Positive Changes We Are Seeing

We are seeing changes beginning to happen in the thinking and strategies of our clients

Continue reading “Positive Changes We Are Seeing”

We are seeing changes beginning to happen in the thinking and strategies of our clients

Continue reading “Positive Changes We Are Seeing”

The Macro View

Similar to 2011, this year starts with a favorable outlook. GDP is up, unemployment rates are down and the last quarter of 2011 saw improvement in leasing activity. Development has also returned in some selected areas under a new guise. Industrial developers are preparing sites and building pads with the goal of constructing the building once they secure a tenant. This modified build-to-suit will shave a year off the normal development cycle.

Something new has been added to the industrial areas of Los Angeles. Campers and trailer homes are dotting the industrial streets and unfortunately they are becoming an eyesore and a nuisance. But more importantly they are driving tenants away from properties where the campers are parking. I have experienced this first hand.

|

Date |

1 Mo |

3 Mo |

6 Mo |

1 Yr |

2 Yr |

3 Yr |

5 Yr |

7 Yr |

10 Yr |

20 Yr |

30 Yr |

|

09/01/11 |

0.02 |

0.02 |

0.05 |

0.10 |

0.19 |

0.31 |

0.90 |

1.49 |

2.15 |

3.10 |

3.51 |

|

09/02/11 |

0.02 |

0.02 |

0.05 |

0.10 |

0.20 |

0.33 |

0.88 |

1.41 |

2.02 |

2.92 |

3.32 |

|

09/06/11 |

0.02 |

0.02 |

0.07 |

0.13 |

0.21 |

0.33 |

0.88 |

1.40 |

1.98 |

2.86 |

3.26 |

|

09/07/11 |

0.00 |

0.02 |

0.06 |

0.11 |

0.21 |

0.34 |

0.92 |

1.45 |

2.05 |

2.96 |

3.36 |

|

09/08/11 |

0.01 |

0.02 |

0.07 |

0.12 |

0.19 |

0.33 |

0.88 |

1.41 |

2.00 |

2.92 |

3.32 |

|

09/09/11 |

0.00 |

0.01 |

0.05 |

0.11 |

0.17 |

0.31 |

0.81 |

1.34 |

1.93 |

2.86 |

3.26 |

|

09/12/11 |

0.01 |

0.01 |

0.05 |

0.11 |

0.21 |

0.35 |

0.87 |

1.38 |

1.94 |

2.84 |

3.24 |

|

09/13/11 |

0.00 |

0.01 |

0.05 |

0.10 |

0.21 |

0.35 |

0.89 |

1.42 |

2.00 |

2.92 |

3.32 |

(Daily Treasury Yield Curve Rates)

