Analytic tools are essential ways to address space shortages for Occupiers or Investors. The reasons are complicated but the traditional market no longer supplies enough quality space. Online listing services do not yield satisfying choices. More aggressive tools, that emulates your precise business strategy or market expertise are needed to find deals in the era of Space Scarcity. The surest way to make deals is to create them and data is an integral part. Understanding the market comes first before developing the tools to exploit it. For instance, this is the case that better data will help you purchase Big Industrial deals…

The development side of Big Industrial is generally made up of two groups. One is the Big Entities which as a combined group owns roughly 50% of the better industrial space in major markets. They have their own capital, a stable of Occupiers, and control land and buildings. They are generally public companies and receive institutional finance who need internal returns to pay to shareholders or claimants. Performance is benchmarked to market indices. At the Big Entities, real estate is normally held to generate income for stable returns and property is only for on limited occasions. Yield is the end game.

The second group are the entrepreneurial developers who can come from different backgrounds. They include Big Entity veterans, land owners themselves, and opportunists with a taste for risk. They each have an expertise in market specialization, build-to-suit, capital relationships, or a low land basis. Because of the diverse backgrounds, there are different profit motives. The entrepreneurs hold or sell depending on their best choice at the moment. By skewing Big Industrial data, we can focus on merchant builders who are seeking profit.

The Occupier market is similarly constructed. The majority of occupiers want leased space and have no interest in ownership equity. They are not rewarded for owning property and in many cases punished by stockholders even if the numbers make sense. At the same time, there is a much smaller sub-group of Occupiers who use real estate to increase net worth. These are mostly tightly held companies or family run businesses who leverage their occupancy into favorable real estate returns. Data analytics can optimize the relationships between merchant builders and occupiers who can anchor the deal. To improve overall performance, additional analytics can be run on the entire team involved in the real estate deal. Often this will include the land seller, developer, broker, investor(s). lender, occupier(s) and buyer.

This amount of data, especially on a national basis, can only be done by coding. Investors are A, Occupiers are B, Developers are C. Sellers are D. Brokers are E. There are also codes for geography, size, industry and preference. More data generally will deliver better results but only to a certain performance hurdle. It’s really no different than what a smart dealmaker does in his head but data science is able to increase the scale without diminishing the contribution of relationships, experience and street smarts.

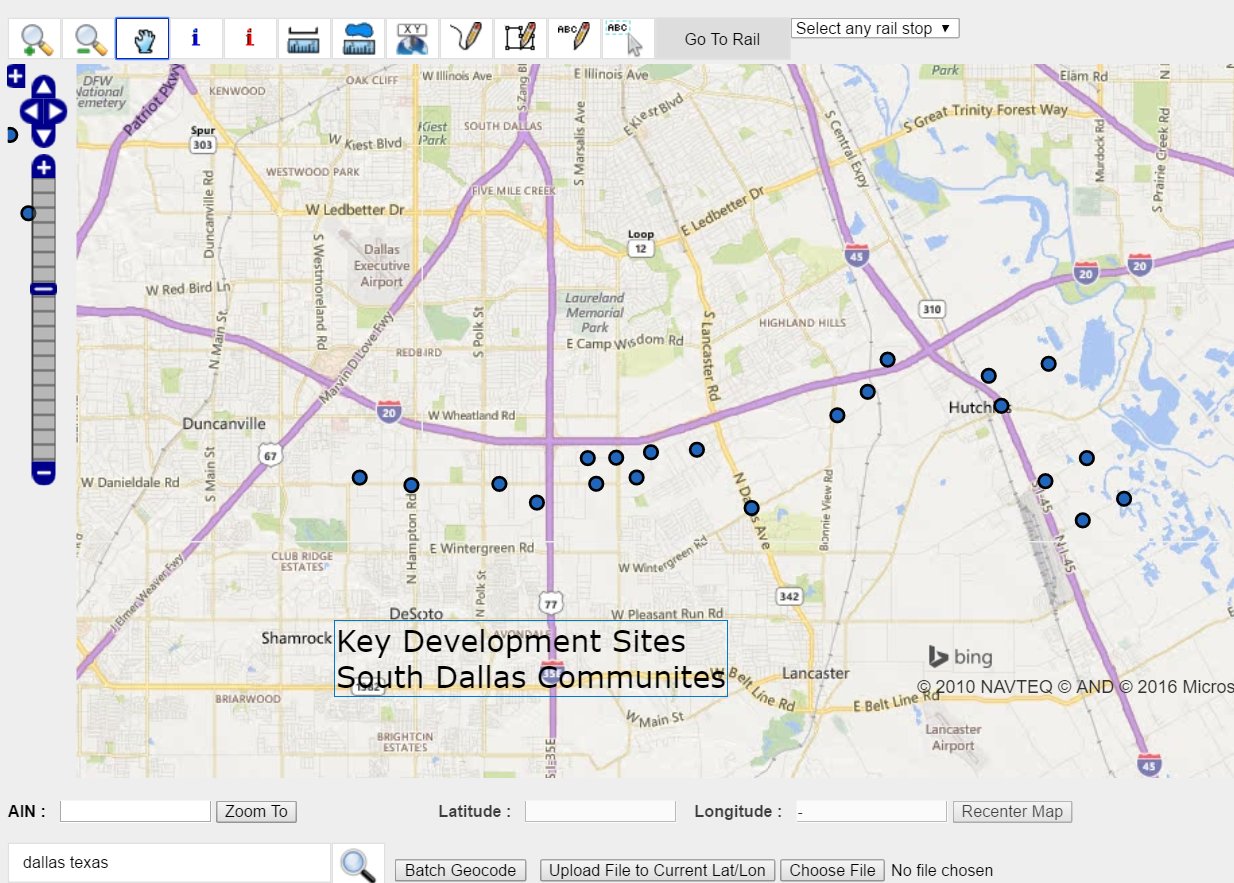

By the end of the year, we will be making our MAPP program public. It’s a program we developed that combines data and spatial information. It was designed in particular as an acquisition tool to help buy property. I use MAPP for infill land sites, Gardena, and Big Industrial Nationwide. I can see all US ownership, who leases, and how much space they occupy. By running relationship queries MAPP can make predictive analysis about who would be right for a given site. There will be some interesting platform economics to get buy-in from participants but I’ll explain how I hope that will work on another day. For now, if you are looking for industrial real estate deals, I have the data.

The most analytical post with a lot of useful data about real estate.

I think using your realtor as a reference point for a financial adviser sounds like a great idea. If your realtor is recommending them, that means that they have probably worked together or know each other well. Thanks for sharing!

Hey,

great piece of content.

This is my very first visit on your blog and I would love to say thanks to big daddy Google for redirecting me on your blog. You have amazing writing skills and your writing way is so natural and convincing.