Why Is Industrial the Hot Investment

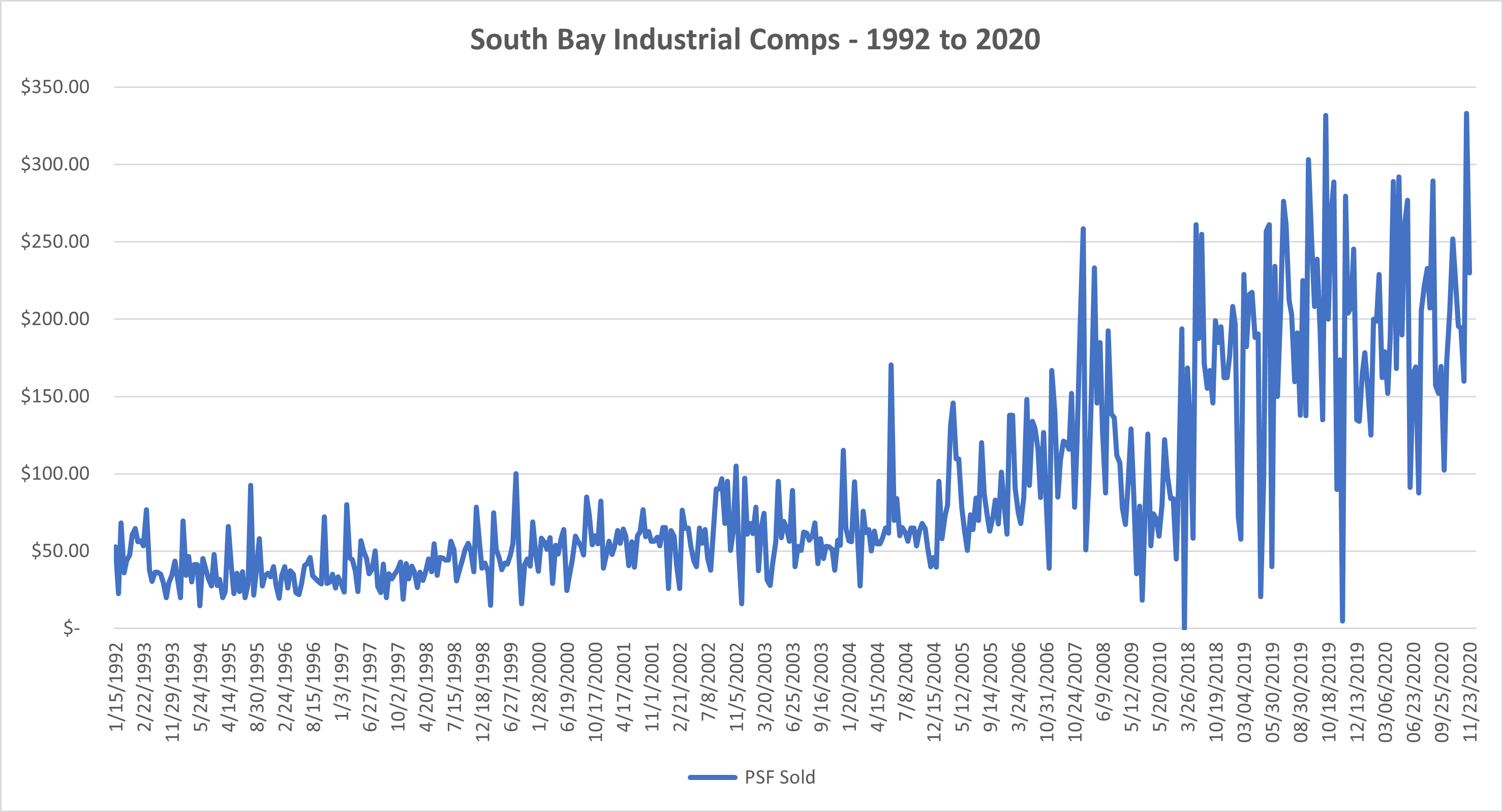

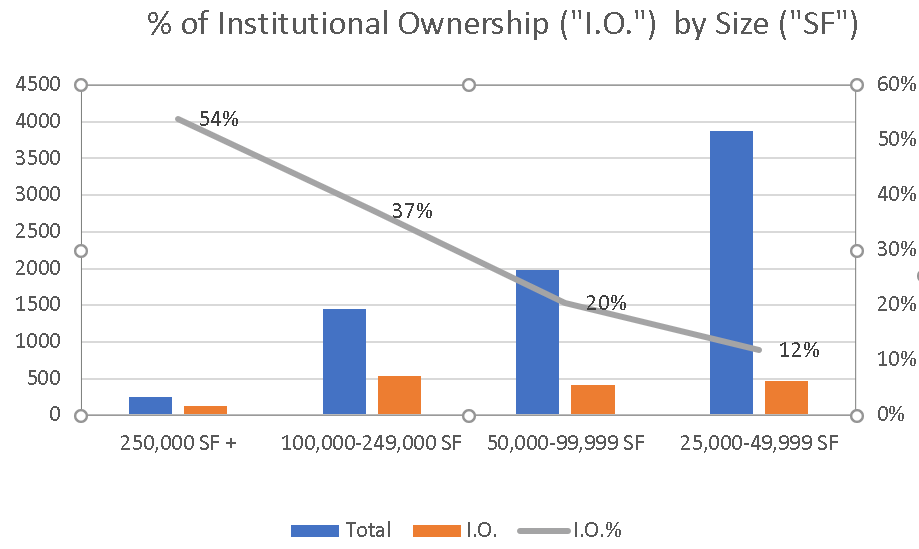

As 2020 comes to an end, Industrial Buildings continue to be good investments. With annual appreciation at 6% and current cap rates at 5%, Buyers are getting 11% annual returns and greater on an “all-cash” basis. These calculations reflect market conditions and not based on finding a “good deal”. With interest rates at 3% or lower, there is strong leverage boosting cash-on-cash returns to 10% with conservative financing. Levered returns increase to 15% (cash flow + appreciation). If you can find property for sale, not always that simple, conditions are very supportive.

Continue reading “Why Is Industrial the Hot Investment”