Real Estate Deals in the GIS and Data Universe

Good technology can improve real estate deal making. This article describes my experience with Geographical Information Systems (GIS) and how it has become a fundamental tool for my business. At its simplest, GIS programs are a visual adjunct to database and contact management programs. However, if used to its fullest, GIS can crystalize multiple property relationships to monetize real estate information by traditional forms of deal making, solve complicated problems and create new business models.

Continue reading “Real Estate Deals in the GIS and Data Universe”

2012 RECAP

.jpg)

2012 was a very steady year and the best since 2007. I sold land in New York and North Carolina; A $3MM warehouse sale in Savannah, Georgia and a $9MM apartment community in Central Los Angeles. My Gardena/South Bay Industrial core was very solid with over 175,000 SF of building sales and leases. Several things are coming togeth er at the same time. My 30-year presence in Industrial Los Angeles has given me trusting relationships and extensive market knowledge. The investment in a sophisticated GIS database (MAPP) helps to locate property with exacting criteria. The New York State Real Estate License gives me another large market to tap. Strong national and international ties through SIOR substantially widen my geographical scope. As the economy continues to rebound, we will experience a Golden Age of Real Estate.

Buffet on Pension Funds

One of his (Warren Buffet) big worries these days is about what’s going to happen to all the pension money that is being invested in the markets, often with little success, in part because investors are constantly buying and selling securities on the advice of brokers and advisers, rather than holding them for the long term. “Most institutional investors, whoever is in charge — whether it’s the college treasurer or the trustees of the pension fund of some state — they’re buying what they’re sold.”

For More: http://dealbook.nytimes.com/2012/12/03/for-buffett-the-long-run-still-trumps-the-quick-return/?ref=todayspaper

Deal Book – Anfrew Ross Dorkin

The Golden Age

The next chapter in the real estate recovery is well on its way. Many segments are showing good signs of stability. Housing is improving. Class A industrial is inundated by fierce bidding. User demand is robust for buildings to purchase. Developers are active with many spec developments coming online. My non-real estate friends even know about multi-family housing. We are ready for a long period of smart buying for the long term. I call this period The Golden Age because it will consist of reasonable prices, excellent prospects for growth and minimal downside risks. All through the Great Recession, purchases have been made. But as low as these prices were, they were risky deals because the outcome was still uncertain. Now that the worst is behind us, we are at the start of a new cycle. This also means that Property Owners who did not want to sell at the bottom will fulfill their long delayed plans to part with good real estate. In other words, we are entering a stable period with less risk and the ability to create lifelong investments in real estate.

When Do Investors Rediscover “B” Industrial?

SIOR held their Fall Conference in Los Angeles recently. One panel made a lasting impression. They pointed out the spreads and prices between A and B warehouses are the widest it’s ever been. While no one spelled out the specific reason, a combination of low interest rates, Quantitative Easing, flight to quality, and the Port/Gateway story has revived the investment market for A Industrial. Cap rates of 5% are the current norm for A property in the best industrial markets. Lower grade (non-institutional) sell at 200 to 300 basis points higher. Returns climb in secondary markets. Why aren’t more investors buying up the sub-institutional real estate where returns are greater? It will happen soon and this will be a turning point for dormant industrial markets around the country.

Continue reading “When Do Investors Rediscover “B” Industrial?”

