Where to Find Hard Tech Buildings in Los Angeles

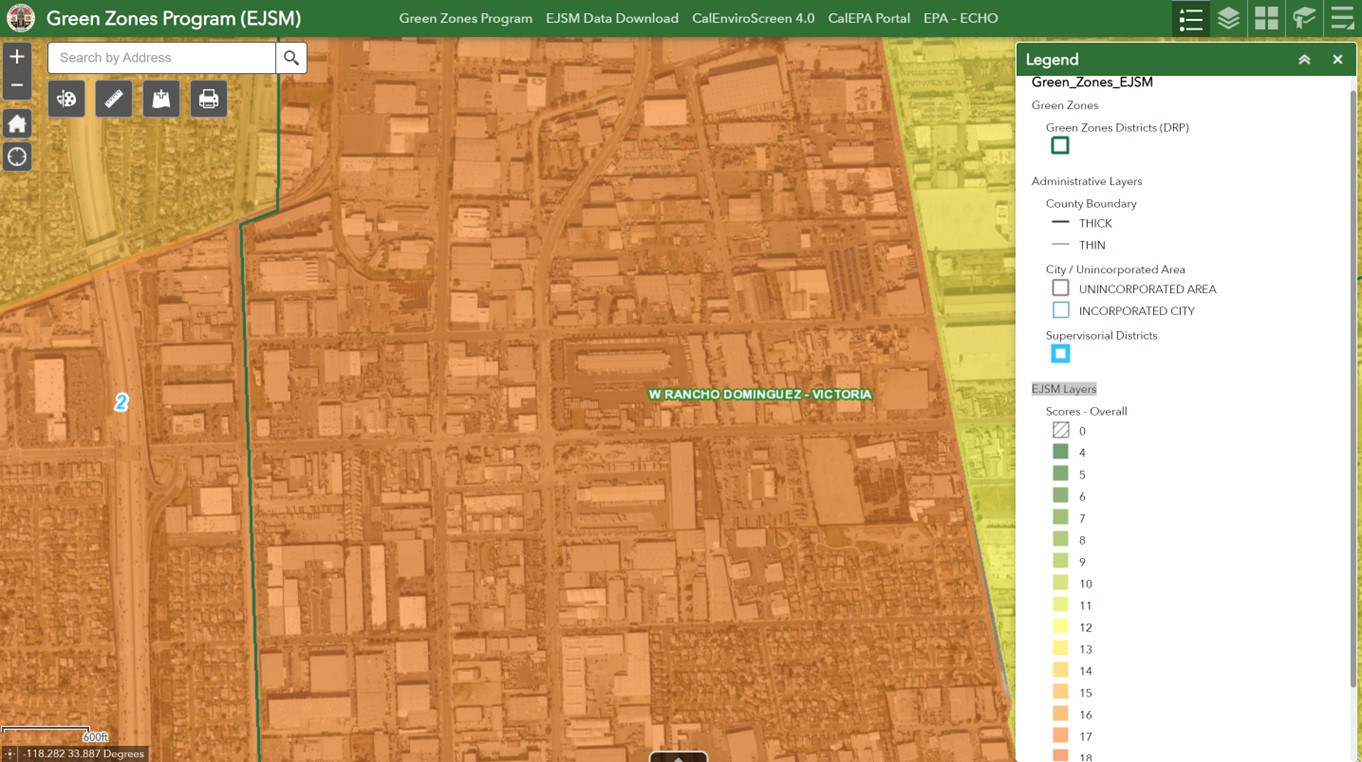

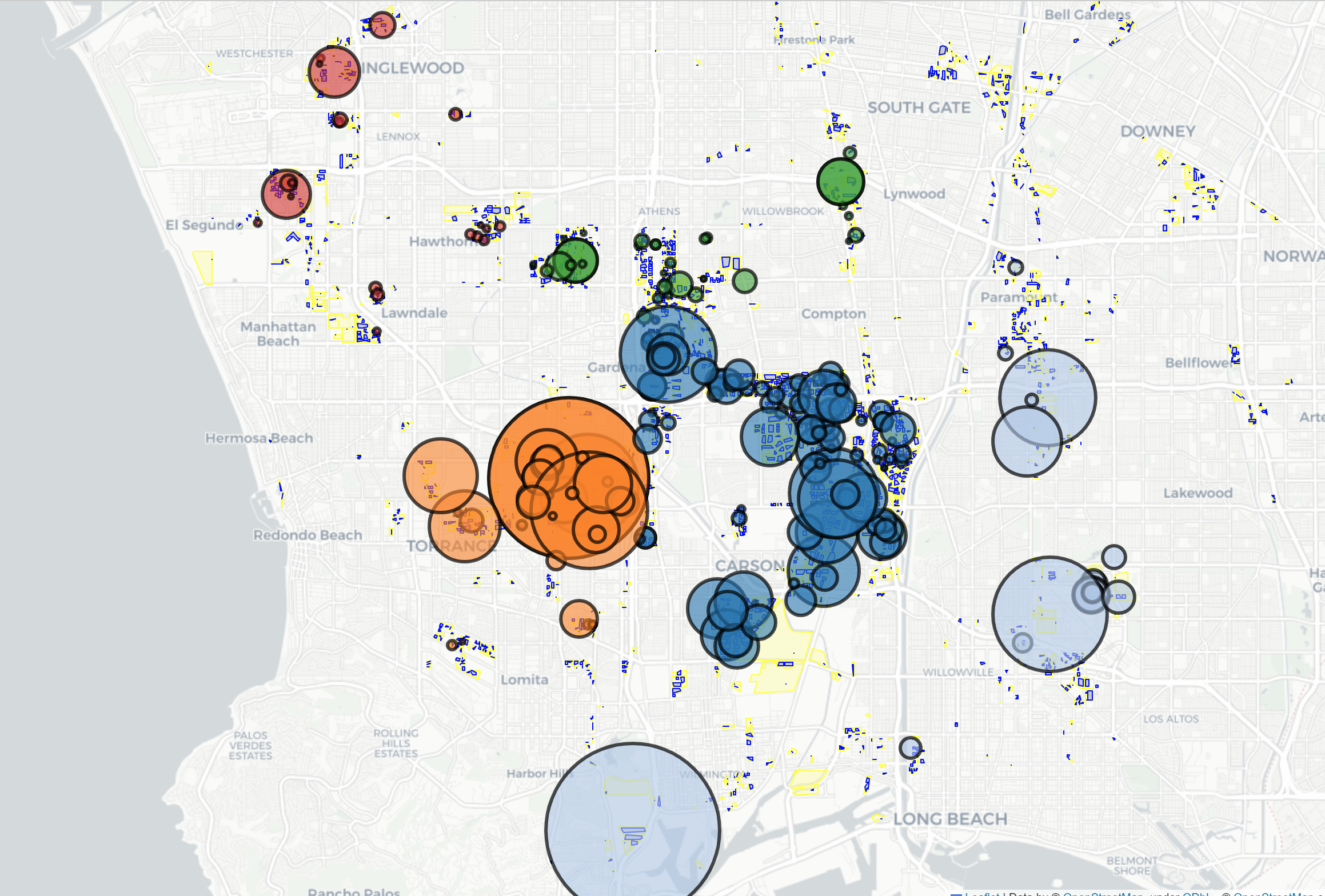

Despite higher than normal industrial vacancies, Hard Tech companies are finding it difficult to locate adequate industrial space. Many Hard Tech companies require substantial electical power. They want a free-standing building for U.S. Government clearance, more office space than is typical, a large parking area, and a location to attract engineers. Many Hard Tech companies prefer El Segundo and neighboring beach communities because of its history of aerospace and defense manufacturing. But they will consider other locatons along the 405 corridor from LAX to Irvine, including Torrance, Long Beach and other locations in Orange County. Some Hard Tech Companies will make the difficult decision to split their manufacturing from engineering to find the right facility in the location they want. Other parts of Los Angeles that served as machining centers in the past are located in Gardena/Carson, Commerce/Vernon and parts of the San Fernando Valley. Following are a couple of graphs describing market conditions:

Offerings are scarce in the El Segundo/Beach Cities area. When Hard Tech companies grow, they often look to Torrance, Hawthorne, Gardena, Carson or Long Beach. These cities are close to experienced engineers and they house good production facilities.

