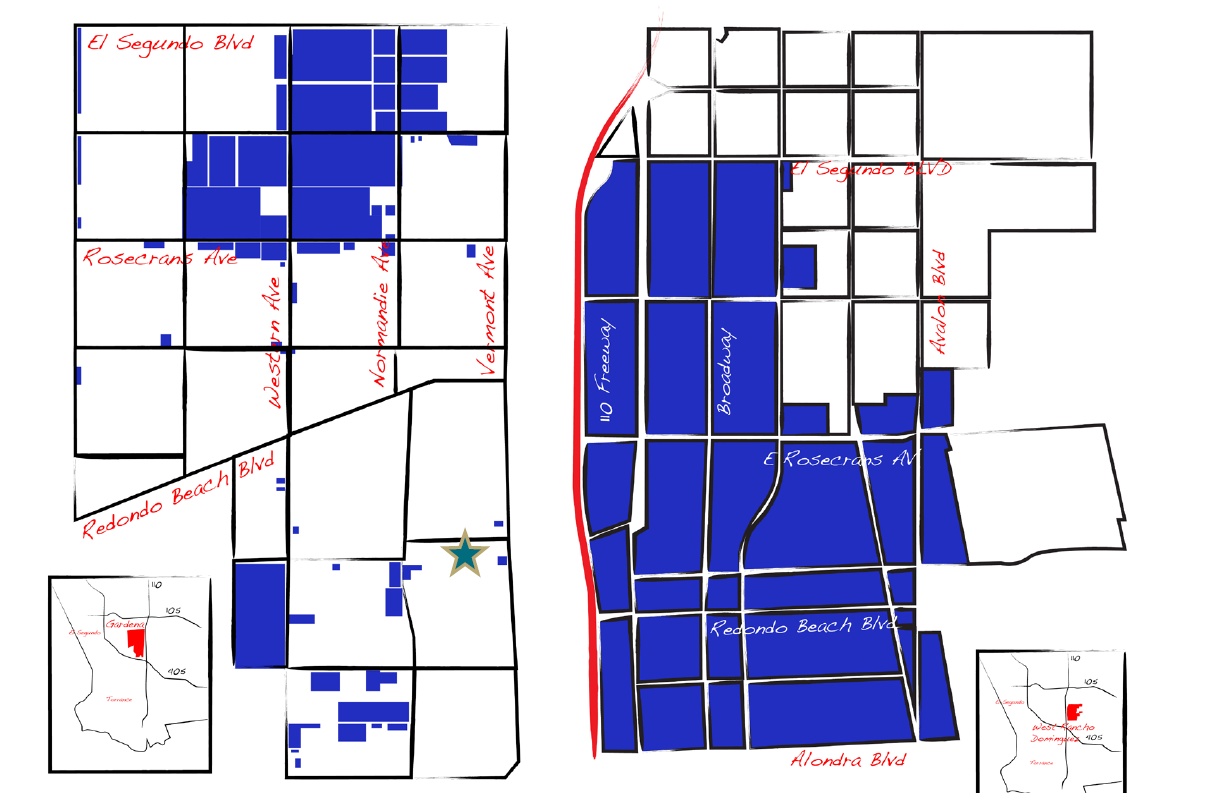

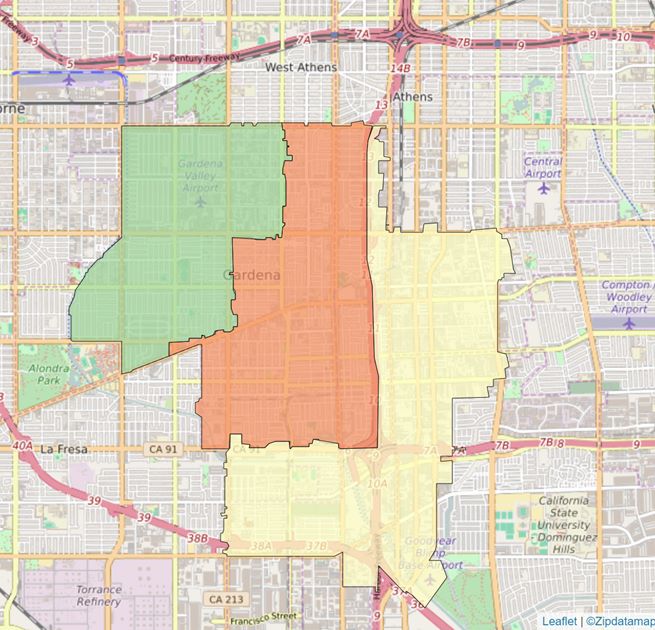

The geography of Gardena needs explanation. There is the City of Gardena proper and three times larger than the city boundary, is the Gardena Postal Zone. The larger Gardena area includes parts of Unincorporated Los Angeles County (West Rancho Dominguez), City of Los Angeles Strip, and the northwestern part of Carson. The zip code 90061 is also included in most market studies of Gardena because it squares off the uniform industrial portion of West Rancho on the north side. When someone asks me how the real estate business is in Gardena, it depends where you are located. Each municipality has its own zoning regulations and homeless policies which have a direct relationship to the individual parcel value.

West Rancho has larger buildings developed in the 1960s and 70s and built with from red block. The Carson portion, because it was incorporated later, has newer, tilt-up buildings. Gardena City, itself, has more small buildings and units than neighboring communities. You will find buildings dating to the 1950’s and 1960’s. It’s a unique building stock because Gardena housed very small, independently-owned, machine shops that served as the bulwark of the U.S. aircraft and defense industry from WWII through Vietnam. These industrial spaces have excellent electric power capacities.

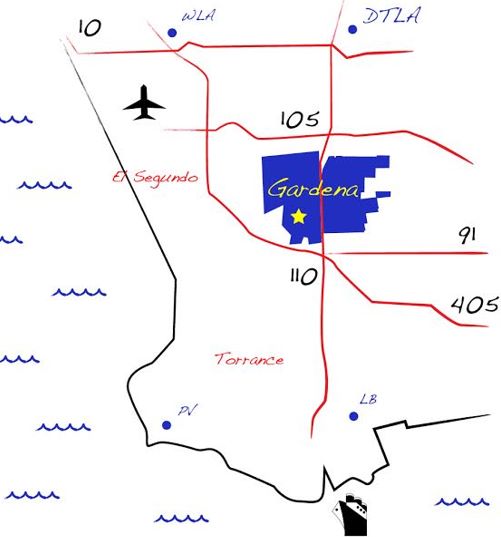

As warehouse/distribution uses replaced manufacturing, Gardena’s central location to Downtown, LAX, and San Pedro Bay attracted many ocean and air shippers. The local freeway network (405,110,91,105) provides convenient transport for labor, executives, and goods to all residential and industrial locations in greater Los Angeles. Gardena is a diversified and organic industrial and transportation center.

