Week of May 11, 2020

Notes from our U.S. monthly industrial call about the state of industrial. Almost 100 SIORs participating:

Activity and demand are substantially down. Exceptions are e-commerce and home delivery services. Where there are deals, they tend to be shorter in term than normal. Landlords are being very reasonable with expectations with more space to come on soon. Rent deferment is modest for existing tenants.

No evidence that rents are falling, but modest concessions in terms. Most say there is not enough evidence for accurate market assessment. For industrial markets, no notable signs of distress except in the retail as well as oil and gas industries. If resiliency becomes a main driver of U.S. industrial policy, it will result in even stronger building fundamentals than we had before the covid-19 outbreak.

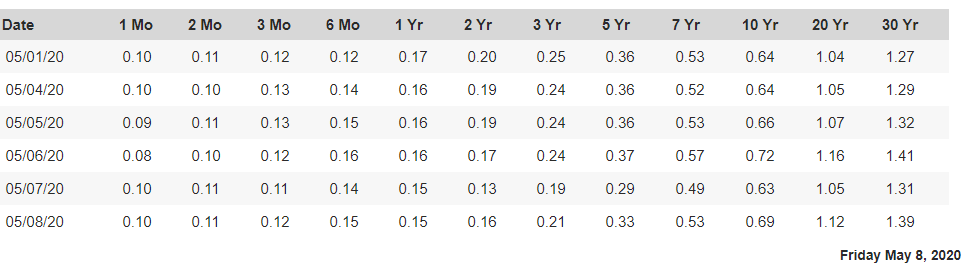

Markets not as overbuilt as in previous recessions. Sale/Leaseback are gaining popularity as a way to raise cash without disrupting operations. New investor platforms are emerging to fill a void for smaller buildings. Low interest rates are a boost to industrial building purchases. I concur that Los Angeles shares many of the same conditions my colleagues see in their local markets.

We’ll have another national report over the summer but will post any new observations we hear in the meantime.

U.S. Treasury Rates for May 8, 2020: