Four Types of Industrial Real Estate Decisions

Four Types of Industrial Real Estate Decisions

For decades, the U.S. industrial real estate landscape was largely shaped by the flow of consumer goods. e-commerce, brick-and-mortar supply chains, and manufacturer distribution networks. This model is not going away and will be enhanced by more e-commerce. However, a profound shift is now underway. New trade dynamics, tax incentives; and support for AI and Data Centers will re-orient location and capital decisions. There is a new emphasis on factors crucial for enhanced industrial production. This evolution leads to richer set of criteria for assessing location value with an emphasis on network dynamics, supply chain and underlying AI infrastructure.

For companies that are facing real estate decisions, we found the following framework helps you determine the type of move you are most likely to take. The first three type of decisions are accepted as standard procedures in corporate real estate circles. Infrastructure demands, particularly power, connectivity, and location have grown to being singly important.

- Incrementalism

- Standardization

- Value-based

- Infrastructure Dependent

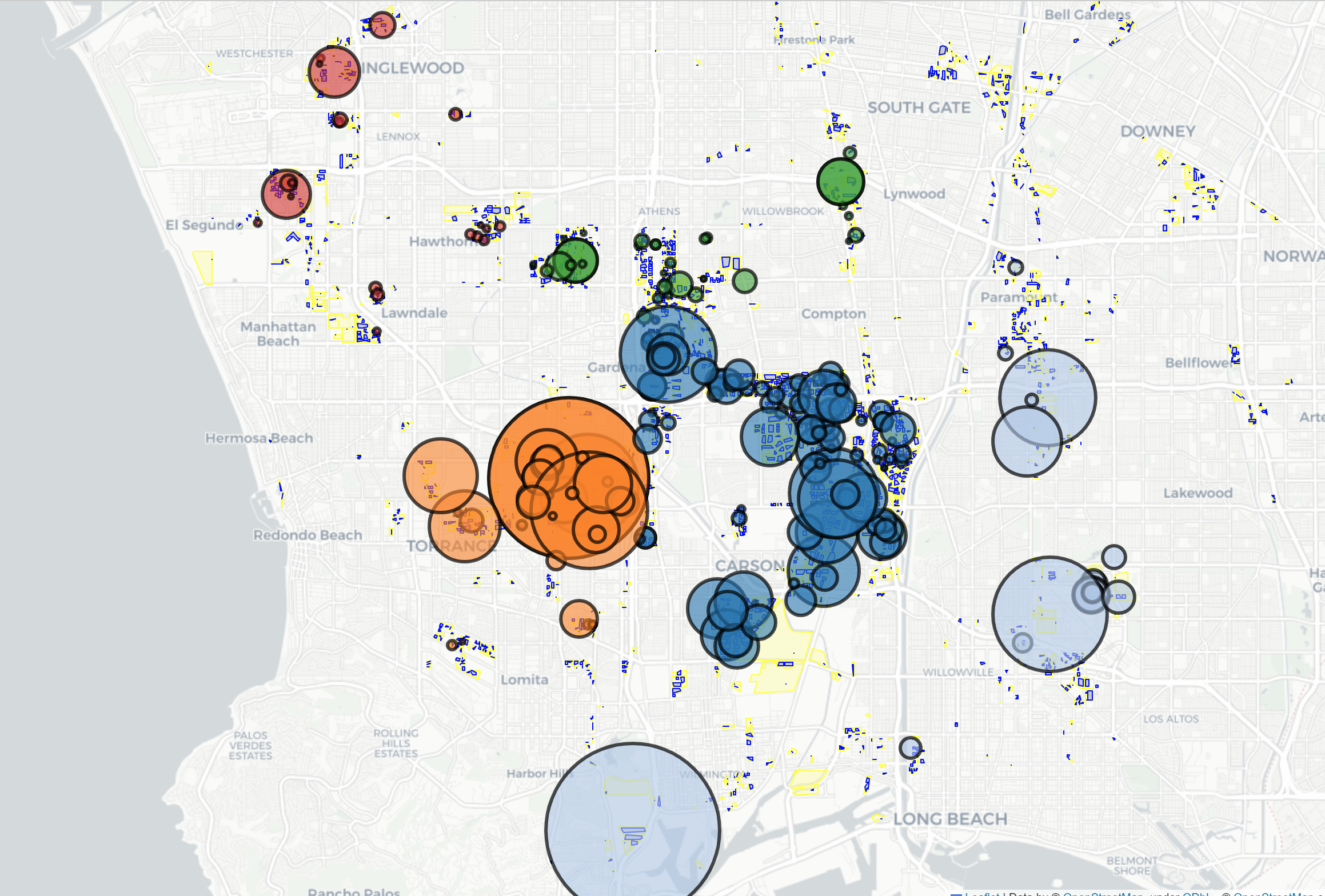

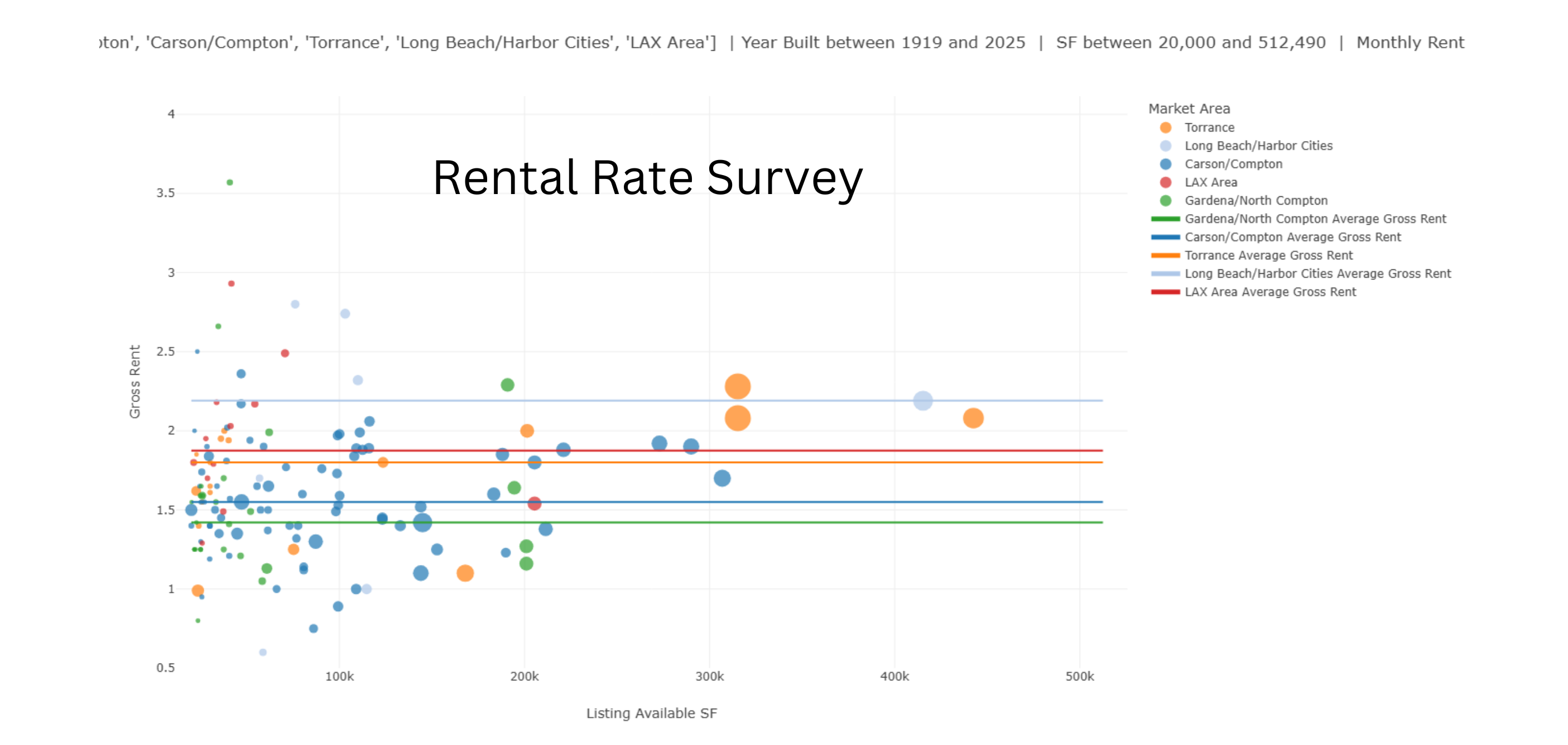

1. Incremental Growth: Remaining close to core operations and seeking nearby buildings to facilitates organic expansion or infill needs. This strategy prioritizes maintaining local expertise and established networks. Incremental growth is the most common way to expand. Value is based on proximity.

2. Standardization: Particularly relevant for companies taking multiple facilities to support regional markets or industries. This approach emphasizes consistent specifications and operational efficiency across a distributed network.Common examples are consumer products, industrial supply, and data centers.

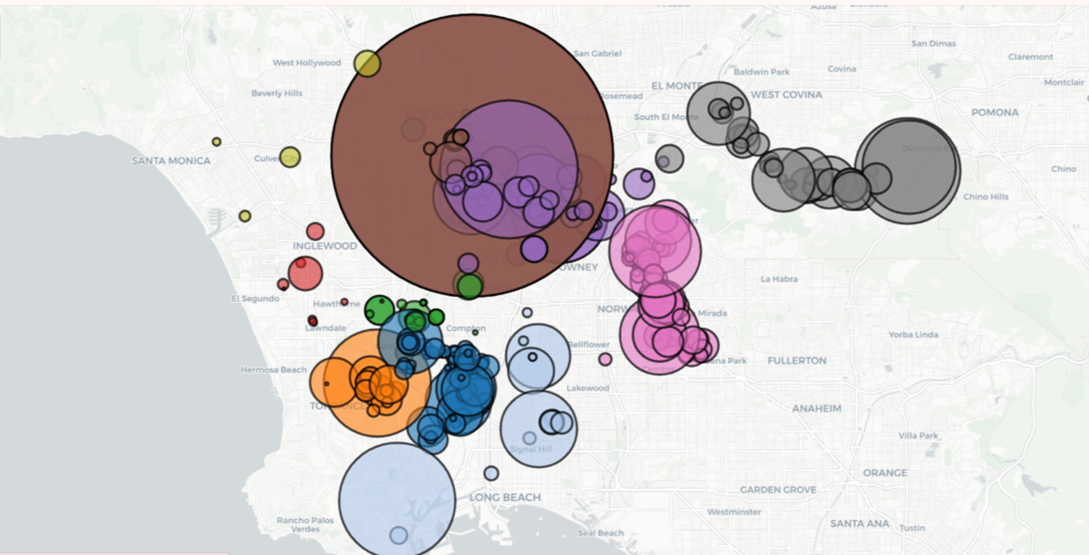

3. Value-Based: Driven by new strategic directions or significant restructuring, this often involves a “Pick Up and Move” to a fundamentally different area, chosen for its long-term alignment with core values and future growth. This frequently occurs when companies leave California for lower costs, fewer regulations or improved synergies with suppliers and customers