From an investment perspective most of the large investors look at West Rancho and Carson for reasons of scale. The City of Gardena is a “Mom and Pop” business with most owners owning a single industrial building. While professional management is rare, cash flow is still extraordinary. Smaller landlords don’t always make market-based decisions but weigh the cost of their personal lifestyle against risk aversion. I advise local building owners to send monthly invoices, use standard leases, inspect periodically, keep rents at market, and regularly service building systems by licensed vendors. Unlike with institutional landlords, individual building owners don’t have the experience and their properties become neglected.

One market abnormality stands out, and not only in Gardena. Rents are increasing, but values are falling. This signals a shift in the market because of higher interest rates. During the recent era of very low interest rates, the market became distorted and investment money came pouring in. This condition crowded out owner/users who wanted to purchase their own buildings. Now that loan and cap rates are significantly higher, investors have pulled back. Owner/users, with a 20% downpayment, can find buildings to purchase where mortgage payments are starting to equal rental rates. This represents a return to normal conditions when owner/users can out pay investors.

Despite the recent surge in interest rates, historic investment fundamentals in Gardena are strong. When I began the business in 1982, average sale prices were $35 per foot and rental rates were $.25 per foot per month. Today we are seeing purchase prices of $350 per foot and rental rates are $1.60+. This equates to annual appreciation of 9.25% and annual rent growth of 6% for a combined 15% annual return. At Klein Commercial, we have the experience to help our customers find great places to house their business and owners to reach their investment goals in Gardena, Los Angeles, and other U.S. locations.

Thank you for subscribing.