Streaming Industrial Real Estate

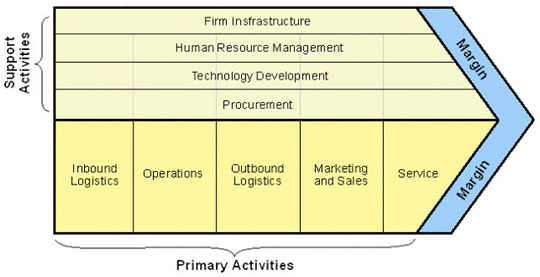

Streaming is the talk of Hollywood. The biggest adaption since television. Technology is replacing human decisions with lessons from on-line, eCommerce and subscription. It’s happening to industrial property. Real estate is already a superior cash streaming business, now with more means to enhance revenues. Visible effects of streaming appear with large space take-downs by studios and independent producers. Agency, too, is being disrupted because the value of data is surpassing personal relationships. Financial concentration and streaming technologies are creating a new real estate business. Virtual and artificial intelligence programs are essential to move forward in these new conditions. Continue reading “Streaming Industrial Real Estate”

.jpg)