More Uncertainty in a Soft Market

As an industrial real estate broker in Los Angeles, we make a living by hustle and personal relationships. Despite our effort, when you step back to analyze, it is the macro influences that are the determinant factors. The Great Financial Crisis drove down interest rates and brought in a wave of institutional investors that purchased almost every available property. These property owners received an additional boost during the Covid period that created a surge of imports and warehouse shortages that increased rents. The economic result was inflation and to combat higher prices, the Fed increased interest rates. This action resulted in reduced investor activity because deals no longer made sense. Now we are facing a Tariff Tantrum that is freezing tenant demand. A few months’ pause in activity wouldn’t be bad except many owners are leveraged and need to service their debt. Each macro event has an unintended consequence on pricing and vacancy.

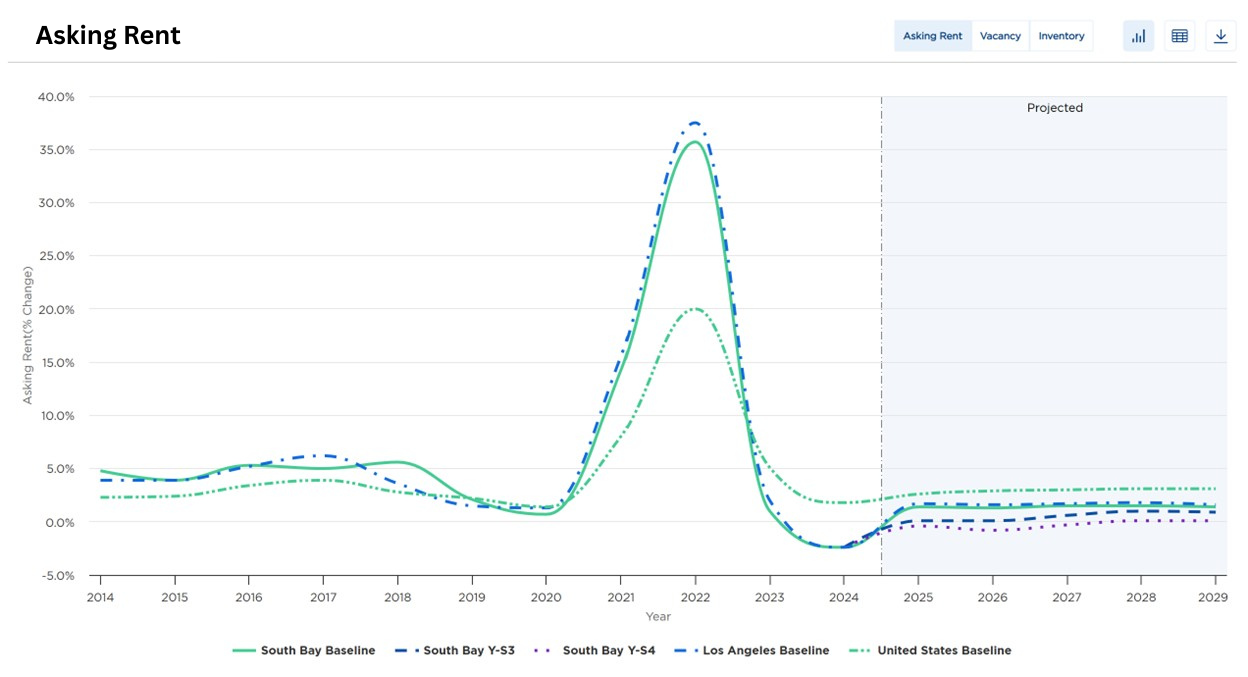

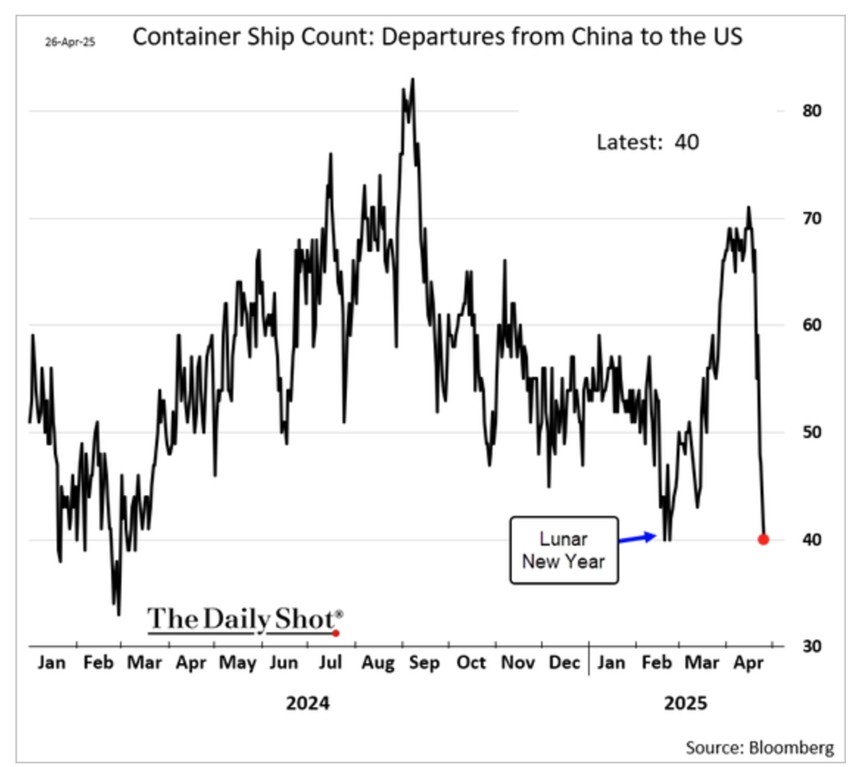

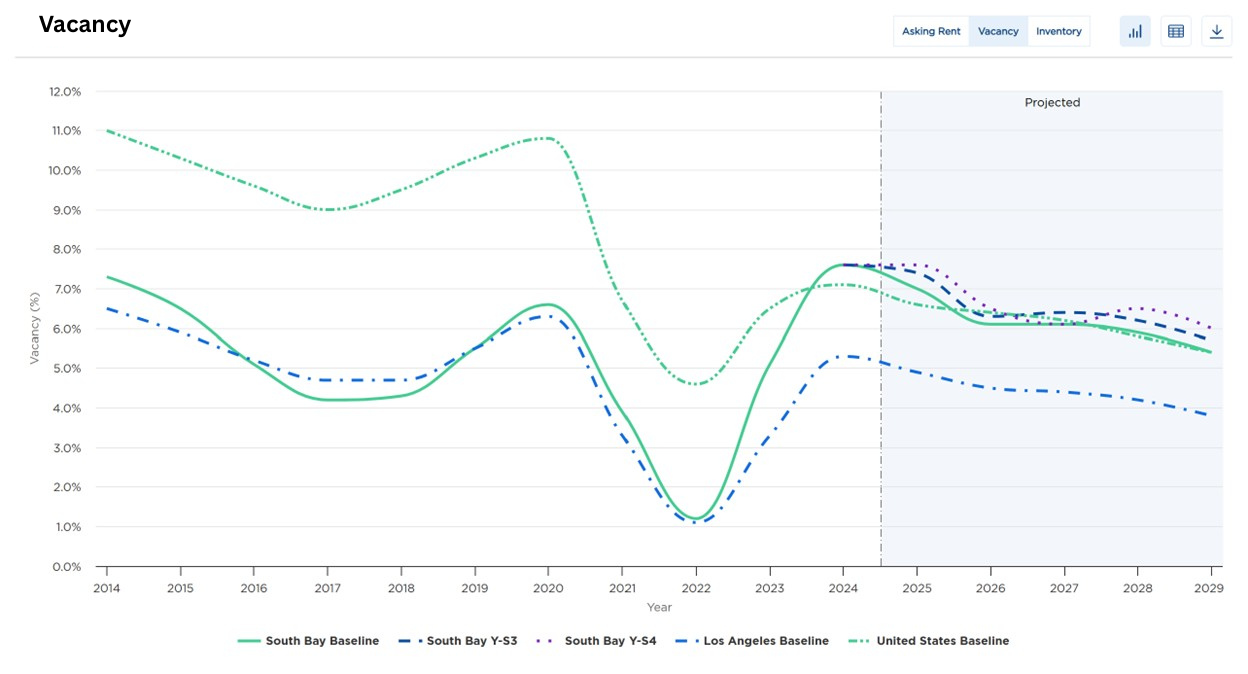

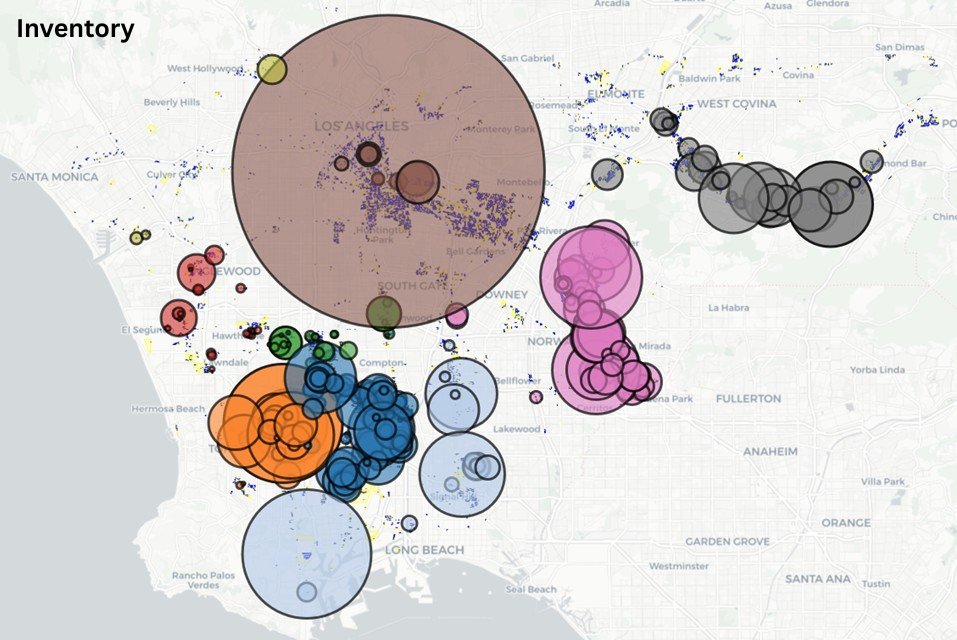