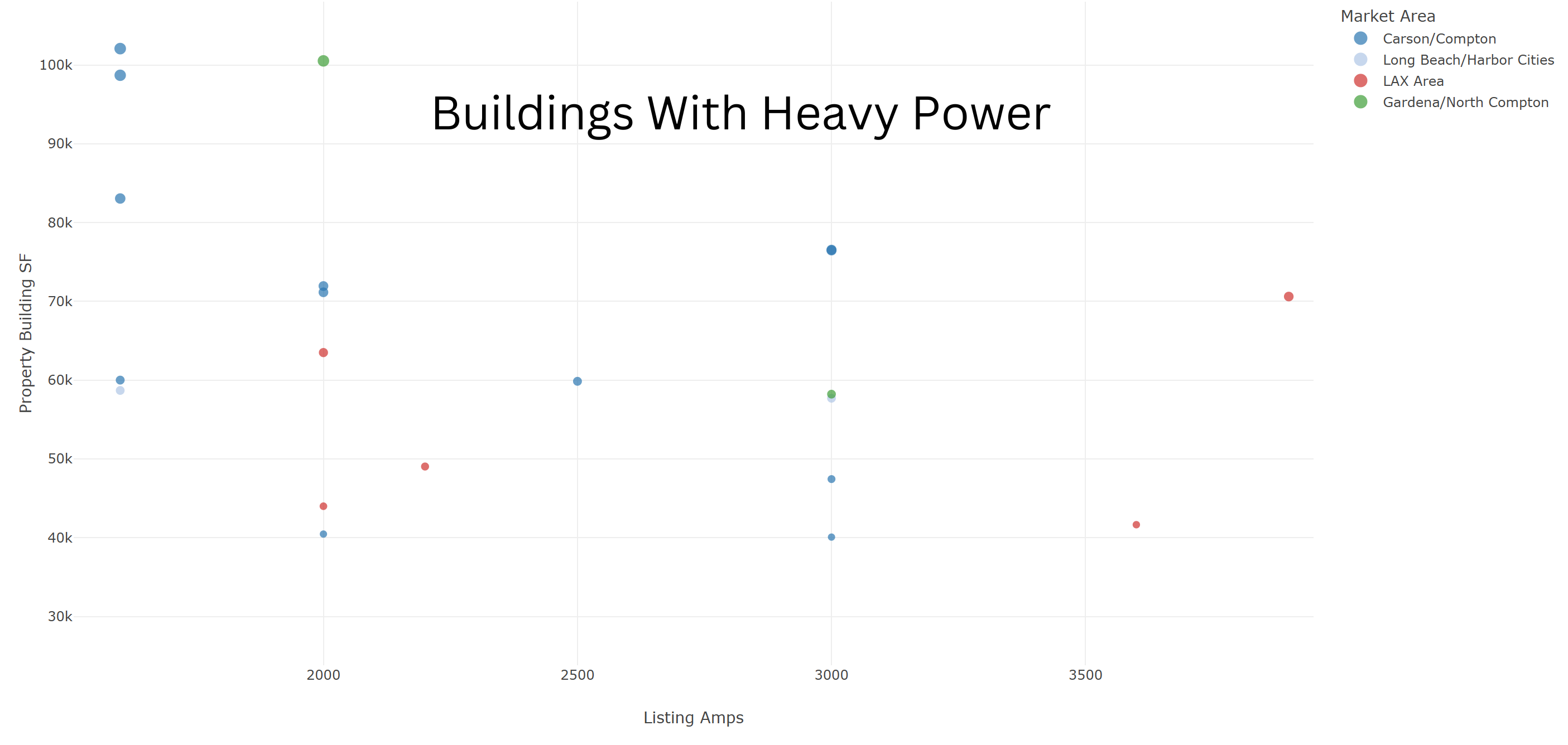

Power is a main criteria for many Hard Tech Companies. If you need heavy power, 2000 AMPs or greater, there are only a few buildings with the necessary capacity in each square foot range.