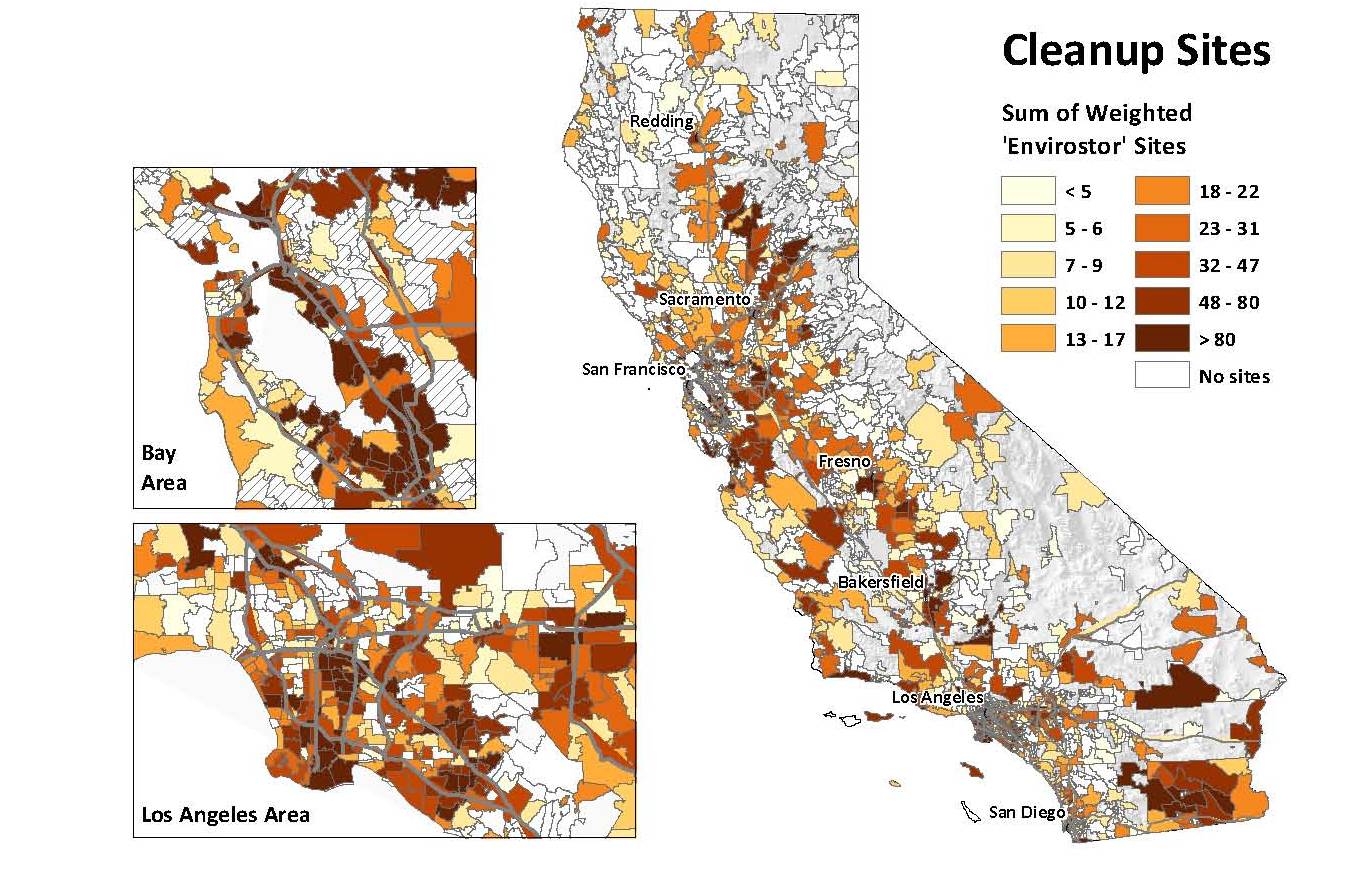

Environmental Justice and the CalEnviroScreen

Soon there will be a new and very comprehensive tool to assess communities, developments and industrial projects in the State of California. The name of this tool is the CalEnviroScreen (CES) and it is a compendium of socioeconomic, health, and environmental resources that is publicly available for the first time in one location. One controversial use of the CES is to judge a project’s potential harm or assistance it will provide to an already stressed community. While the CES provides critical information, if not used properly, it can easily impede new development to communities in need.

Continue reading “Environmental Justice and the CalEnviroScreen”

Cash vs. Tax World

What’s New – Spring 2012

The Macro View

Similar to 2011, this year starts with a favorable outlook. GDP is up, unemployment rates are down and the first quarter of 2012 saw improvement in leasing activity. Development has also returned in some selected areas. Industrial developers are preparing sites and building pads with the goal of constructing the building once they secure a tenant. Some have moved from the modified build-to-suit to actually going spec. The focus is on large buildings where developers can get the per foot cost of construction down. Ecommerce and consumer logistics are a big driver for new buildings.

