Pricing is holding relatively steady but promotional rates are appearing through free-rent and initial teaser rates. There is more sublease space at lower rents. The most notable shift is a drop in long-term demand confirmed by colleagues across the country. While there are short term space requirements for masks, sanitizers, respirators, and emergency medical equipment, much of this activity winds up as false starts. We recently signed one large land lease to store full containers of mostly retail merchandise coming out of the harbor. With stores closed, there is nowhere else to hold inventory.

Opportunity Investors are calling but I have yet been unable to accommodate them with discounted property. These buyers are correct that based on previous recessions, many deals will be sourced off-market, and will be found by established personal contacts with local property owners. Slowing and declining rent growth will put a stop to aspirational pricing as underwriting returns to reason. Property taxes and other property-based assessments will increase to defray large municipal deficits due to Covid-19.

In order to comply with Stay-at-Home and Distancing, we have taken 360 photos of most of our listings so they can be seen virtually. We are making better use of our property data and personal relationships to understand real-time market movements. Digital marketing is an area where we excel and use electronic resources to fill space and find deals. Please stay in touch. It’s the best way to solve problems.

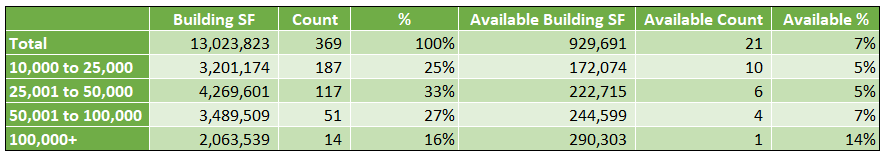

Data Summary for Los Angeles Industrial County “Strip” – 90061 and 90248