Notes From the 2015 SIOR Fall Conference in Chicago

Here are a few notes from the SIOR Fall Convention 2015 that was held in Chicago this past weekend, October 8-10.

Continue reading “Notes From the 2015 SIOR Fall Conference in Chicago”

Here are a few notes from the SIOR Fall Convention 2015 that was held in Chicago this past weekend, October 8-10.

Continue reading “Notes From the 2015 SIOR Fall Conference in Chicago”

This is clearly an exciting market, finally. Land and buildings are trading robustly in all corners of US Industrial.. There are three reasons to explain the activity – moderate growth; dearth of recent, new construction; and lots of institutional finance. There is virtually no product available, especially for newer generation buildings. As far as capital, it’s a wave of money that wants to be invested in industrial.

Continue reading “Big Industrial Land”

We’ve been examining some of the larger ecommerce distribution companies and while it is a very notable trend in the industry, we’re finding the current leasing impact is substantially less than the publicity it currently garners. But this is still early in the migration to a new distribution platform and a lack of building supply is holding back ecommerce adoption especially in infill markets. Ecommerce users generally want a lot of loading, high clearances, and large employee parking lots. These are not buildings typically found on the market and in this period of extreme shortage, there is no incentive for developers to develop anything “out of the box”. However, those few developers who have been willing to take the risk and build ecommerce buildings on spec have been richly rewarded.

Continue reading “The Challenge of Ecommerce Real Estate”

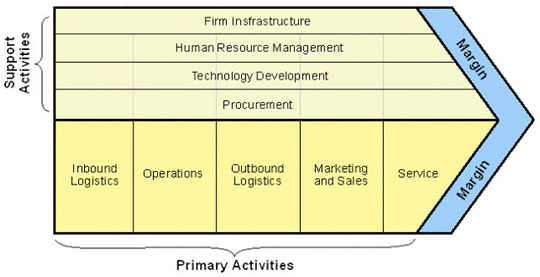

The Cluster Mapping Project (CMP) was pioneered by Michael E Porter of Harvard University. He is just as well known for his works on Competitive Advantage. His work is a necessary foundation for US Industry and business organizations. I reprint his Value Chain diagram below for company diagnostics, which has been repurposed to examine the competitiveness of regions. To understand the implications of location and clustering, you can read an article Professor Porter published in 1995 about the strategic location of inner cities which is just as relevant today.

Continue reading “Looking at US Industrial with the US Cluster Mapping Project”

Tenants have underappreciated power especially in cases of new development and investment projects. Most tenants don’t realize their own worth because they are rarely in the market, don’t experience the development cycle and are oriented towards functionality. Conversely, lease terms and tenant credit are essential to the developer. The capital impact of the lease is well understood by the developer but is often neglected by the tenant.

Continue reading “Tenant Power”

The world of big industrial has evolved with fewer and better capitalized buyers. It’s a core group of 15 or 20 nationwide owners that know the markets, have talented principals and to the delight of most sellers, they close for all cash. In contrast, the entrepreneurial developer who played such an important development role in past buying cycles has almost completely vanished from the scene. High Net Worth Funds, REITS, Pension Plans, and the Insurance Companies dominate the ranks of primary industrial investors. Occasionally, developer partners, seek out capital from the large institutions, but control still reverts to the same dominant group of investors.

Continue reading “Concentration Continues at the Top Tier of Industrial Buildings”

Good technology can improve real estate deal making. This article describes my experience with Geographical Information Systems (GIS) and how it has become a fundamental tool for my business. At its simplest, GIS programs are a visual adjunct to database and contact management programs. However, if used to its fullest, GIS can crystalize multiple property relationships to monetize real estate information by traditional forms of deal making, solve complicated problems and create new business models.