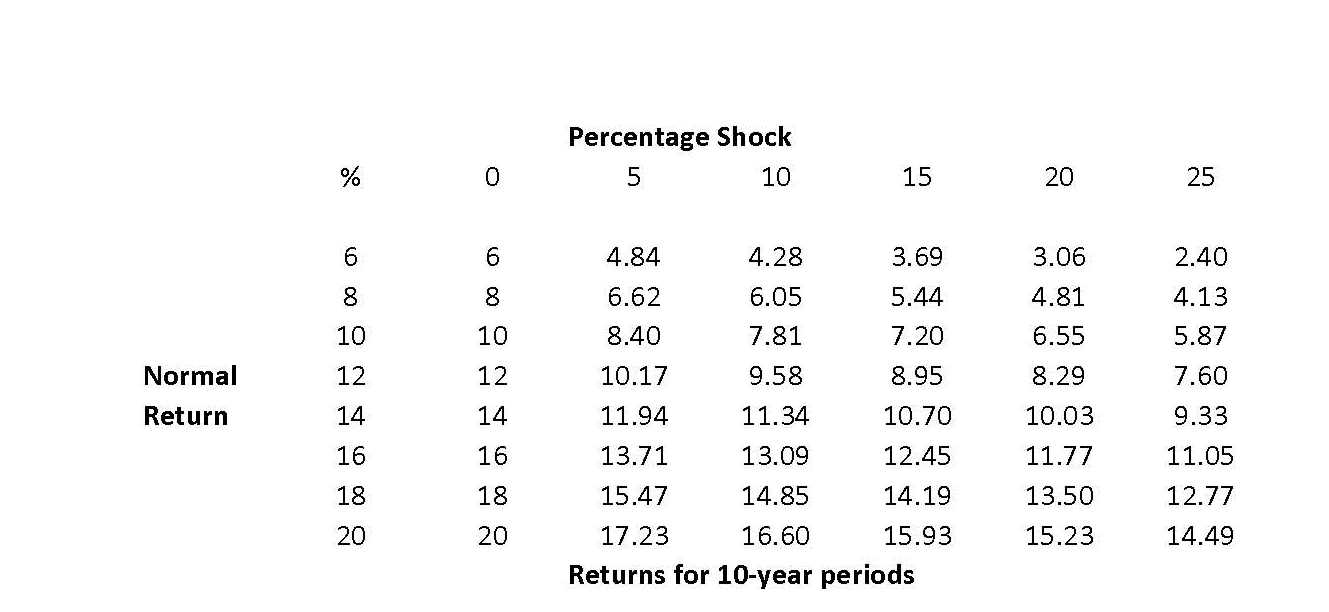

I've reprinted this chart from The Next Convergence by Michael Spence, a Nobel Prize Laureate. While the topic of the book deals mostly with the globalization of economic growth, he spends some time looking at financial shocks and how that partly influences global divergence. One small section of the book looks at periodic systemic risk and how that damages investment returns.

Aerotropolis – The Way We’ll Live Next

By John D. Kasarda and Greg Lindsay

Farar, Straus and Giroux 2011

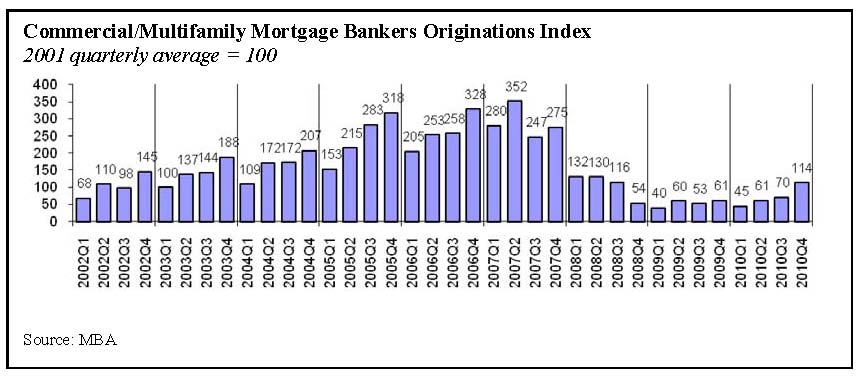

The first signs of a market collapse in commercial real estate began in August of 2007. Home builders started to forfeit large deposits on land deals. The rest of that year, other developers pulled out of deals until it was impossible to sell land to private developers. Many people missed that signal because User building sales were still climbing and continued until the Lehman collapse one year later.

Continue reading “SURVIVING THE MARKET BREAKDOWN – 4 YEARS LATER”

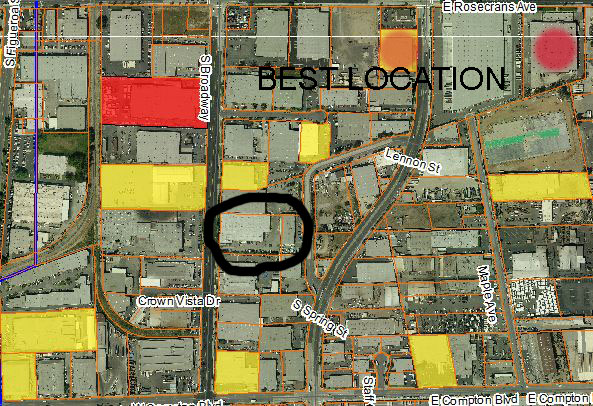

The search is on for industrial. Developers with tenants in tow are looking for industrial land. Big sites are needed for a wide range of reasons. Some users want very customized buildings. Others can’t find modern, first class buildings so they are enlisting developers to build one – if the land can be found. And many of the off-market sites are being picked over carefully. Finally, land prices have come down to a point where new construction makes economic sense.

You may have seen this article earlier in the week about Rick Perry inviting businesses in Vernon to consider relocating to Texas. It’s not the type of press California needs as it struggles to recover. Once this news item goes viral it won’t take long for other states to get the same idea to woo California business. Plus when states start looking at the economic benefits of moving companies from Vernon, the same math will apply to every city in California. Perhaps the most unsettling part of the article is that the conditions leading up to the proposed company pilfering were caused by California’s own government leaders. Firstly, greedy Vernon leaders created the attention, but the Speaker of the California Assembly, by proposing to change the governance of a very successful business community, is creating the groundswell to consider alternatives.

Continue reading “Texas Governor Woos Vernon Businesses”

Firstly, the mood was more upbeat and optimistic. Most people agree that the past few years were terrible but since the end of last year activity has increased. Nationwide, there is agreement that we have a bifurcated market with quality, institutional grade and trophy properties hitting 5% cap rates. Prices for these properties have returned to previous highs. Meanwhile, everyday buildings that most of us broker are still in the doldrums. In order to capitalize on this divergence investors are focusing on the $1MM to $5MM market where high returns exist.

Continue reading “COMING OUT ON TOP – SIOR SPRING CONFERENCE”