Week of June 18, 2020

Industrial land is an excellent investment. Sites are difficult to find because they are not widely offered. Zoning adds another complication and each municipality has its own rules. For the right property, economics are attractive. Land is selling for high $50s to mid $60s per foot. Land rents are about $5.00 per year. This equates to 8%-10% return on an all cash basis, non-leveraged. These are much higher returns than purchasing industrial buildings.

Institutional investors like leased land parcels and often refer to it as “covered”. In other words, there is enough rent to cover the carrying cost, make a reasonable profit, and wait for the right time to develop. In many cases, these landowners find it is more beneficial to collect the rents than to build.

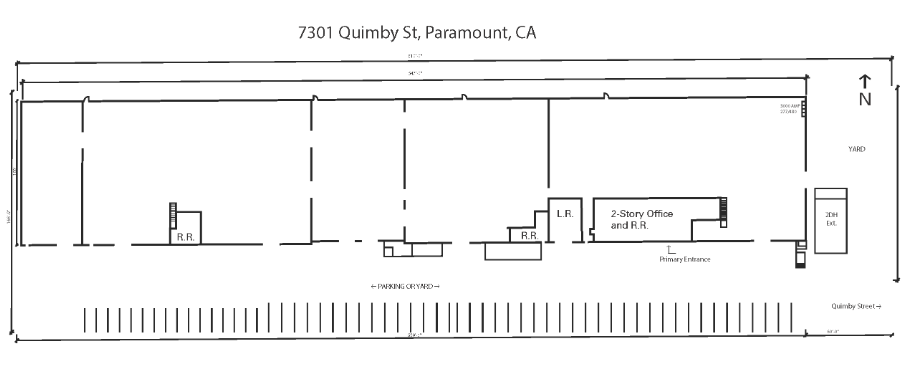

Buildings with large lots are also evaluated for its land value. For instance, the site below is a 55,000 square foot building on a 100,000 square foot site. This is not a lot of “extra” land but the way lot is shaped, with a 550’ depth, vehicles can be parked on the south property line and more rent can be earned in addition to the building rental. Trucking companies are the most obvious tenants for industrial land in the Los Angeles area. Construction materials, contractors, vehicles, and containers are also very viable.

It is not always obvious how to generate income through land. Land investment is often considered a specialty because of entitlements, preparation costs, financing, and tenant credit. However, for most sophisticated investor/developers, they will quickly learn when there is a generous return at stake.