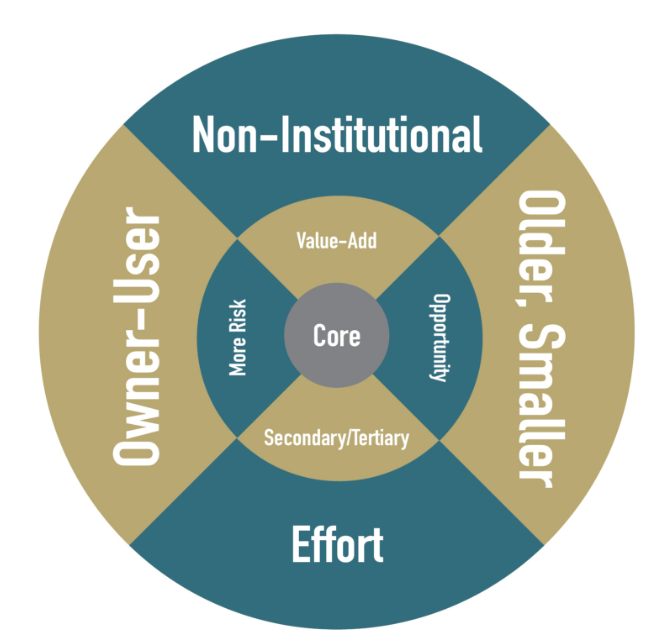

Industrial Buildings: From Private Hands to Institutional Buyers

One of the longest running trends in industrial real estate is the shift of ownership from private hands to institutions. Traditionally, insurance companies, pension funds, and real estate investment trusts (REITs) would purchase new developments and industrial parks after they had been leased and stabilized. It served as both a guaranteed exit for entrepreneurial developers as well as the way investors would acquire property to match long term obligations.

Continue reading “Industrial Buildings: From Private Hands to Institutional Buyers”