Los Angeles Industrial Real Estate: Opportunities in the New Tariff Era

Introduction

The industrial real estate landscape in Los Angeles stands at a critical inflection point following the implementation of significant tariffs by the Trump administration in early 2025. With Chinese goods now effectively subject to tariffs exceeding 54% and China’s reciprocal 34% tariffs on US imports, the traditional trade flows that have long defined the Los Angeles industrial market are undergoing substantial transformation.

This report examines the emerging opportunities in Los Angeles industrial real estate created by this new tariff environment. While short-term disruptions are inevitable, the combination of reshoring initiatives, supply chain restructuring, and development constraints creates a potentially favorable environment for strategic industrial assets in the region.

Current Market Metrics

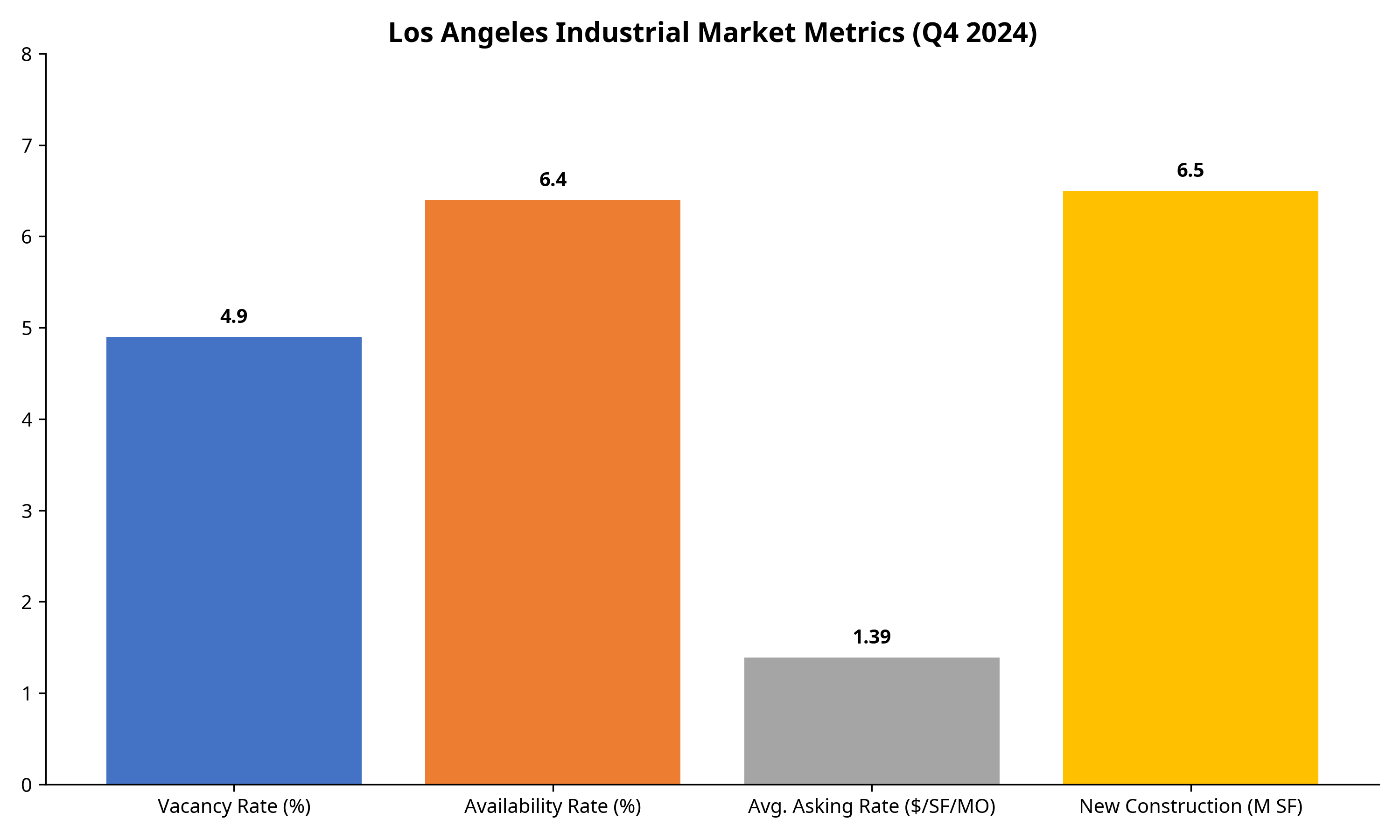

The Los Angeles industrial real estate market entered this period of tariff-induced change with the following key metrics:

Los Angeles Industrial Market Metrics (Q4 2024)

Source: Cushman & Wakefield Los Angeles Industrial Market Report, Q4 2024

Vacancy & Availability

- Vacancy Rate: 4.9% in Los Angeles County (year-end 2024)

- Availability Rate: 6.4% (up from 4.8% one year earlier)

- Total Direct Available Space: 42.1 million SF

- Total Sublease Available Space: 9.2 million SF

Rental Rates & Construction

- Average Asking Rate: $1.39 NNN/PSF/MO

- Rental Trends: Rates have fallen for five straight quarters but remain 54% higher than pre-pandemic levels

- New Construction: 6.5 million square feet added in Los Angeles County in 2024

- Construction Pipeline: Slowing dramatically, with “limited new options in 18-24 months”

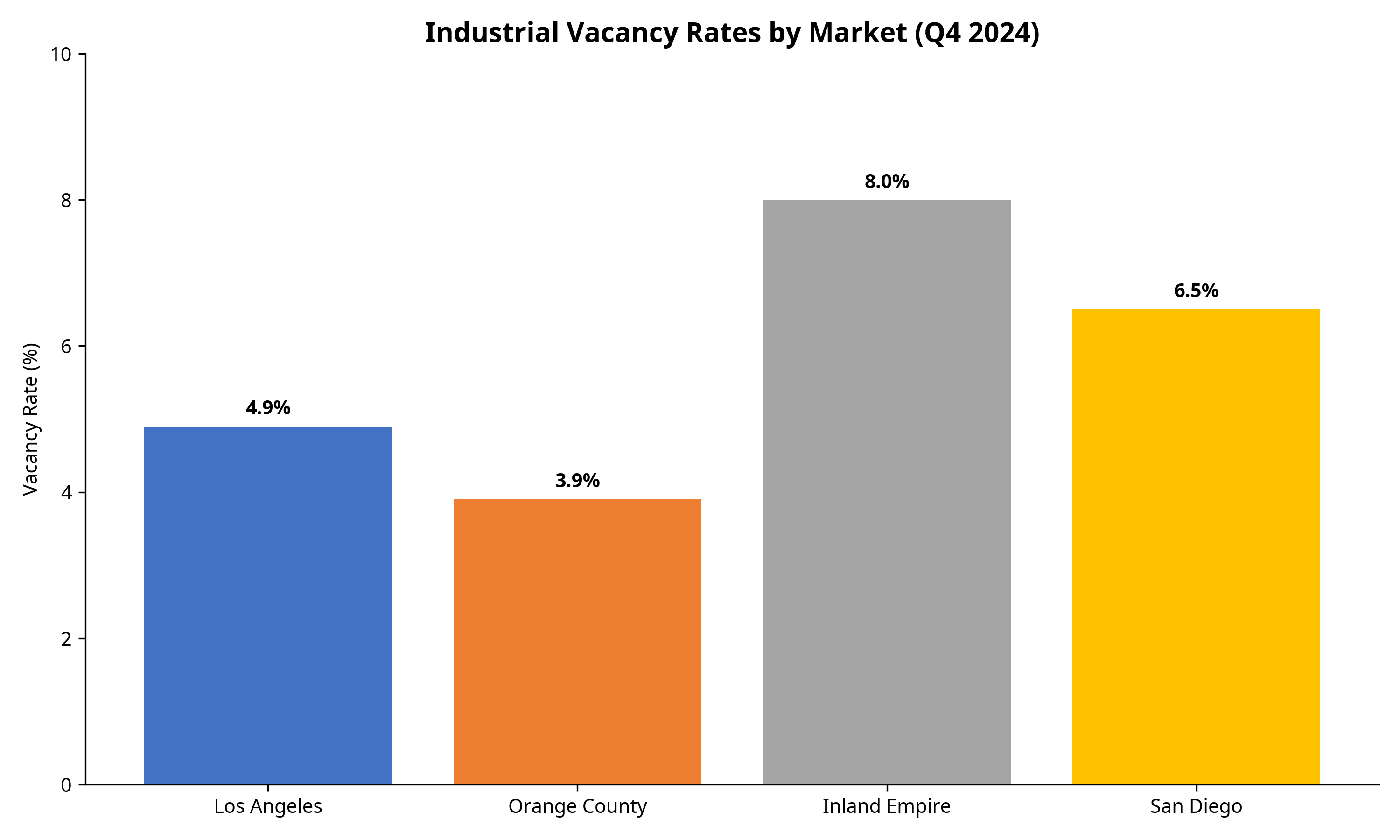

Vacancy Rates Comparison

Source: JLL Industrial Market Outlook, Q1 2025

Tariff Impact Analysis

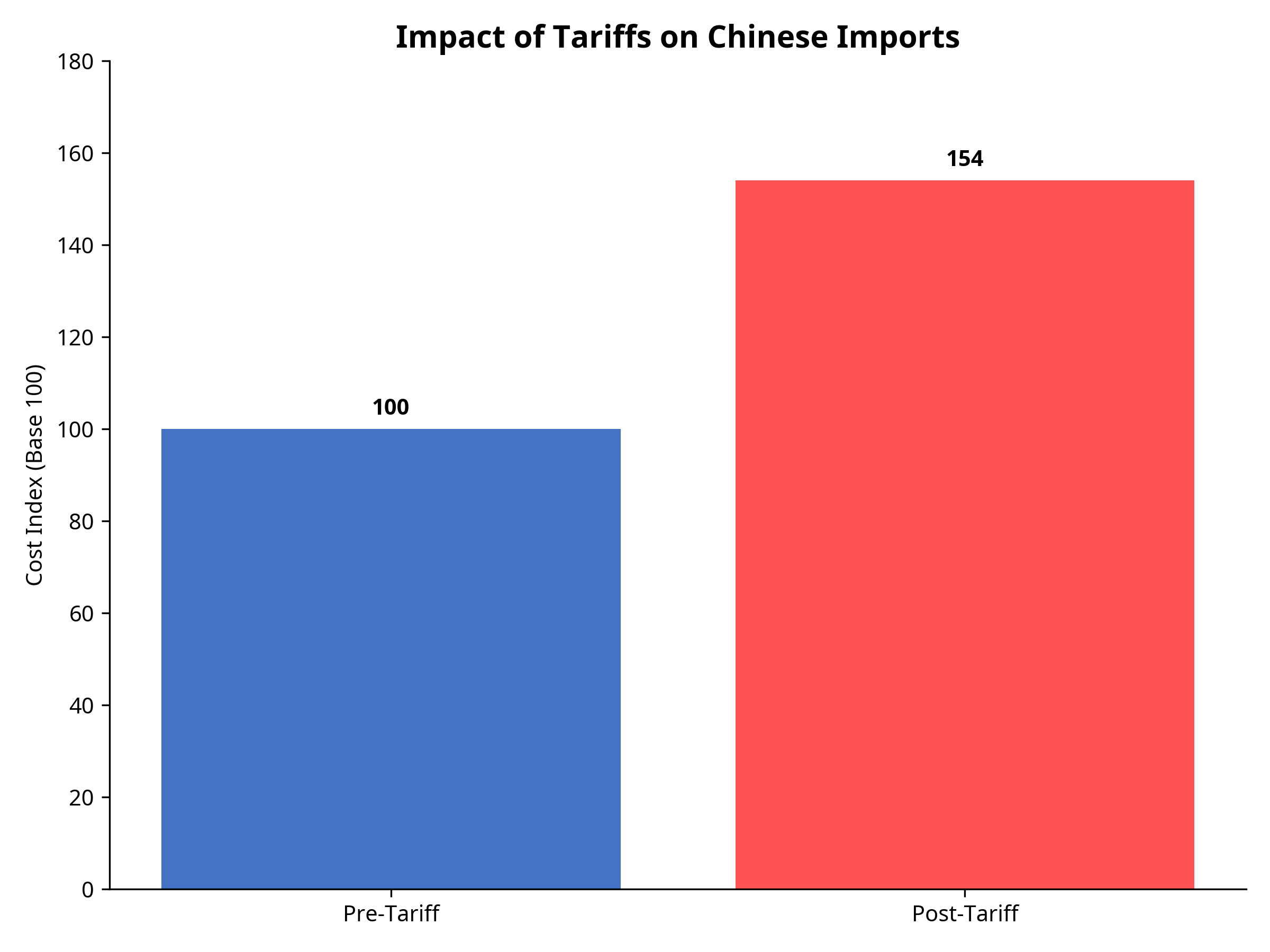

Impact of Tariffs on Chinese Imports

Chart shows the effective cost increase of Chinese imports after tariffs (base 100 = pre-tariff cost)

Recent Tariff Implementations

- An additional 34% tariff on all Chinese goods imported into the US (March 2025)

- Two previous 10% tariff tranches imposed since January 2025

- Combined with pre-existing tariffs, Chinese goods are now effectively subject to tariffs exceeding 54%

- China has responded with reciprocal 34% tariffs on all US imports, effective April 10, 2025

Port of Los Angeles Impact

- Port of Los Angeles Executive Director Gene Seroka predicts a 10% drop in cargo volume in the second half of 2025

- Every four containers moved through the Port of LA creates one job; a 10% reduction in cargo could impact employment across the supply chain

- Higher import volume at local ports in early 2025 suggests companies front-loaded imports ahead of tariff implementation

- Companies are actively reconsidering sourcing strategies, with potential shifts away from China to countries like Vietnam, Indonesia, and Malaysia