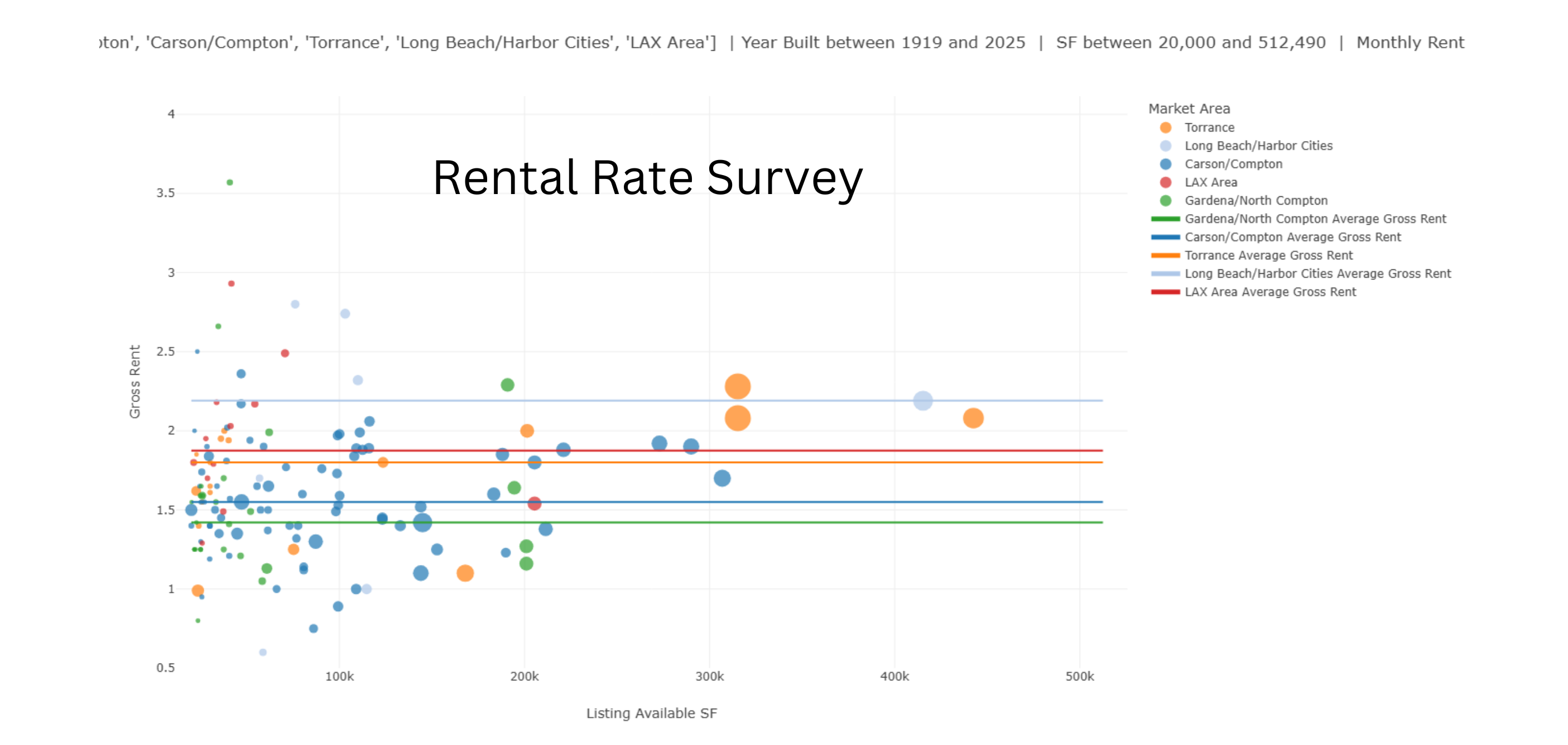

Rents hover between $1.50 to $2.25 Gross per square foot per month depending on location and amenities.

