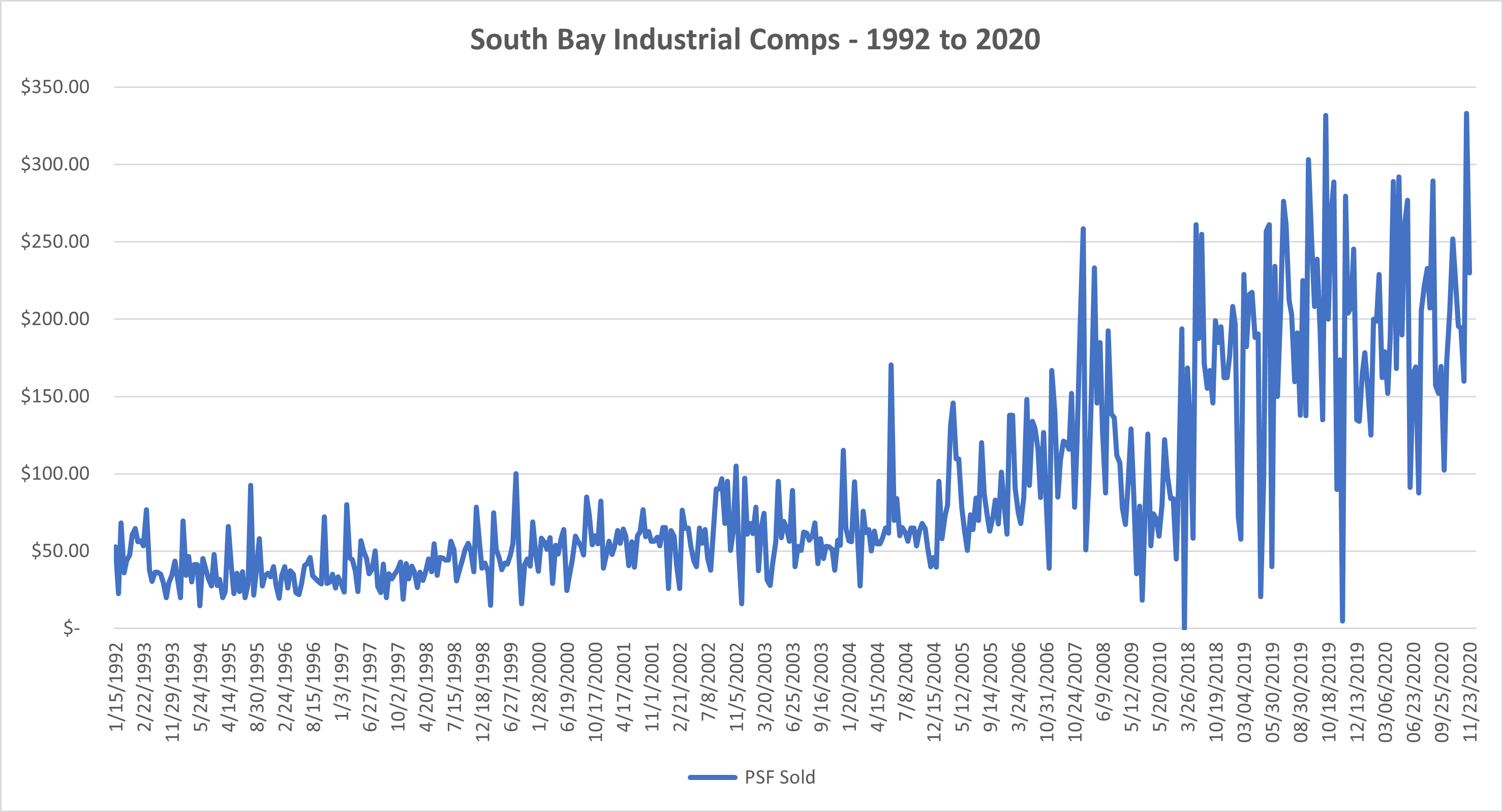

As 2020 comes to an end, Industrial Buildings continue to be good investments. With annual appreciation at 6% and current cap rates at 5%, Buyers are getting 11% annual returns and greater on an “all-cash” basis. These calculations reflect market conditions and not based on finding a “good deal”. With interest rates at 3% or lower, there is strong leverage boosting cash-on-cash returns to 10% with conservative financing. Levered returns increase to 15% (cash flow + appreciation). If you can find property for sale, not always that simple, conditions are very supportive.

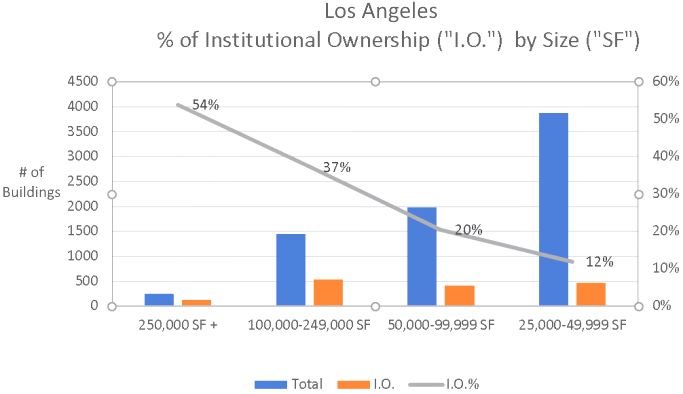

Where to look? With all the money pouring in from Institutional Buyers, there is more opportunity in smaller sizes. Institutions want larger buildings because they have lots of cash to invest and it’s harder to buy several buildings instead of one. However, the dearth of product is forcing institutional investors to consider smaller scale purchases. When the final results come in, 2020 may be a turning point with institutional attention dropping to 50,000 square feet and lower. Covid has caused many owner/users to stay on the sidelines, while big investors have been increasing their allocations.

When looking at property that has sold over the past few years, many buildings were never offered on the open market, through Co-Star, Loopnet or the Industrial Multiple. The favored way to sell is to offer the property to a select list of investors. Owner/Users never see the buildings until they appear for lease. “Off-Market” favors the buyers and brokers who are connected. Does little harm to Sellers because the investors make the market. However, when there is only a handful of major property owners, it creates disincentives to negotiate. Institutional capital has permanently changed the market and it will continue unabated.