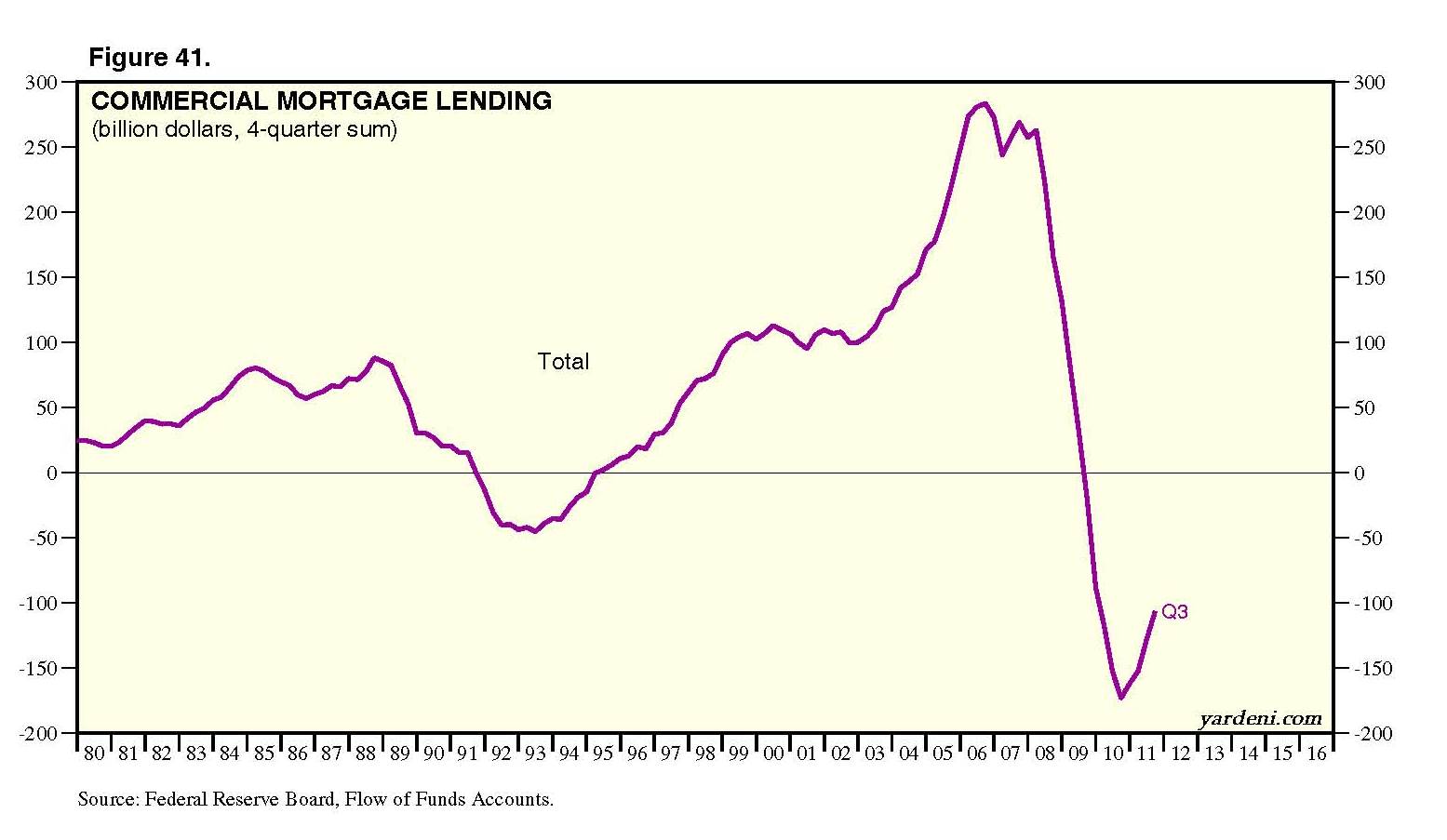

Commercial Mortgages Are On The Way Up

Many have already seen charts like this one showing a big drop at the end of 2007. It explains the past four years of weak sales. The small uptick demonstrates the recent increase of deals. Since this is 2011 Q3 data, (but released earlier this month), I expect to see more improvements. The same indicators are alive in the market. A long way from peak conditions but in the right direction.

.png)

.jpg)