Week of May 15, 2021 – The Return of Corporate Real Estate

There has been a resurgence of demand from Corporate Real Estate. Once, the most important sector of the industrial real estate business, corporate influence has waned in comparison to investor/developers. The fade of corporates is a long-term trend starting when manufacturing moved off shore in the 1980s. Since the Great Financial Crisis, Capital’s influence in industrial real estate has only become more pronounced as investors search for yield. Tenants are the crucial for cash flow, but where it counts the most, in the ownership rankings and at the negotiation table, Capital is the market leader.

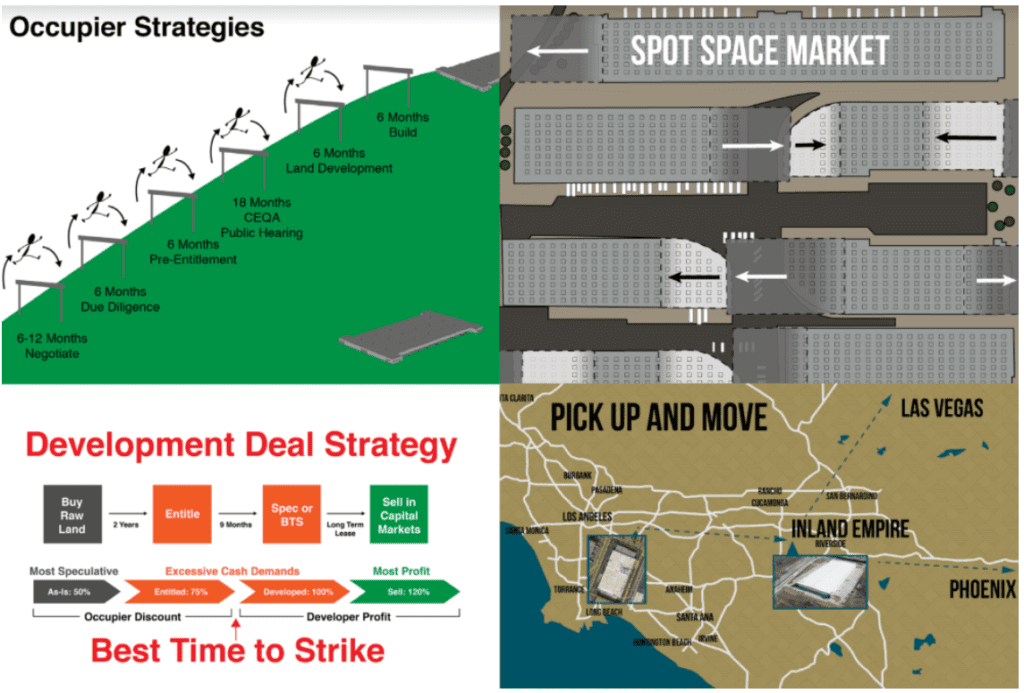

Corporations are realizing industrial space is disappearing and to keep up with production and shipments, they need to make some exceptional moves acquire space despite the sudden shortage. Although corporates with good balance sheets can jump ahead of local credit, they still need contend with limited inventory, high rents and long term leases.

There are other variables. Many corporates have not faced supply shortages like we have today and do not have the experience on board. In-house corporate real estate positions have mostly been eliminated or diminished. Now decisions are made ad hoc by either the warehouse person, the CEO, or a manager where real estate is an added function. There is no continuity or long-term memory. When needing to commit to longer leases, above asking rents, distant locations or abrupt market swings, corporates are forced to react instead of plan.

As a summary, there are three general types of real estate decisions. The first is Incrementalism where growth is uncertain, but space needs are immediate. Second is Standardization where the company is optimizing its space commitments for instance, in cases of rolling out a national distribution or service center platform. In this case, the corporate has the luxury of both foresight and certainty. The third decision is Value-Based. It requires planning and creativity but when executed properly, it will reinforce the corporate culture and operation. Headquarters or tech campuses are clearly in this category.

To address the deficiency in corporate real estate, many brokerages have established large corporate service departments to take up the slack. Many of these services are more functionary than strategic. For instance, these services include lease management, accounting, maintenance, security or purchasing. There is generally no longer a single person who can make an important real estate decision. In cases of severe space shortages, fast action is a requirement. As corporations realize they will be left without space, key managers and officers will take a more dominant role making space and location decisions. As key individuals accept more responsibility and companies recognize the strategic importance of property, we will gradually see a return of corporate influence in the markets.