Jim Klein, SIOR, Interview on Last Mile

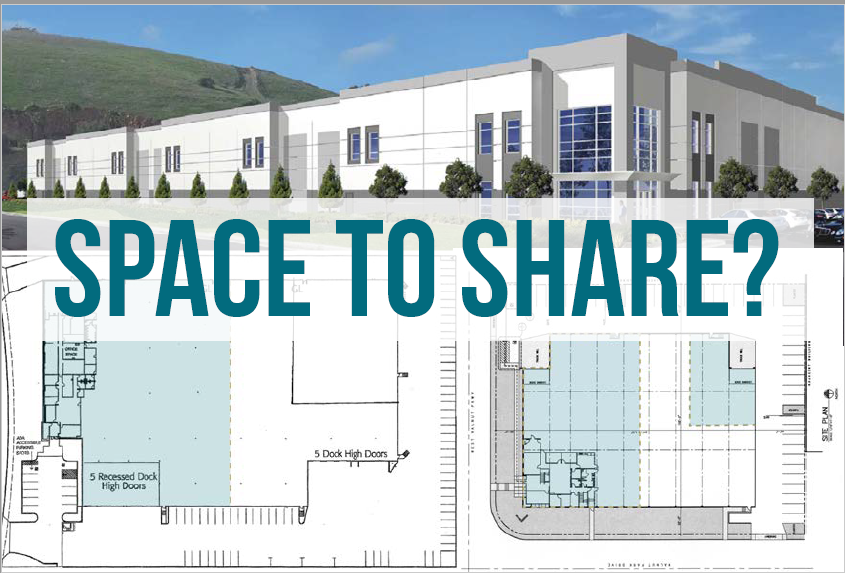

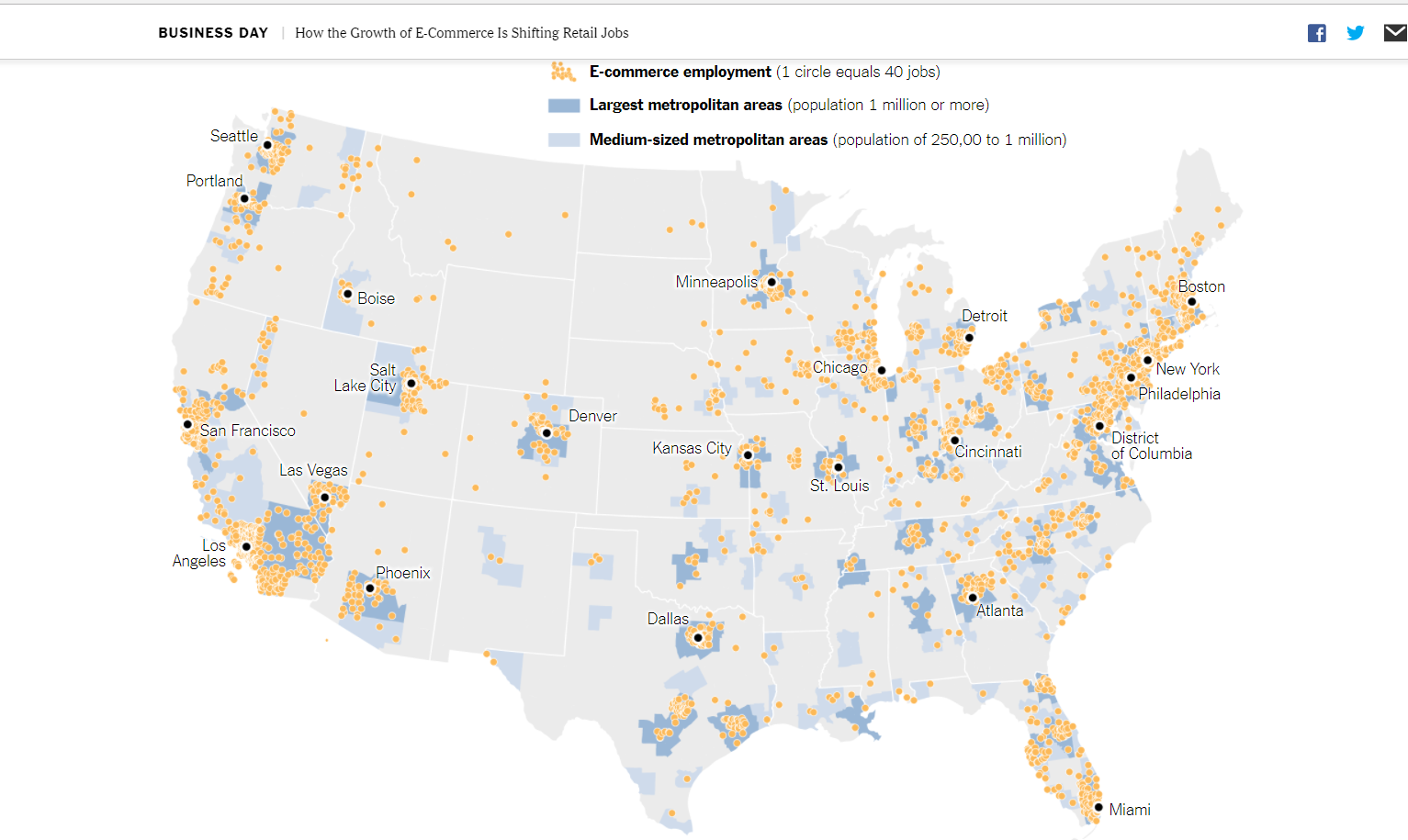

“Some e-commerce players use their warehouses much like they use computer servers,” Klein said. “They figure out what the best space is, what the most valuable space is, and they time it so it is more seasonal. And that’s the revolution that is coming. You can monetize your warehouses and get more rents by sharing it with different tenants than you can just by getting one tenant.”

Entire Article at Bisnow

and attached The Rise Of Urban Last-Mile Logistics Brings Warehouse Renovations And Higher Rents – Industrial