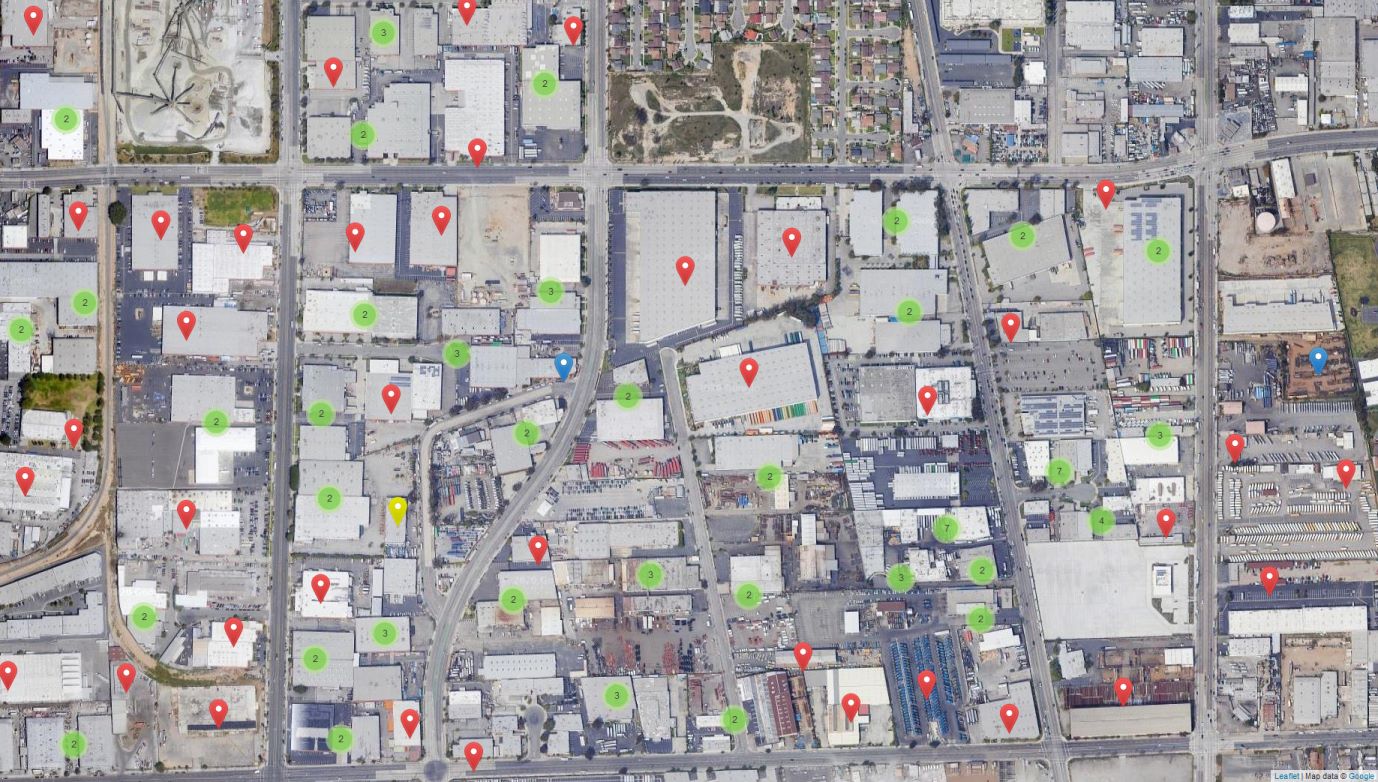

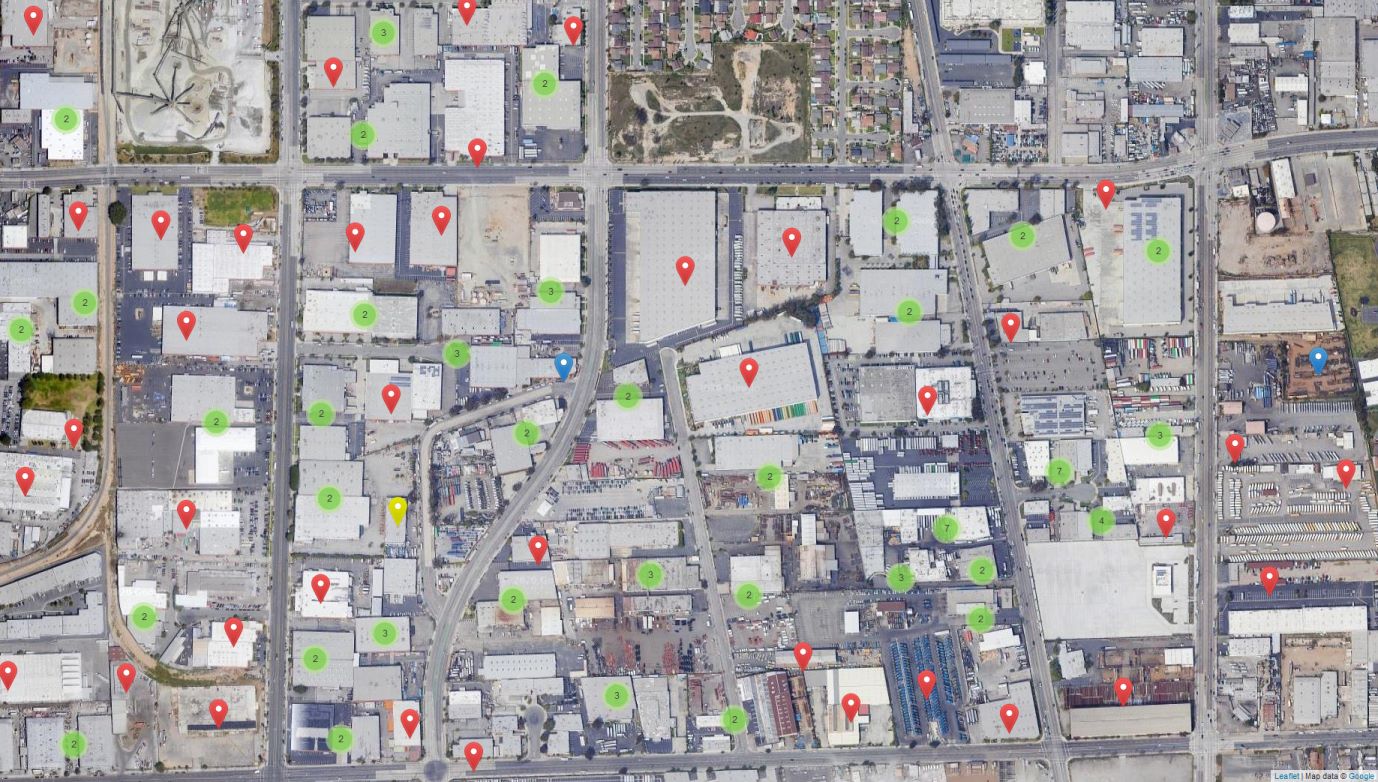

Most of us have experience with basic spreadsheet packages, databases, and CRMs like Excel, Access, or Salesforce. These are common examples of machine learning. More complicated are the advanced expressions that computer scientists write for high finance trading. All rely on search, update, replace, and other basic commands. By setting up procedures and calculations that process your property information, you too can start gaining valuable machine knowledge to make more deals. We’ll be discussing more about this in person during the TransACT 360 Tech Committee’s Program, “Collaborative Innovation”, on April 30 in Indian Wells, Calif.

Continue reading “Machine Learning and Industrial Real Estate”