Leasing conditions throughout Los Angeles have moderated from the rent surges of the Covid period. Nowhere felt the impact from the Supply Chain Crisis more acutely than San Pedro Bay. There were severe space shortages and warehouse rents were increasing daily. The frenzy was magnified by extremely low interest rates that brought a host of investors to purchase sub-institutional grade property and land developments.

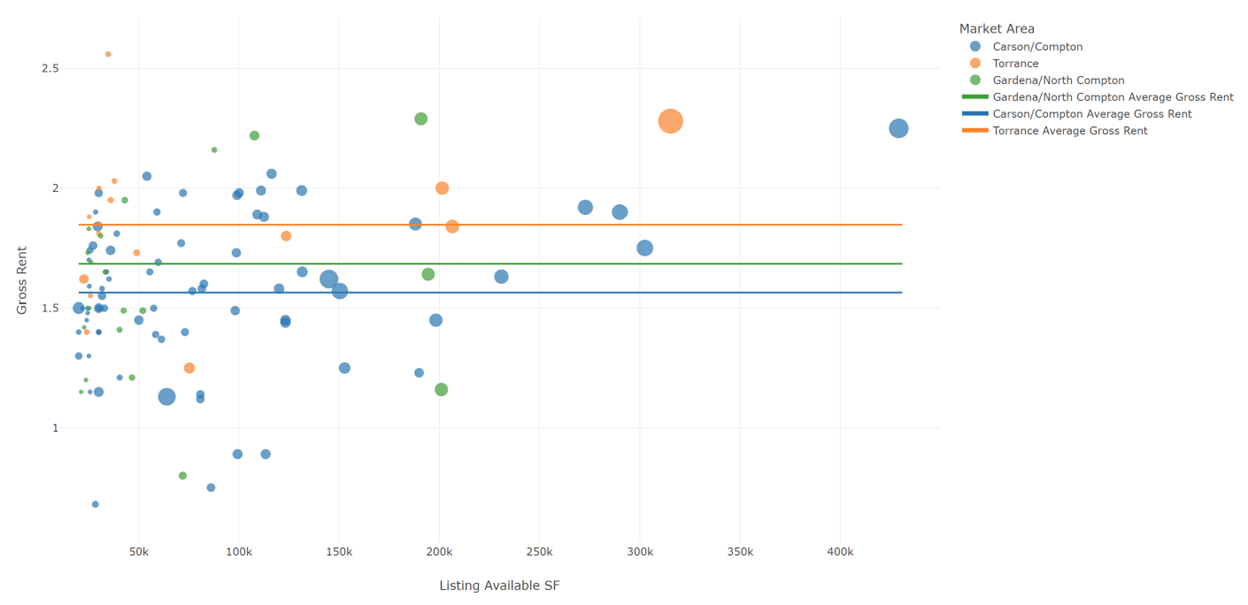

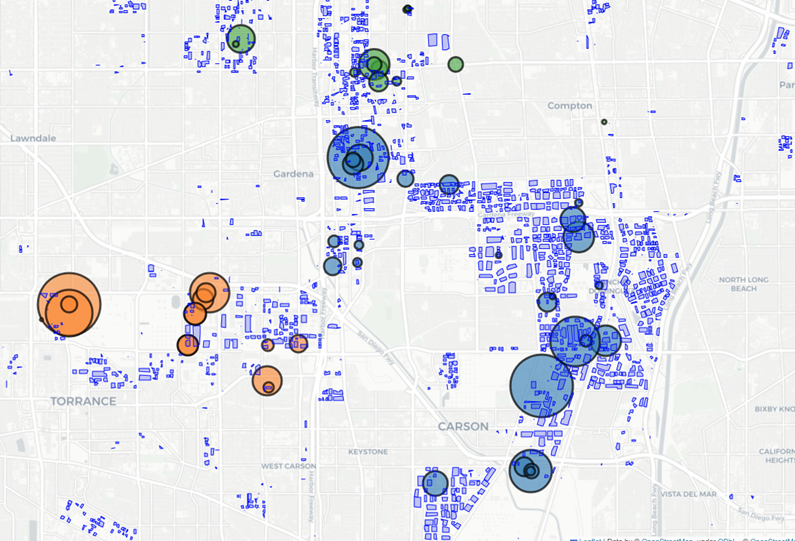

A mix of price moderation and higher interest rates rate starting in early 2023 brought a cooling to market conditions and we are now in a normally functioning market that favors the tenant. While rents are down from the peak, they are steady on a long-term basis. There is good supply in the South Bay area. You can find reasonable space at $1.50 per foot Gross (including taxes and property insurance). Newer buildings are priced in the range of $2.50 per foot (all-in).Property taxes, due to Prop 13, have an outsized effect on the rent.

