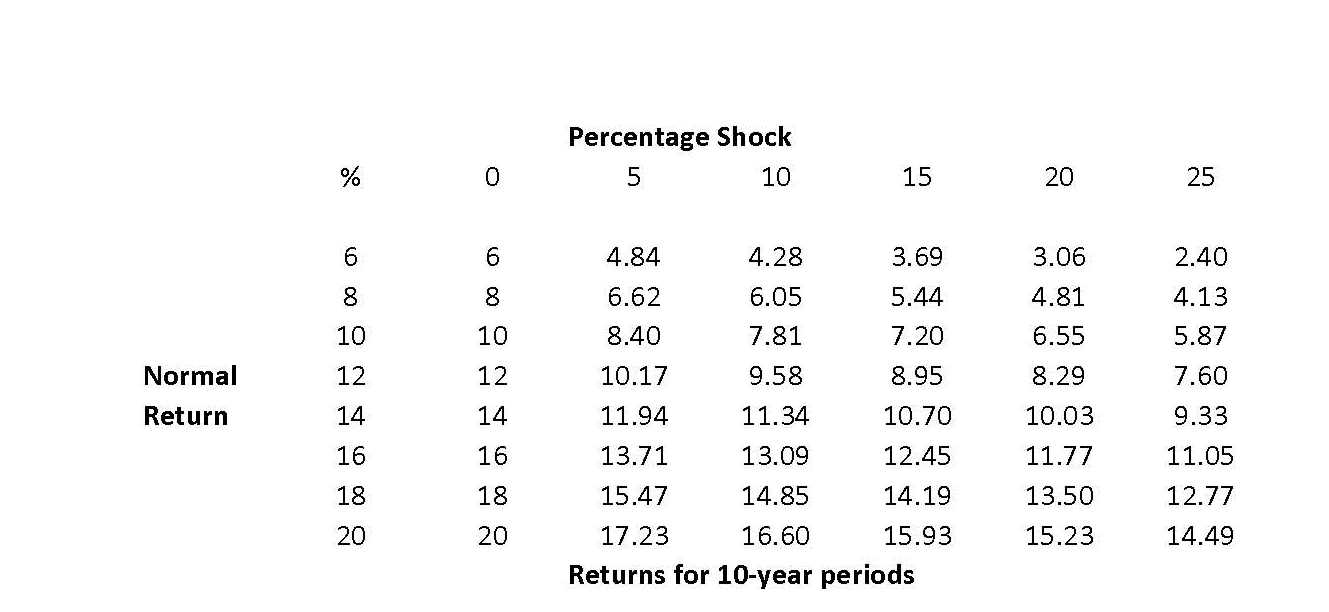

I've reprinted this chart from The Next Convergence by Michael Spence, a Nobel Prize Laureate. While the topic of the book deals mostly with the globalization of economic growth, he spends some time looking at financial shocks and how that partly influences global divergence. One small section of the book looks at periodic systemic risk and how that damages investment returns.

On the one hand it's a simple as saying when the market crashes, investments get killed. If you need to sell at the bottom, you will be wiped out. It's a very common theme today. What struck me most about this chart is that it is presented in a very similar manner of real estate investment returns. Cap rates on the left side and projections over time. But this chart specifically shows the result of a market shock which this author believes will become more frequent. A basic example is if you purchase a property at an 8 cap, the expected yield could be much lower than anticipated after a shock.

Investors, fund managers, endowments, and other buyers of property look carefully at predictable returns when they purchase real estate. Illiquid investment like real estate can be more severely affected than liquid investments. This chart was not printed to scare investors from purchasing real estate but to give them another way to look at their investment. What we recently experienced in the real estate crash will return again.