Geodata is widely used in many commercial internet applications like Yelp, Google Maps, Twitter, Foursquare and Factual. Many of these web services match your phone’s location to their own mapping programs. In most cases location data is an aid to sell goods and services. I use the same relationship between point data and the connected internet to find more real estate deals using MappSnap.

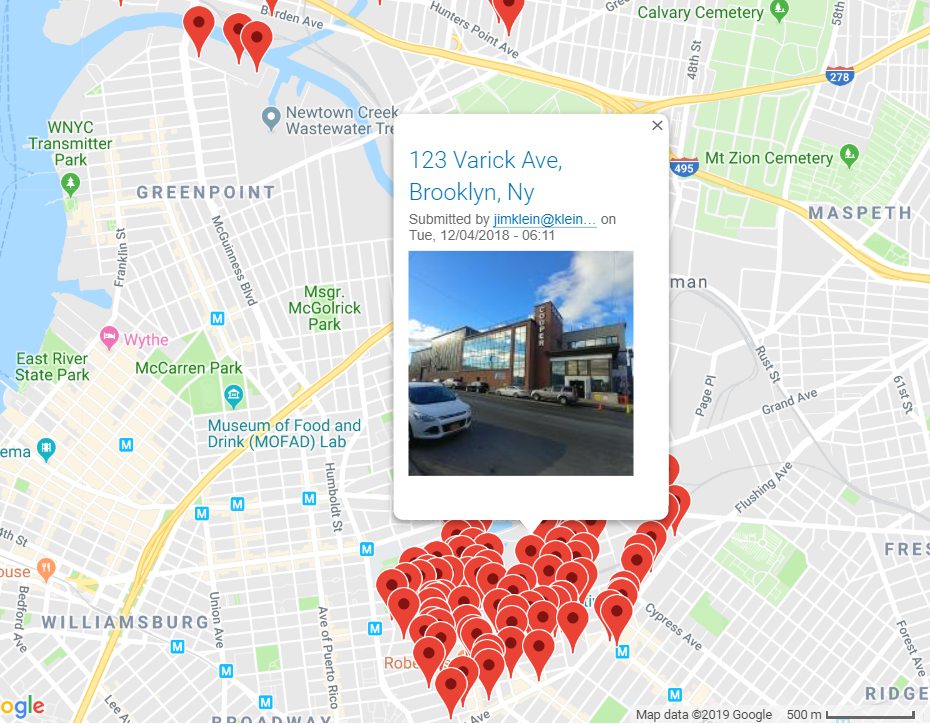

By using your phone’s location services, anyone can snap a picture and that image will appear at the exact location where the picture was taken. In the field, we routinely take pictures and videos to catalog entire industrial areas. By processing image, location, and parcel data, we forecast which properties will potentially become near term deals and have available space. As we develop better techniques, Artificial Intelligence and Machine Learning will augment human judgement to make better predictions with our data sets.

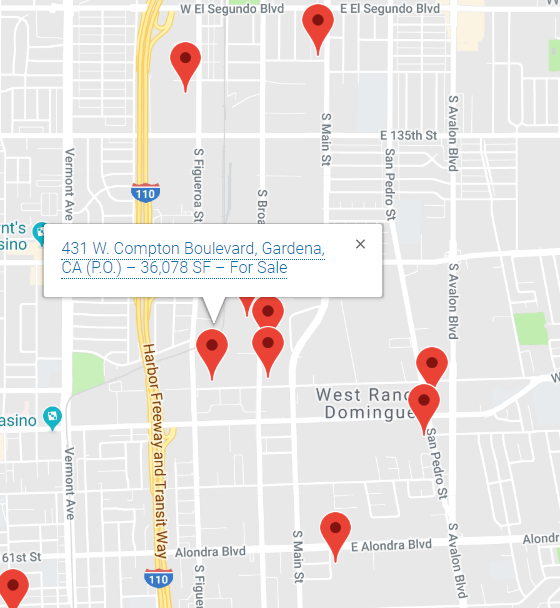

Location is a natural and intuitive way to organize and archive real estate information. Longitude and latitude coordinates are freely accessible due to Global Positioning Satellites. Visually, whether on satellite or map view, you can comprehensively see the market area coverage. Once images are loaded, most commercial Content Management Systems (CMS) like WordPress, Drupal, or Joomla, will let you automatically create content for each property in an easily retrievable format using common search, location and database functions. I can take individual pieces of point data and grow it on a transactional platform that serves up content depending on specific criteria and inputs. In addition, once data is captured, cleaned and formatted, it’s easy to manually run sorting and selection operations for specific properties you are seeking. The next logical step is to feed this same data to cloud services for more intelligent analytics. In other words, GeoData is the first step to cataloging the industrial building universe for purposes of archiving and transacting.