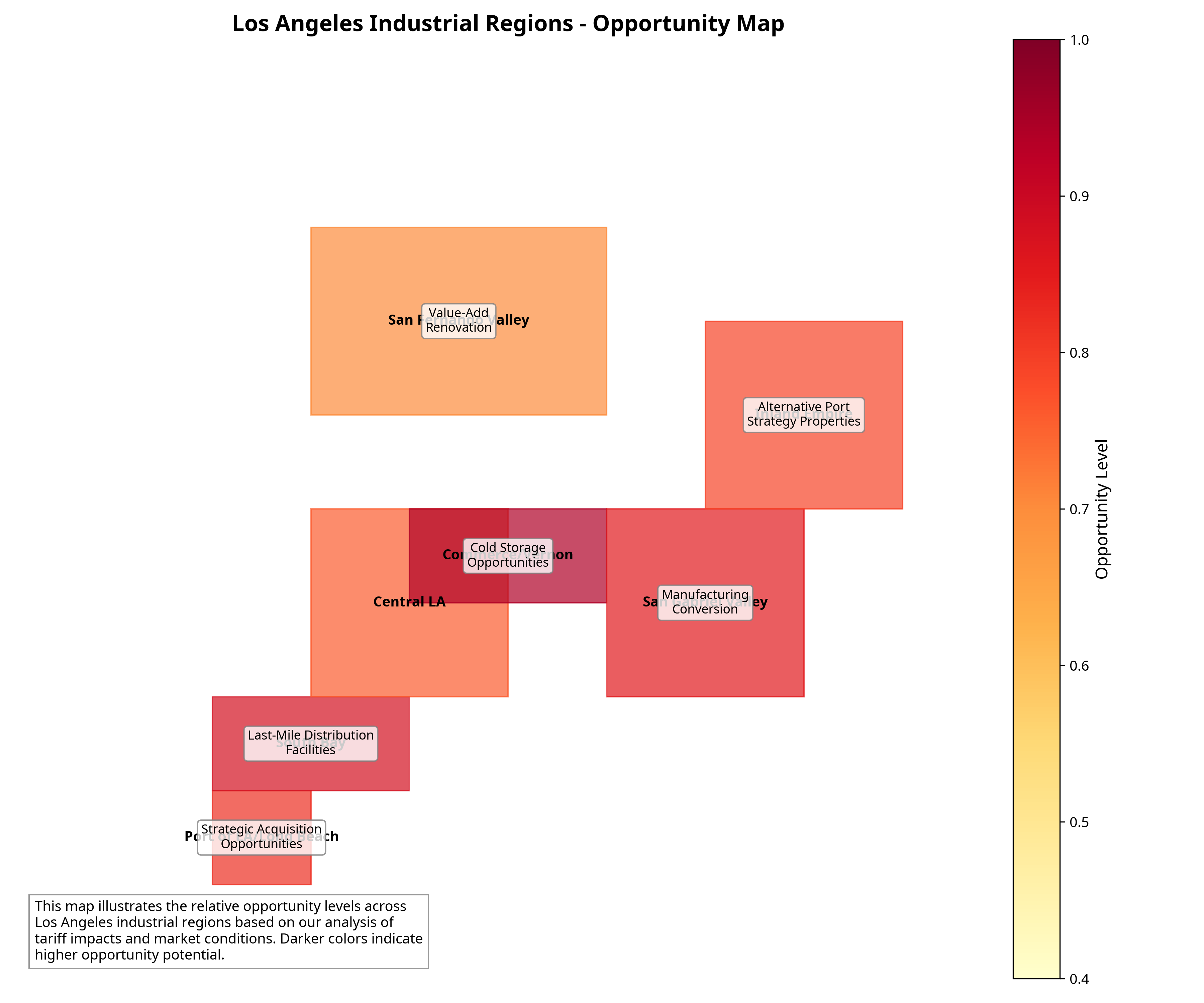

Los Angeles Industrial Regions Map

Industrial Regions Opportunity Map

Map shows relative opportunity levels across Los Angeles industrial regions based on tariff impacts and market conditions

The map above illustrates the key industrial regions of Los Angeles County and adjacent areas, highlighting the relative opportunity levels based on our analysis of tariff impacts and market conditions. Regions like Commerce/Vernon show particularly high opportunity potential for cold storage facilities, while the South Bay area presents strong opportunities for last-mile distribution facilities.