Continue reading “Real Estate Deals in the GIS and Data Universe”

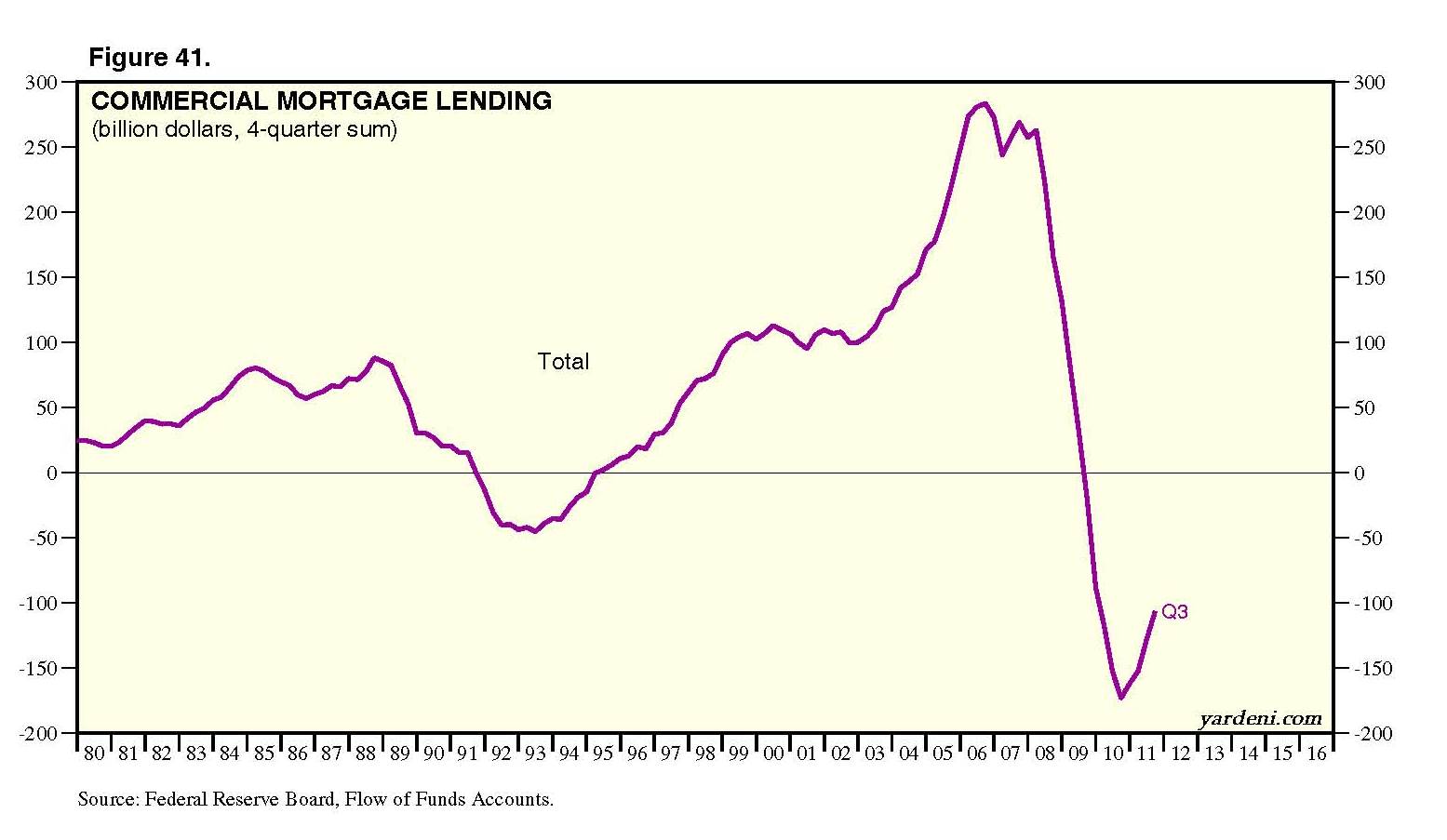

Many have already seen charts like this one showing a big drop at the end of 2007. It explains the past four years of weak sales. The small uptick demonstrates the recent increase of deals. Since this is 2011 Q3 data, (but released earlier this month), I expect to see more improvements. The same indicators are alive in the market. A long way from peak conditions but in the right direction.

We are starting an extremely interesting and confusing period as redevelopment agencies (RDAs) come to an end. Firstly, RDAs were a powerful force in every city’s arsenal. They employed large staffs and had enormous budgets. A lot of the built commercial world is attributable to redevelopment through direct land contribution, infrastructure, subsidies, guarantees, loans or other physical or financial contributions. RDAs created a lot of very good development that would not have otherwise been built. High quality, low income housing units were developed. Many private and capable developers profited.

Continue reading “Questions About The End of California Redevelopment”