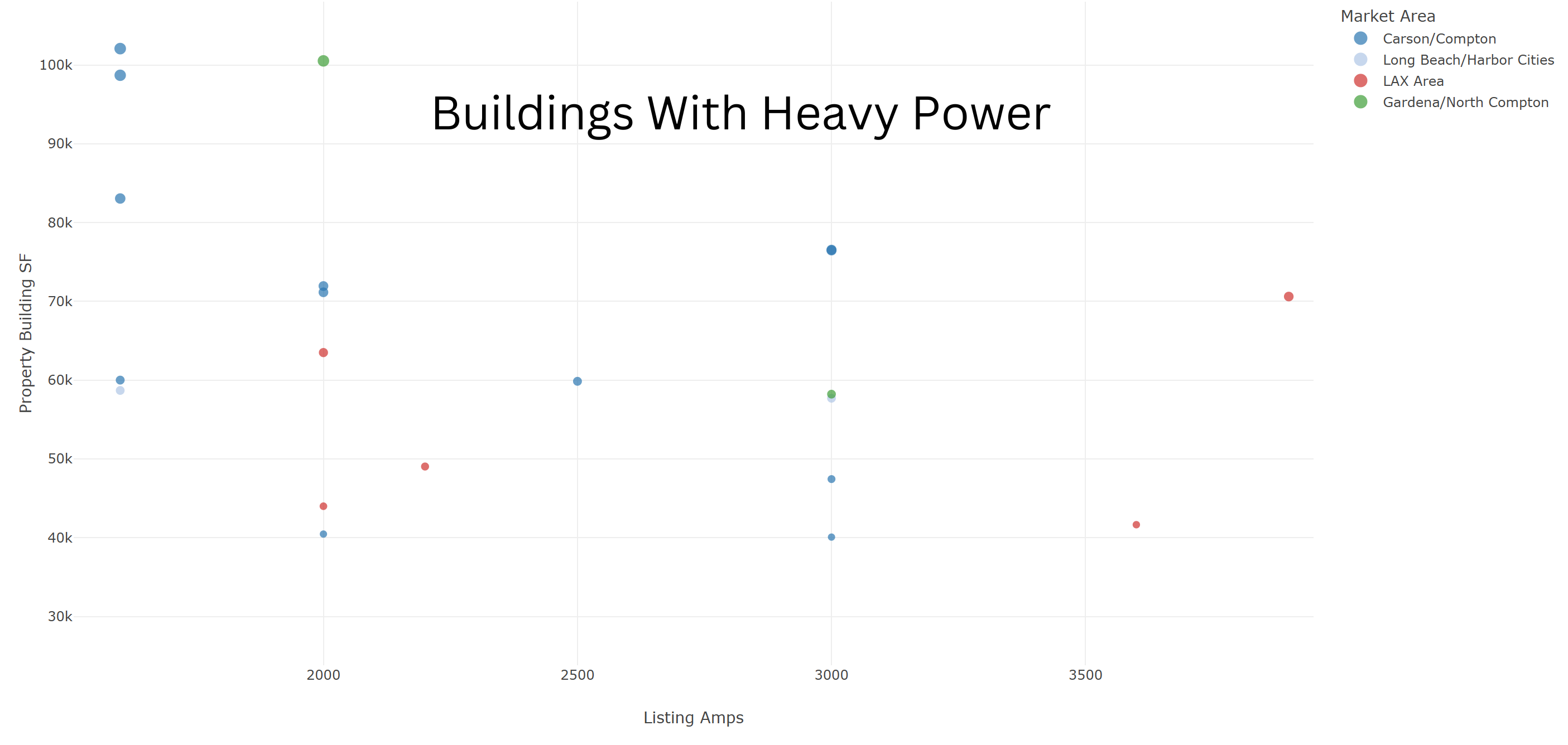

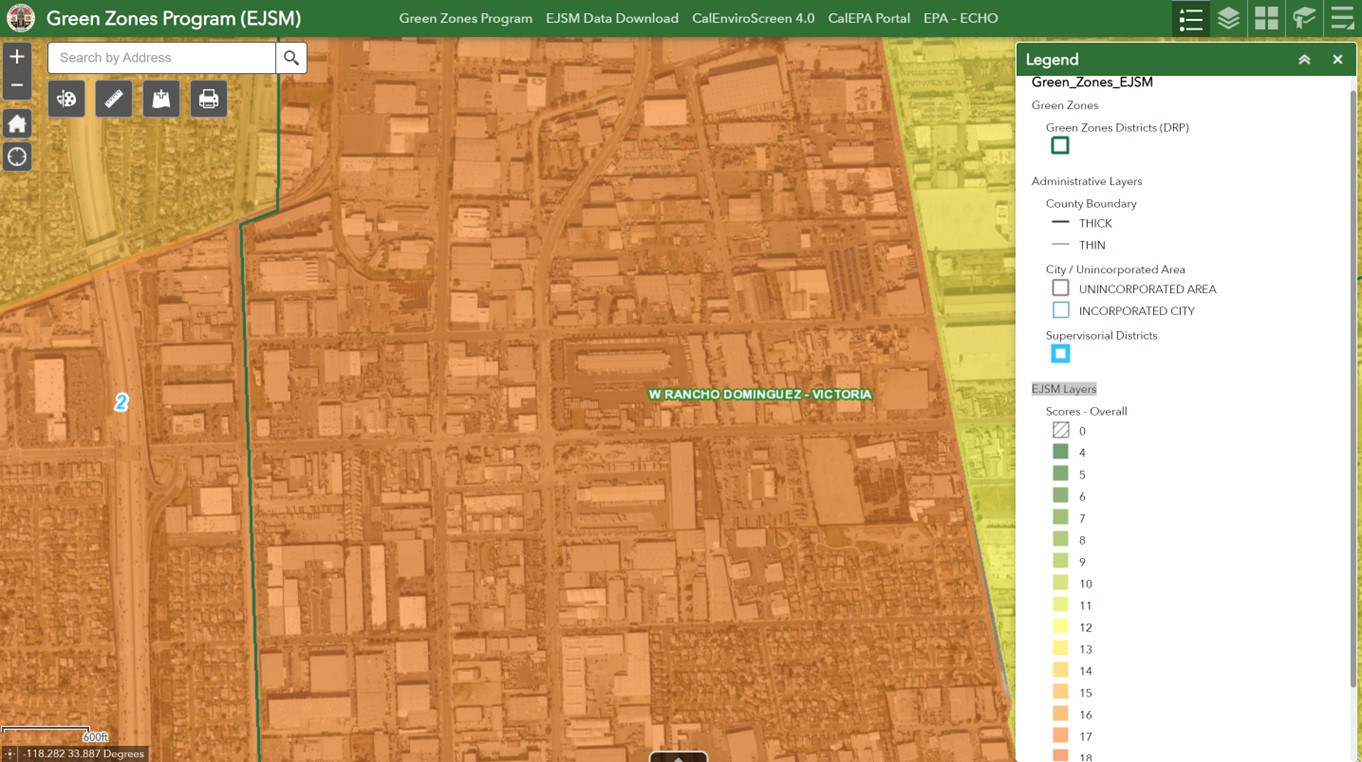

4. Infrastructure Dependent: The largest expenditure of industrial development is data centers. Hyperscalers are dependent on huge amounts of power and connectivity on relatively large parcels of heavy industrial land, almost anywhere. Edge data centers are smaller and located in urban centers to serve autonomous vehicles, consumer, shopping, delivery and nearby industrial and commercial facilities.

