Week of April 27, 2020

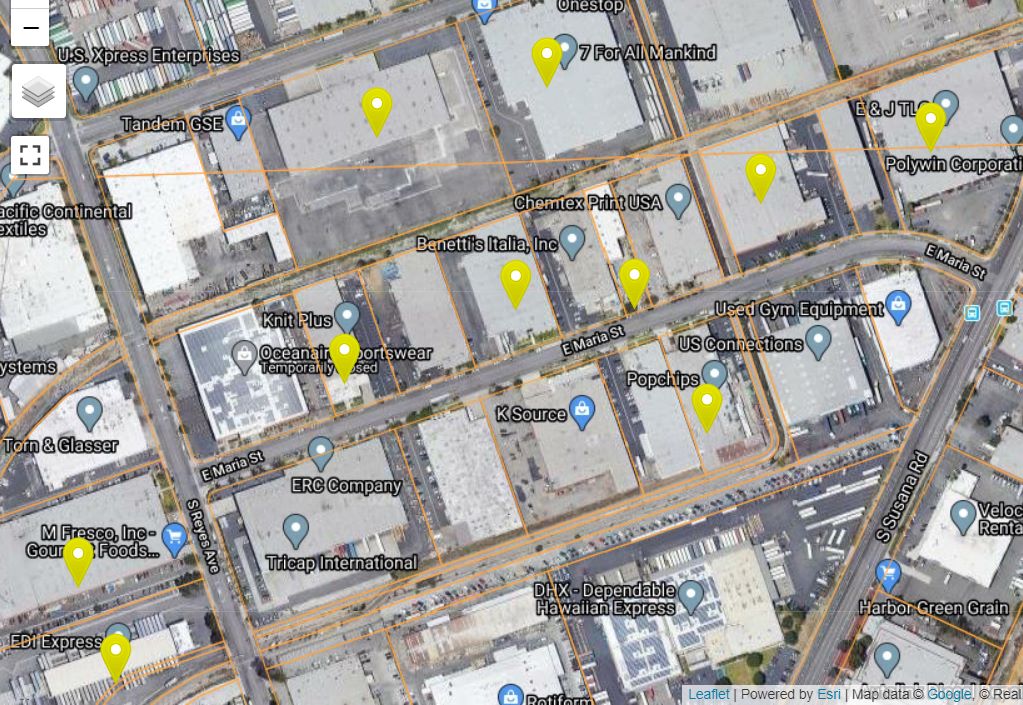

Large institutional investors are generally keeping the same pricing levels from before the virus for Class “A” industrial buildings. Lower interest rates are helping to maintain activity. In addition stimulus money from the Fed has prevented the bottom from falling out of the investment market. I am seeing wider spreads in B and C buildings where prices are starting to slip if Sellers need immediate liquidity. This picture of Rancho Dominguez is concerning. Yellow dots show buildings currently available in one of the prime industrial markets of Los Angeles.

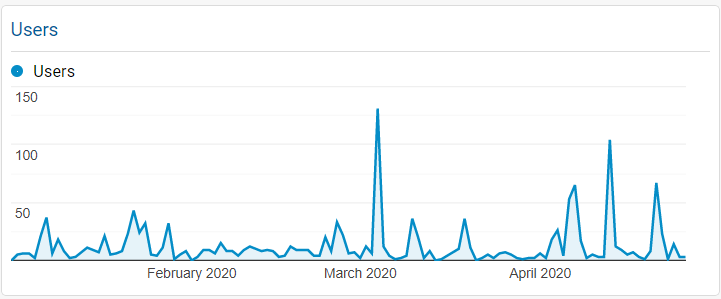

Occupier demand is weak but we are negotiating deals. Sellers have become more realistic on pricing and Buyers have reduced expectations because they are no longer counting on rent growth. While lease rates are generally holding, there is more flexibility on lease term and promotional rates offerings. Web activity has surprisingly picked up either due to more advertising on our part or web searching from those at home.

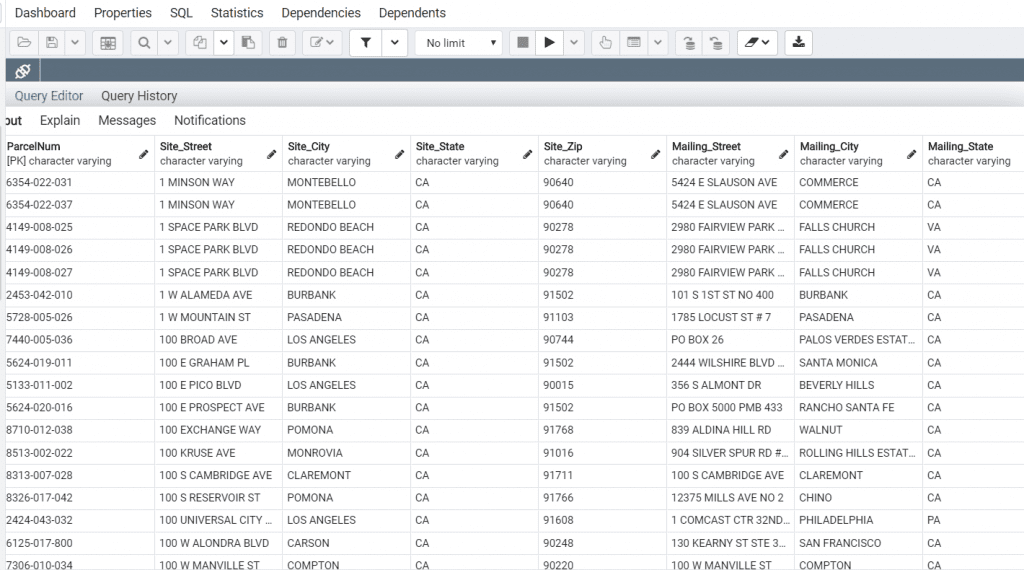

Talking to major investors, sentiment is relatively bullish and they see this period as an opportunity to find bargains. Industrial Los Angeles is still a favored investment across all real estate classifications. “Search for Yield” continues and industrial cap rates will remain attractive in comparison to investment alternatives. We are spending most of our time at home looking for tenants to fill space. We also use our extensive data resources to locate off-market properties that can be purchased. Luckily, our days are filled working with clients.