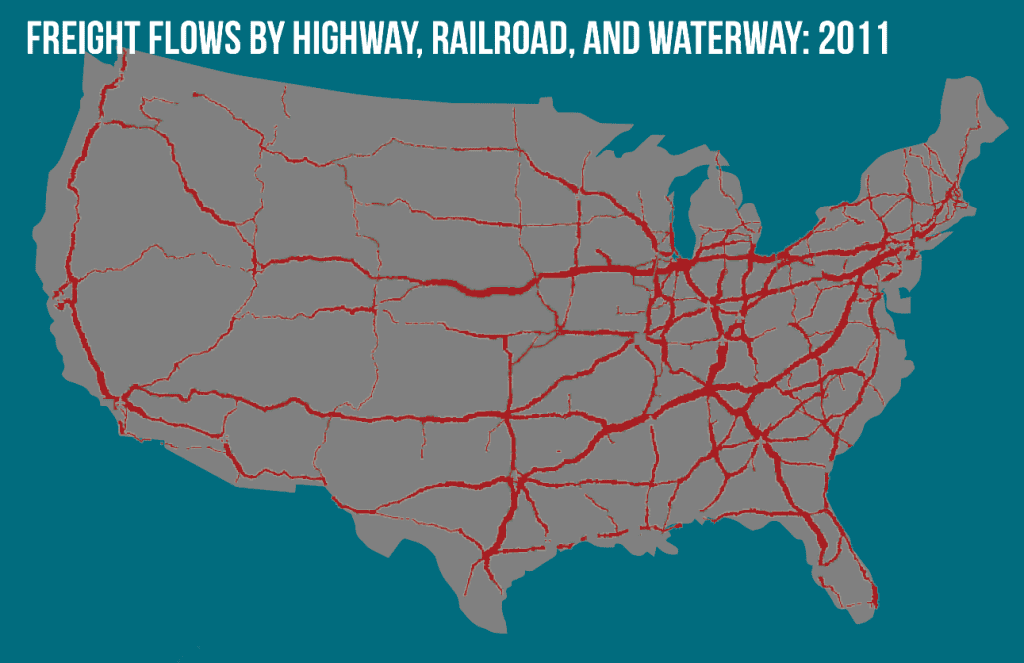

Geodata comes embedded with many mathematical functions. Most familiar is radius search. For any property, it’s easy to record GPS data and use it to focus on nearby geographies. This allows precision searching under the principle that the closest people are the most interested in any given location. More advanced GIS programs have more complicated alogrithms. One example from the hedge fund industry is the use of alternative data to guide investments. In one case, Thasos is a data company that uses geofencing to analyze shopping mall traffic and predict retail sales. Similarly, point and traffic pattern data is used to measure truck traffic to find the busiest freight nodes to evaluate warehouse locations. In the case of MappSnap, we use location data to find properties in the “off-market” and make individual determinations on the investment and development potential.

Geodata is an underappreciated real estate tool because it only takes a small amount of technical expertise to start. GPS is a free and ubiquitous protocol, maintained by the U.S. Government, that works seamlessly with property. Mobile applications allow you to be in the field and serve up real time location data to a CMS program. Recently, we have been experimenting with live-streaming on the street and research operations in the office for on-the-ground immediacy.

As we invest more in geo-data field operations our biggest obstacle is financing, but even more problematic, is the shortage of capable programmers who can combine web, mobile, geo, and analytics. There are several open source mapping programs that are very useful, including MapBox, Leaflet, and Open Map, but all have limitations when directed to specific commercial applications like the ones we are developing. Luckily, it’s a virtuous cycle that with more geo investments, we find more opportunities that in turn allow for more development.

Please contact us if you would like to be a collaborator or user of MappSnap. We are always looking to share.

https://youtu.be/1RBhDqD54-U