Industrial real estate is a diverse business that includes Investment funds, developers, private/family owners, corporations, occupiers, and a mix of product types and industries. Industrial buildings are in every community and are the source of employment, production, distribution, and wealth for many. The nation’s economic health rides on the success of industrial real estate.

There are several factors that are driving deals today. Broadly, these include Interest Rate Policy, US Industrial Strategy, and Local Municipal Governance. Everyone is affected differently. For example, higher interest rates are never good for real estate, though they affect sales more than leases; sale transactions are interest rate sensitive while leasing is supply and demand based. As an experienced broker, we use detailed knowledge, market analytics, and long-standing relationships to help you in making the best decision.

The rapid rise of interest rates is putting downward pressure on asset values and adds to development costs. Income is reduced when borrowers need to pay higher interest rates. Either prices drop or owners add value to improve their returns. Not all property classes are affected equally. During times of economic uncertainty there is a flight to quality. Tenants will pay for higher ceilings, better loading, and truck courts, especially at close-in locations. Older buildings see reduced demand but because many of those property owners have a low basis, they can often reduce rents and still maintain a steady income.

Sale prices are on the decline, but not as much as you would think. Users, who have been shut out of the market by investors for so long, want to purchase their own building. Many users are wealthy and if they can justify a mortgage payment instead of rent, they are incentivized to purchase. This puts a healthy bottom on how far prices can fall. In fact, it resembles a more functioning market, before the era of negative interest rates, where users would typically pay more than investors. In the broad history of finance, 6% or 7% money is not unreasonable. However, it’s the suddenness and rapidity of the rate moves that is disruptive.

Industrial building geography is rapidly shifting because of US Industrial Policy. Between the Inflation Reduction Act, Chips Act, and Bipartisan Infrastructure Law, the US is offering $800 Billion in investment and subsidies. This is matched by corporate and state investments. Much of the money will go to build manufacturing plants and improve industrial infrastructure. There are new manufacturing plants for electric vehicles, clean energy (solar, wind), batteries, semiconductors, space, aircraft, and defense; This investment is creating a noticeable shift of the industrial supply chain to Phoenix, Austin, Greater Charlestown/Savannah, Columbus, and many other Southern “right-to-work” states. Kentucky is a prime beneficiary due to a very important senate leader. A smattering of Midwest projects in the old rust belt are also resurging. Large plants, particularly for vehicles and aircrafts, will bring many suppliers to create small boomlets.Mexican production plants are a large part of this evolution with more development along the NAFTA (or USMCA) Highway.