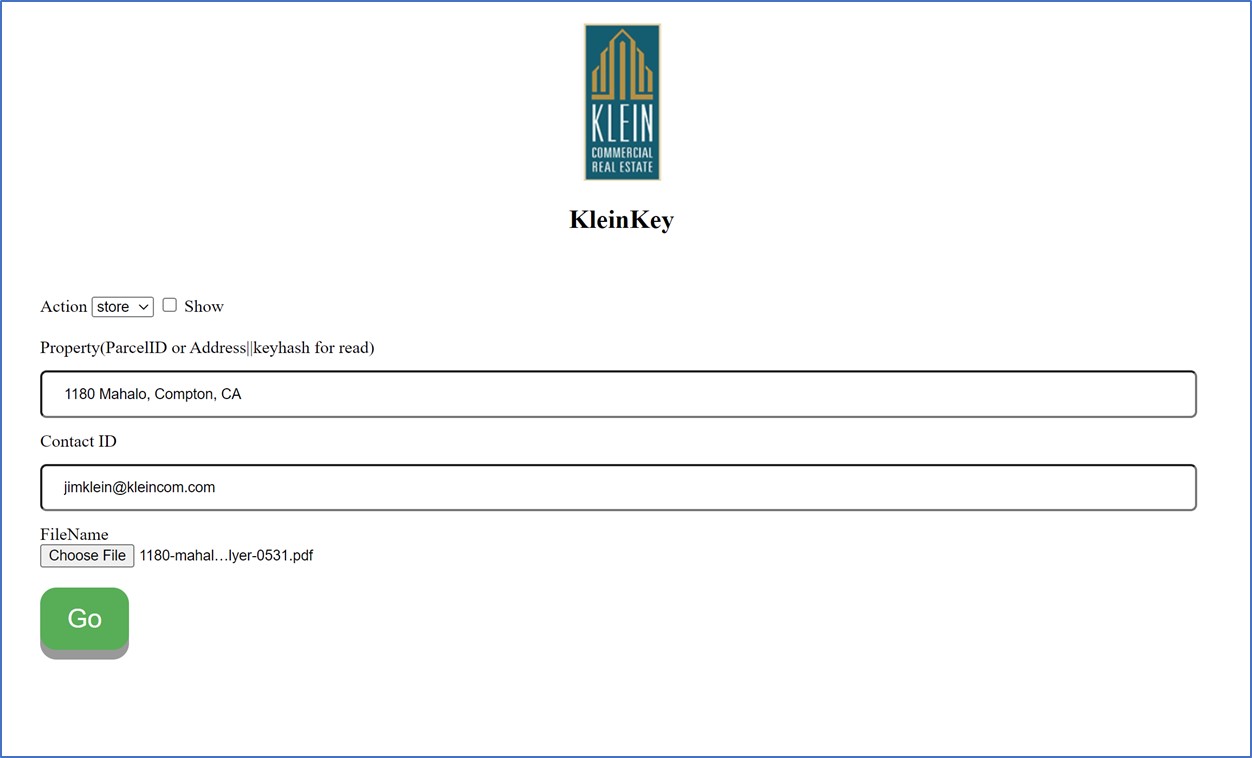

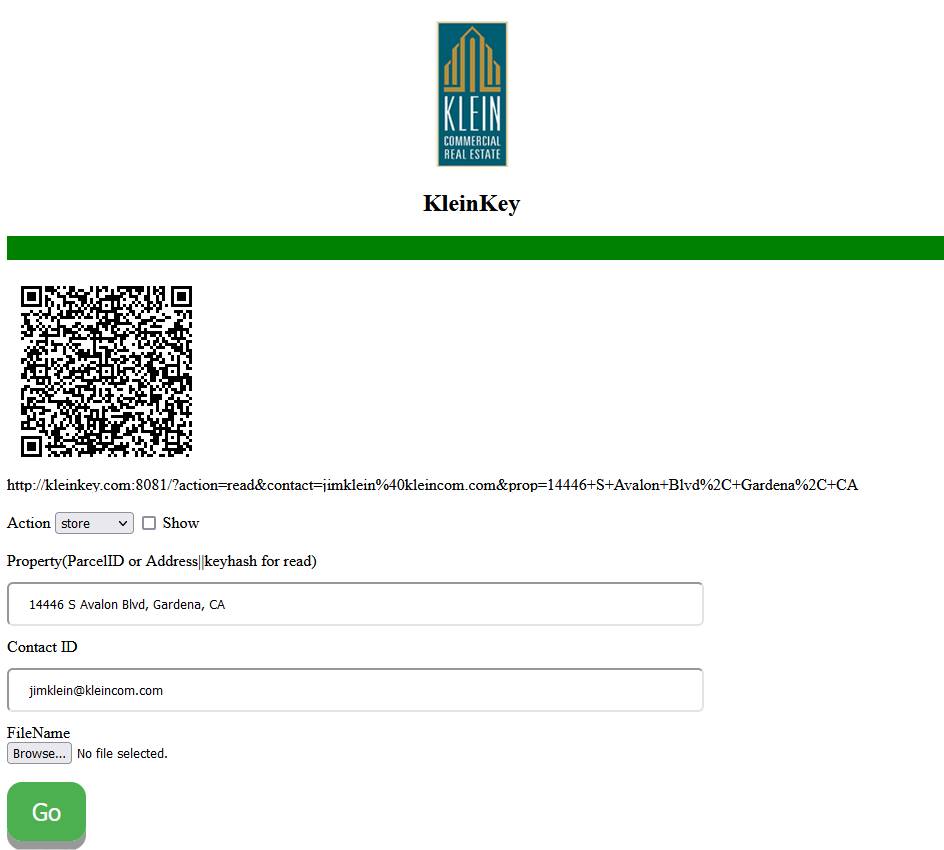

To support our clients, we developed these strategies over 45 years. We have custom analytics, self-developed maps and personal relationships across North America and Europe. Our diagnostics pinpoint the buildings that are right for you. Please contact us with your questions and comments.

Thank you for Subscribing.