Week of February 1, 2021

For data tracking we use space on the market instead of actual vacant space. It is easier to track but the results skew higher than other vacancy stats that are published. The data by itself can be misleading. For 100,000 SF and greater, the only two buildings “available” are in early stages of construction. You could easily say there is zero vacancy in that size range. Big buildings are new to this market but as a sign of positive demand, they are mostly pre-leased before the end of construction.

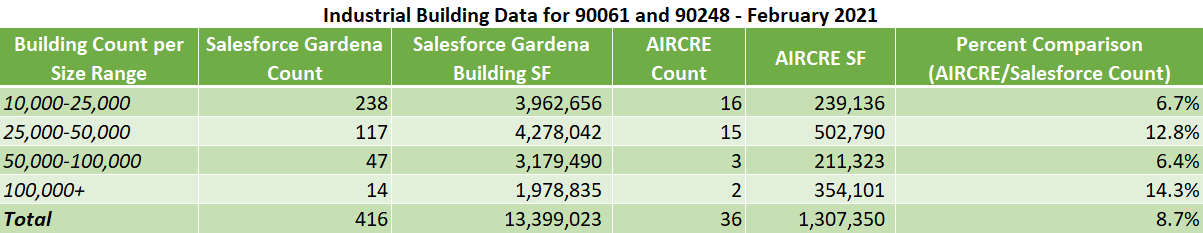

Weaker, is the typical Gardena building of 25,000 SF to 50,000 SF. This range is more representative of the area and is showing softness. 15 buildings on the market out of 117. You could say it’s a reflection of sickness in the economy. Many of these buildings are older and not fit for ecommerce. The large numbers in this range show opportunity and once the economy rebounds later this year, the vacancy numbers will shrink. Best buys are in this range.

The 25K to 50K range lacks much institutional ownership. Private buyers can still find a deal. Expect sale prices at $200 per foot and rents at $11 Annual NNN. While buildings are older, they are generally functional and in good locations. The market is 5.5% cap rates with good appreciation. Local credit tenancies with track records for 5 year terms. Build in 3 to 6 month vacancies and refurbishment costs. These mid market buildings in the Los Angeles industrial core are solid investments.

On a personal level, anything for sale has strong interest, no matter the age or class. Investment funds and SBA-backed are the dominant purchasers. Leasing is more moderate for the typical Gardena building. The exception is new, distribution buildings which are the focus of corporate users. I would characterize the market as robust with good activity. There are soft spots, generally in older buildings where owners do not want to sell.