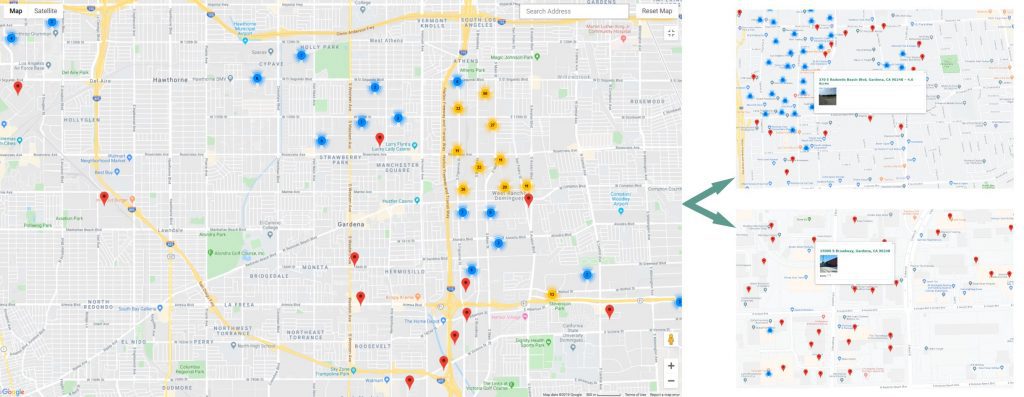

We feature two types of investment activities. Our primary activity is brokering industrial buildings to investors. We represent buyers and sellers, mostly by matching local industrial properties to institutional and national-level investors. Many individual owners seek our experience as exclusive agents.

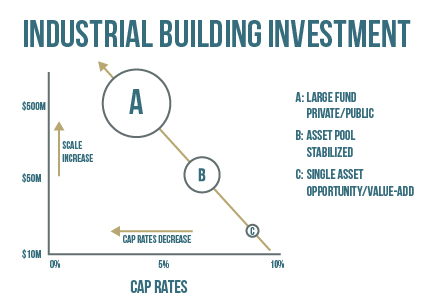

Our other growing investment activity is with investment partners. Partnership Buildings generally deliver current income and appreciation. Cap Rates vary from 4% for all cash “Class A” investments in New York and Los Angeles to 6.5% for older, but functional buildings in those same markets. There are particular opportunities for infill buildings that have not been re-positioned adequately for ecommerce and creative industrial. Our core competency is identifying those buildings, one-by-one, that are suitable for investment. We see more opportunities than last year.

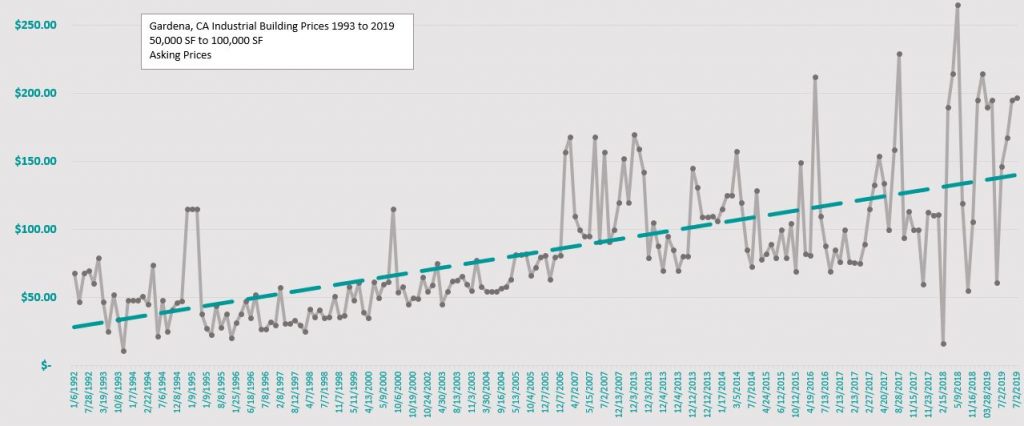

Cap Rates are 4 to 5 percent with minimal leverage. If those returns sound skimpy, historical appreciation for Los Angeles Industrial has been averaging almost 11% per annum from 1993 to 2019. There is a series interruption in this data set (2007-2013), but I can calculate the periods 1993 to 2007 which returned 11.7% in Annual Average Appreciation. And dramatically from the period, 2013-2019, that delivered 19.6% in Annual Appreciation. This due to Cap Rate Compression and the dip during the Great Recession. The general investment proforma for properties shows a 5% positive cash flow (all cash investment) and 10% in annual appreciation.

