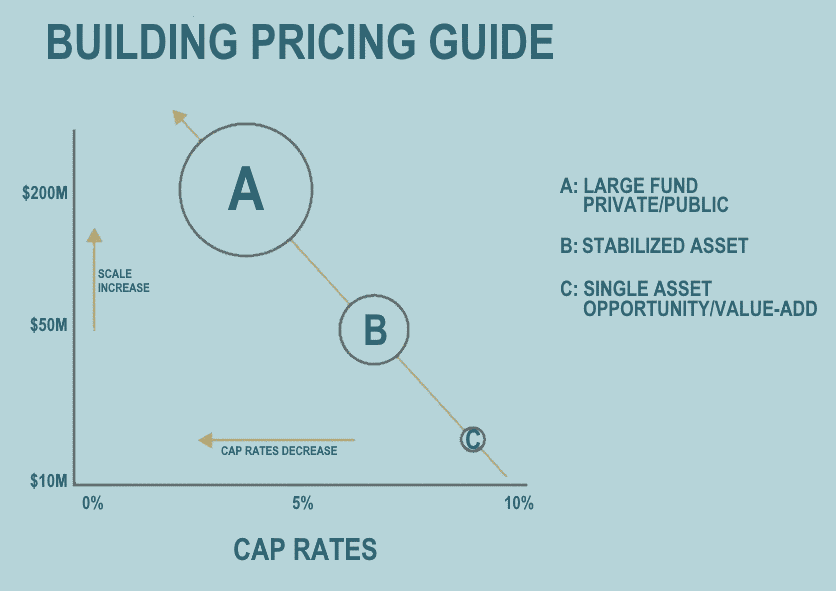

We have two main investment activities. The primary is selling industrial buildings to developers and institutional investors. Industrial buildings in greater Los Angeles are very attractive and there is no shortage of buyers. There is a lot of liquidity for industrial property.

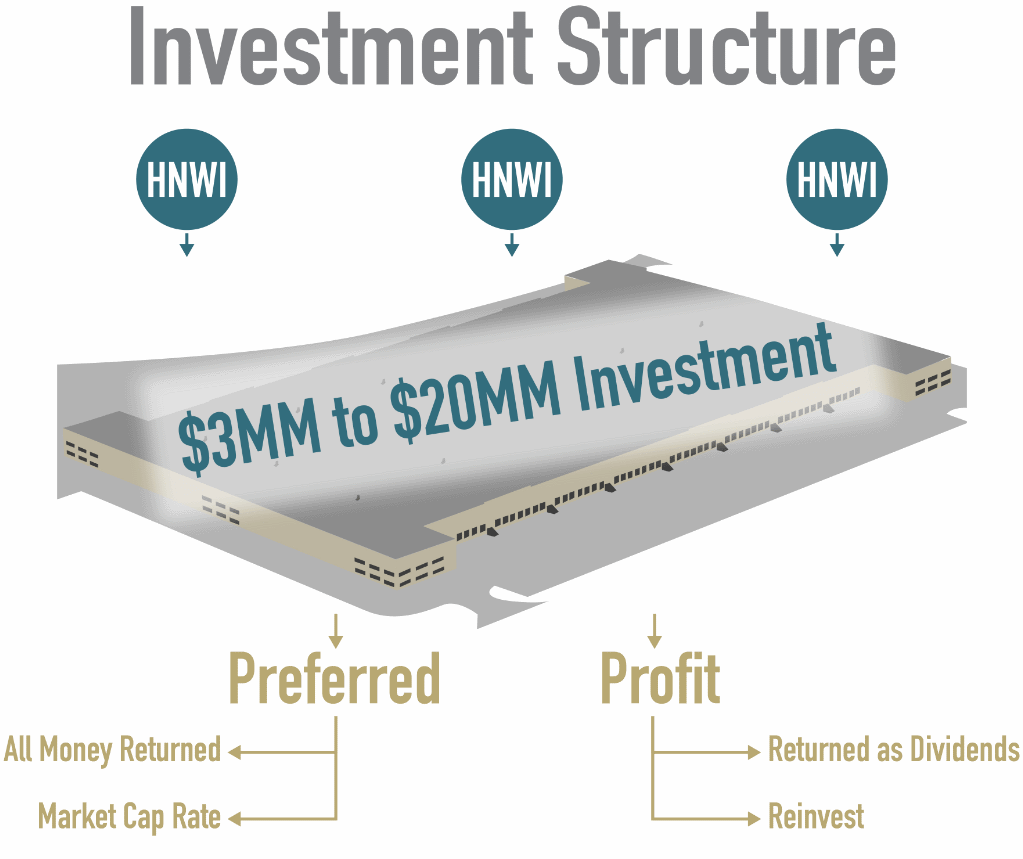

Secondarily, for buildings that are below institutional standards because of age, quality, or size, there is an active market of private investors. They raise money from accredited investors and buy buildings as partners. Investors receive market returns and upside. Unlevered yields are 5%-6.5%. Historical annual appreciation in greater Los Angeles exceeds 10%. Buildings in the $2,000,000 to $10,000,000 range are below most institutional thresholds. Redeveloping older, well-located buildings is a rewarding enterprise. Truck yards can still yield mid-teens with leverage.

Skip to content