Not only has the market normalized, meaning rents have come down, but development activity created a bifurcation between two tiers of space. One is the older tier, with lower rents, smaller footprints, partial obsolescence, and suitable for local tenants. The new tier is “development space” recently completed with superior attributes, large footprints, built for regional sized companies or national freight distributors. The pricing difference between the two tiers is 60%, coincidentally, the same difference between 32’ high and 20’ high. Development spaces, while located in Gardena, are not necessarily intended for organically growing Gardena companies but for larger companies comparing the entire L.A. Basin.

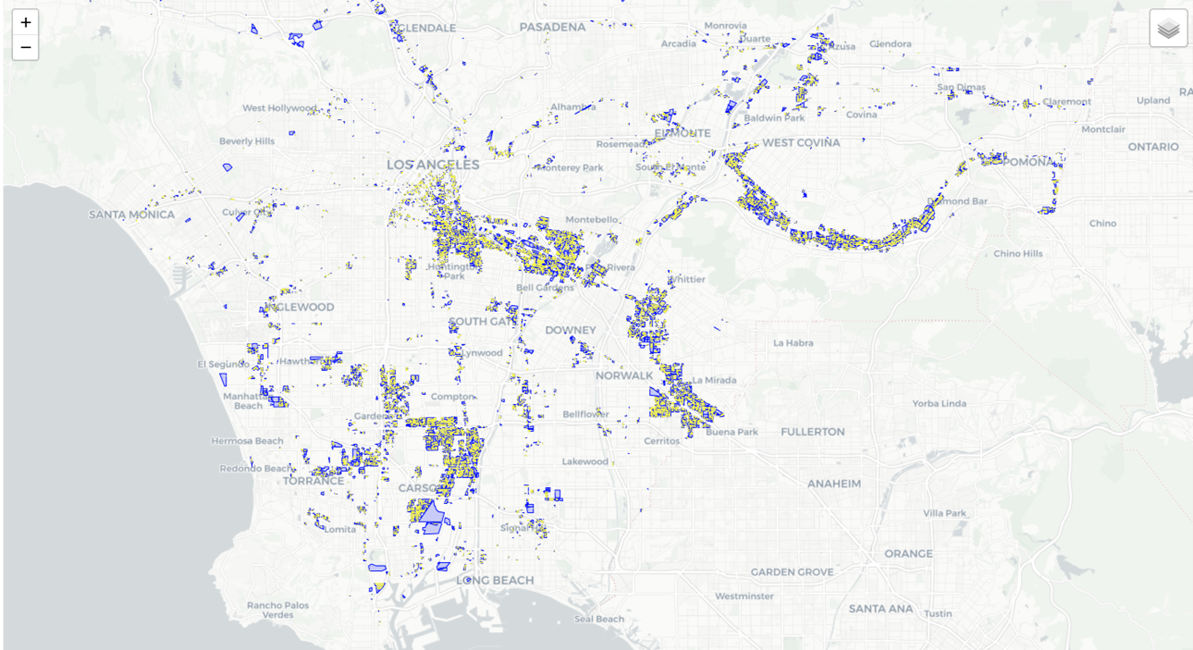

While current supply is plentiful, the rift between residents and industrial uses will result in a long-term restriction of industrial buildings. Local moratoriums, zoning prohibitions, and statewide measures like California Assembly Bill 98, (Planning and zoning: logistics use: truck routes), enshrines a 500’ and in other cases, a 900’ buffer from “sensitive receptors”. Inother words, intensive industrial need to be away from schools, residences, churches,medical facilities and other places with a high concentration of people.

While Green Zone ordinances in LA County are meant to satisfy residents, it doesn’t address the underlying issues of crime, unsanitary conditions, trash, and homelessness. If the County were to listen to businesses, they would attract better companies and property owners wouldn’t have to solely rely on truckers and warehousers to lease their properties. Green zones and similar restrictions are the result of neglect by County leaders desperate to appease residents without having to do the hard work of making these neighborhoods safe and livable.