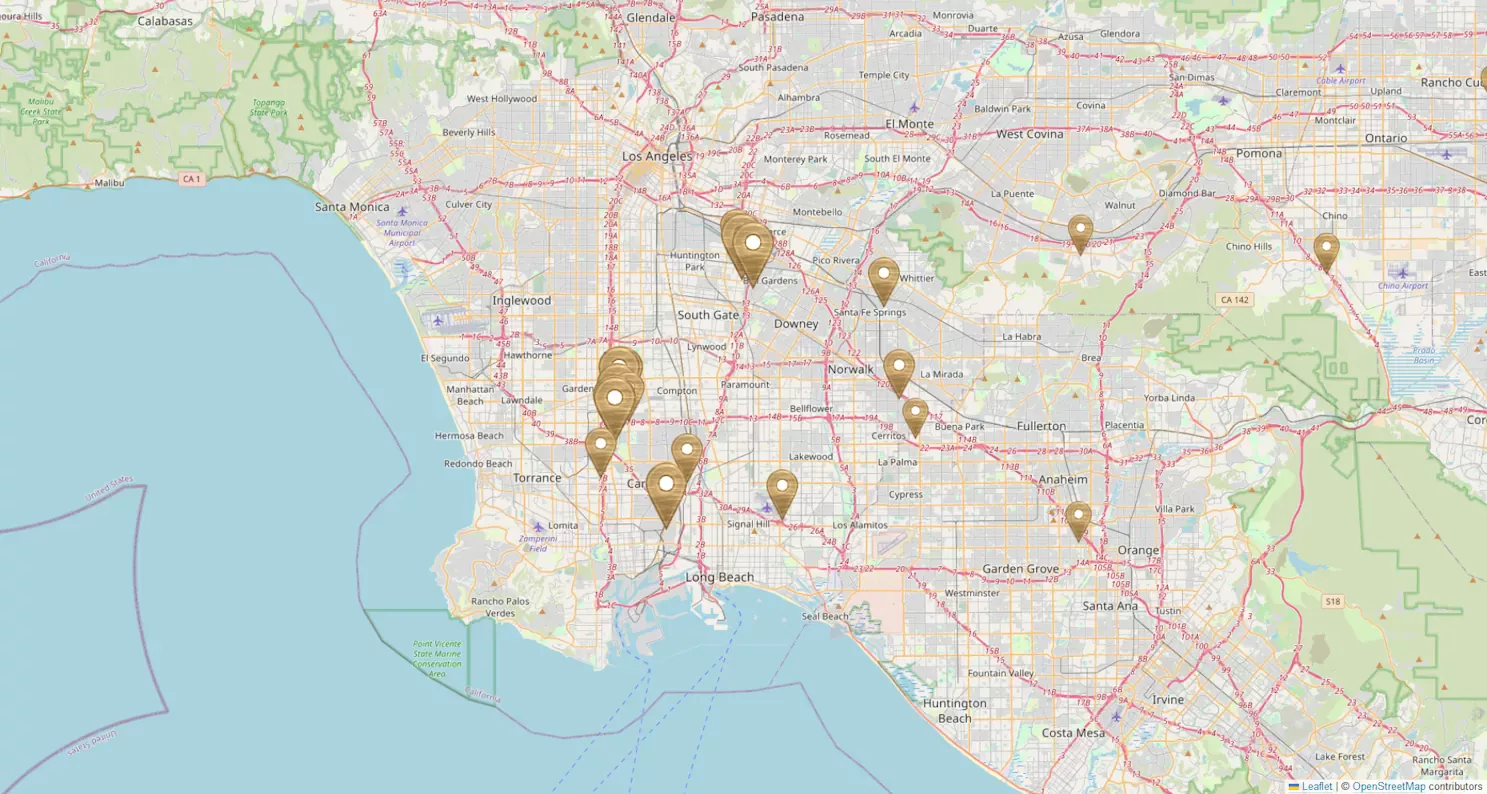

Even before massive federal industrial investments there was already an attraction to the southeast by European manufacturers and suppliers because of the proximity to home countries. Asian goods, too, are permanently being re-routed away from Los Angeles to Houston, Savannah, Newark and other south and eastern ports. These are permanent realignments with many 3PLs and their customers signing long term leases. The trade war with China is having an additional diminishing effect on west coast container volumes. You can clearly see the decreased need of truck and container yards by the declining yard rents. The remaking of the US industrial market started with ecommerce and is now being supported by manufacturing. Many of my clients are continuing to look outside of California to be part of the US industrial renaissance – luckily with my help.

While US industrial policy is incentivizing many industrial companies to follow the action, local California streets and its leaders are also driving California companies away through neglect, costs, and adverse political actions. The legislative and budget priorities of Social Justice and Homelessness are diverting funds from productive investment and the functioning of private property. Three hundred fifty (350) California Headquarters have left the state over the past five years1. What can we do to make Los Angeles more receptive to industry?