Seven Key Opportunity Areas

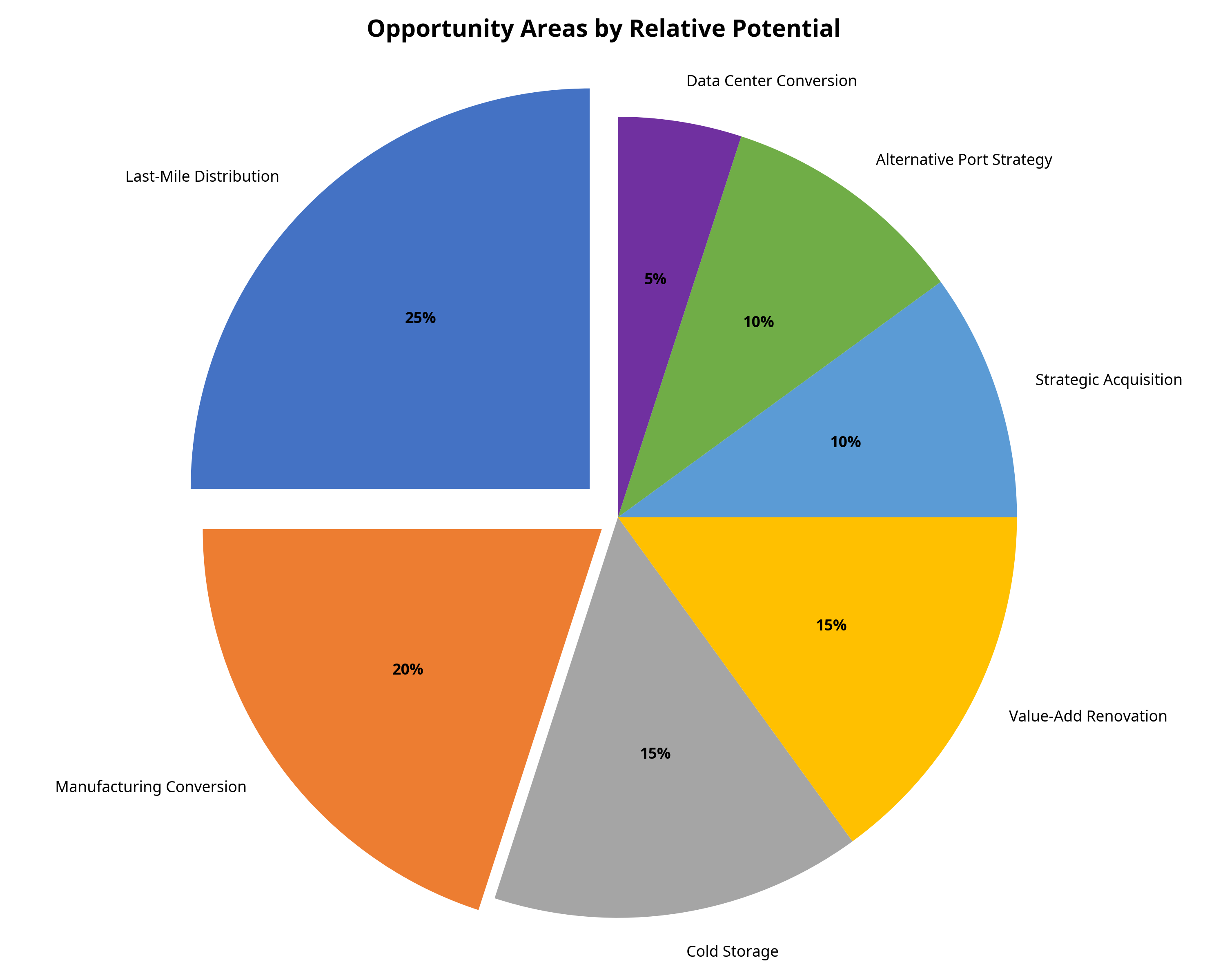

Opportunity Areas by Relative Potential

Relative opportunity potential based on market analysis

Opportunity Areas Overview

The intersection of tariff impacts and market conditions creates several distinct opportunity areas in the Los Angeles industrial real estate market:

- Last-Mile Distribution Facilities: Smaller, strategically located facilities that reduce delivery times and transportation costs

- Manufacturing Conversion Opportunities: Properties suitable for light manufacturing, especially high-tech manufacturing

- Cold Storage and Specialized Facilities: Temperature-controlled warehouses for food and pharmaceuticals

- Value-Add Renovation Opportunities: Older industrial properties that can be upgraded to meet modern logistics requirements

- Strategic Acquisition of Undervalued Assets: Properties near port facilities that may temporarily decrease in value

- Alternative Port Strategy Properties: Facilities positioned to benefit from cargo shifting to alternative ports

- Data Center Conversion: Industrial properties with robust power infrastructure for AI and cloud computing