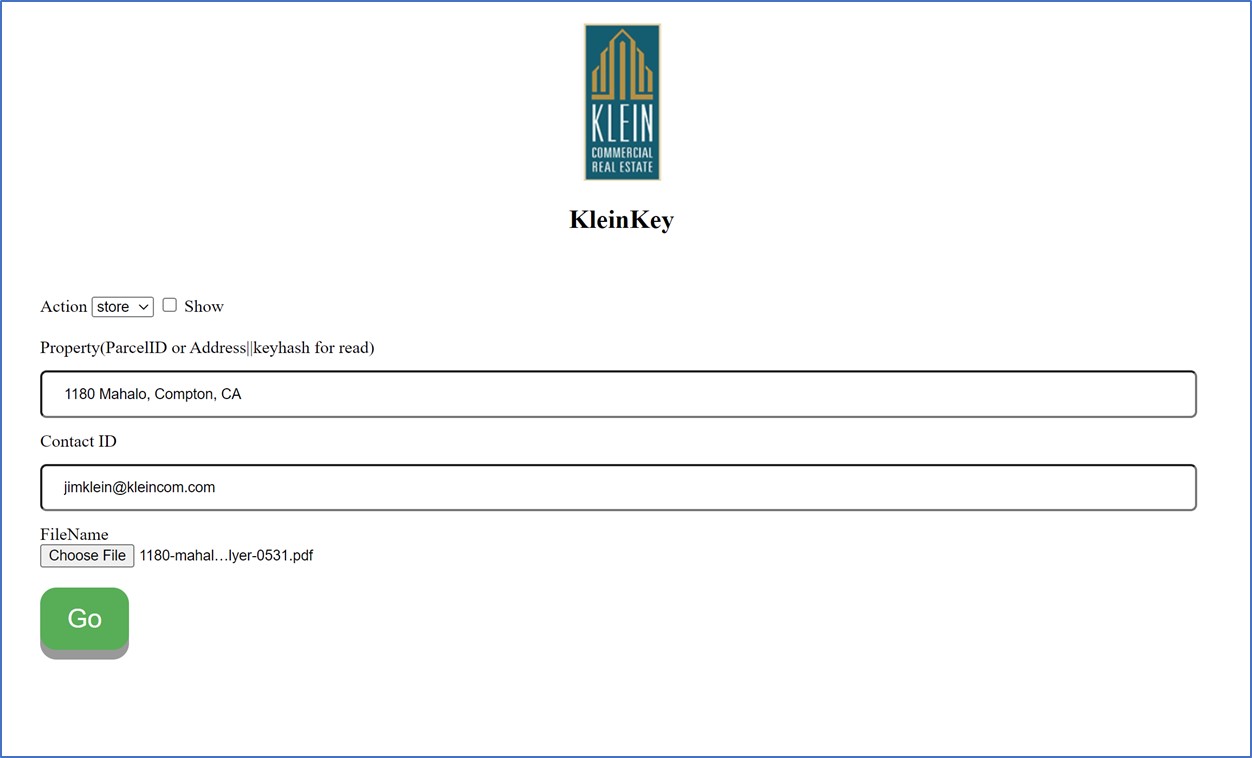

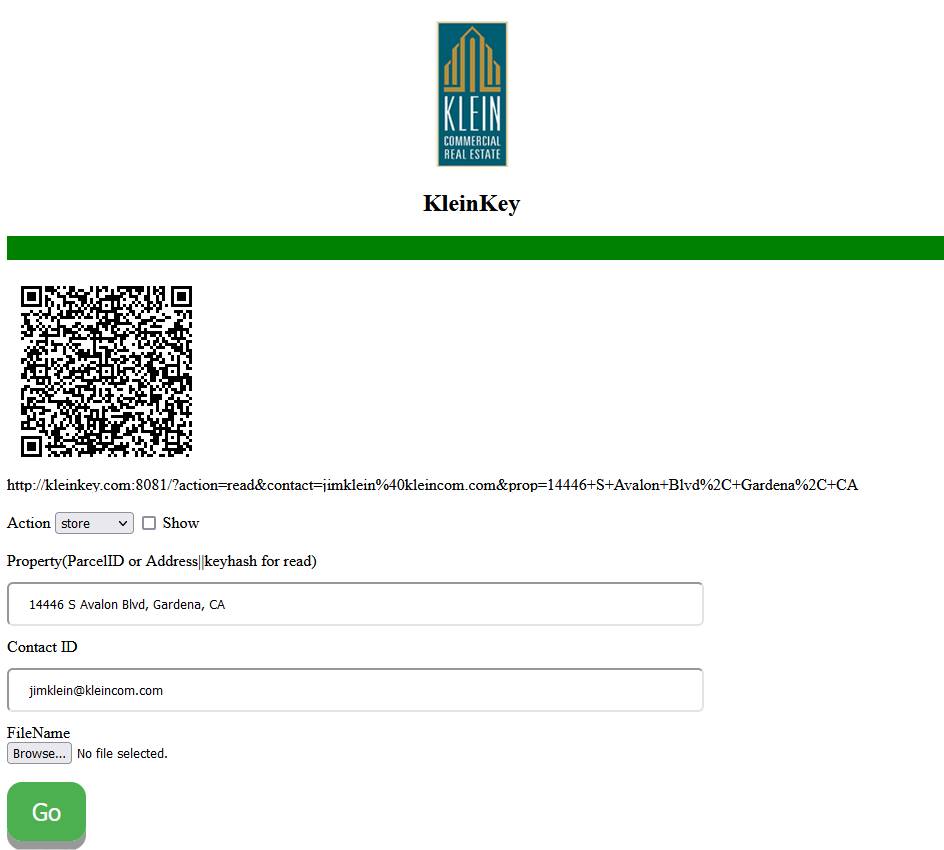

If you are seeking a new building or have questions about Los Angeles industrial real estate, please contact us today.

Thank you,

Jim Klein, SIOR – Jimklein@kleincom.com

Quan Wu – Quan@kleincom.com