisions. Core nodes and most heavily trafficked corridors are shown on this GIS patterned map. Best locations tend to be where freight flows are greatest and you can serve a large metro areas at the same time. Key markets like Dallas, Los Angeles, New Jersey, Altanta, Chicago will serve locally and regionally.