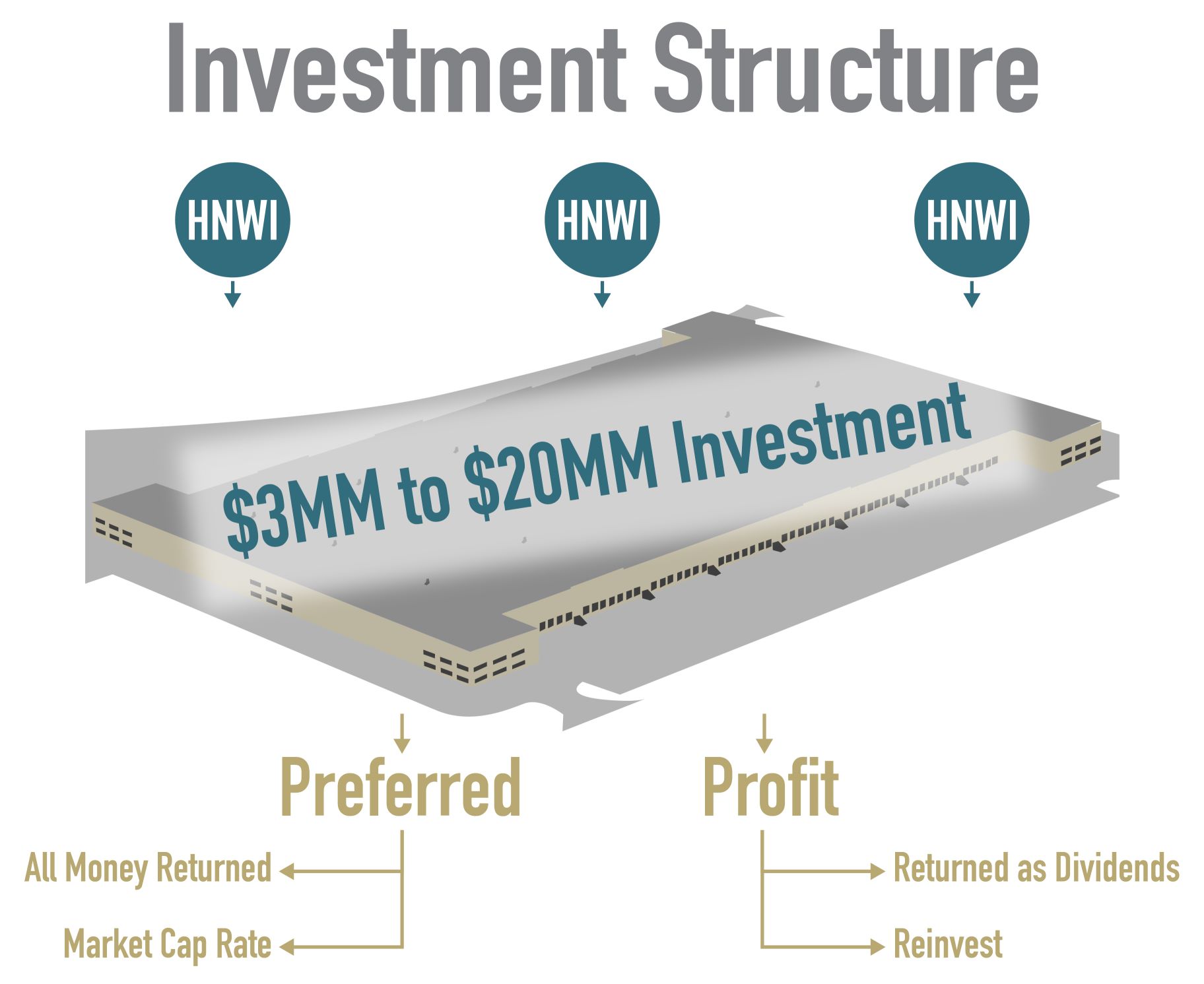

Investments are supported with granular detail of owners, tenants, analytics and street knowledge. Deals are created by the data we collect and market experience. The most lucrative areas are sub-institutional grade because the market has not been consolidated. We frequently post opportunities to purchase buildings in well located, major industrial markets along with our rationale. Pricing is $5MM to $15MM. The biggest obstacle is raising capital until these properties are re-positioned and stabilized.

For those looking for industrial building investments, please contact us to be included in any new offerings. Thank you.