Los Angeles industrial is particularly dependent on goods coming through San Pedro Bay. During Covid, when there were 100 ships waiting to be unloaded, it created a beneficial rent surge for property owners. Today, with a 70% decrease in port traffic, rents are declining. While obvious in buildings, the clearest example is Industrial Outside Storage (IOS), basically truck yards, which has seen a drop of more than 50%. IOS was the darling of large investors and served as a new property class. However, many of those truck yards remain vacant and were underwritten at much higher rents.

Another source of demand, particularly here in the South Bay, comes from aircraft and defense companies. It’s origin in WWII has ebbed and flowed between war and peace. I had one client who made aircraft fasteners and during times of peace, they would store their machinery and lease out the buildings. But during the Korean, Vietnam, and Cold War periods, they would bring out that same machinery and start manufacturing. We are at another similar period with a different breed of defense companies financed by venture capital and not by prime contractors. It’s a growing industry but also hampered by not getting the parts they need from foreign countries. We are also seeing Chinese companies exploring the creation of a manufacturing base in the U.S. with their advanced manufacturing equipment.

You could say it’s the revenge of the private property owner. During the boom period of low interest rates, competition prevented private owners from affordably purchasing property except through investment vehicles with larger funds. Today, private and long-time owners with a low basis can cut their rents and because of Proposition 13, also have low property taxes. For private owners, they merely need to cover their lifestyle while they wait for better times. Large, newly created funds are faced with valuation cuts that can put them out of business.

It’s an unpleasant decision to make, but cutting rents is the way to lease buildings until conditions improve. There are simply too many buildings for lease. Long-time property owners have a clear advantage in today’s market until market conditions change. After all, it’s a cycle.

(The Rent and Vacancy charts are supplied by Moody’s Analytics and are based on their data research and forecast methods. However, they do not account for market sentiment based on current tariff conditions and potential of negotiations. Until trade dynamics become more certain, the current sentiment is unfavorable especially for property owners and tenant’s dependent on import and export activity)