*******************************************************************************************

The opportunity in Los Angeles industrial real estate is as great now as ever because activity is constant.

Los Angeles a premier industrial market in the United States. While interest rates, trade flows, taxes and governmental policies will alter your tactics, there are three consistent dynamics which keep deals flowing.

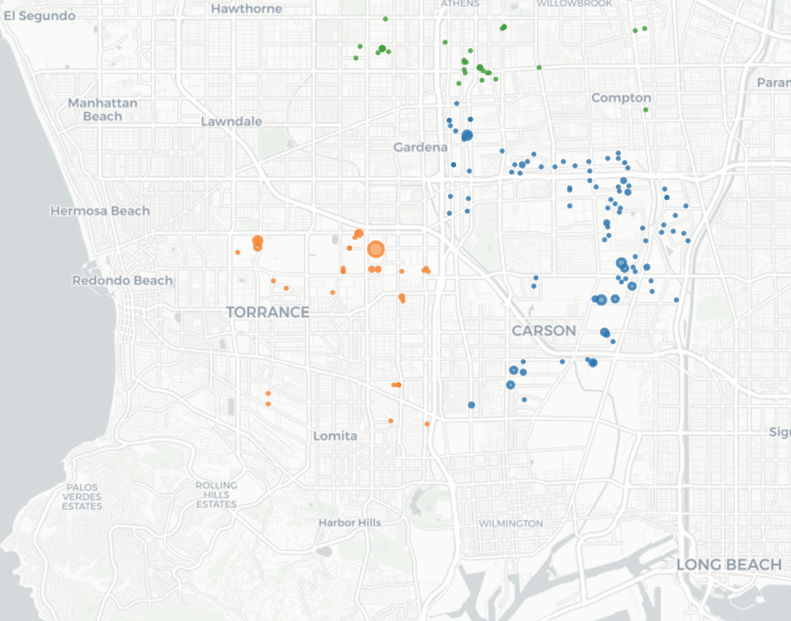

1. Real estate is local. This principle of the property business states the most interested buyers and tenants are closest to the property in ever widening circles. Social Scientists and Urban Geographers call it agglomeration and Los Angeles has a very high ratio of local commercial interaction. When businesses grow, they want to maintain proximity to markets, customers, and employees and will often decide to stay close.

2. It’s possible to anticipate where companies are moving from based on historical trends. Companies generally move for more space, less rent and to improve their business.Companies in L. A. County generally follow the same movement patterns, mostly based on the freeway network. As an example, West L.A. companies will move south down the 405 Freeway. South Bay Companies will move to Mid Counties (91 Freeway). Mid Counties will move to the Inland Empire (10 , 60 and 91). There are many other patterns in Southern California that keeps company movement local and predictable. Anticipating where tenants come from keep buildings leased.

4. Aside from geography, there is always robust transactional activity among investors. Except in rare instances of turbulence, properties flow from private hands to investor control. It’s a steady force as new capital follows an old business plan of finding buildings that will provide a reasonable return to their investors. Los Angeles is a crossroads destination with a lot of property still residing in private hands. In addition, Owner/Users will buy when the mortgage payment is equivalent to rent. It’s a positive time to purchase.

