Ownership Concentrations in Los Angeles Industrial Real Estate

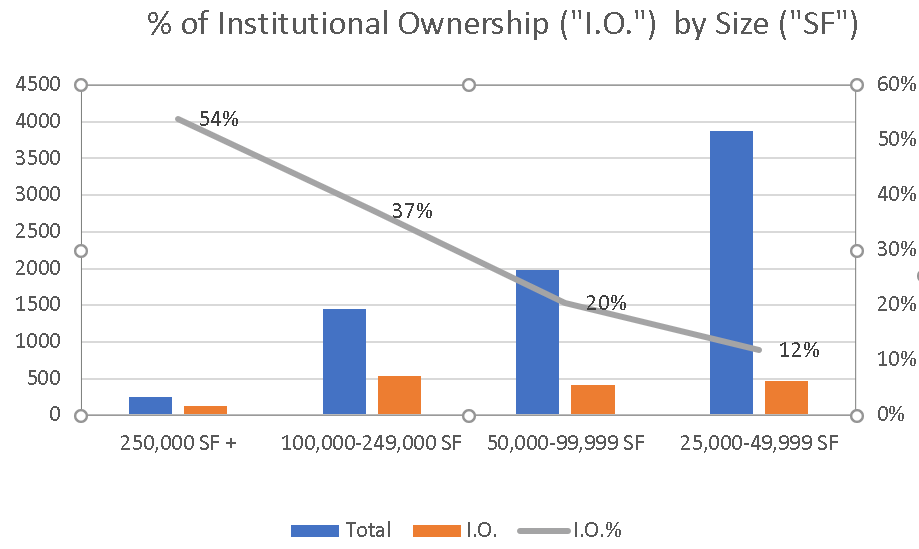

Every August, the Los Angeles Tax Assessor releases its annual Tax Roll that lists all ownership in Los Angeles County. This is valuable data and serves as an important part of our statistical analysis for the year. In other words, Tax Roll data helps us find properties to purchase. For Tax Year 2019/2020, the share of Institutional ownership increased in all size ranges, particularly larger buildings. For investment buyers, more focus on smaller buildings will be fruitful because there is less institutional concentration.

Continue reading “Ownership Concentrations in Los Angeles Industrial Real Estate”

Creative Industrial: The Next Wave of Building Investment

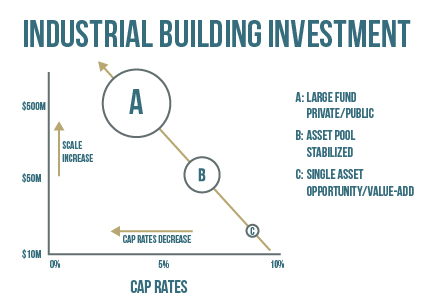

We’ve come to end a long period of consolidation in the warehouse and distribution sector. Particularly over the past ten years, a handful of national owners have rolled-up a vast network of separately owned warehouses into an industrial building behemoth across the best locations. It’s a feat worthy of acknowledgement but consolidation marks a turning point. The buccaneering ethos of deal-making has been permanently replaced by a staid, institutional mindset. There is a final hurrah for Private Investors and that is Creative Industrial.

Continue reading “Creative Industrial: The Next Wave of Building Investment”

Los Angeles Industrial Real Estate

The New Industrial Real Estate Business

If you are buying, selling or leasing, today’s industrial real estate business has permanently shifted. It has become an investor led market that was originally established for Occupiers. Investment fundamentals supersede many traditional occupancy concerns. Industrial markets became financialized because of strong and increasing money flows from institutional funds, REITs and private investors. In the New Industrial Real Estate Business, profits accrue fastest to those who treat their buildings like an investment product. The primary market driver is improving income through rental increases, operations, and tenancies. The wave of financialization is affecting most local industrial markets in the best metros and is visible building-by-building. Technical sophistication and specialized platforms are the new means of operating in today’s industrial building business.

Continue reading “The New Industrial Real Estate Business”

Vernon, California – Second L.A. Market

Industrial Buildings: From Private Hands to Institutional Buyers

One of the longest running trends in industrial real estate is the shift of ownership from private hands to institutions. Traditionally, insurance companies, pension funds, and real estate investment trusts (REITs) would purchase new developments and industrial parks after they had been leased and stabilized. It served as both a guaranteed exit for entrepreneurial developers as well as the way investors would acquire property to match long term obligations.

Continue reading “Industrial Buildings: From Private Hands to Institutional Buyers”

Geodata, MappSnap and Industrial Real Estate

Geodata is widely used in many commercial internet applications like Yelp, Google Maps, Twitter, Foursquare and Factual. Many of these web services match your phone’s location to their own mapping programs. In most cases location data is an aid to sell goods and services. I use the same relationship between point data and the connected internet to find more real estate deals using MappSnap.

Continue reading “Geodata, MappSnap and Industrial Real Estate”

A Backwater No Longer

As industrial moves from being an operations decision to a financial product, it’s no longer a sleepy backwater of the investment world. Institutional Capital has permanently changed markets from locally owned and operated to globally owned and tenanted. It’s a 40-year trend beginning with the first wave of Japanese corporations and now exploding with institutional capital since the 2008 Financial Crisis. The influence of institutional capital makes it a different business. The driver is no longer business operations but financialization.

Continue reading “A Backwater No Longer”