If you are buying, selling or leasing, today’s industrial real estate business has permanently shifted. It has become an investor led market that was originally established for Occupiers. Investment fundamentals supersede many traditional occupancy concerns. Industrial markets became financialized because of strong and increasing money flows from institutional funds, REITs and private investors. In the New Industrial Real Estate Business, profits accrue fastest to those who treat their buildings like an investment product. The primary market driver is improving income through rental increases, operations, and tenancies. The wave of financialization is affecting most local industrial markets in the best metros and is visible building-by-building. Technical sophistication and specialized platforms are the new means of operating in today’s industrial building business.

Not long ago, Corporates and Owner-Users owned most of the industrial property and the industry revolved around Occupier decisions and corporate strategy. When investors played a role, it was in support of Occupiers. While institutions, particularly insurance companies, were always significant investors, the Great Recession was an inflection point. Institutional Investors expanded their investments in industrial property to find yield (and income) when most interest rates were at zero. Ten years later, Institutional Investors want even more industrial and they have noticeably increased hiring and investment allocations. Dynamically, it’s not Occupiers making periodic relocations, but the volume of institutional investment that is moving markets.

Financialization creates generous rewards to find and create income. We see many large and small platforms infused with intelligence and designed for profit. Substantial investment is being made in data collection, imagery, new tech products, and custom programs. While there is still a premium for human experience, many processes are being organized for machine intelligence and prediction. As an example, Big Data, Search, Platforms, Geolocation, Visualization, and Content Marketing are now commonly used to find deals and operate property. More than methodology, financialization and enabling technologies are transforming fundamental concepts like value, agency and risk.

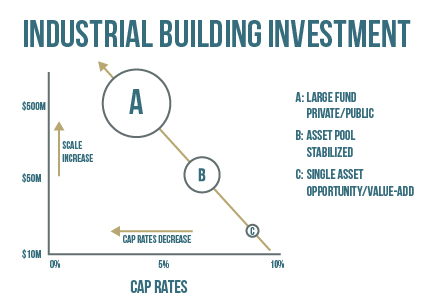

Value is determined by income and not how well the building fits a business. With income as the primary measurement, pricing fluctuates based on market and financial variables. Scarcity, rent surges, volatile interest rates, hot money, and other timely events will affect real time value. Conventional market data, like appraisals or comps, sets limits, but it does not capture the fluctuations within that band that can vary between 10% and 20%. Errors in human behavior during a deal may also add considerable variance. Value investors measure real time signals and capture part of movement in the purchase price. Pricing falls in a range, but value is created by reading signals and applying skill.

Agency is another change. Traditionally, Agents provide access to markets and develop strategies for positioning, marketing, representation, and advocacy. Agents also bridge common language and cultural barriers between ethnic groups and the space markets. However, big changes are coming to the Agency business, due to financialization and online platforms. When buildings become investment products and can be informally rated, they can be directly traded on platforms amongst experienced buyers, with or without agents. Space with certain homogenous characteristics are also traded with less friction. On platforms, transaction fees are reduced because conventional broker duties of fiduciary and agency are replaced by electronic trust, certification and experience. Commodification of building investments and rentable space is allowing platforms to grow and requiring agents to adapt.

Investors view risk differently than owner-occupiers. For example, portfolio investors can take more risk on any single property than individual owners with their wealth in only a few assets. More importantly, investors invest in tools and personal relationships to reduce risk and increase income. Digital operations, for example, yield analytics, no matter how basic, that measure performance and improve decisions. You can move the odds in your favor with better intelligence and technology. Risk measurement, enabled by advanced analytics, is a new and determining factor in local industrial markets.

Financialization creates an environment with continuous market signals. Signals are seen, measured, and evaluated. In many ways it’s unfair for individual owners because they lack the same tools or access to information as big investors. But individual owners can reverse the tables with shrewd calculations and turn the tight market to their advantage. In cases of leasing or selling, operating on a carefully designed platform, with market data and transaction capability, will put the odds back in your favor. As industrial markets move from local to national, capabilities extend from the personal to the digital.

Financial fire power and technical sophistication is putting local industrial property in the hands of national and global investors. It’s an unstoppable wave that creates many positive effects through plentiful liquidity and dynamic markets. Competition from investors has made owning your own industrial buildings more difficult, but the ability to invest and operate with less risk has greatly improved. In the New Industrial Real Estate Business, capital and technology are the primary forces moving the markets. While Big Investors and financialization create the momentum, good tools are available for anyone to adapt, participate and succeed.

Do you have a Youtube channel as well with this kind of content on it? I would love to see this post turned into a longer video if possible. Maybe I can share on it on my website.