Market Timing Considerations

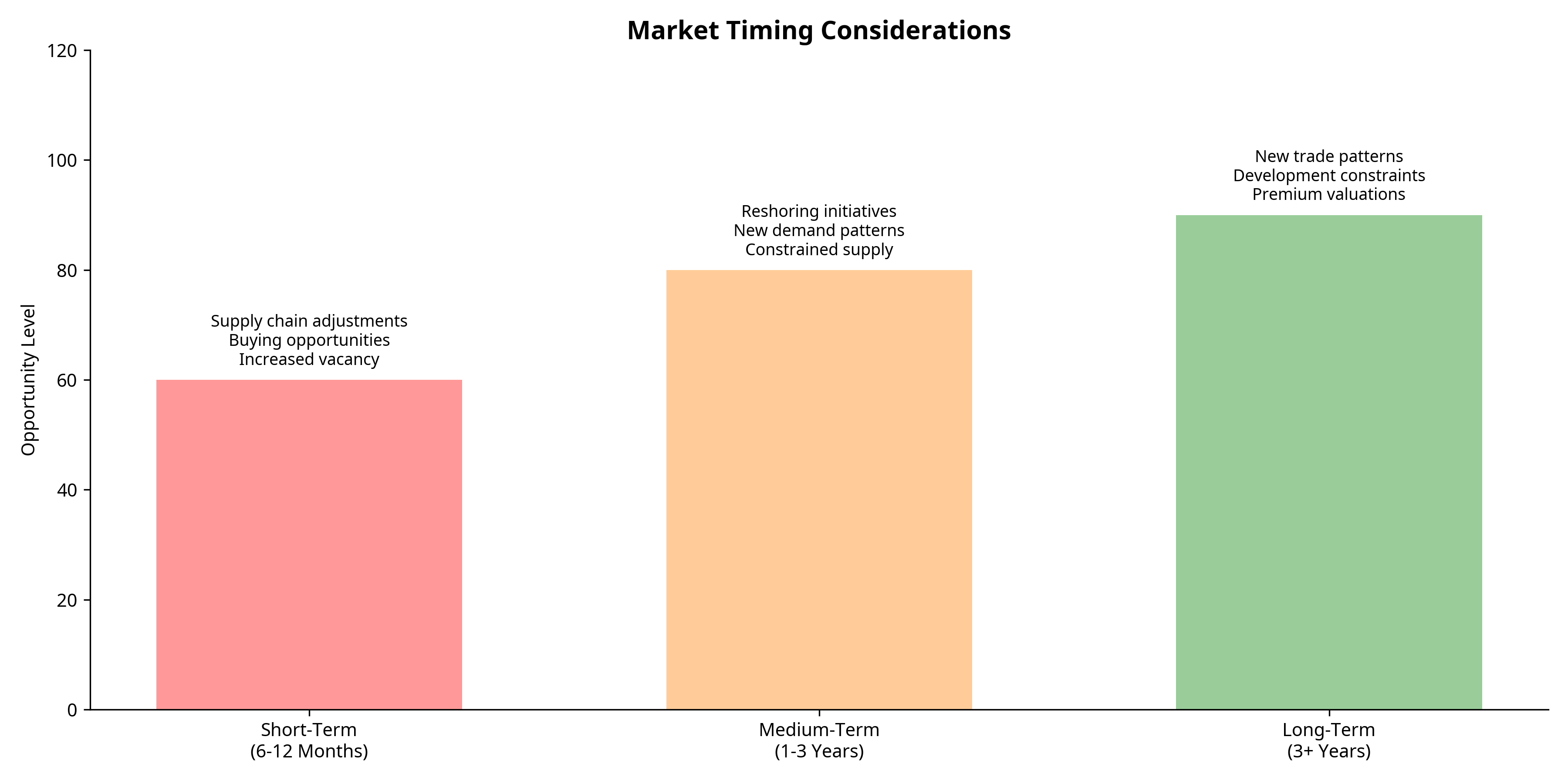

Timeline of Opportunity

Timeline showing opportunity levels and key factors across different time horizons

Short-Term (6-12 Months)

- Supply chains will adjust to tariffs, potentially creating buying opportunities

- Expect increased vacancy in properties heavily dependent on Chinese imports

- Potential for price adjustments in certain submarkets most exposed to trade disruption

Medium-Term (1-3 Years)

- Reshoring initiatives will take hold, driving demand for manufacturing facilities

- Supply chain reconfiguration will create new demand patterns

- Limited new development will begin to constrain supply, potentially driving rent growth

Long-Term (3+ Years)

- New trade patterns will solidify, with Los Angeles maintaining its strategic importance

- Development constraints from AB 98 will further limit new supply

- Properties that successfully adapt to new market realities will achieve premium valuations

Strategic Investment Recommendations

1. Focus on Location Quality

Properties with superior access to transportation networks, population centers, and skilled labor will outperform regardless of short-term market fluctuations.

2. Target Flexible Building Designs

Industrial properties that can accommodate multiple use cases will maintain value through market transitions.

3. Monitor Reshoring Announcements

Track major companies announcing US manufacturing investments to identify potential tenant demand patterns.

4. Consider Counter-Cyclical Acquisitions

The temporary disruption in port volumes may create buying opportunities for well-located assets at attractive valuations.

Conclusion

The recent tariff implementations have created a complex but potentially opportunistic environment for Los Angeles industrial real estate. While short-term disruptions are inevitable, the combination of reshoring initiatives, supply chain restructuring, and development constraints creates a potentially favorable environment for strategic industrial assets.

The Los Angeles industrial market’s fundamental strengths—its strategic location, robust transportation infrastructure, and access to one of the largest consumer markets in the country—will continue to support its long-term viability despite the current trade policy shifts.