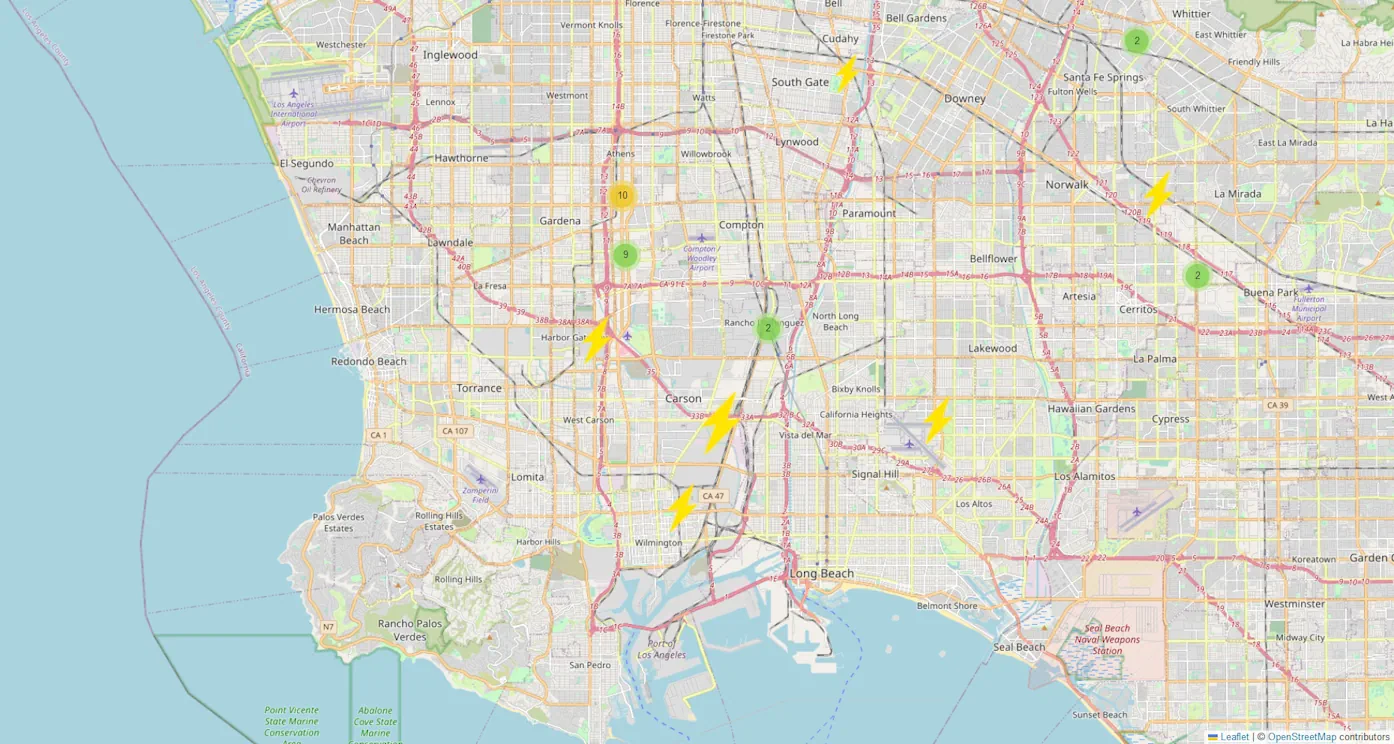

Homelessness is a tragedy, but policies are not implemented evenly across jurisdictions. Some cities have an outright ban on overnight camper parking and tents, while other cities have become ungovernable with RV Campers parked on every street and sidewalk. Los Angeles and Los Angeles County are the most permissive. RV and tent encampments create poor sanitary conditions, crime, building break-ins, and fire hazards; Children are afraid to walk down the street to go to school. Imagine bringing someone to look at buildings where I need to ask the people living in front to move their belongings away from the front door. Municipal policies are destroying values. The real estate price difference between permissive and non-permissive communities only a block apart can be up to 25%. Business owners don’t want to locate on ungovernable streets.

Everyone knows about high taxation in California. For tenants, it’s the uneven taxation that comes as a surprise. First, a minor disparity is each city has different tax rate areas. For instance, Compton is 1.6% of assessed value, whereas adjacent LA County, it’s 1.1% of assessed value. A wider inequity is caused by Proposition 13; Long-time property owners keep their original assessment (with a 2% annual inflator), whereas new property owners are taxed on the current assessment. The difference can be ten times (10x) greater. Property taxes can easily add another 25% to a tenant’s rent (or up to $0.50 PSF/Mo). Many tenants have a weak understanding and don’t investigate the property taxes they are responsible for paying.

In a recent democratic election, one group of citizens voted to tax wealthy owners at a higher rate when a property is transferred. In Los Angeles, the law is known as Measure ULA2, or the mansion tax. While the intent is to tax the rich, many small investors get swept up if they own small partnerships in larger buildings; They will pay up to 5.5% of their sale proceeds. Thus Los Angeles property taxes are confusing, can be changed arbitrarily, and are being progressively bracketed.

The newest assault on industrial property owners by local municipalities are zone restrictions and downzones. In the name of Social Justice, Los Angeles County and other municipalities are trying to reduce the allowable industrial uses of your property. First, it was limits on trucking and distribution uses by green zoning. Second, without consultation, the County attempted to downzone to make your property practically unleasable. Only a concerted pushback by property owners caused a delay. Now, the County has caused so much confusion regarding allowable uses, you must obtain a business license before you close a deal. Be aware, some cities will put you through lengthy and costly corrective hoops with fees and permits before they will issue a business license.

Industrial real estate is evolving quickly. New industries supporting the green transition and national resiliency are sprouting up across the country. The investment landscape is adapting, with asset managers seeing the damage being caused by higher interest rates, but also looking at the promise of new deals at higher returns. Finally, can Los Angeles be a place where businesses and families want to locate? Our local deal activity shows Los Angeles is a strong industrial market that can be improved with the right leaders who add business to their agenda.

- Why Company Headquarters Are Leaving California in Unprecedented Numbers. Hoover Institution. September 14, 2022. Retrieved May 20, 2023.

- The Base Tax rate of $2.25 per $500 or part thereof (“Base Rate”). The ULA Tax rates of: 1) 4% for properties conveyed over 5,000,000, but under $10,000,000, and 2) 5.5% for properties conveyed at $10,000,000 or more (“ULA Rates”).