****************************************************************************************************

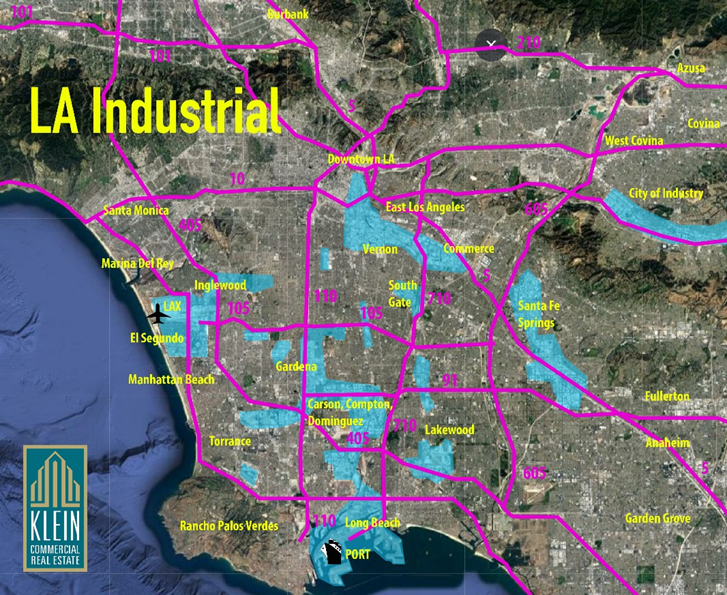

What makes Southern California an industrial powerhouse? Within a 60-minute drive of Downtown Los Angeles, there is approximately 2 Billion square feet of industrial space worth $500 Billion dollars and is almost 15% of the entire industrial space in the U.S.

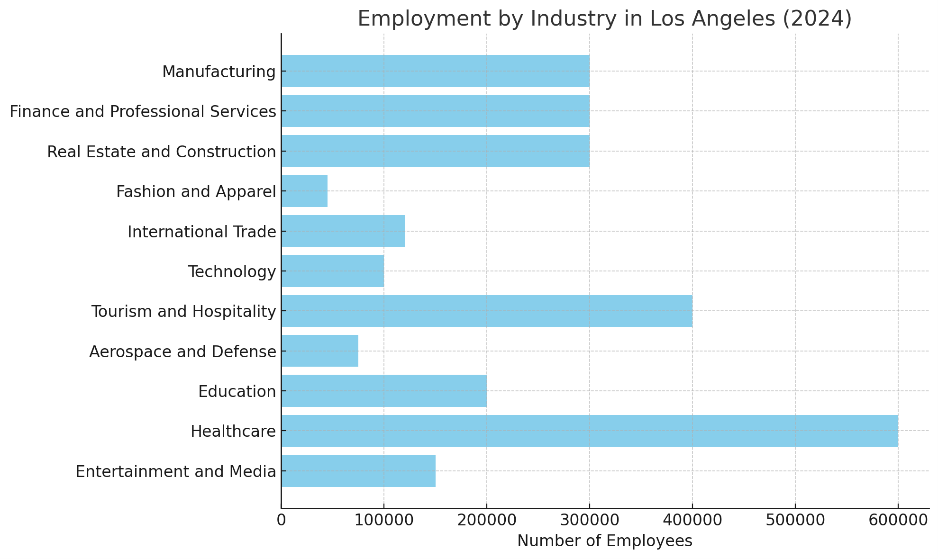

Most people arrive at LAX which is the largest employment center of aerospace and defense employment in the U.S. SpaceX, TRW, Lockheed Martin, Northrop, BAE, and Raytheon have major facilities along with their suppliers and subcontractors. As a derivative of its engineering and technical resources , El Segundo has a burgeoning “Hard Tech” industry that combines digital technology and physical manufacturing.

Thirty minutes south on the 405 Freeway are the Ports of Long Beach and Los Angeles. Each by themselves has more container volume than any other US port and when combined creates a shipping colossus that supports local warehouses and trade from the South Bay, to Downtown, Mid Counties, Inland Empire and as far as Phoenix and Las Vegas. Approximately 4 million rail cars head to other parts of the U.S. from the six intermodal railyards in the region.

Heading north on the Long Beach Freeway (710), in thirty minutes, you reach Downtown Los Angeles, particularly Commerce and Vernon. These cities were the manufacturing center of the West with large production plants that built cars, tires, glass, food, plastics, furniture and clothing. While many of the largest plants are gone, it left a robust industrial infrastructure with approximately 4,000 companies and 100,000 employees. Today, food, apparel, furniture, metals, machinery and the second largest U.S. wholesale market are major businesses.

Another 20 minutes northeast on the 101 Freeway, you reach Hollywood, home to the international capital of film, television, recording, pre-and-post production employing 200,000 (down from 250,000 at its peak in 2017).

Heading east is the San Gabriel Valley and Inland Empire with 1 Billion square feet of industrial buildings. To the Southeast towards Orange County is Mid Counties. And north is the San Fernando Valley. Each of these submarkets have more industrial space by themselves than most U.S. metros.

Klein Commercial Real Estate has been locally headquartered in Gardena for 45 years. Our specialty is selling industrial buildings and representing corporations in their real estate moves.