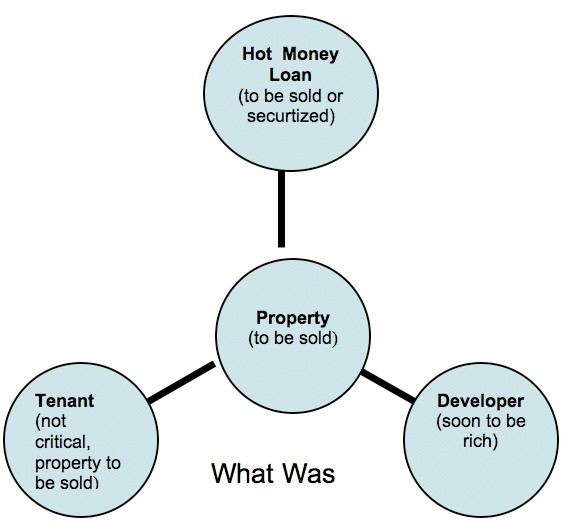

At the Edge and Stagnation of Valuation

The business of real estate is close to an end. Developing, investing and lending have all halted except for the most secure or distressed situations. An enormous swath of the industry is mothballed like an auto plant in the summer. Just like autoworkers, real estate practitioners are wondering if production will re-open. Lending divisions, development companies, land developers, and acquisition departments are closed until further notice. The biggest fallout is people we have all known for many years that are deciding what to do for the future.